Minneapolis Fed President Neel Kashkari wants to run a new high-inflation stress test on banks to identify at risk banks.

Inflation Alert! Minneapolis Fed President Neel Kashkari wants to run a new high-inflation stress test on banks to identify at risk banks. Kashkari: "the historical record shows that banks are unlikely to take meaningful actions to enhance their resiliency against this risk on their own"

Executive Summary:

Wut mean?:

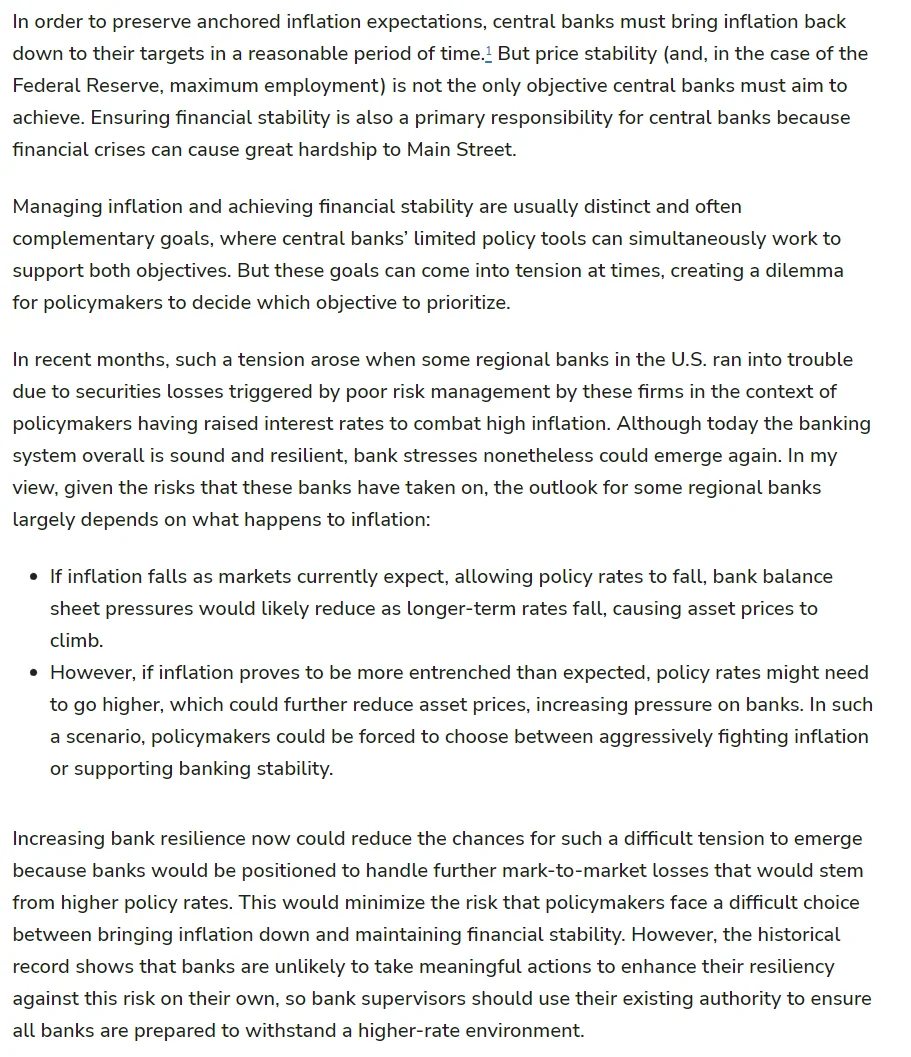

Minneapolis Fed President Neel Kashkari starts discussing the dual responsibilities of the Fed: managing inflation (keeping prices stable) and ensuring financial stability (keeping the banking system healthy).

- These two goals usually work well together, but sometimes they can conflict, with policymakers left to decide what to prioritize.

- Kashkari calls out regional banks in the U.S. faced problems when the Fed raised interest rates to fight high inflation (he claims poor risk management but . I argue the Fed's forward guidance is what caused it to begin with)

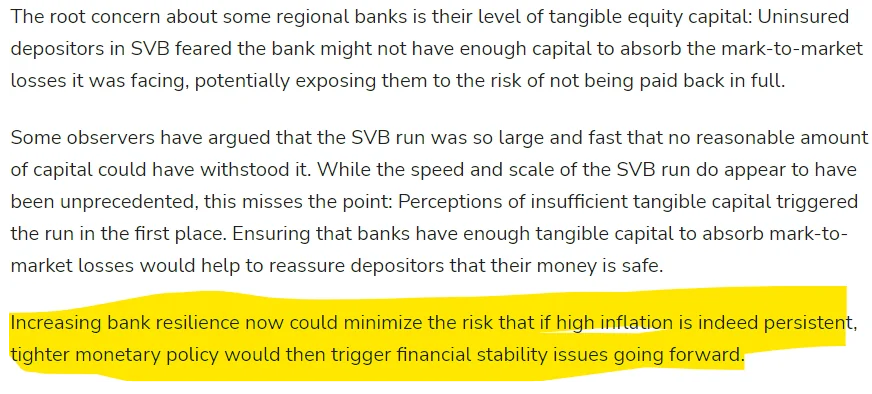

- Kashkari suggests that making banks more resilient now could help avoid this difficult choice. Banks would be better prepared to handle losses from higher interest rates.

- However, 'the historical record shows that banks are unlikely to take meaningful actions to enhance their resiliency against this risk on their own', so bank supervisors should ensure that all banks are ready to handle a higher-rate environment.

"Inflation and Stability Are Typically Distinct—but Tensions Can Arise"

Wut mean?

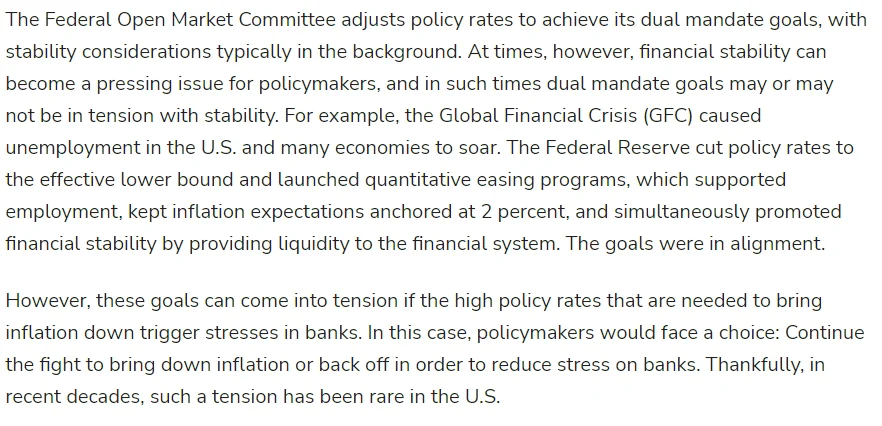

The Federal Open Market Committee adjusts interest rates to achieve its mandate: stable prices and maximum employment.

- Usually, financial stability is a secondary concern.

- "At times, however, financial stability can become a pressing issue for policymakers, and in such times dual mandate goals may or may not be in tension with stability."

- For example, the Global Financial Crisis caused unemployment to soar. The Fedcut policy rates to the effective lower bound and fired up the printer!

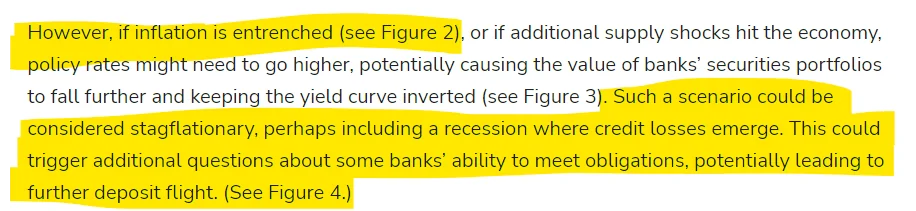

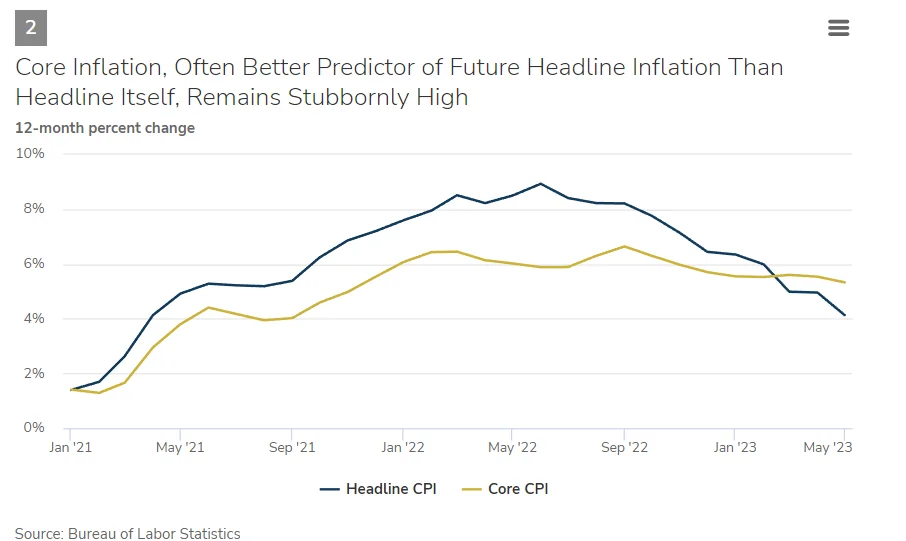

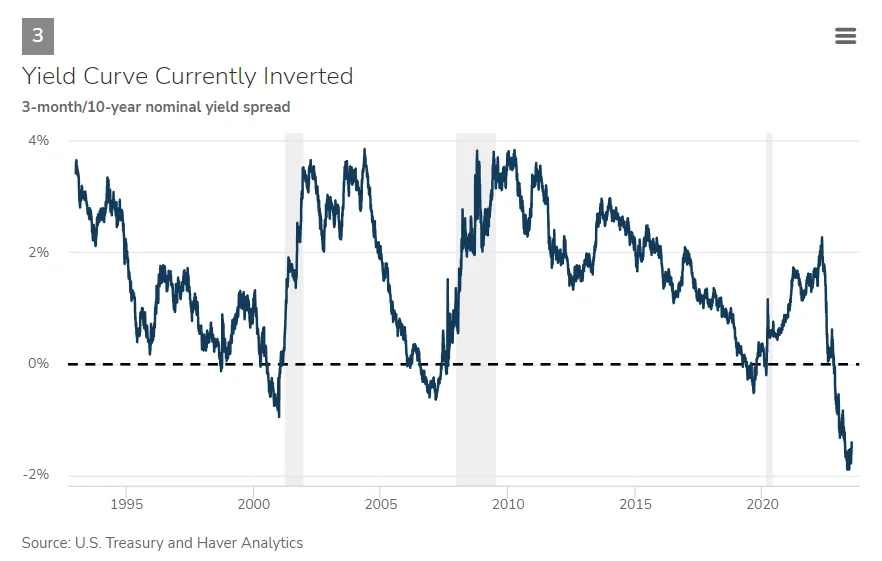

- However, if high interest rates are needed to control inflation, this could put stress on banks.

- Kashkari calls out policymakers would then face a difficult decision: should they continue to fight inflation or ease off to reduce stress on banks?

"High Inflation Triggered Recent Stresses in Some Regional Banks; Their Outlook Depends On Inflation"

Wut mean?

- "High Inflation Triggered Recent Stresses in Some Regional Banks; Their Outlook Depends On Inflation"--looks like he agrees with me?!?! I believe inflation is the match that has been lit that will light the fuse of our rocket.

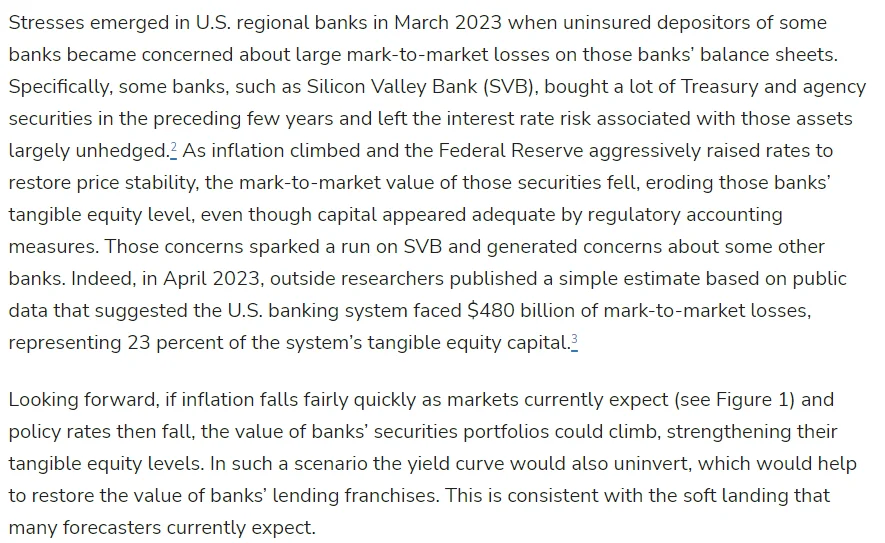

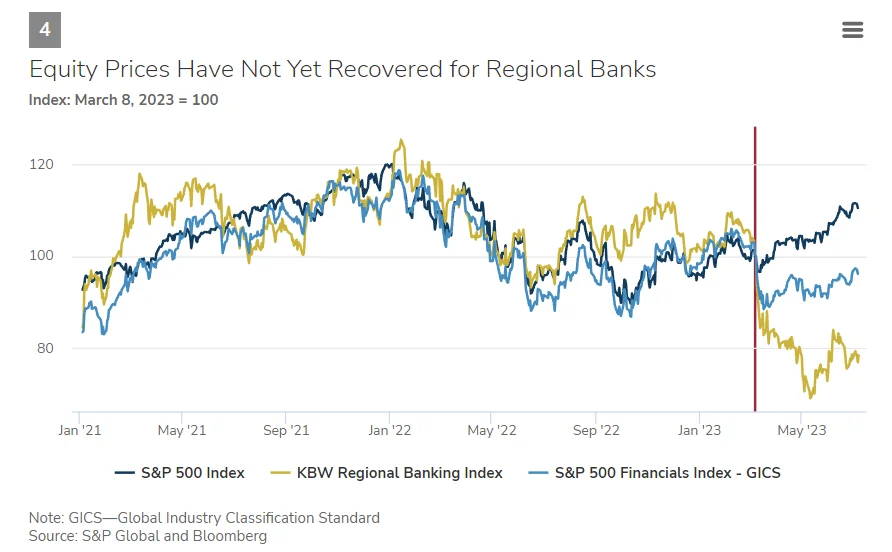

- In March, some regional banks, like Silicon Valley Bank (SVB), experienced stress because they had bought a lot of Treasury and agency securities and didn't hedge against the risk of interest rates changing--again, I argue the Fed's forward guidance is what caused it to begin with.

- With inflation raging the Fed increased rates to combat it, the value of these securities fell.

- This reduced the banks' tangible equity level, which is a measure of their financial strength.

- This caused a run on SVB and raised concerns about other banks.

- In April 2023, researchers estimated that the U.S. banking system could face $480 billion in losses, which is 23% of the system's tangible equity capital.

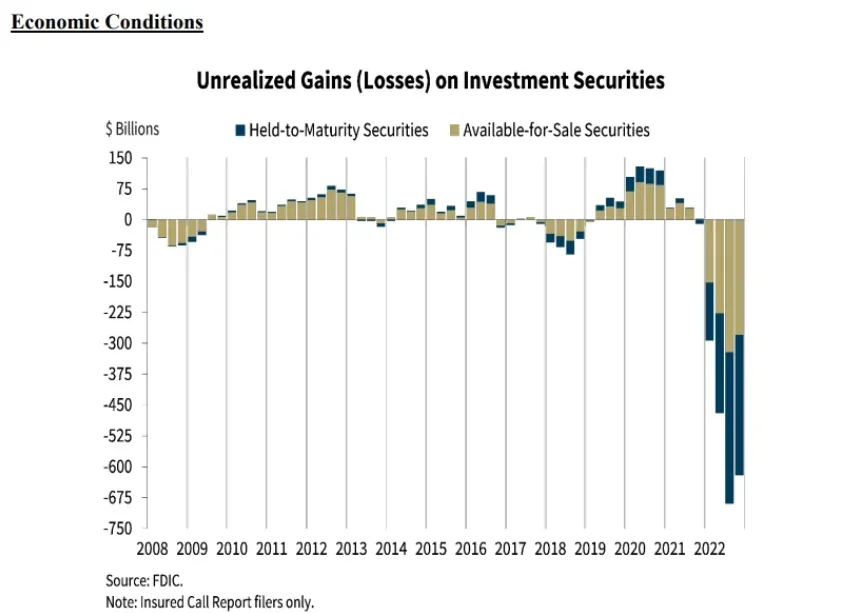

- Kashkari claims if inflation decreases quickly as expected and policy rates also decrease, the value of the banks' securities could increase, which would strengthen their tangible equity levels.

"Increased Bank Resilience Would Reduce the Chance of Financial Stability Risks Materializing"

Wut mean?:

- Some people who had a lot of money in SVB started to worry that the bank's safety net wasn't strong enough--enter bank run.

- Kashkari states some people say that this run on SVB was so big and fast that no safety net could have stopped it but the real problem was that people thought the safety net wasn't strong enough in the first place.

"Banks Are Unlikely to Take Meaningful Action to Increase Resiliency On Their Own"

Wut mean?

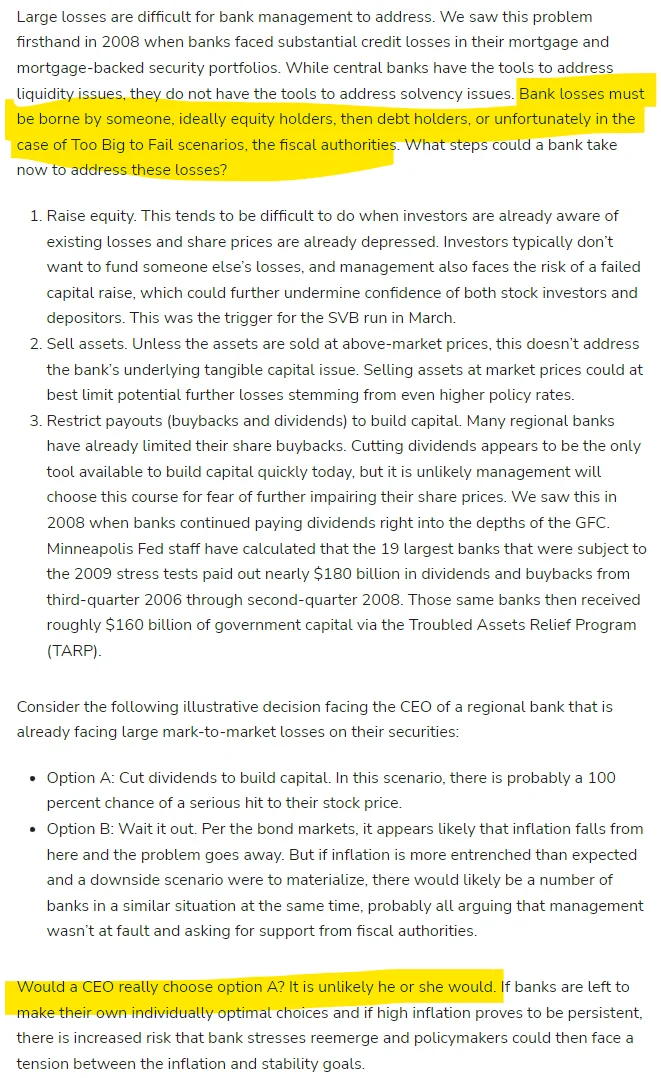

- When banks lose a lot of money, it's hard for them to fix the problem, like in 2008 when banks lost a lot on mortgages.

- The Fed can help with cash flow problems--$100 billion a week from the BTFP liquidity fairy for example!, but they can't fix a bank that's losing more money than it has.

- Someone has to cover these losses, usually the bank's owners, then its lenders, or TBTF, the tax payer.

- He calls out what a bank can do in this situation:

- Raise more money by selling shares. This is hard when investors already know about the losses and the bank's share price is low. This is what happened with SVB in March.

- Sell assets. Unless the assets are sold for more than their market price, this doesn't fix the bank's underlying problem. Selling assets at market price could at best stop potential further losses.

- Stop payouts (like buying back shares and paying dividends). Figures the big banks did this IMMEDIATELY after 'passing' the stress test the other day:

"What Could Supervisors Do to Push Banks to Prepare for High Inflation Risks?"

Wut mean?

- "One way supervisors could ensure banks are prepared is to run new high-inflation stress tests to identify at-risk banks and size individual capital shortfalls."

- The potential losses banks face today from interest rate risk appear to be more idiosyncratic than systemwide, and this high-inflation stress test would help banks prepare for a worse-than-expected scenario.

TLDRS:

- Minneapolis Fed President Neel Kashkari wants to run a new high-inflation stress test on banks to identify at risk banks. Kashkari: "the historical record shows that banks are unlikely to take meaningful actions to enhance their resiliency against this risk on their own"

- Kashkari calls out policymakers would then face a difficult decision: should they continue to fight inflation or ease off to reduce stress on banks?

- The potential losses banks face today from interest rate risk appear to be more idiosyncratic than systemwide, and this high-inflation stress test would help banks prepare for a worse-than-expected scenario.

- So I guess those stress tests they all passed the other day aren't worth the paper they are written on?

- Reminder, while banks have the liquidity fairy, 'we' get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.