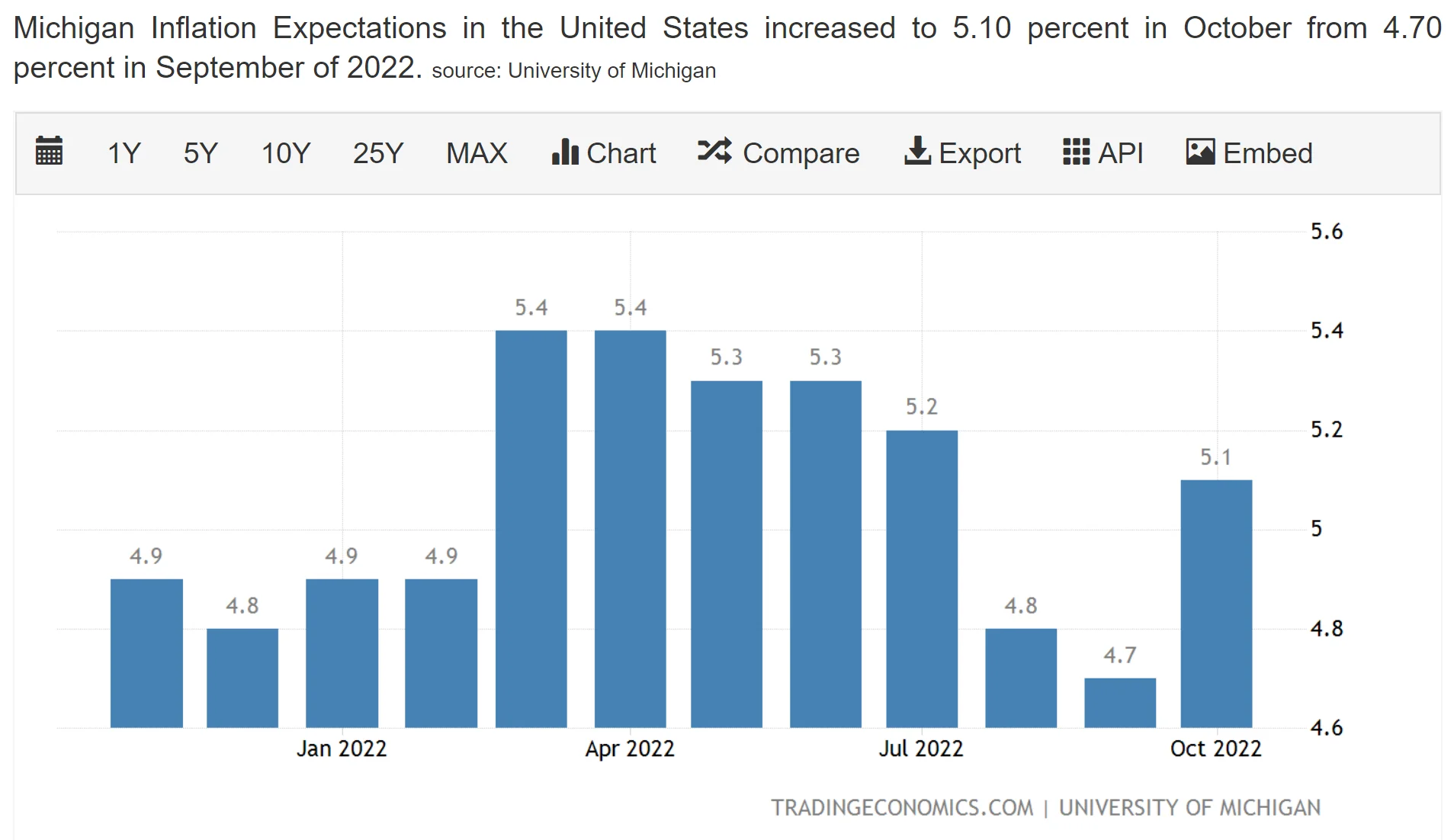

Inflation Alert! UMich: 'Continued uncertainty over the future trajectory of prices, economies, and financial markets around the world indicate a bumpy road ahead for consumers. The median expected year-ahead inflation rate rose to 5.1%

The median expected year-ahead inflation rate rose to 5.1%, with increases reported across age, income, and education. Last month, long run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then expectations have returned to that range at 2.9%. After 3 months of expecting minimal increases in gas prices in the year ahead, both short and longer run expectations rebounded in October.

What is the United States Michigan 1-Year Inflation Expectations?

The Index of Consumer Expectations focuses on three areas: how consumers view prospects for their own financial situation, how they view prospects for the general economy over the near term, and their view of prospects for the economy over the long term. Each monthly survey contains approximately 50 core questions, each of which tracks a different aspect of consumer attitudes and expectations. The samples for the Surveys of Consumers are statistically designed to be representative of all American households, excluding those in Alaska and Hawaii. Each month, a minimum of 500 interviews are conducted by telephone.

Pair these expectations with retail food and services sales today:

Advance estimates of U.S. retail and food services sales for September 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $684.0 billion, virtually unchanged (±0.5 percent)* from the previous month, but 8.2 percent (±0.7 percent) above September 2021. Total sales for the July 2022 through September 2022 period were up 9.2 percent (±0.5 percent) from the same period a year ago. The July 2022 to August 2022 percent change was revised from up 0.3% (±0.5 percent)* to up 0.4 percent (±0.2 percent).

Wut mean?

The numbers and survey data show people are still buying stuff and believe prices to continue to go up, which feeds into the inflation numbers we are seeing. AKA, inflation is not slowing down and hitting wage-price spiral territory.

Remember, even the average person now believe the 2% inflation 5 years from now number the Fed governors have spoken to this week isn't happening with out more rate hikes and QT. Heck, the New York Fed's 5 year outlook is over 2% now (2.2%).

This is yet more data that inflation is not tamed.