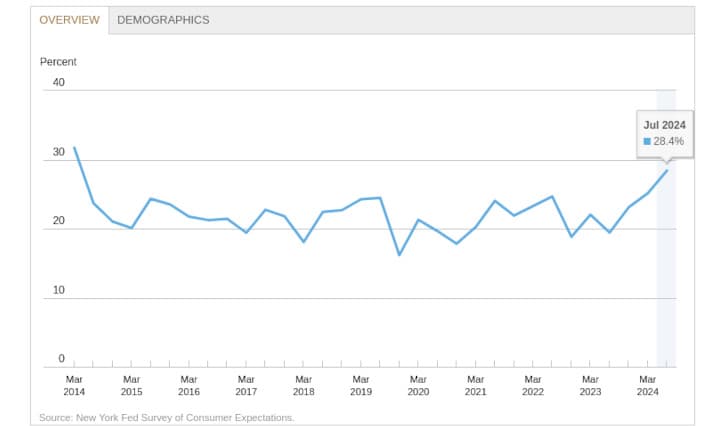

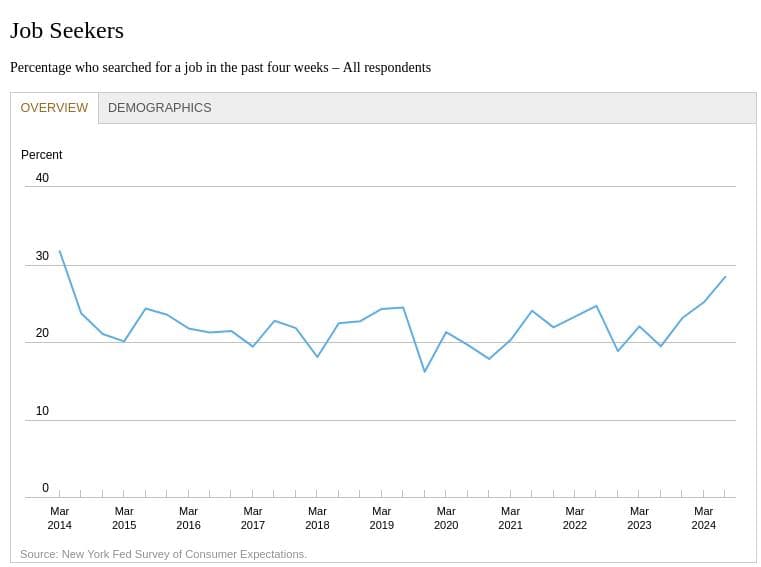

SCE Labor Market Survey: The proportion of individuals who reported searching for a job in the past four weeks rose to 28.4% from 19.4% in July 2023, highest reading since March 2014.

The Federal Reserve Bank of New York’s Center for Microeconomic Data has released the July 2024 SCE Labor Market Survey, highlighting significant shifts in job market dynamics.

The SCE Labor Market Survey, fielded as part of the Survey of Consumer Expectations (SCE) since March 2014, provides information on consumers’ experiences and expectations regarding the labor market. Every four months, approximately 1,000 SCE panelists are asked details about their current (or most recent) job. Respondents are asked about job transitions, and about their job search effort and outcomes (number of job offers and offer wages), over the last four months. The currently employed are also asked about their level of satisfaction with wages, non-wage benefits, and their prospects for advancement at their current job. In addition, the survey elicits respondents’ expectations about job transitions over the next four months. Respondents are asked about the likelihood of receiving at least one job offer over the next four months, the expected number of offers, and the expected wages for these offers.

The SCE Labor Market Survey, a part of the broader Survey of Consumer Expectations (SCE) since 2014, provides insights into consumers' experiences and expectations in the labor market. Conducted every four months, the survey collects data from around 1,000 panelists about their current or most recent job.

Key areas of focus include job transitions, job search efforts, the number of job offers received, and the wages offered. Additionally, employed respondents report on their satisfaction with wages, non-wage benefits, and prospects for advancement at their current jobs. The survey also captures expectations for future job transitions, including the likelihood of receiving job offers, the expected number of offers, and anticipated wages over the next four months.

- The proportion of individuals actively searching for jobs jumped to 28.4%, the highest level since the survey began in 2014, up from 19.4% in July 2023.

- This increase was most notable among those over 45, without a college degree, and with household incomes below $60,000.

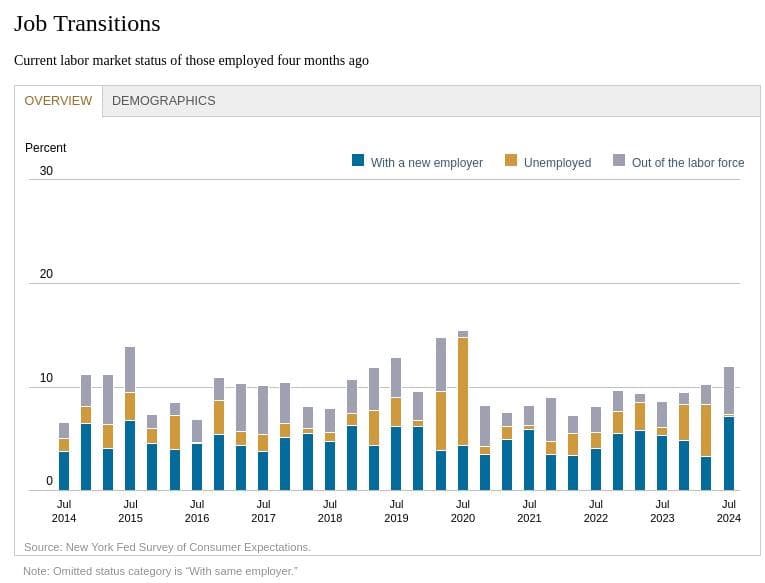

- Only 88% of those employed four months ago remained with the same employer, a series low, with the rate of switching employers rising to 7.1%.

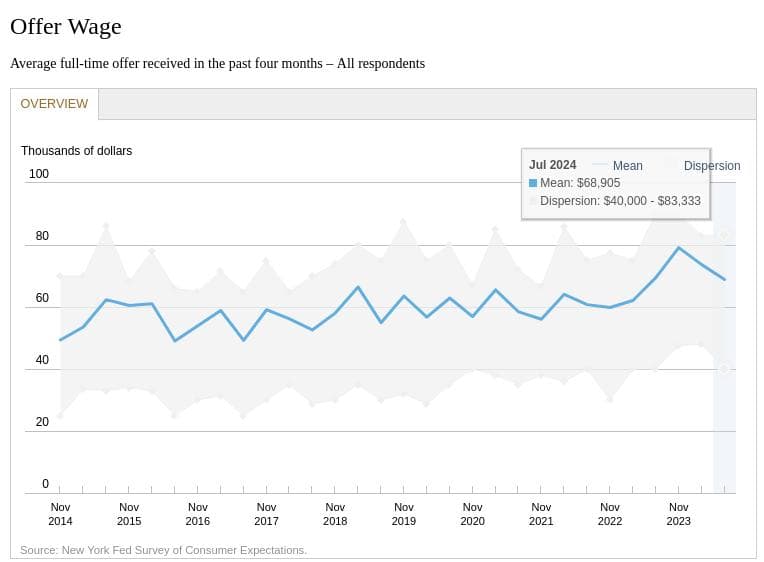

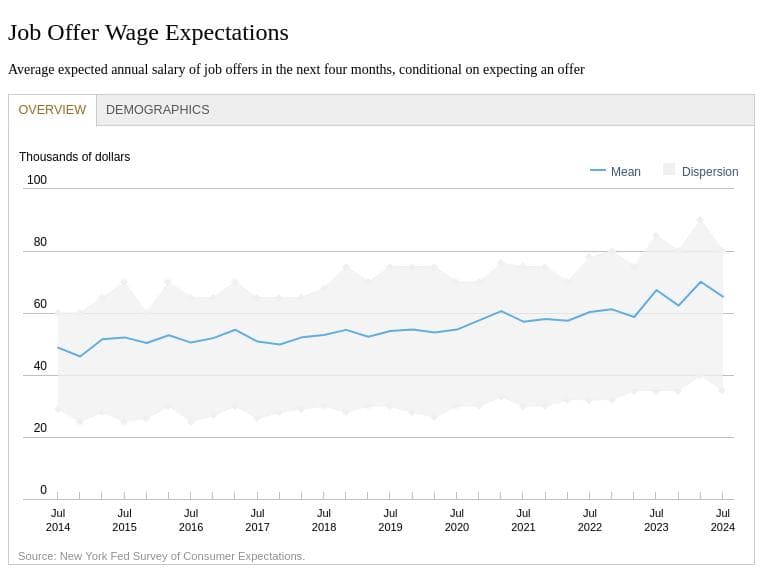

- Despite more job searches, the proportion of individuals receiving at least one job offer remained steady at 19.4%, while the average wage for full-time offers slightly decreased to $68,905.

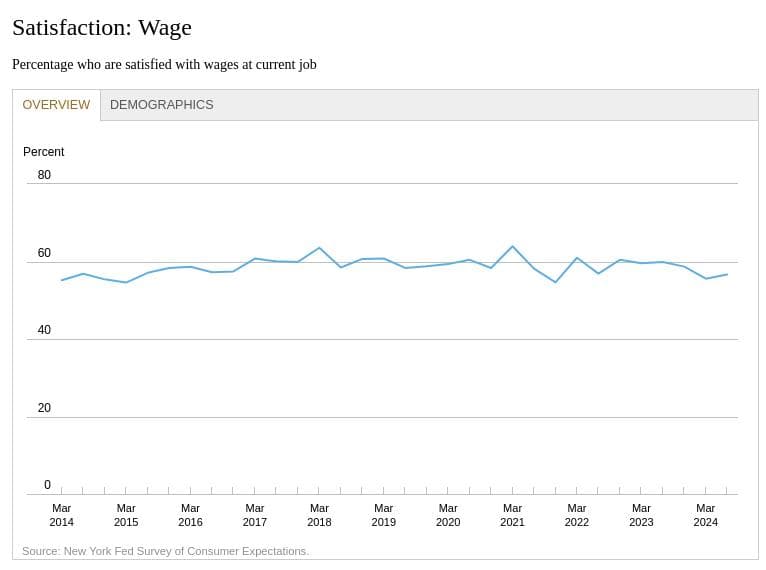

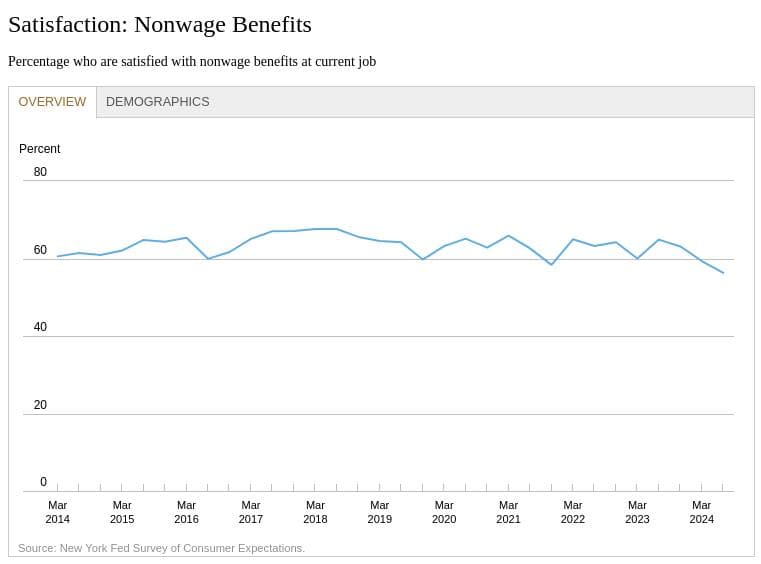

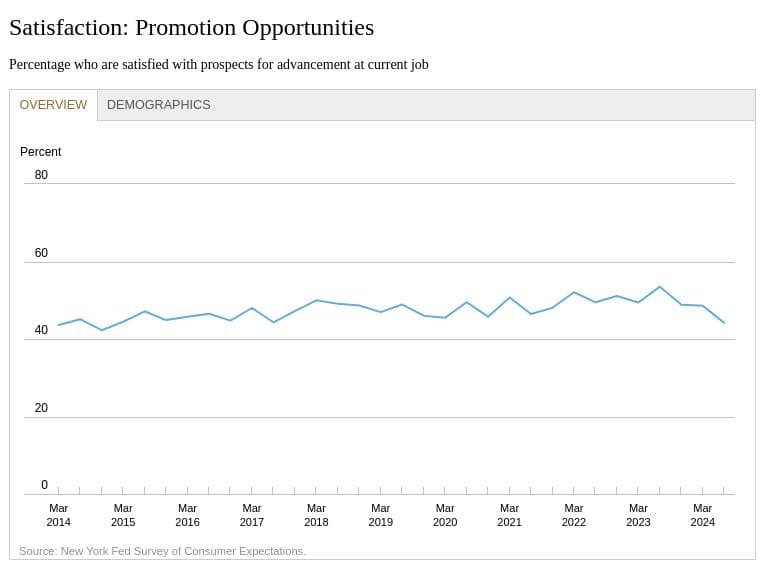

- Satisfaction with wage compensation, non-wage benefits, and promotion opportunities all declined compared to last year, particularly among women, those without a college degree, and lower-income respondents.

- Satisfaction with wages fell to 56.7%, non-wage benefits to 56.3%, and promotion opportunities to 44.2%.

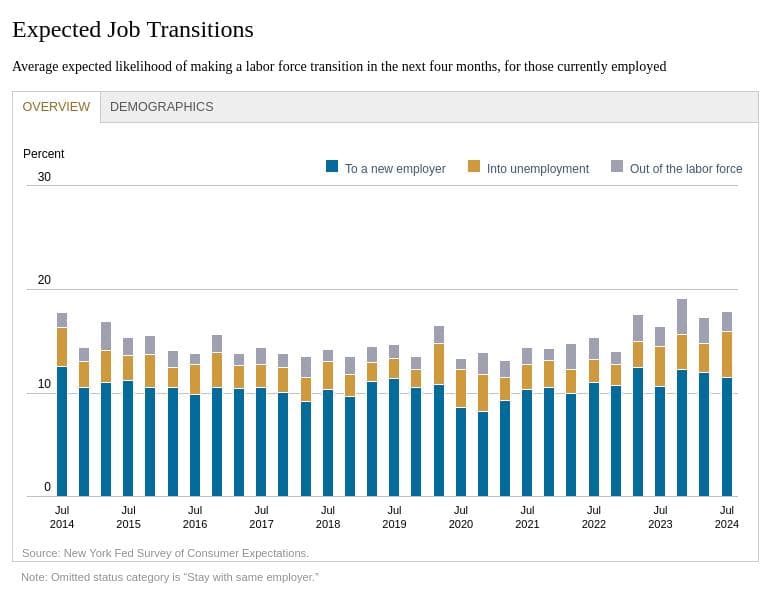

- The expected likelihood of moving to a new employer rose to 11.6%, while the likelihood of becoming unemployed increased to 4.4%, the highest since the series began in 2014.

- The expected average salary for future job offers dropped to $65,272, though it remains above pre-pandemic levels.

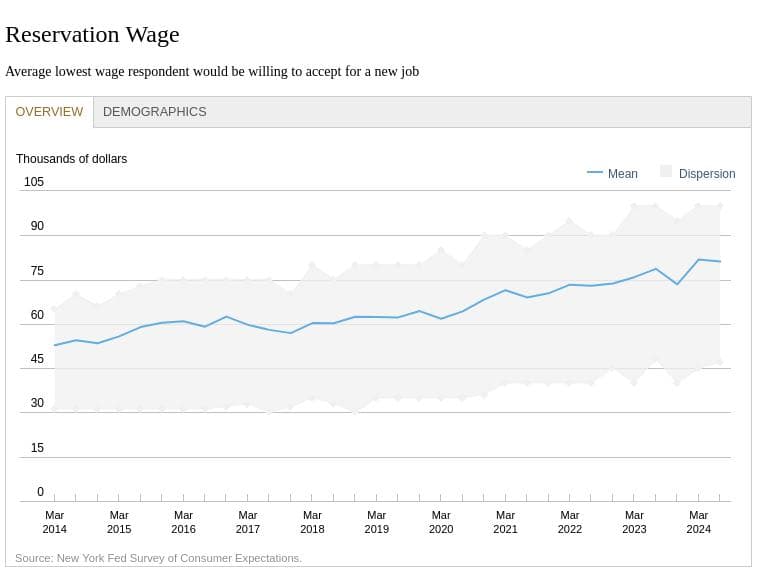

- The average reservation wage—the minimum salary respondents would accept for a new job—rose to $81,147, although it slightly retreated from a record high in March 2024.

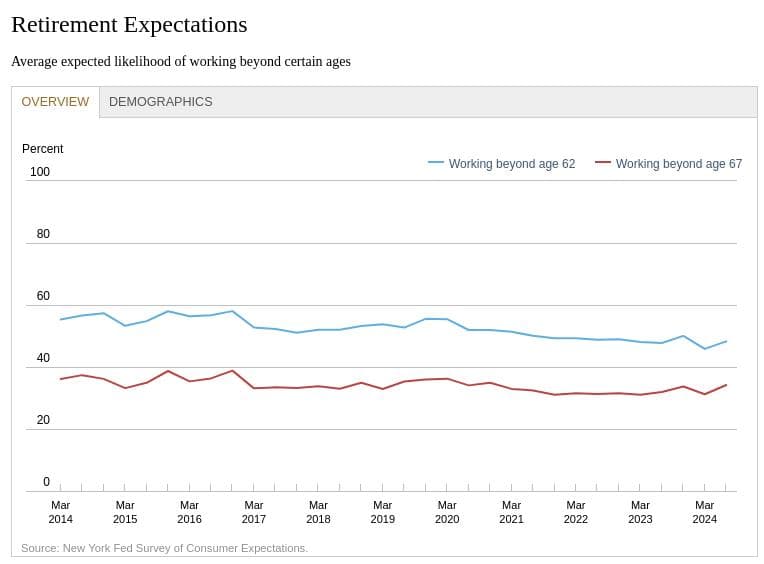

- Expectations for working beyond retirement age have increased, with 48.3% of respondents expecting to work past age 62 and 34.2% beyond age 67, reversing a decline seen since the pandemic began.

Reviewing in images:

TLDRS:

- The Federal Reserve Bank of New York’s July 2024 SCE Labor Market Survey reveals significant changes in the job market, with 28.4% of individuals actively searching for jobs, the highest level since the survey's inception in 2014.

- The rise in job searches was particularly pronounced among those over 45, without a college degree, and with household incomes below $60,000.

- Only 88% of those employed four months ago remained with the same employer, a record low, while the rate of switching employers increased to 7.1%.

- Despite more active job searches, the proportion of individuals receiving job offers remained stable at 19.4%, and the average wage for full-time offers slightly decreased to $68,905.

- Job satisfaction has declined across several areas, including wage compensation (down to 56.7%), non-wage benefits (56.3%), and promotion opportunities (44.2%), with notable dissatisfaction among women, those without a college degree, and lower-income respondents.

- The expected likelihood of moving to a new employer rose to 11.6%, and the likelihood of becoming unemployed increased to 4.4%, the highest since the series began.

- Expectations for working beyond retirement age have increased, with 48.3% of respondents expecting to work past age 62 and 34.2% beyond age 67, reversing a decline seen since the pandemic began.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold or even increasing interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

SCE Labor Market Survey: The proportion of individuals who reported searching for a job in the past four weeks rose to 28.4% from 19.4% in July 2023, highest since March 2014. The average expected likelihood of becoming unemployed in the next four months reached a series high.

by u/Dismal-Jellyfish in Superstonk

Fed: The proportion of individuals who reported searching for a job in the past four weeks rose to 28.4% from 19.4% in July, highest since March 2014. The average expected likelihood of becoming unemployed in the next four months reached a series high.https://t.co/9aSJExGrBZ

— dismal-jellyfish (@DismalJellyfish) August 19, 2024