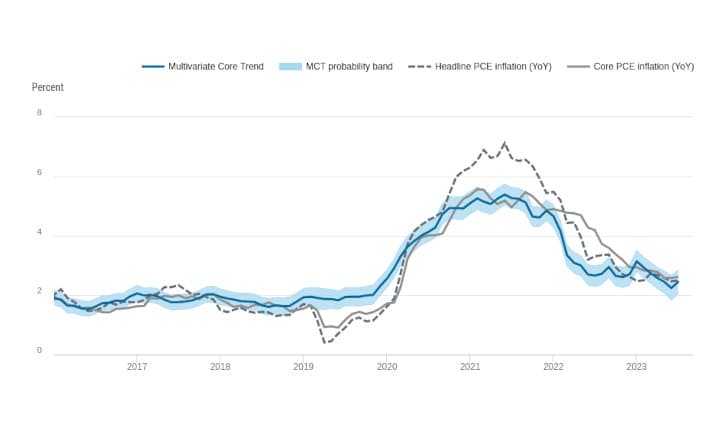

Inflation Alert! Bank of Japan when raising interest rates today: 'The functioning of bond markets has deteriorated, particularly in terms of relative relationships among interest rates of bonds with different maturities and arbitrage relationships..."

Inflation Alert! Bank of Japan when raising interest rates today: 'The functioning of bond markets has deteriorated, particularly in terms of relative relationships among interest rates of bonds with different maturities and arbitrage relationships between spot and futures markets.'

Source: https://www.boj.or.jp/en/announcements/release_2022/k221220a.pdf

The Bank of Japan announced wideng the band of its yield peg that kept the 10-year yield capped at ~0.25%. It raised the upper limit of the yield peg to 0.5%--from 0.25%. It left its short-term policy rate unchanged in the negative, at -0.1%--the last central bank with negative interest rates AKA Free Money.

Why are they doing this? In its statement on monetary policy today:

Since early spring this year, volatility in overseas financial and capital markets has increased and this has significantly affected these markets in Japan. The functioning of bond markets has deteriorated, particularly in terms of relative relationships among interest rates of bonds with different maturities and arbitrage relationships between spot and futures markets. Yields on Japanese government bonds (JGBs) are reference rates for corporate bond yields, bank lending rates, and other funding rates.

and

If these market conditions persist, this could have a negative impact on financial conditions such as issuance conditions for corporate bonds. The Bank expects that the measures decided today will facilitate the transmission of monetary easing effects generated under the framework of yield curve control, such as through corporate financing. The Bank will aim to achieve the price stability target by enhancing the sustainability of monetary easing under this framework through implementing these measures.

This caused bond yields to rally:

This jump in yield also saw the yen gain against the dollar as well:

What changed? The Bank of Japan starting selling USD in September:

Through October (most recent data available from Treasury), Japan’s holdings of Treasury securities decreased by $121 billion, to $1.08 trillion, and were down $242 billion from a year earlier.

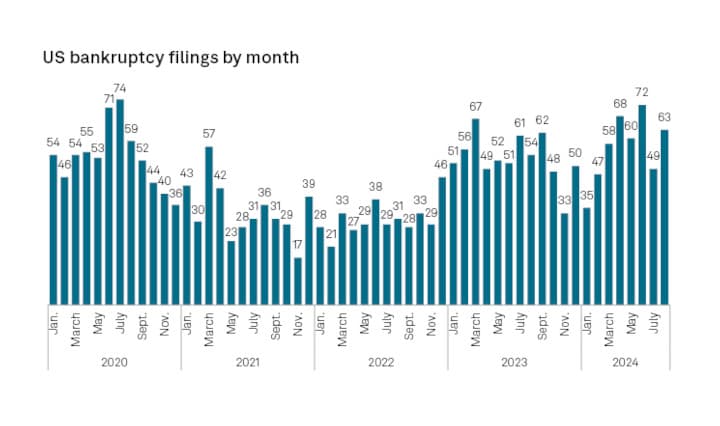

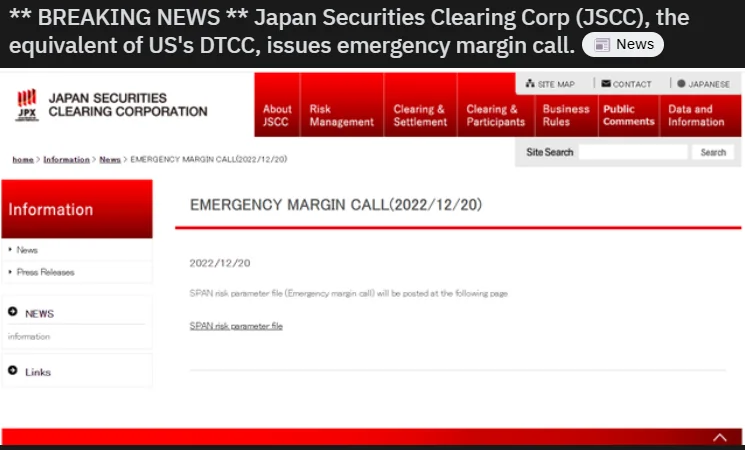

All of which brings us back to today and things starting to get funky as the reverberations from rate increases felt:

Buckle Up!