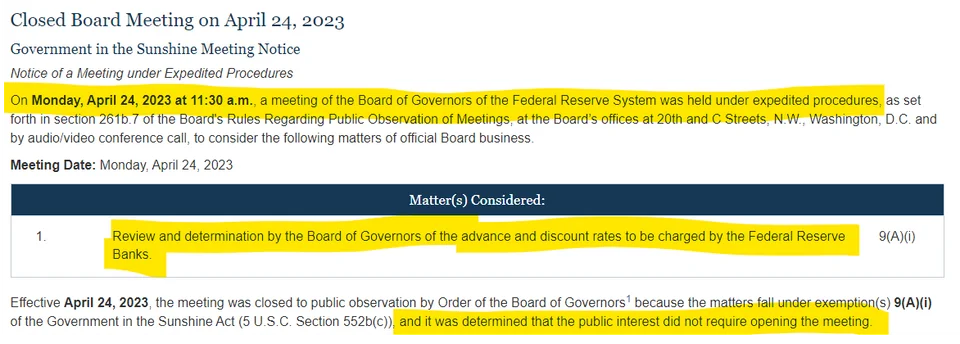

Federal Reserve Alert! Today, a CLOSED meeting of the Board of Governors of the Federal Reserve System was held under expedited procedures as it was determined that the public interest did not require opening the meeting.

Source: https://www.federalreserve.gov/aboutthefed/boardmeetings/20230424closed.htm

| Tool | 3/15 | 3/22 | 3/29 | 4/5 | 4/12 | 4/19 |

|---|---|---|---|---|---|---|

| Discount Window/Primary Credit | $152.85 billion | $110.248 billion | $88.157 billion | $69.705 billion | $67.633 billion | $69.925 billion |

Overview:

Federal Reserve lending to depository institutions (the “discount window”) plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy.

By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress. Thus, the discount window supports the smooth flow of credit to households and businesses. Providing liquidity in this way is one of the original purposes of the Federal Reserve System and other central banks around the world.

The "Primary Credit" program is the principal safety valve for ensuring adequate liquidity in the banking system. Primary credit is priced relative to the FOMC’s target range for the federal funds rate and is normally granted on a “no-questions-asked,” minimally administered basis. There are no restrictions on borrowers’ use of primary credit.

Examples of common borrowing situations:

- Tight money markets or undue market volatility

- Preventing an overnight overdraft

- Meeting a need for funding, including a short-term liquidity demand that may arise from unexpected deposit withdrawals or a spike in loan demand

The introduction of the primary credit program in 2003 marked a fundamental shift - from administration to pricing - in the Federal Reserve's approach to discount window lending. Notably, eligible depository institutions may obtain primary credit without exhausting or even seeking funds from alternative sources. Minimal administration of and restrictions on the use of primary credit makes it a reliable funding source. Being prepared to borrow primary credit enhances an institution's liquidity.

I wonder which institution(s) are seeking “no-questions-asked” "no restrictions on borrowers’ use of primary credit." to the tune of to the tune of $69.925 billion this past week @ 5.00%?

The sudden rise in Primary Credit shows big players are trying to get as much liquidity backstop as possible and are increasing their borrowing from the Fed, happily paying 5.00% to borrow billions. These are not cheap loans...