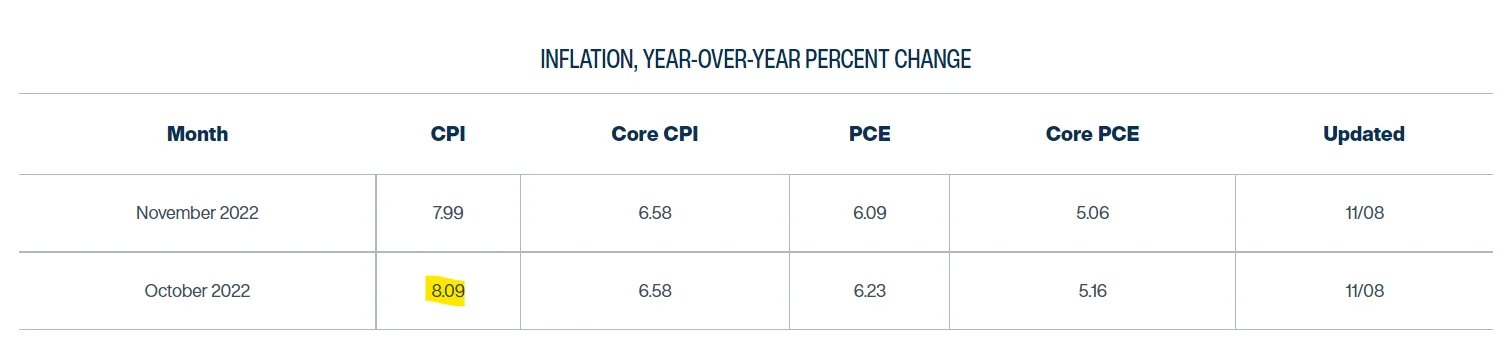

Inflation Alert! Ahead of Thursday's CPI numbers, the Federal Reserve bank of Cleveland daily “nowcasts” shows October with CPI at 8.09% and PCE at 6.23%

About Inflation Nowcasting

The Federal Reserve Bank of Cleveland provides daily “nowcasts” of inflation for two popular price indexes, the price index for personal consumption expenditures (PCE) and the consumer price index (CPI). Nowcasts are estimates or forecasts of the present. The Cleveland Fed produces nowcasts of the current period's rate of inflation—inflation in a given month or quarter—before the official CPI or PCE inflation data are released. These forecasts can help to give a sense of where inflation is now and where it is likely to be in the future.

Our inflation nowcasts are produced with a model that uses a small number of available data series at different frequencies, including daily oil prices, weekly gasoline prices, and monthly CPI and PCE inflation readings. The model generates nowcasts of monthly inflation, and these are combined for nowcasting current-quarter inflation. As with any forecast, there is no guarantee that these inflation nowcasts will be accurate all of the time. But historically, the Cleveland Fed’s model nowcasts have done quite well—in many cases, they have been more accurate than common benchmarks from alternative statistical models and even consensus inflation nowcasts from surveys of professional forecasters.

Plugging those estimates in for the year we have seen so far:

| Month | CPI Percent Change from Year Ago | PCE Percent Change from Year Ago |

|---|---|---|

| January | 7.5% | 6.1% |

| February | 7.9% | 6.4% |

| March | 8.5% | 6.8% |

| April | 8.3% | 6.4% |

| May | 8.6% | 6.5% |

| June | 9.1% | 7.0% |

| July | 8.5% | 6.4% |

| August | 8.3% | 6.2% |

| September | 8.2% | 6.2% |

| October* | 8.09% | 6.23% |

| November* | 7.99% | 6.09% |

| YTD reading** | 8.27% | 6.39% |

| * 'Nowcast' estimate | ** Includes 'Nowcast' estimate |

After the hypothetical readings:With 1 reading left in the year, even if CPI inflation comes in at 0 for the rest of the year, 2022 CPI inflation would be at 7.58%, 61.27% greater than the CBO's 4.7% estimate for CY2022.With 1 reading left in the year, even if PCE inflation comes in at 0 for the rest of the year, 2022 PCE inflation would be at 5.86%. This is 193% higher than the FOMC's stated 2% PCE goal.

With price stability so obviously still broken (by the Fed's own hand at that) and with labor still strong, Boston Fed President Susan Collins said Friday:

Making policy decisions going forward will not be easy – it never is at this stage in the economic cycle.

Returning to price stability will set the foundation for sustainable maximum employment– and for achieving the mission of a vibrant, inclusive economy that works best for all in the long run.

To conclude, let me reiterate my commitment to the Fed’s dual mandate – price stability and maximum employment – and specifically, my resolve to restore price stability.

TL:DRS

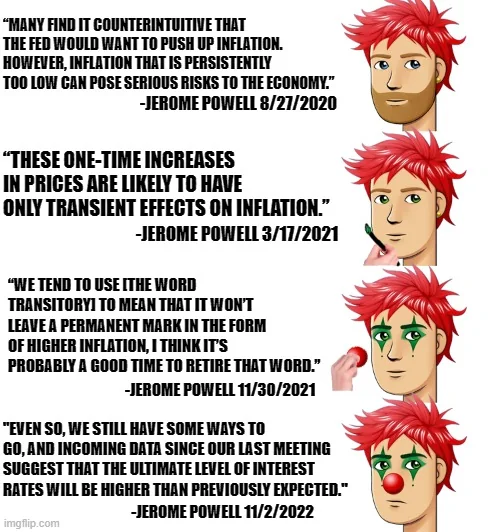

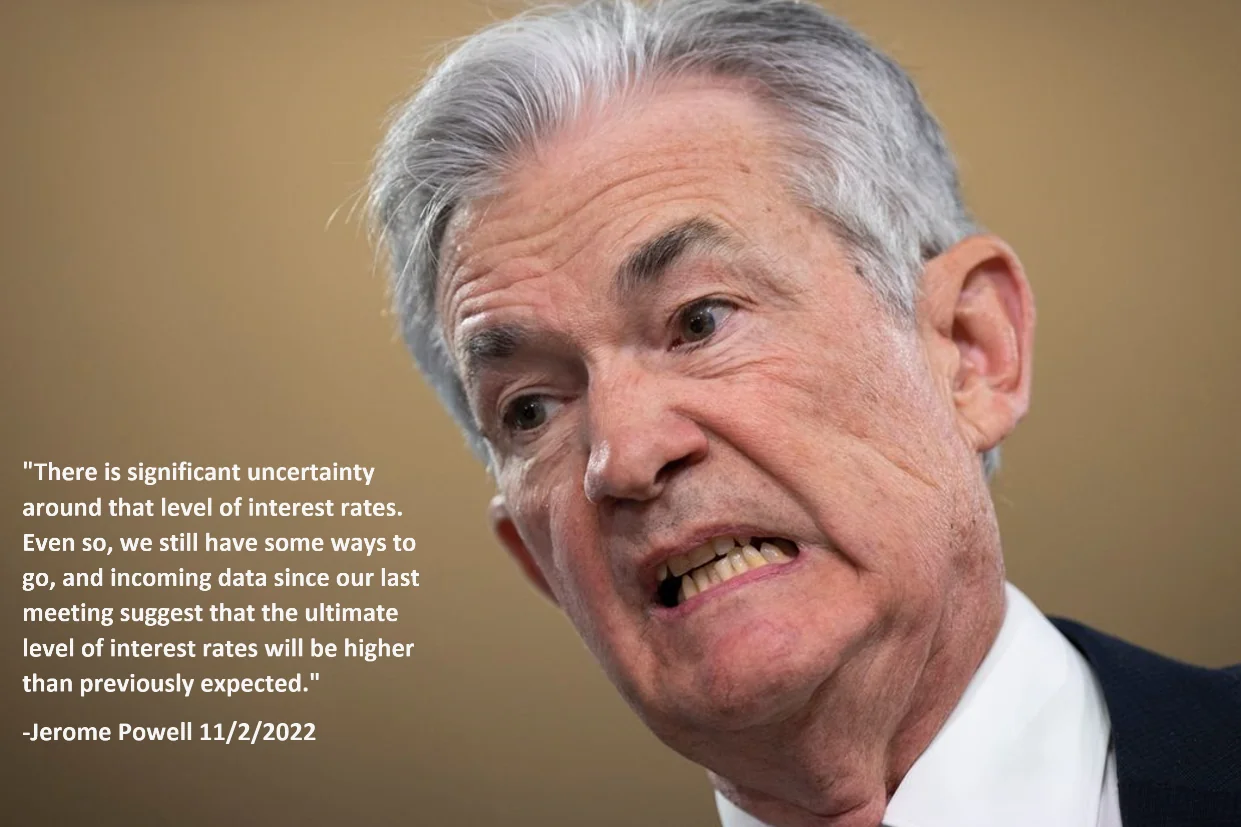

Coming out of the most recent FOMC meeting, JPow stated 'incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.' This is a review of some of that data via the Federal Reserve bank of Cleveland's daily “nowcasts”

To fix one end of the mandate (price stability) from the problem they created, the Fed is sacrificing employment (their other end of the mandate) to bolster price stability.