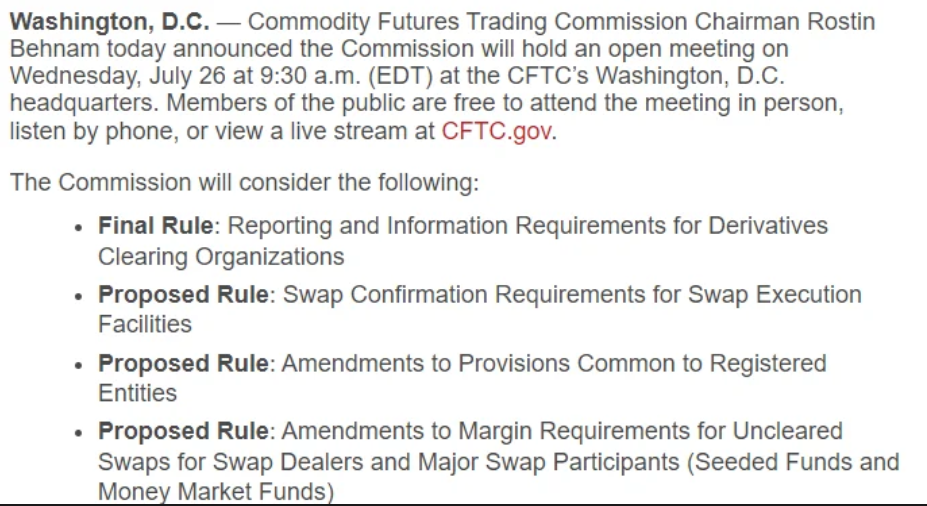

OPEN meeting Wednesday July 26, 2023 at 10 a.m. SEC to consider whether to propose new and amended rules relating to conflicts of interest associated with broker-dealers’ use of predictive data analytics in connection with certain investor interactions.

Source: https://public-inspection.federalregister.gov/2023-15664.pdf

MATTERS TO BE CONSIDERED:

1. The Commission will consider whether to adopt rules to enhance and standardize disclosures regarding cybersecurity risk management, strategy, governance, and incidents by public companies that are subject to the reporting requirements of the Securities Exchange Act of 1934.