ICYMI Weekend Review (October 31st-November 4th): A recap with analysis of this Week's Major U.S. Economic Reports, Fed Speakers, and Statements.

Hello r/Superstonk, I hope everyone is enjoying a nice start to the weekend! This is another attempt at tying posts and happenings from the week in one spot.

MONDAY, OCT. 31

| Report/Speech | Period | Previous | Actual | Superstonk Coverage: |

|---|---|---|---|---|

| Chicago PMI | Oct. | 45.7 | 45.2 | chicago_pmi_dropped |

TUESDAY, NOV. 1

| Report/Speech | Period | Previous | Actual | Superstonk Coverage: |

|---|---|---|---|---|

| S&P U.S. manufacturing PMI (final) | Oct. | 49.9 | 50.4 | |

| ISM manufacturing index | Oct. | 50.9% | 50.2% | |

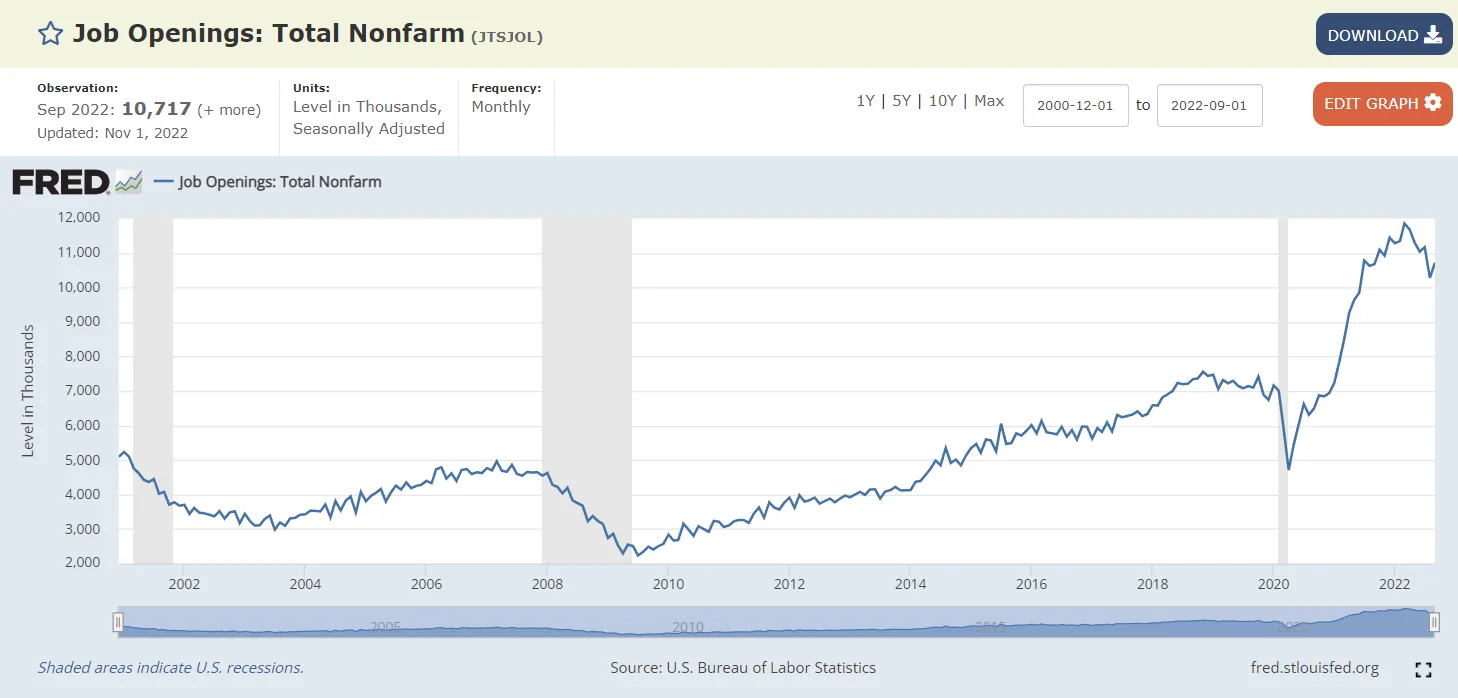

| Jobs openings | Sept. | 10.1 million | 10.7 million | |

| Quits | Sept. | 4.2 million | 4.1 million | |

| Construction Spending | Sept. | -0.7% | 0.2% | |

| FINRA delays data reporting | finra_previously_announced |

WEDENESDAY, NOV. 2

THURSDAY, NOV. 3

| Report/Speech | Period | Previous | Actual | Superstonk Coverage: |

|---|---|---|---|---|

| Initial jobless claims | Oct. 29 | 208,000 | 217,000 | |

| Continuing Jobless Claims | Oct. 22 | 1.44 million | 1.485 million | |

| Foreign Trade Deficit | Sept. | -$67.4 billion | $73.3 billion | |

| Productivity | Q3 | -4.1% | 0.3% | |

| Unit Labor Cost | Q3 | 10.2% | 3.5% | |

| S&P U.S. services PMI (final) | Oct. | 46.6 | 47.8 | |

| ISM services index | Oct. | 56.7% | 54.4% | |

| Factory Orders | Sept. | 0.2% | 0.3% | |

| FDIC Systemic Resolution Advisory Committee (SRAC) to Meet Next Week |

FRIDAY, NOV. 4

| Report/Speech | Period | Previous | Actual | Superstonk Coverage: |

|---|---|---|---|---|

| Nonfarm payrolls (level change) | Oct. | 263,000 | 261,000 | |

| Unemployment Rate | Oct. | 3.5% | 3.7% | |

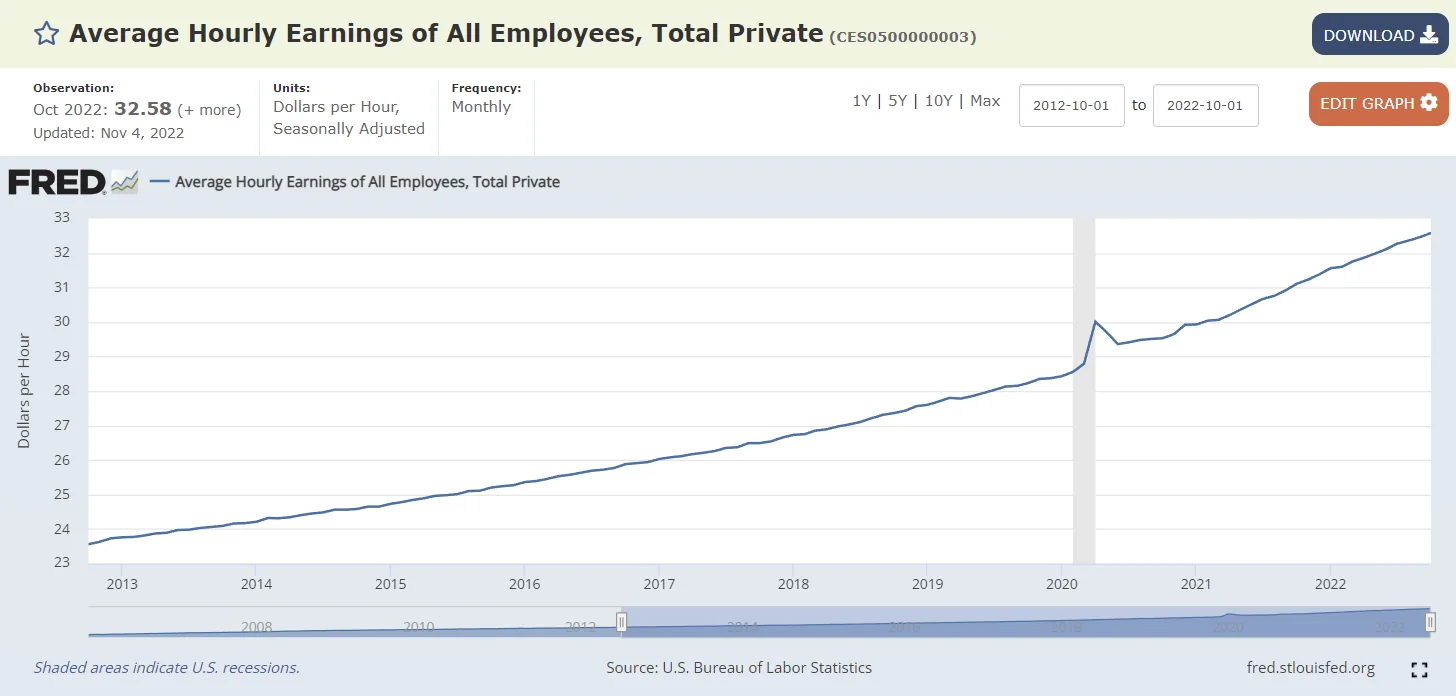

| Average Hourly Earnings | Oct. | 0.3% | 0.4% ($32.58) | |

| Labor-force participation rate | Oct. | 62.3% | 62.2% | |

| Financial Stability Report, framework for assessing the resilience of the U.S. financial system and presents the Board’s current assessment | fed_releases_financial | |||

| Boston Fed President Susan Collins | boston_fed_president_susan |

Analysis

It was a busy week over all for reports and statements. However, of the items called out above, I would like to discuss the following further:

| Report/Speech | Period | Previous | Actual | Superstonk Coverage: |

|---|---|---|---|---|

| Jobs openings | Sept. | 10.1 million | 10.7 million | |

| Quits | Sept. | 4.2 million | 4.1 million | |

| ADP employment report (level change) | Oct. | 208,000 | 239,000 | |

| FOMC announcement | Sept. | 3.00%-3.25% | fomc_statement | |

| Fed Chair Jerome Powell press conference | ||||

| Initial jobless claims | Oct. 29 | 208,000 | 217,000 | |

| Continuing Jobless Claims | Oct. 22 | 1.44 million | 1.485 million | |

| Unemployment Rate | Oct. | 3.5% | 3.7% | |

| Average Hourly Earnings | Oct. | 0.3% | 0.4% ($32.58) | |

| Boston Fed President Susan Collins | boston_fed_president_susan |

Before diving into the data and JPow's quote that 'ties' it all together, I would like to level set with some context:

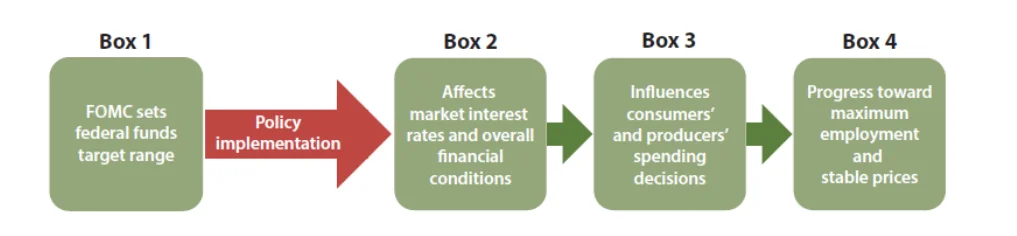

- The Federal Reserve has been given a dual mandate by congress—pursuing the economic goals of maximum employment and price stability.

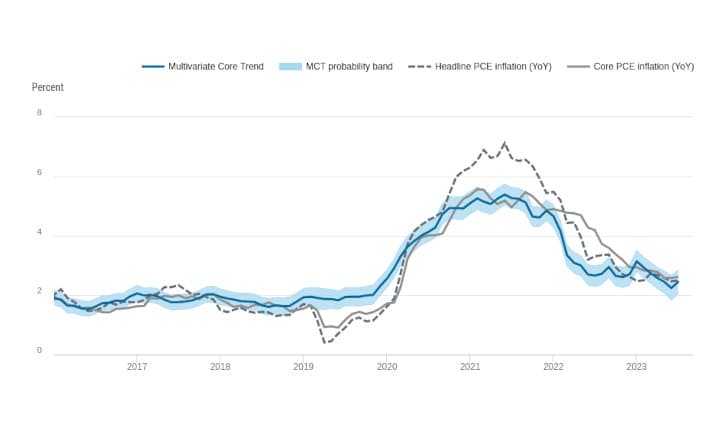

- The Fed and JPow in the past have stated 'price stability' is inflation at the rate of 2 percent, as measured by the annual change in the Price Index for Personal Consumption Expenditures (PCE).

- The Fed views maximum employment as the highest level of employment that the economy can sustain over time. The Fed does not have a numerical target for the level of employment; rather, the Fed analyzes economic conditions (reports in the table above).

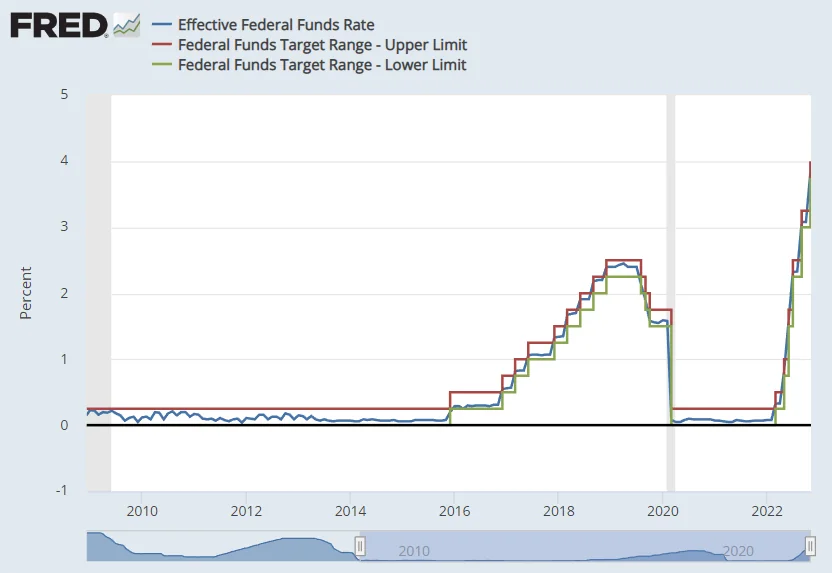

- The federal funds rate ( the rate that banks pay for overnight borrowing in the federal funds market ) is the Fed’s policy rate, which means it is the rate the Fed chooses to target to achieve its policy goals–the dual mandate.

- Changes in the federal funds rate influence other interest rates that in turn influence borrowing costs for households and businesses as well as broader financial conditions.

- The Federal Open Market Committee (FOMC) sets the target range for the federal funds rate with the upper and lower limits on the range

- To fight inflation, FOMC has been raising the federal funds rate.

- However, when interest rates go up, it becomes more expensive to borrow, so businesses are generally unwilling to add more workers and may have to reduce headcount to account for increased costs.

- This generally places downward pressure on employment and wages

- Rates have been going up:

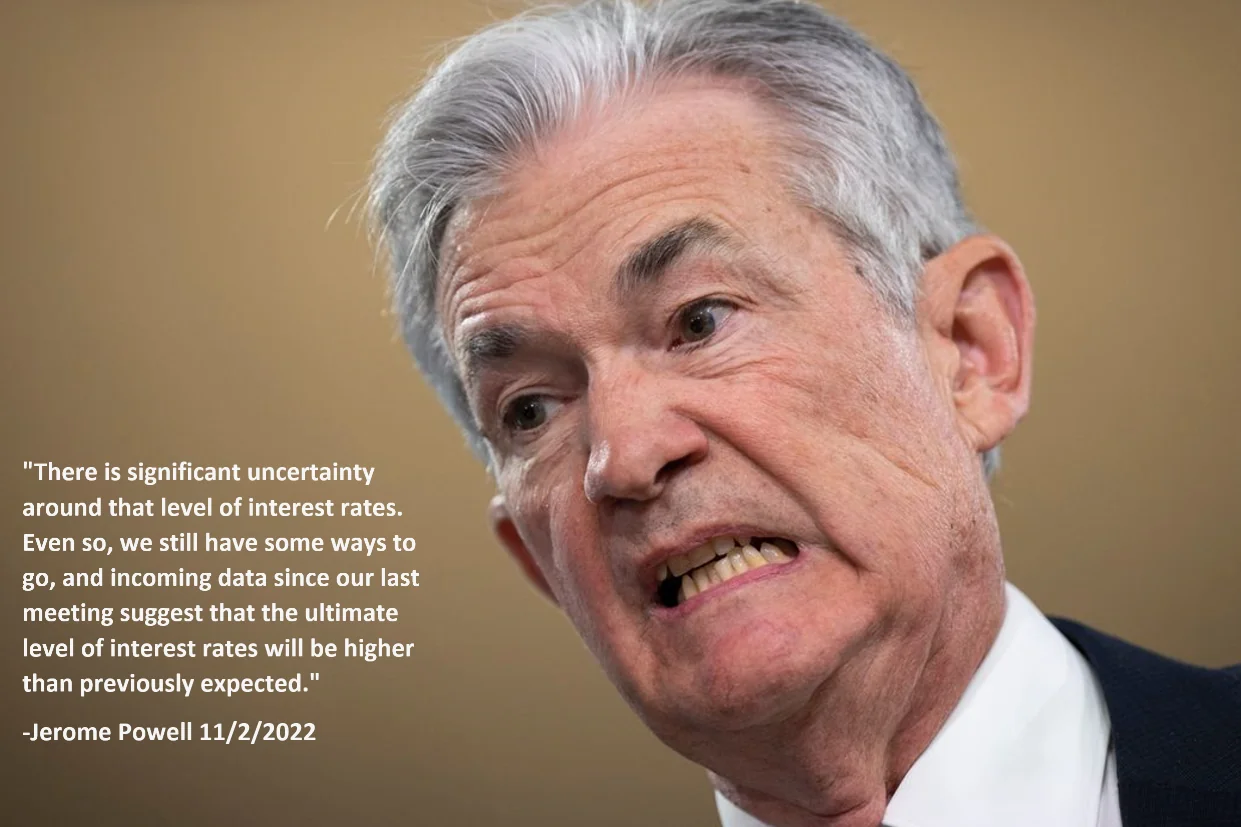

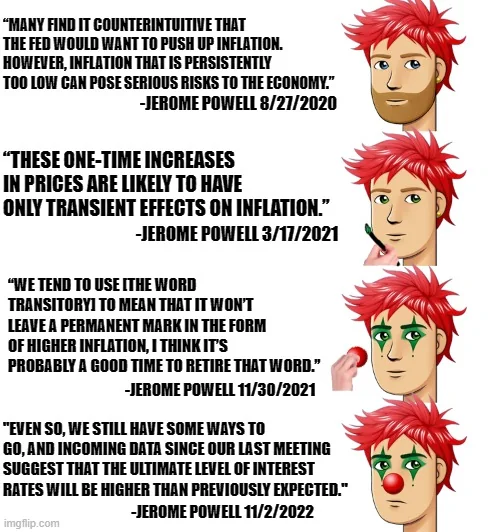

All of which brings me to this quote from Jerome Powell at this week's FOMC presser:

So what incoming data has him concerned?

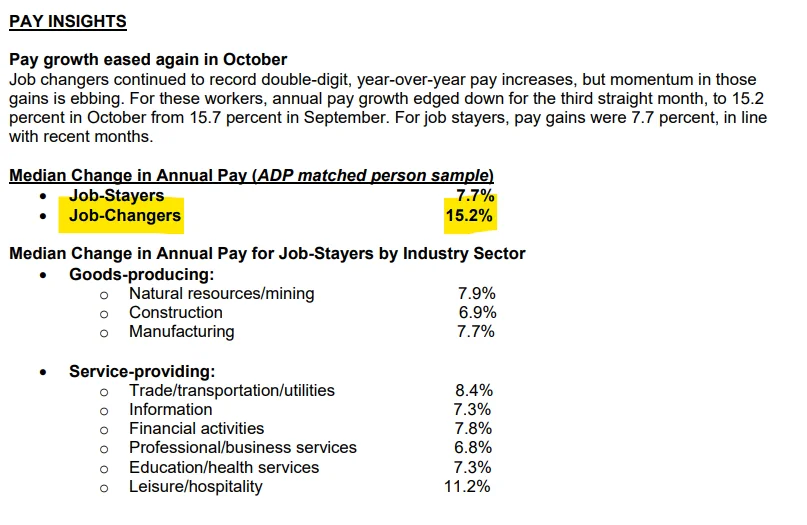

For starters, ADP employment report (level change):

Folks changing jobs is one of the few ways to beat CPI inflation (with wage increases for job changers nearly double that of CPI inflation) since employers are having to offer higher wages in a tight labor market while employers have already complained about hiring/training folks.

Yet, all this churn and job hopping is happening in the background of a HOT labor market with a slew of open jobs (10.7+ million) reported this week:

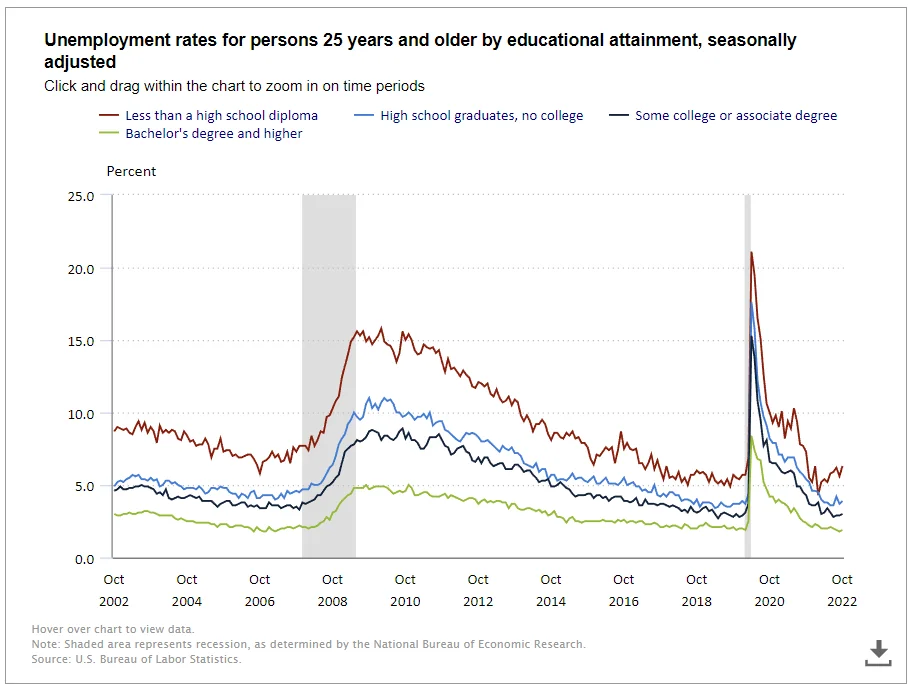

Additionally, the overall unemployment figure is at (3.7%):

- Less than a high school diploma: 6.3%. (previous 5.6%)

- High school graduate and no college: 3.9% (previous 3.7%)

- Some college or associate degree: 3.0% (previous 2.9%)

- Bachelor’s degree and higher: 1.9% (previous 1.8%)

As we can see from above, the labor market by most major metrics is primed to continue feeding into inflation (and further upsetting price stability.

Speaking of price stability, new CPI numbers come out this week but consider this calendar year so far:

| Month | CPI Percent Change from Year Ago | PCE Reading Percent Change from Year Ago |

|---|---|---|

| January | 7.5% | 6.1% |

| February | 7.9% | 6.4% |

| March | 8.5% | 6.8% |

| April | 8.3% | 6.4% |

| May | 8.6% | 6.5% |

| June | 9.1% | 7.0% |

| July | 8.5% | 6.4% |

| August | 8.3% | 6.2% |

| September | 8.2% | 6.2% |

| YTD reading | 8.38% | 6.44% |

With 3 readings left in the year, even if CPI inflation comes in at 0 for the rest of the year, 2022 CPI inflation would be at 6.29%, 33.8% greater than the CBO's 4.7% estimate for CY2022.With 3 readings left in the year, even if PCE inflation comes in at 0 for the rest of the year, 2022 PCE inflation would be at 4.83%. This is +2.83% (141.5%) higher than the committee's stated 2% PCE goal.

Back to the Fed's dual mandate, with price stability so obviously still broken (by the Fed's own hand at that) and with labor still strong, Boston Fed President Susan Collins yesterday said:

Making policy decisions going forward will not be easy – it never is at this stage in the economic cycle.

Returning to price stability will set the foundation for sustainable maximum employment– and for achieving the mission of a vibrant, inclusive economy that works best for all in the long run.

To conclude, let me reiterate my commitment to the Fed’s dual mandate – price stability and maximum employment – and specifically, my resolve to restore price stability.

TL:DRS

Coming out of the most recent FOMC meeting, JPow let slip 'incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.' This is a review of some of that data and how the Fed will sacrifice from the labor market (by continuing to raise rates) for price stability.

Meme to close us out:

Thanks for dropping by and I hope everyone has a wonderful rest of the weekend!