Inflation Alert! Fresh off yesterday's report that confidence among homebuilders plummeted for a record 12th month in December, U.S. single-family homebuilding dropped to a 2.5-year low in November and permits for future construction nose dived.

Source: https://www.census.gov/construction/nrc/pdf/newresconst.pdf

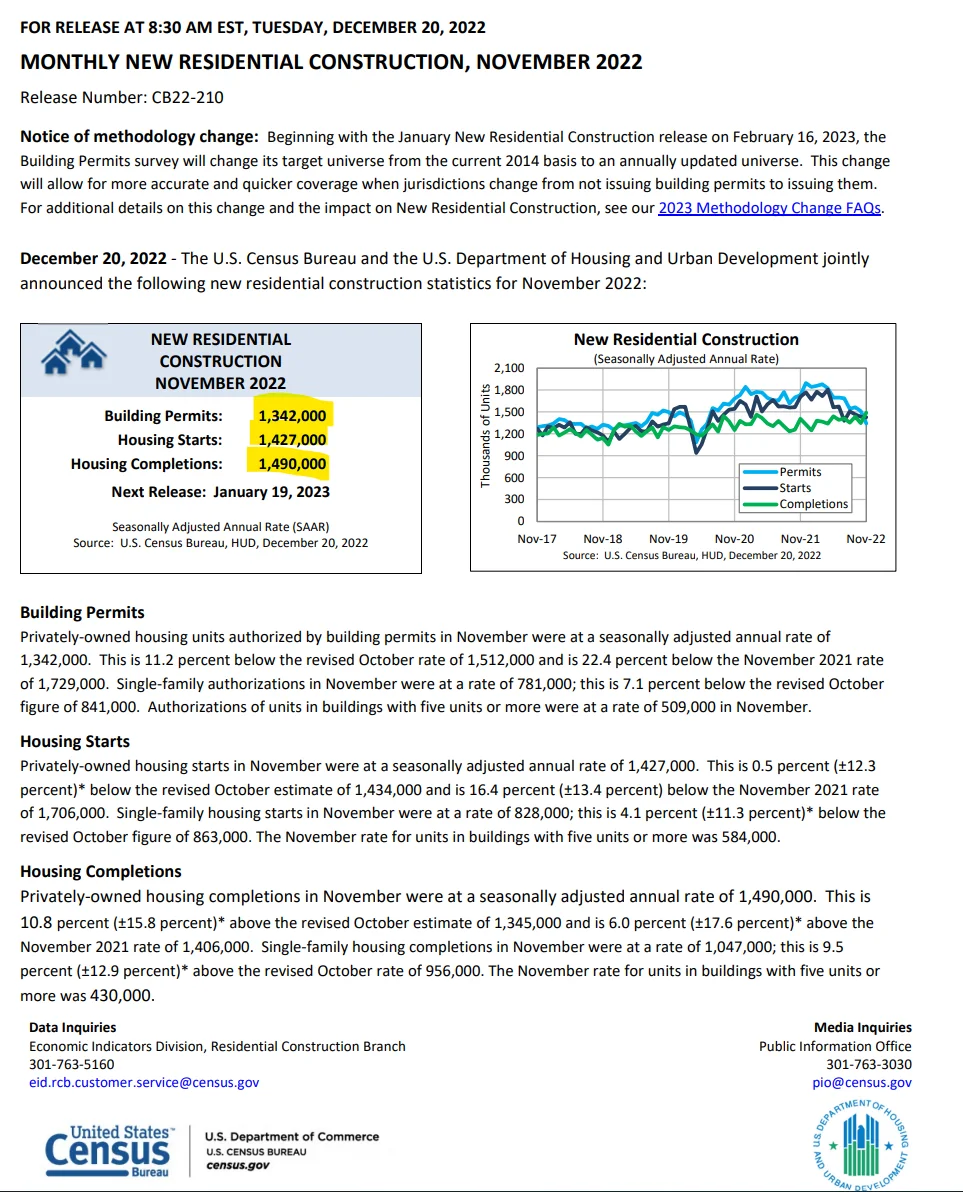

Fresh off yesterday's report that confidence among homebuilders plummeted for a record 12th month in December, U.S. single-family homebuilding dropped to a 2.5-year low in November and permits for future construction nose dived.

2022 United States Building Permits

| Month | Building permits |

|---|---|

| January | 1.841 million |

| February | 1.857 million |

| March | 1.879 million |

| April | 1.823 million |

| May | 1.695 million |

| June | 1.696 million |

| July | 1.685 million |

| August | 1.542 million |

| September | 1.564 million |

| October | 1.512 million |

| November | 1.342 million |

As you can see, building permits in the United States are down 27.1% from January and 22.4% below November 2021. Permits, which act as a proxy for future construction, have been falling as soaring prices and rising mortgage rates hit demand and activity.

2022 United States Housing Starts

| Month | Building permits |

|---|---|

| January | 1.666 million |

| February | 1.777 million |

| March | 1.716 million |

| April | 1.805 million |

| May | 1.562 million |

| June | 1.575 million |

| July | 1.377 million |

| August | 1.508 million |

| September | 1.465 million |

| October | 1.434 million |

| November | 1.427 million |

Housing starts are down 14.35% compared to January and 16.4% below November 2021. Single-family starts are the weakest since February 2019, while single-family homebuilding decreased in the South and Midwest, usually thought of as more affordable regions of the United States, while it increased in the Northeast and West.

These numbers play out with the sinking confidence we saw yesterday in the National Association of Home Builders (NAHB)/Wells Fargo housing market index.

Builder confidence in the market for newly built single-family homes posted its 12th straight monthly decline in December, dropping two points to 31, this is the lowest confidence reading since mid-2012, with the exception of the onset of the pandemic in the spring of 2020:

2022 National Association of Home Builders (NAHB)/Wells Fargo housing market index

| Month | Score |

|---|---|

| January | 83 |

| February | 81 |

| March | 79 |

| April | 77 |

| May | 69 |

| June | 67 |

| July | 55 |

| August | 49 |

| September | 46 |

| October | 38 |

| November | 33 |

| December | 31 |

Look at how confidence among single-family homebuilders has dropped this year, down 62.7% since January's reading of 83!

Conclusion:

Remember, the Fed is attempting to slow inflation by bringing down demand for everything from housing to labor. The labor market has remained tight but the housing market has contracted for 6 straight quarters now.

However, higher mortgage rates + declining single-family homebuilding + declining inventory will likely mean MORE housing inflation as the above combination exacerbates an already savagely unhealthy housing market.