IMF: "Services price inflation is holding up progress on disinflation, which is complicating monetary policy normalization. Upside risks to inflation have thus increased, raising the prospect of higher-for-even-longer interest rates"

The International Monetary Fund said Tuesday in its World Economic Outlook Update that global growth remains on track with the April 2024 World Economic Outlook (WEO) forecast, projected at 3.2% in 2024 and 3.3% in 2025. However, persistent services price inflation is complicating disinflation efforts and in turn, monetary policy normalization, raising the prospect of higher interest rates amid escalating trade tensions and increased policy uncertainty.

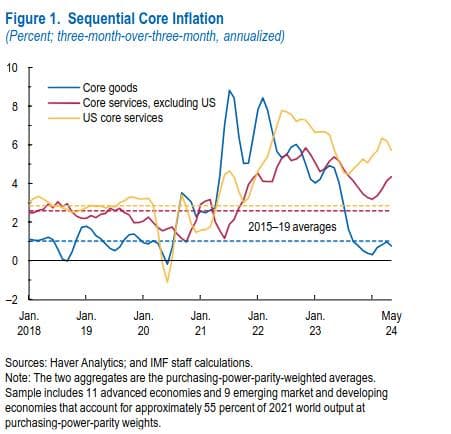

The slowing momentum on global disinflation reflects persistent high inflation in services. This has delayed policy normalization in the U.S., putting other advanced economies like the euro area and Canada ahead in the easing cycle. Central banks in emerging markets remain cautious about cutting rates due to external risks and currency depreciation.

"At the same time, a number of central banks in emerging market economies remain cautious in regard to cutting rates owing to external risks triggered by changes in interest rate differentials and associated depreciation of those economies’ currencies against the dollar."

Persistent inflation in the services sector, driven by wage and price setting, poses significant challenges says the IMF report. Higher nominal wage growth, especially with weak productivity, could lead to further wage and price inflation stickiness. Renewed trade or geopolitical tensions could exacerbate price pressures.

Elevated inflation risks have raised the prospect of prolonged high-interest rates, increasing external, fiscal, and financial risks. Prolonged dollar appreciation could disrupt capital flows, affecting growth and planned monetary policy easing. High borrowing costs and financial stability concerns could arise if fiscal improvements do not counterbalance higher real rates amid lower potential growth.

Potential economic policy swings due to elections this year have increased uncertainty around the baseline. These shifts could lead to fiscal profligacy, worsening debt dynamics, and increasing long-term yields and protectionism. Trade tariffs and industrial policies could result in damaging cross-border spillovers and retaliation, creating a costly race to the bottom.

"In countries where upside risks to inflation—including those arising through external channels—have materialized, central banks should refrain from easing too early and remain open to further tightening should it become necessary."

- "we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. Incoming data for the first quarter of this year did not support such greater confidence."

- Consumer spending remains robust, with moderate growth in capital spending and residential investment.

- The labor market has stabilized with a 4.1% unemployment rate and an average of 222,000 payroll job gains per month in the first half of the year.

- Even if interest rates decrease this year, hundreds of banks with substantial total assets remain at risk unless they significantly reduce their CRE exposure or bolster their resilience.

TLDRS:

- The IMF's World Economic Outlook Update projects global growth at 3.2% in 2024 and 3.3% in 2025.

- Persistent services price inflation complicates disinflation efforts and monetary policy, raising the likelihood of higher interest rates amidst escalating trade tensions.

- The slowing disinflation momentum is evident in the U.S., delaying policy normalization compared to the euro area and Canada; emerging market central banks are cautious about rate cuts due to external risks.

- Higher nominal wage growth and weak productivity in the services sector could lead to persistent wage and price inflation, with renewed trade or geopolitical tensions potentially worsening price pressures.

- Elevated inflation risks could result in prolonged high-interest rates, increasing external, fiscal, and financial risks, potentially disrupting capital flows and planned monetary policy easing.

- Fed Chair Jerome Powell testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, highlighting economic expansion despite moderating GDP growth in the first half of the year.

- "we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. Incoming data for the first quarter of this year did not support such greater confidence."

- A combination of slower wage growth, higher interest rates, and depleted savings indicate that the headwinds will continue against consumers.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

International Monetary Fund: "Services price inflation is holding up progress on disinflation, which is complicating monetary policy normalization. Upside risks to inflation have thus increased, raising the prospect of higher-for-even-longer interest rates"

by u/Dismal-Jellyfish in Superstonk

IMF: "Services price inflation is holding up progress on disinflation, which is complicating monetary policy normalization. Upside risks to inflation have thus increased, raising the prospect of higher-for-even-longer interest rates"https://t.co/Flkg9eBMK3

— dismal-jellyfish (@DismalJellyfish) July 17, 2024