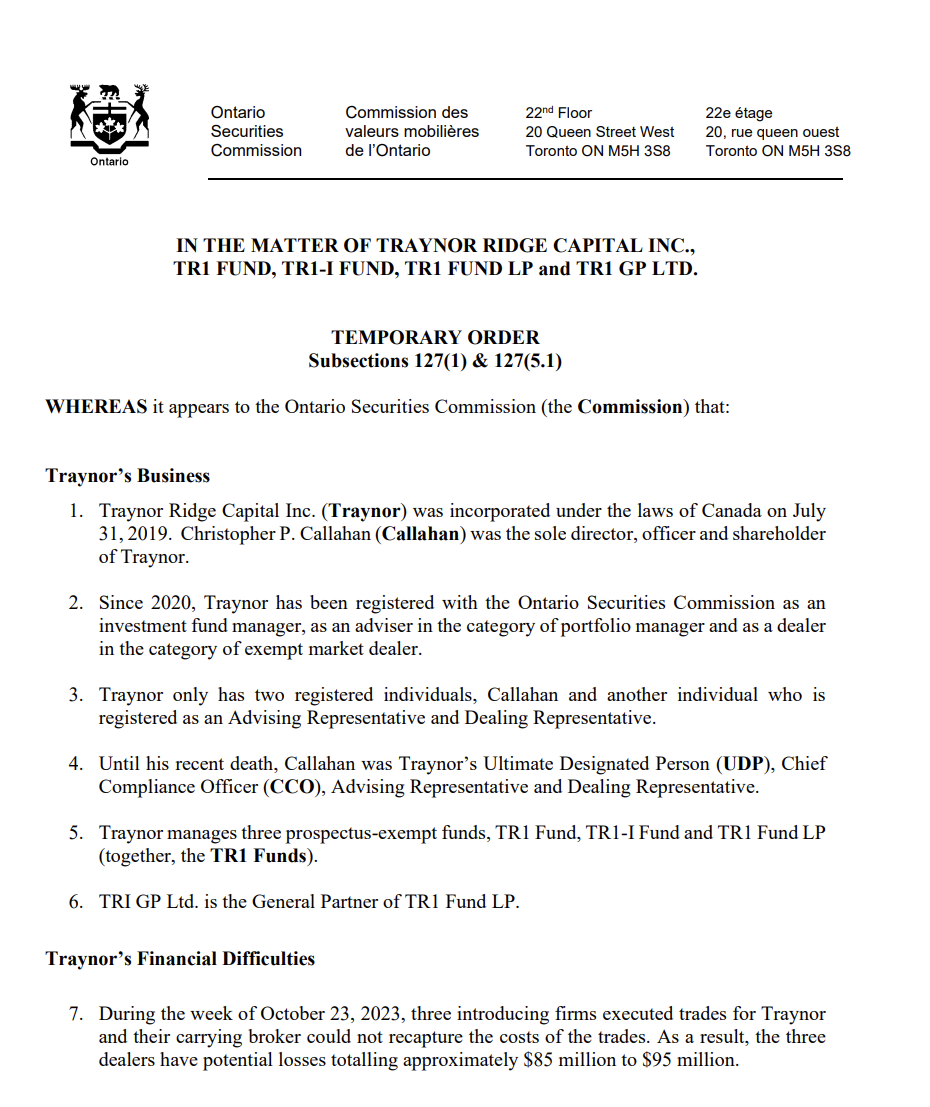

Ontario’s securities regulator barred Traynor Ridge Capital Inc. (a Toronto-based hedge fund) from trading after its lead manager died and dealers were hit with large losses on the firm’s trades.

Wut Mean?:

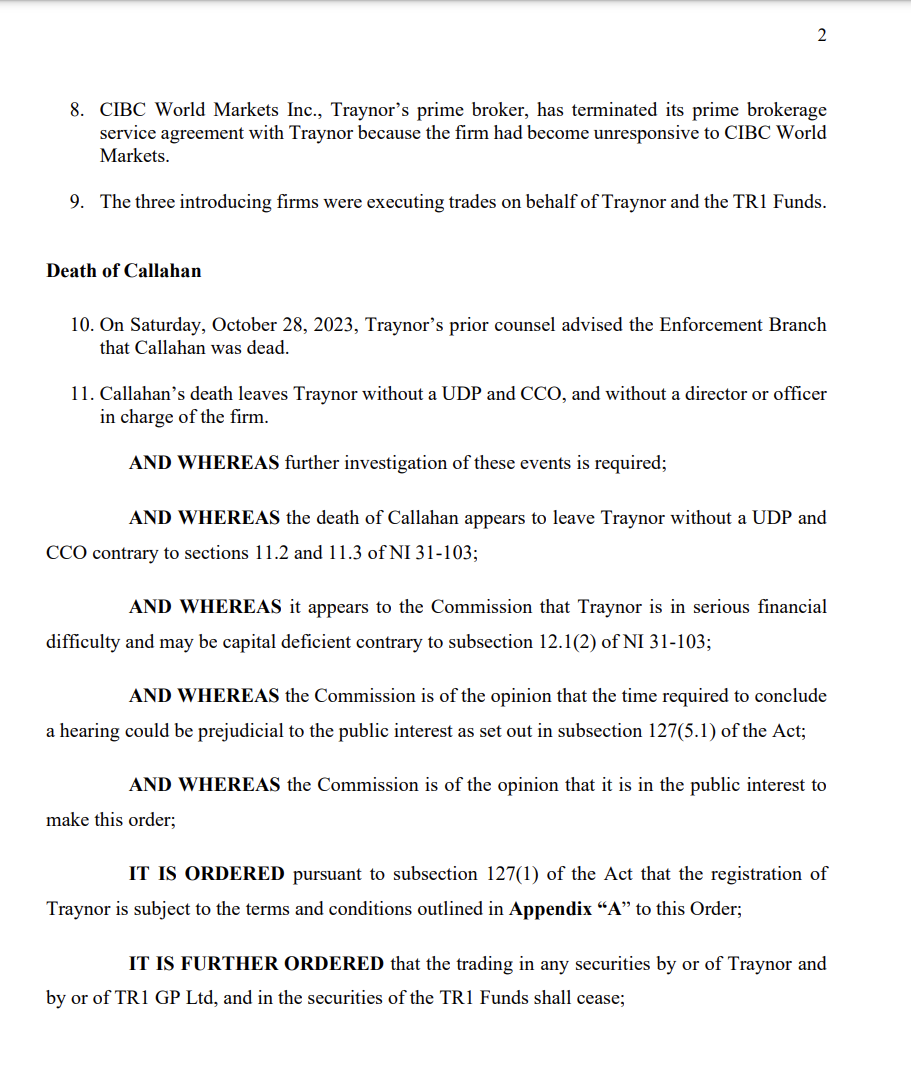

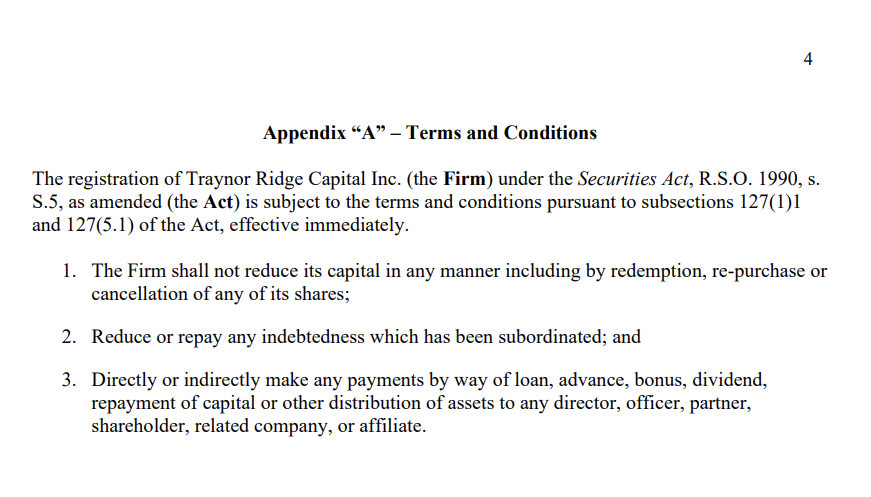

- The Ontario Securities Commission (OSC) has temporarily suspended trading for Toronto-based hedge fund Traynor Ridge Capital Inc. following the death of its lead manager and significant losses incurred by dealers.

- The suspension and investigation were triggered by a series of failed trades that resulted in losses ranging from $85 million to $95 million for three brokerage firms during the week of October 23.

- The fund's chief compliance officer and ultimate designated person, Christopher Callahan, was reported deceased on October 28. Callahan was also the founder and lead portfolio manager of Traynor Ridge Capital.

- The OSC cited serious financial difficulties for Traynor Ridge Capital and has indicated the need for further investigation.

- Traynor's prime broker, CIBC World Markets Inc., terminated its service agreement with the fund due to unresponsiveness, and representatives for both Traynor and CIBC have not yet responded to comment requests.

Did not post this to speculate around the death called out in the article headline but rather the fact the hedge fund barred from trading because of the losses that did occur.

Given that Hedge Funds are so levered and connected, could this cause any sort of cascading effect?

On average, they have exceeded 20-to-1 leverage according to Gary: