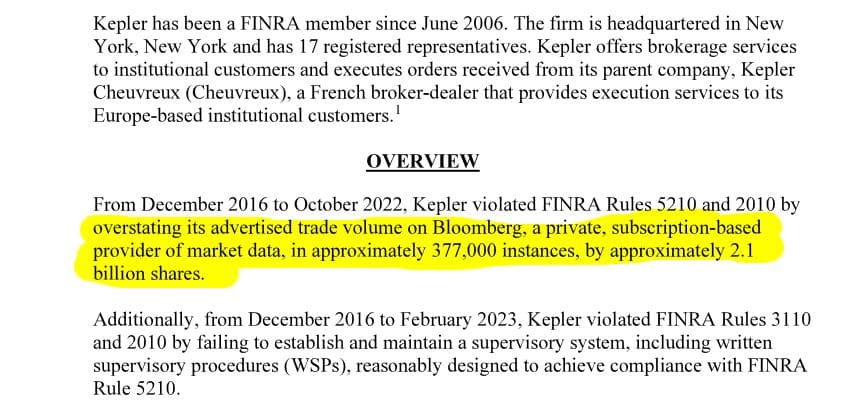

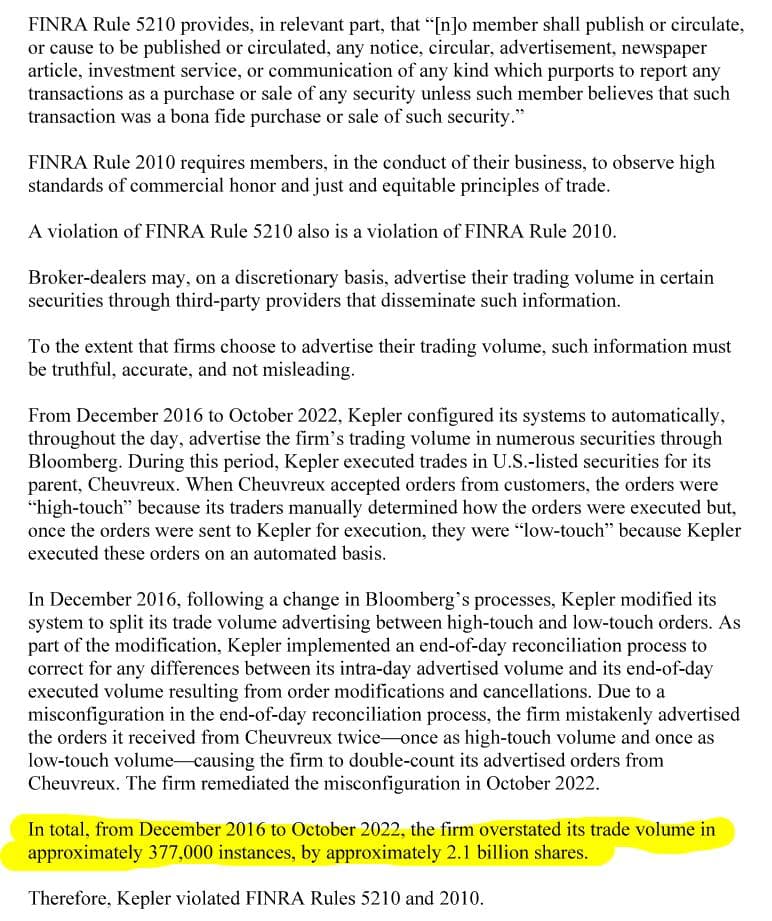

From December 2016 to October 2022, Kepler Capital Markets overstated its trade volume in approximately 377,000 instances, by approximately 2.1 billion shares. Penalty? Without admitting to the findings, a censure and $475k fine.

Kepler overstated its advertised trading volume:

Penalty?:

How could this have impacted GameStop?:

Inflated trading volumes can mislead the market as a whole about the liquidity and demand for a stock, potentially influencing trading decisions and stock prices unfairly.

My understanding is this creates a false impression of market activity, enabling short sellers to exploit perceived liquidity to potentially have executed large short positions without detection.

TLDRS:

- From December 2016 to October 2022, Kepler Capital Markets overstated its trade volume in approximately 377,000 instances, amounting to about 2.1 billion shares.

- Penalty? Without admitting to the findings, a censure and $475,000 fine.

- This false activity could have been exploited by short sellers to execute large short positions without detection.

From December 2016 to October 22, Kepler Capital Markets overstated its trade volume in approximately 377,000 instances, by approximately 2.1 billion shares. Penalty? Without admitting to the findings, a censure and $475k fine.

by u/Dismal-Jellyfish in Superstonk

From December 2016 to October 2022, Kepler Capital Markets overstated its trade volume in approximately 377,000 instances, by approximately 2.1 billion shares. Penalty? Without admitting to the findings, a censure and $475k fine.https://t.co/6FMTs6UkQw

— dismal-jellyfish (@DismalJellyfish) June 20, 2024