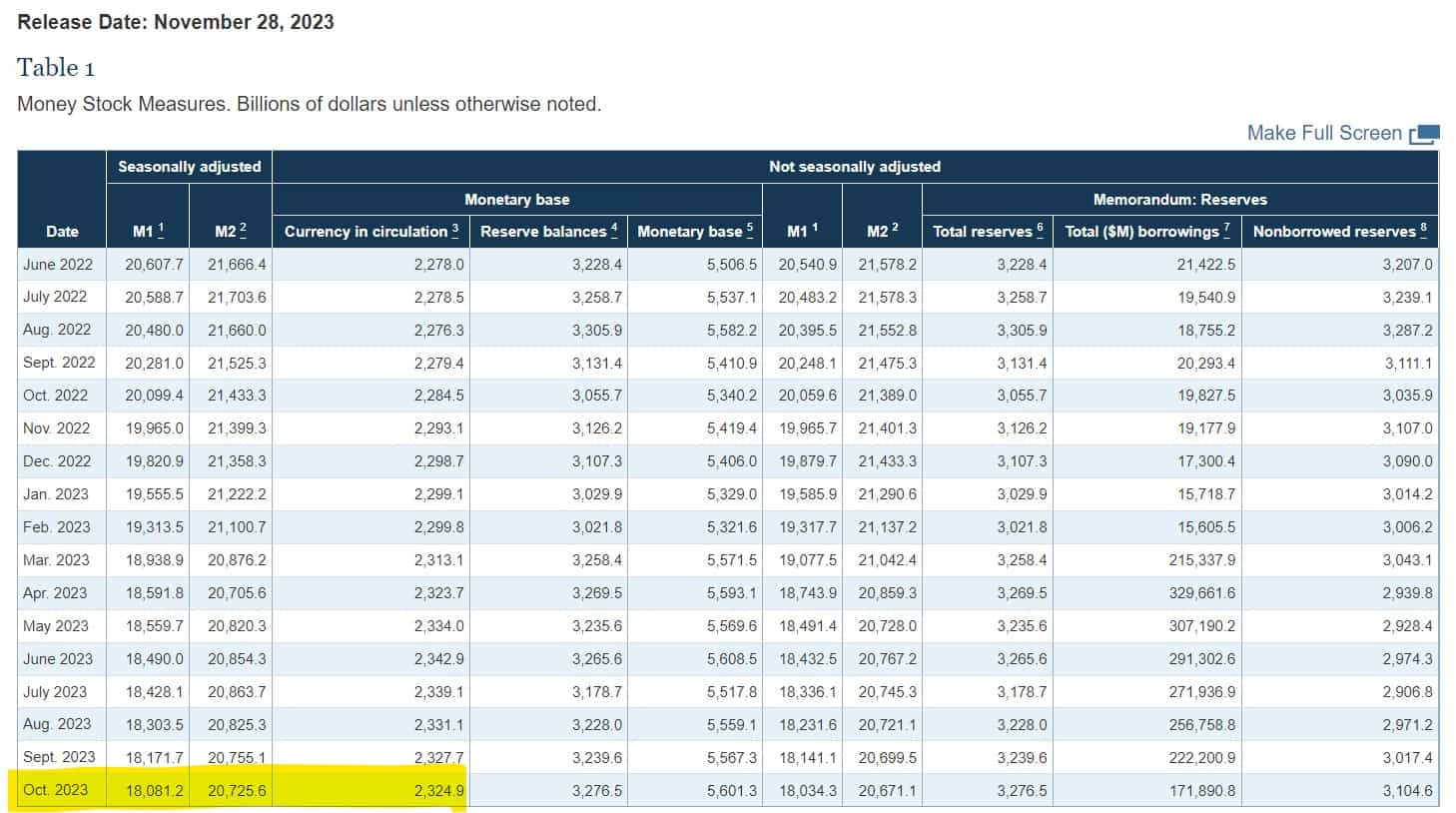

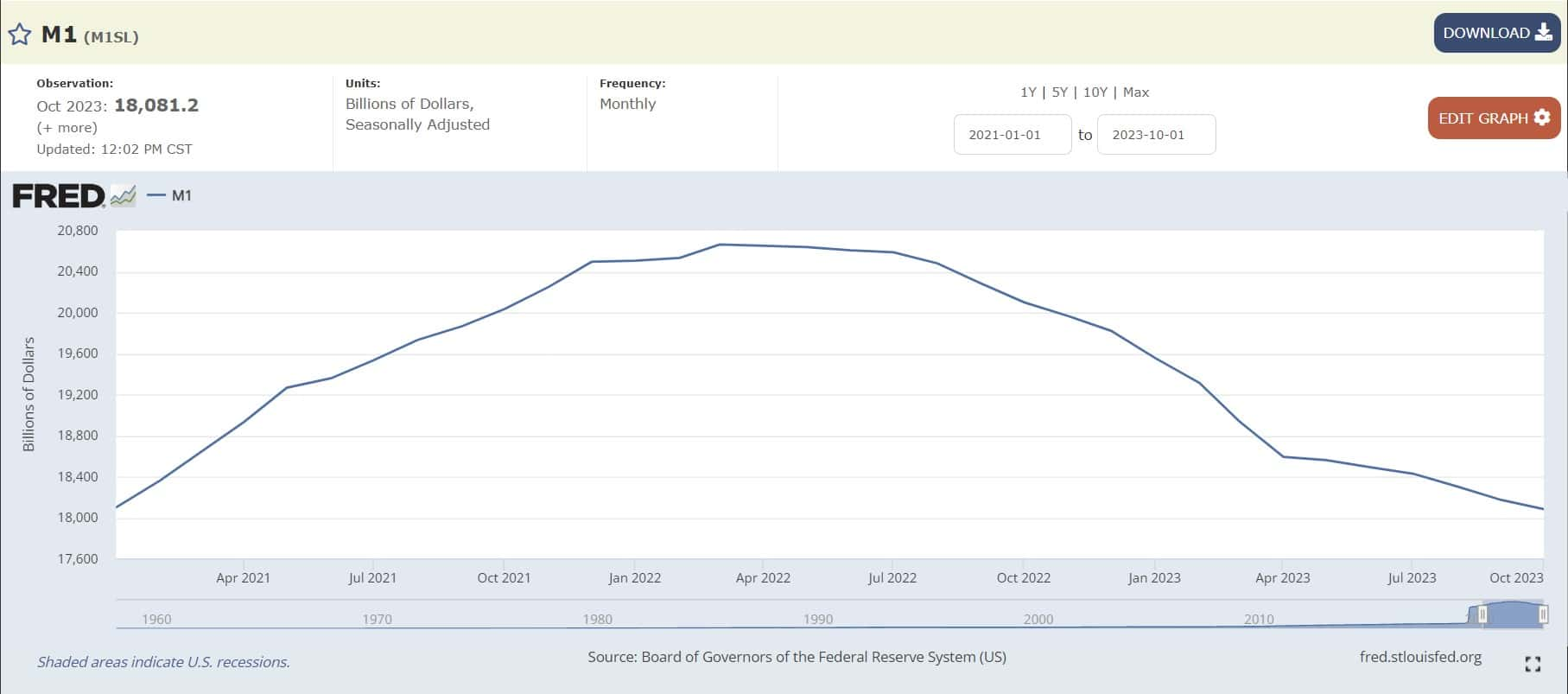

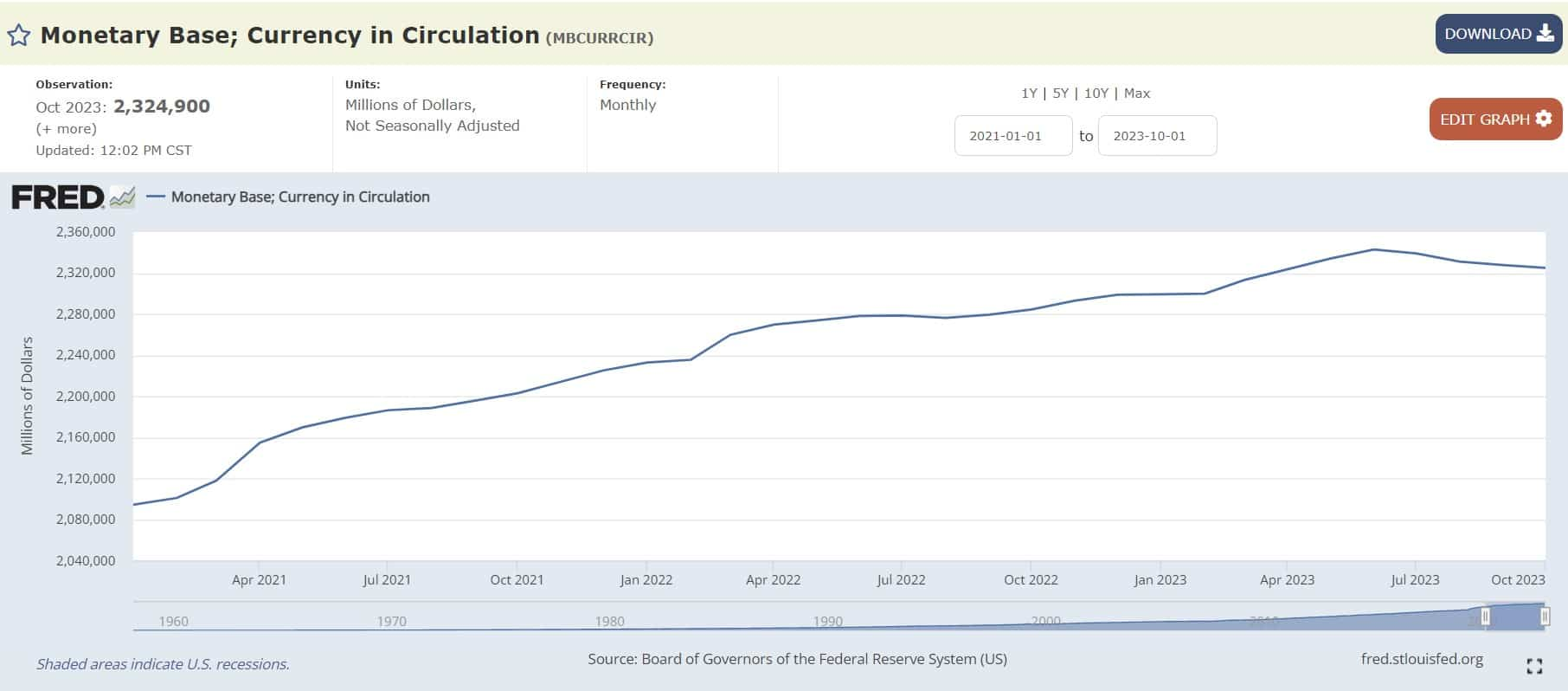

Seasonally adjusted M1 (-$90.5B) (-.5%), M2 (-$29.5B) (-.1%), and currency in circulation (-$2800M) (-.1%) all dropped in October.

- M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of other checkable deposits (or OCDs, which comprise negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions) and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and other liquid deposits, each seasonally adjusted separately.

- M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (2) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing small-denomination time deposits and retail MMFs, each seasonally adjusted separately, and adding the result to seasonally adjusted M1.

- Currency in circulation consists of Federal Reserve notes and coin outside the U.S. Treasury and Federal Reserve Banks.

- Reserve balances are balances held by depository institutions in master accounts and excess balance accounts at Federal Reserve Banks.

- Monetary base equals currency in circulation plus reserve balances.

- Total reserves equal reserve balances plus, before April 2020, vault cash used to satisfy reserve requirements.

- Total borrowings in millions of dollars from the Federal Reserve are borrowings from the discount window's primary, secondary, and seasonal credit programs and other borrowings from emergency lending facilities. For borrowings included, see "Loans" in table 1 of the H.4.1 statistical release.

- Nonborrowed reserves equal total reserves less total borrowings from the Federal Reserve.

TLDRS:

- Seasonally adjusted M1 (-$90.5B) (-.5%), M2 (-$29.5B) (-.1%), and currency in circulation (-$2800M) (-.1%) all dropped in October.

- M1 includes the most liquid forms of money, such as cash and checking deposits.

- A decrease in M1 suggests a reduction in the most readily available money in the economy.

- M2 includes all of M1 plus "near-money" (savings deposits, money market mutual funds, and other time deposits).

- A decrease in M2 indicates a decline in not only the liquid money supply (M1) but also in slightly less liquid financial assets.

- The drop in currency in circulation shows less cash is being held by the public.