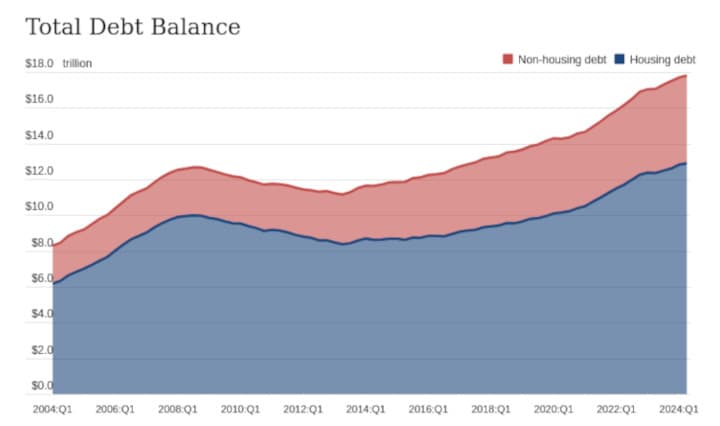

NY Fed Q2 Report on Household Debt & Credit: Total household debt rose by $109 billion to reach $17.80 trillion. Auto & credit card delinquency rates remain elevated.

The Federal Reserve Bank of New York’s Center for Microeconomic Data released its Quarterly Report on Household Debt and Credit for Q2, revealing a $109 billion (0.6%) increase in total household debt in Q2 2024, reaching $17.80 trillion.

Key Findings:

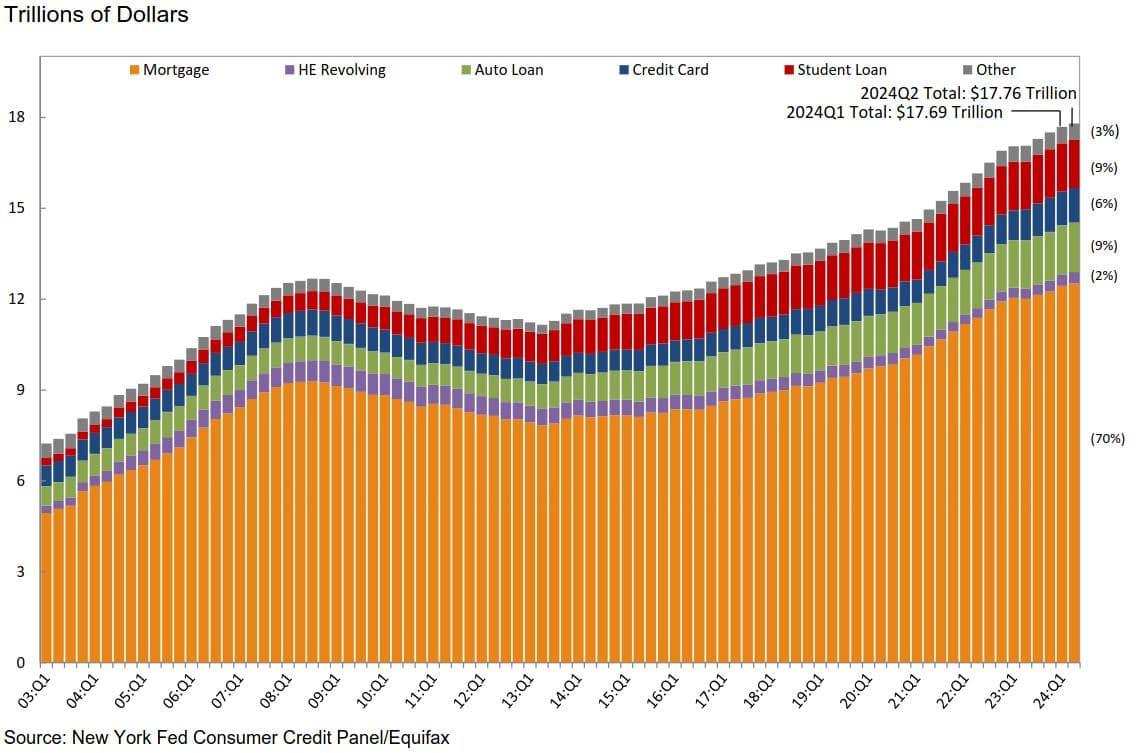

- Mortgage balances rose by $77 billion to $12.52 trillion.

- Mortgage originations remained low, mainly due to subdued refinancing activity.

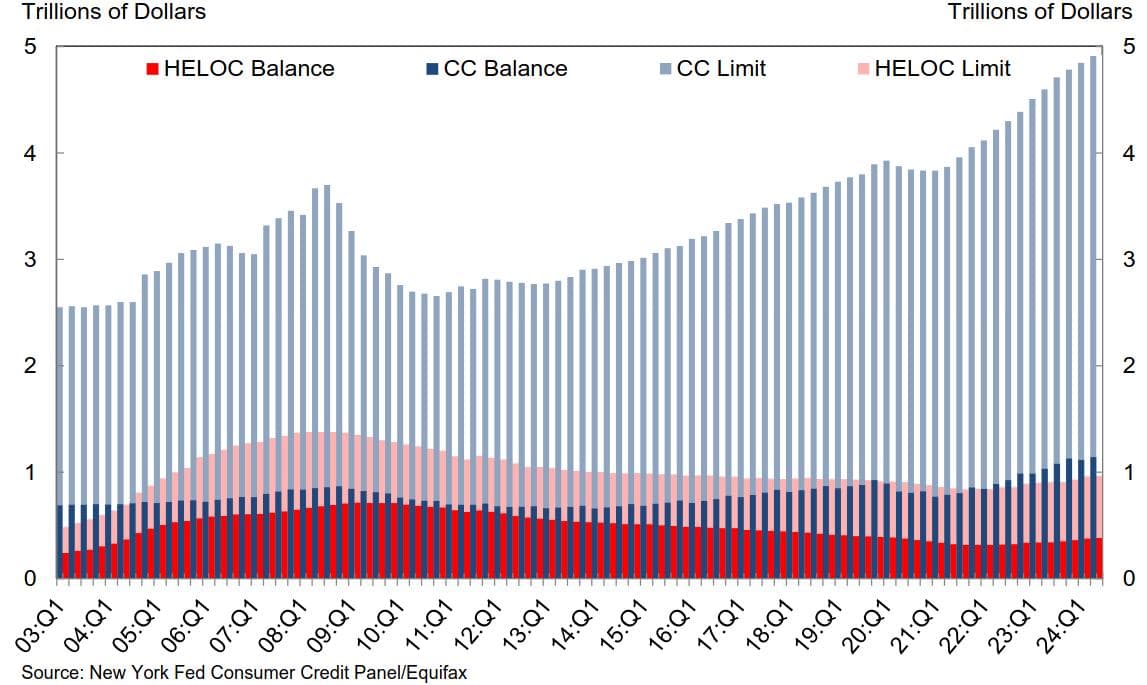

- Home equity lines of credit (HELOC) balances increased by $4 billion, marking the ninth consecutive quarterly rise since Q1 2022, reaching $380 billion.

- This is a $63 billion increase from the low in Q3 2021, as it appears homeowners using HELOCs to extract home equity.

- Credit card balances increased by $27 billion to $1.14 trillion, and auto loan balances rose by $10 billion to $1.63 trillion.

- Outstanding student loan debt fell and stood at $1.59 trillion in 2024Q2.

- Missed federal student loan payments will not be reported to credit bureaus until 2024Q4.

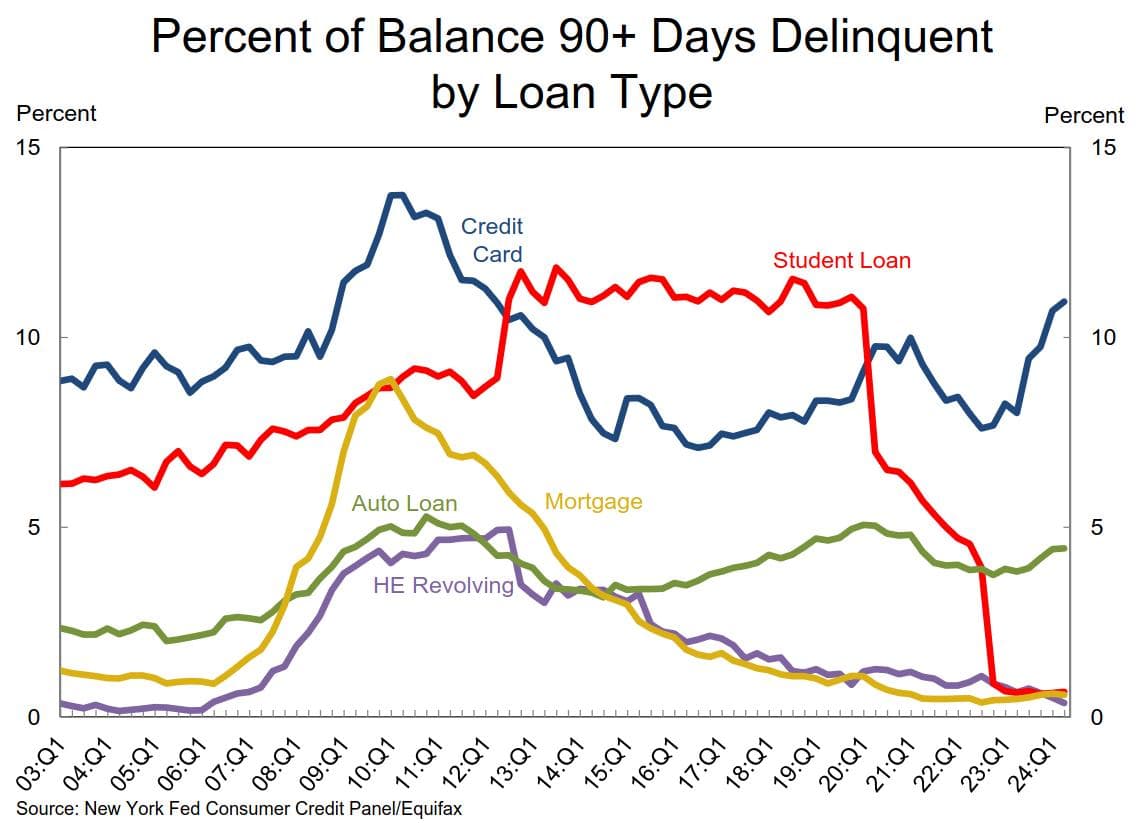

- Because of these policies, less than 1% of aggregate student debt was reported 90+ days delinquent or in default in 2024Q2 and will remain low until at least 2024Q4.

- Aggregate limits on credit card accounts increased by $69 billion (1.4%), and HELOC limits increased by $3 billion, continuing a nine-quarter upward trend.

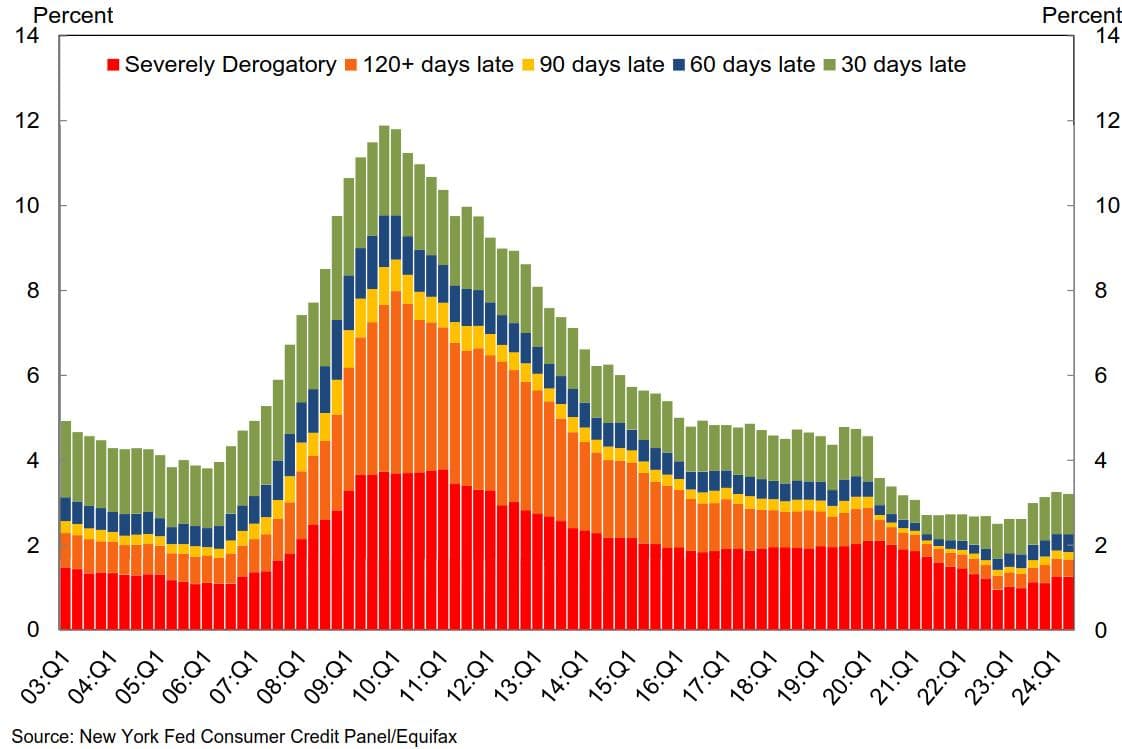

- Aggregate delinquency rates held steady at 3.2%.

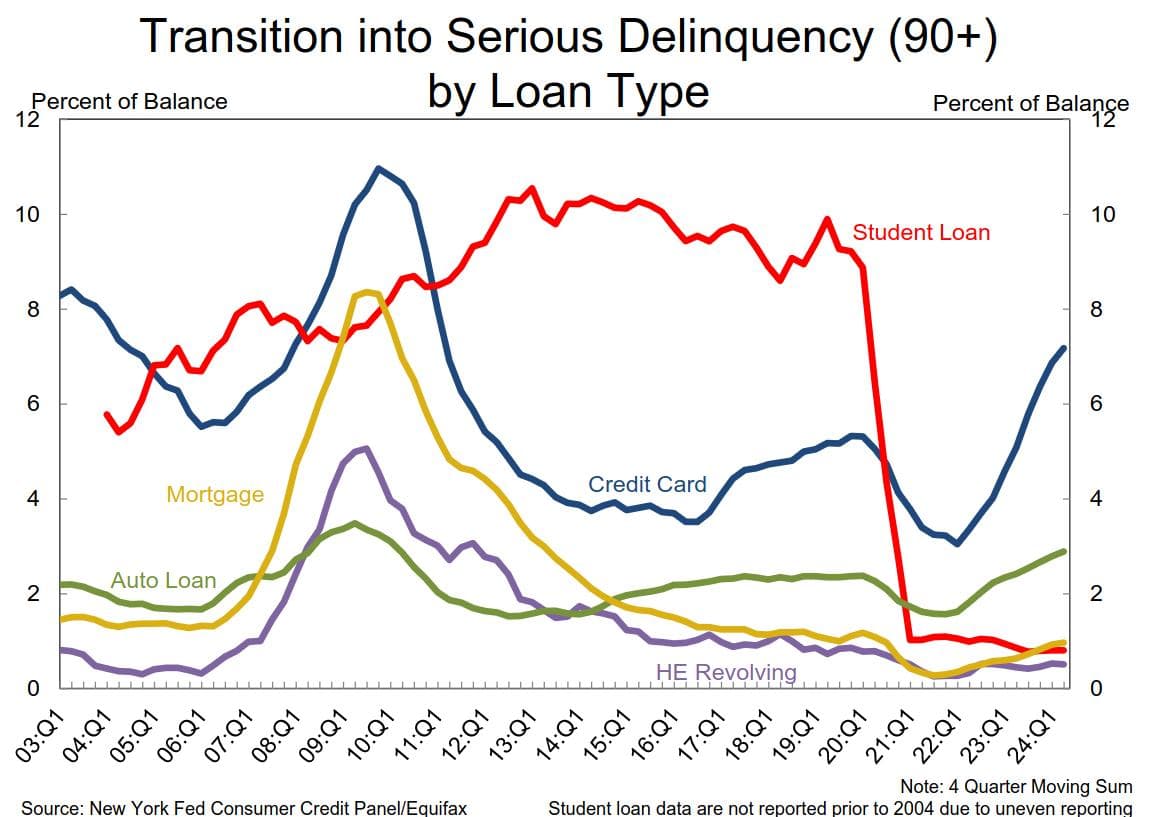

- However, delinquency transition rates for credit cards, auto loans, and mortgages saw slight increases.

- Approximately 9.1% of credit card balances and 8.0% of auto loan balances transitioned into delinquency over the past year.

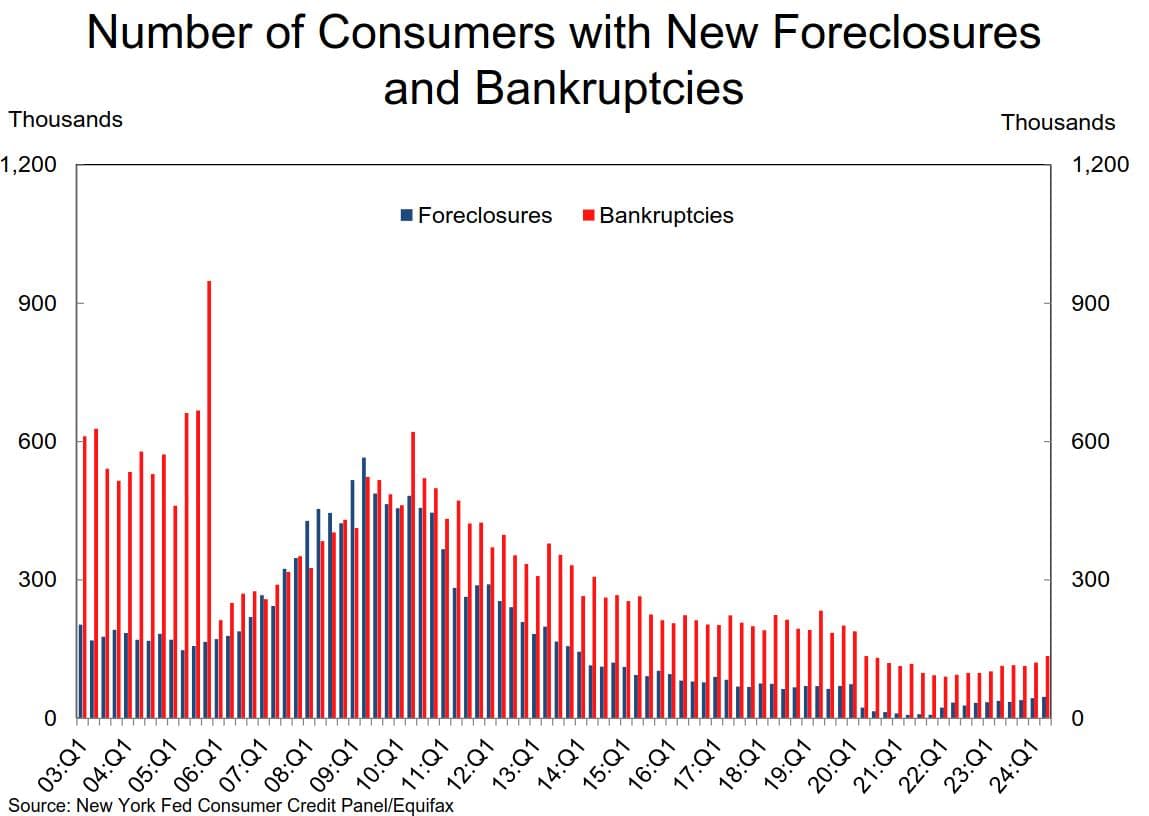

- Around 136,000 consumers had a bankruptcy notation added to their credit reports in Q2 2024, an increase from the previous quarter.

Adding, Andrew Haughwout, Director of Household and Public Policy Research at the New York Fed, noted the rise in HELOC balances as homeowners seek alternative ways to

Total Debt Balance and its Composition:

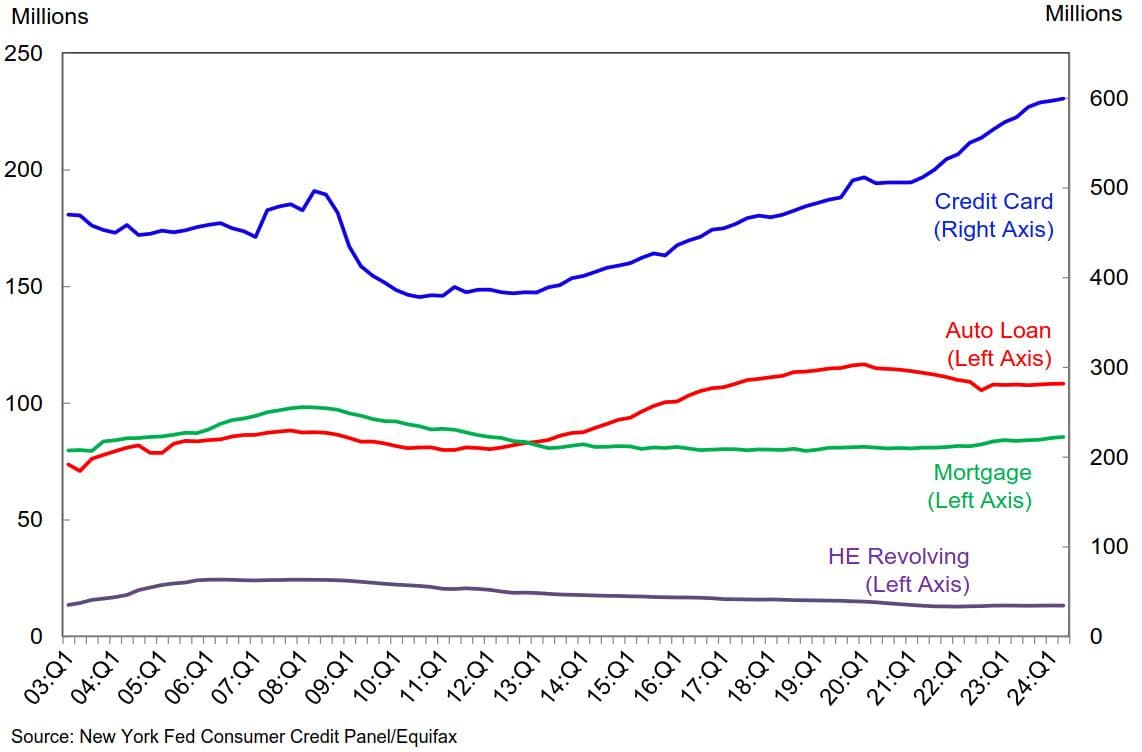

Number of Accounts by Loan Type:

Credit Limit and Balance for Credit Cards and HE Revolving:

Total Balance by Delinquency Status:

Percent of Balance 90+ Days Delinquent by Loan Type:

Transition into Serious Delinquency (90+) by Loan Type:

Number of Consumers with New Foreclosures and Bankruptcies:

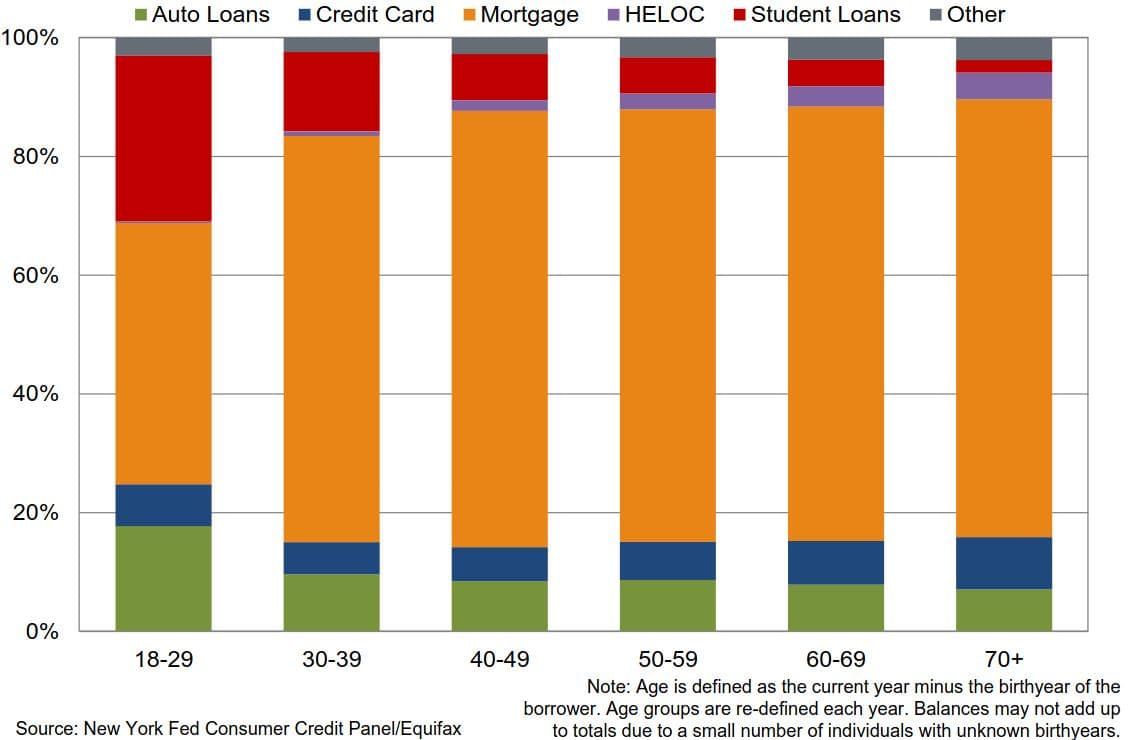

Debt Share by Product Type and Age (2024 Q2):

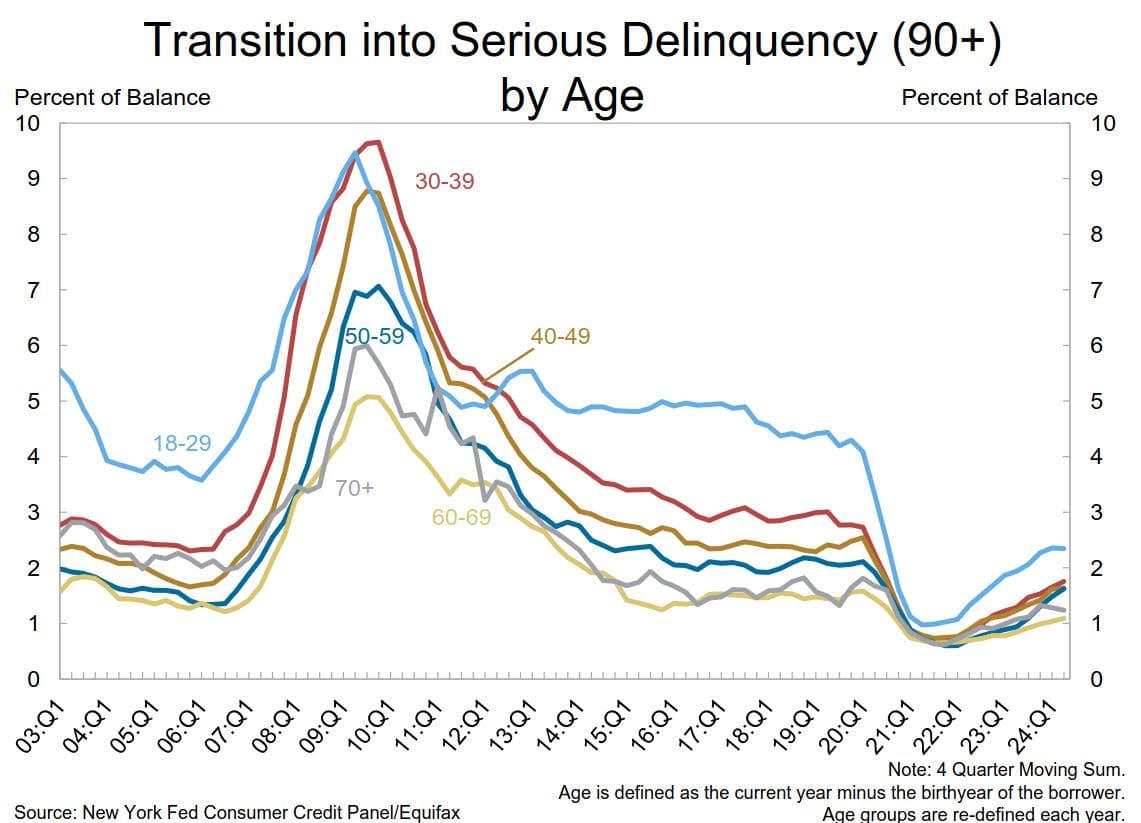

Transition into Serious Delinquency (90+) by Age:

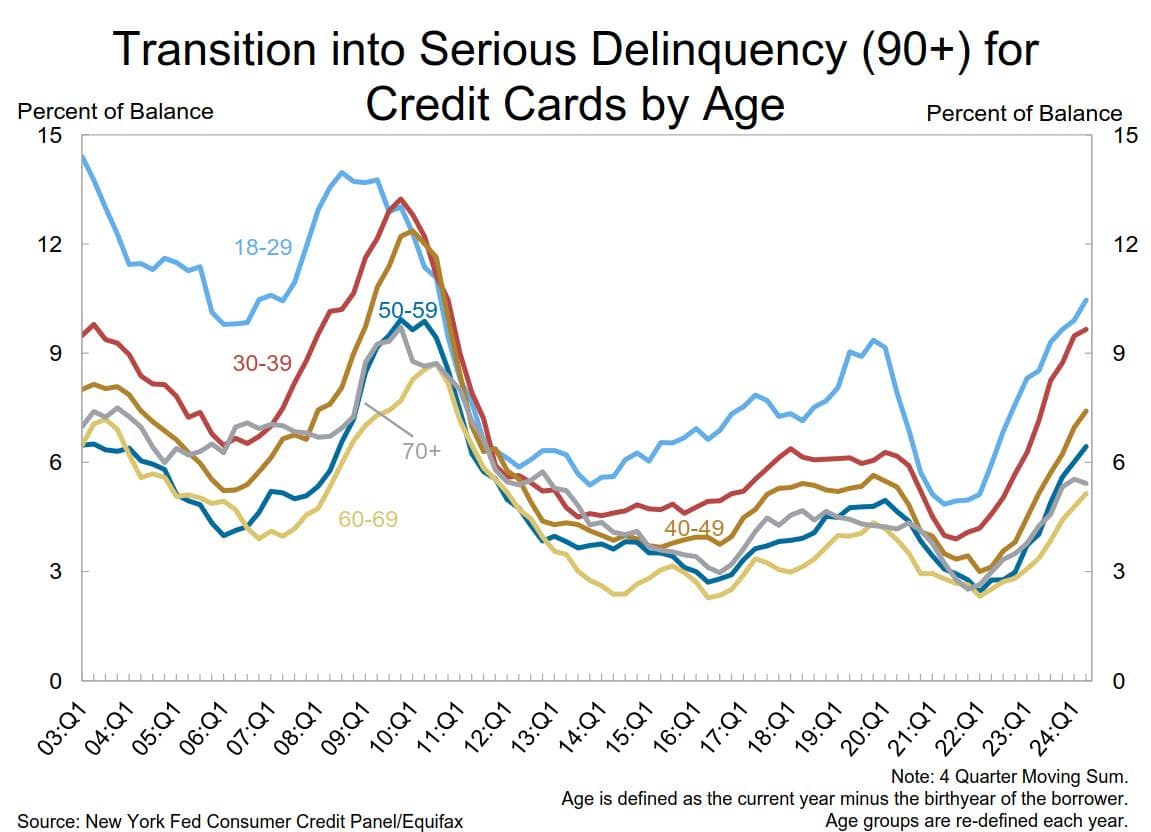

Transition into Serious Delinquency (90+) for Credit Cards by Age:

Where was the debt a year ago?:

TLDRS:

- The Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit for Q2 2024 shows a $109 billion (0.6%) increase in total household debt, reaching $17.80 trillion.

- Total Household Debt has increased by $3.64 trillion since the end of 2019!

- Credit card balances grew by $27 billion to $1.14 trillion, and auto loan balances rose by $10 billion to $1.63 trillion.

- Outstanding student loan debt fell to $1.59 trillion, with less than 1% reported 90+ days delinquent or in default due to policy changes delaying reporting of missed payments until Q4 2024.

- Delinquency transition rates for credit cards, auto loans, and mortgages saw slight increases.

- Approximately 9.1% of credit card balances and 8.0% of auto loan balances transitioned into delinquency over the past year, and around 136,000 consumers had a bankruptcy notation added to their credit reports in Q2 2024, up from the previous quarter.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold or even interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

NY Fed Q2 Report on Household Debt & Credit: Total household debt rose by $109 billion to reach $17.80 trillion. Auto & credit card delinquency rates remain elevated--over the last year, approximately 9.1% of credit card balances and 8.0% of auto loan balances transitioned into delinquency.

by u/Dismal-Jellyfish in Superstonk

NY Fed Q2 Report on Household Debt & Credit: Total household debt rose by $109 billion to reach $17.80 trillion. Auto & credit card delinquency rates remain elevated.https://t.co/X2FiBqYRuD

— dismal-jellyfish (@DismalJellyfish) August 6, 2024