Federal Reserve Alert! Q3 Report on Household Debt and Credit: The 15 percent year-over-year increase in credit card balances marked the largest in more than 20 years.

Source: https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2022Q3

Household Debt Rises to $16.51 Trillion on Higher Mortgage, Credit Card Balances

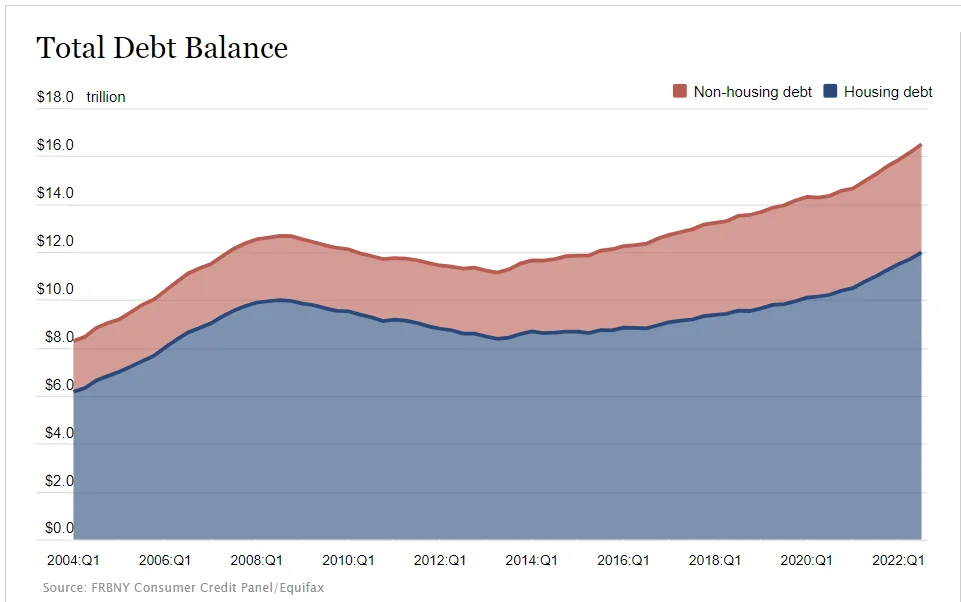

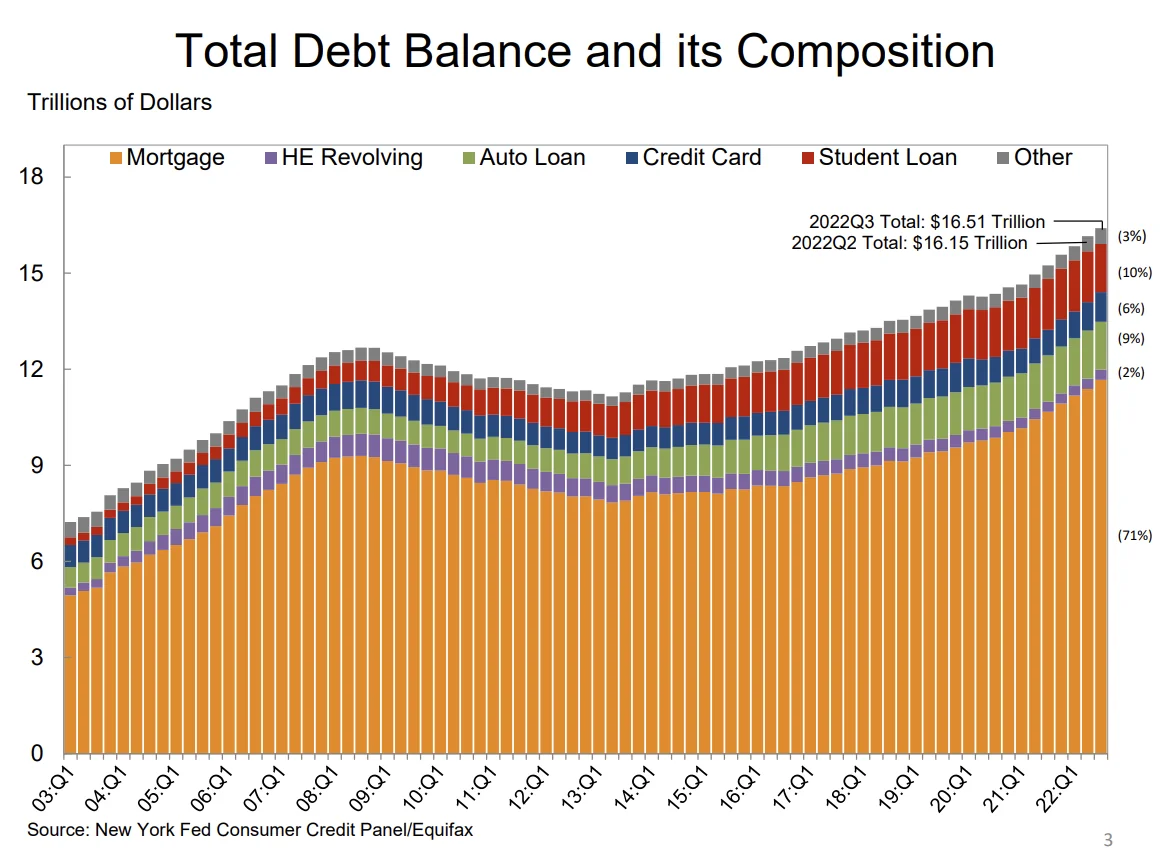

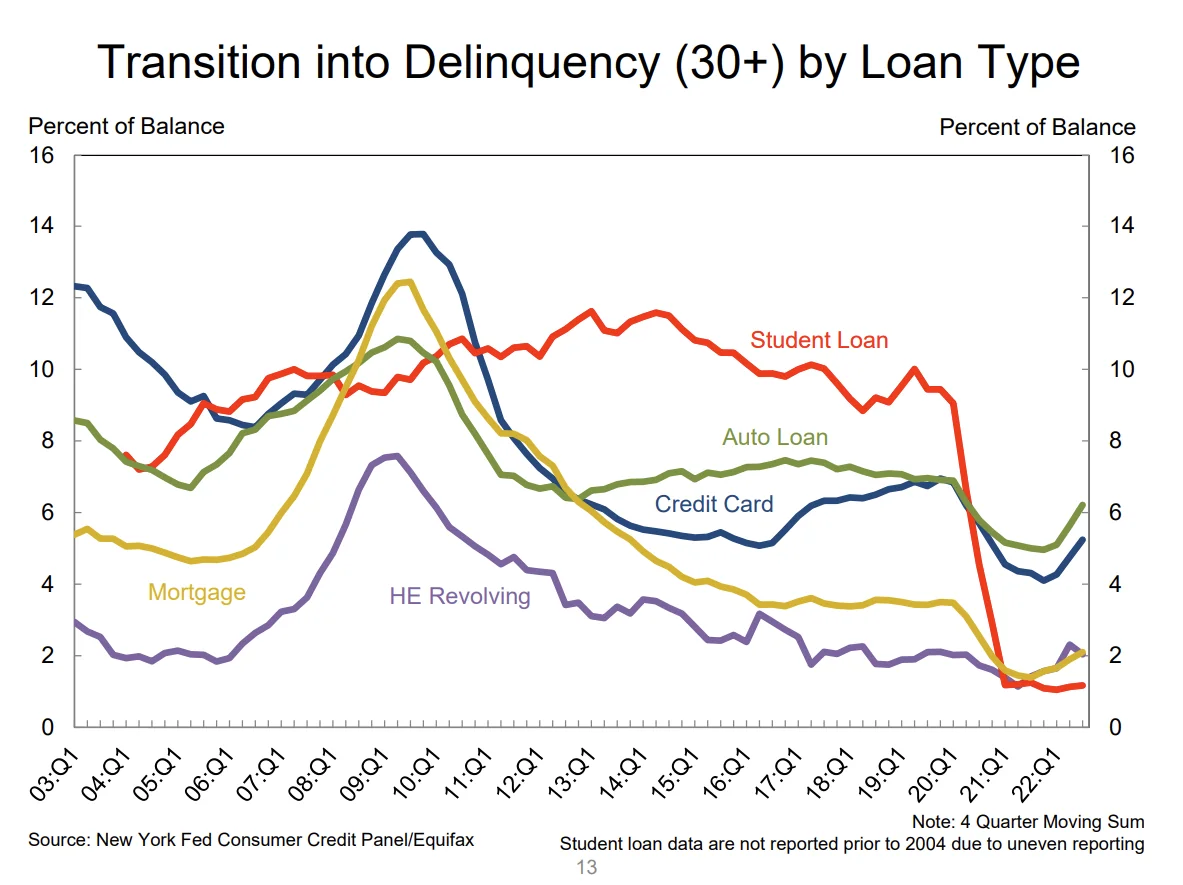

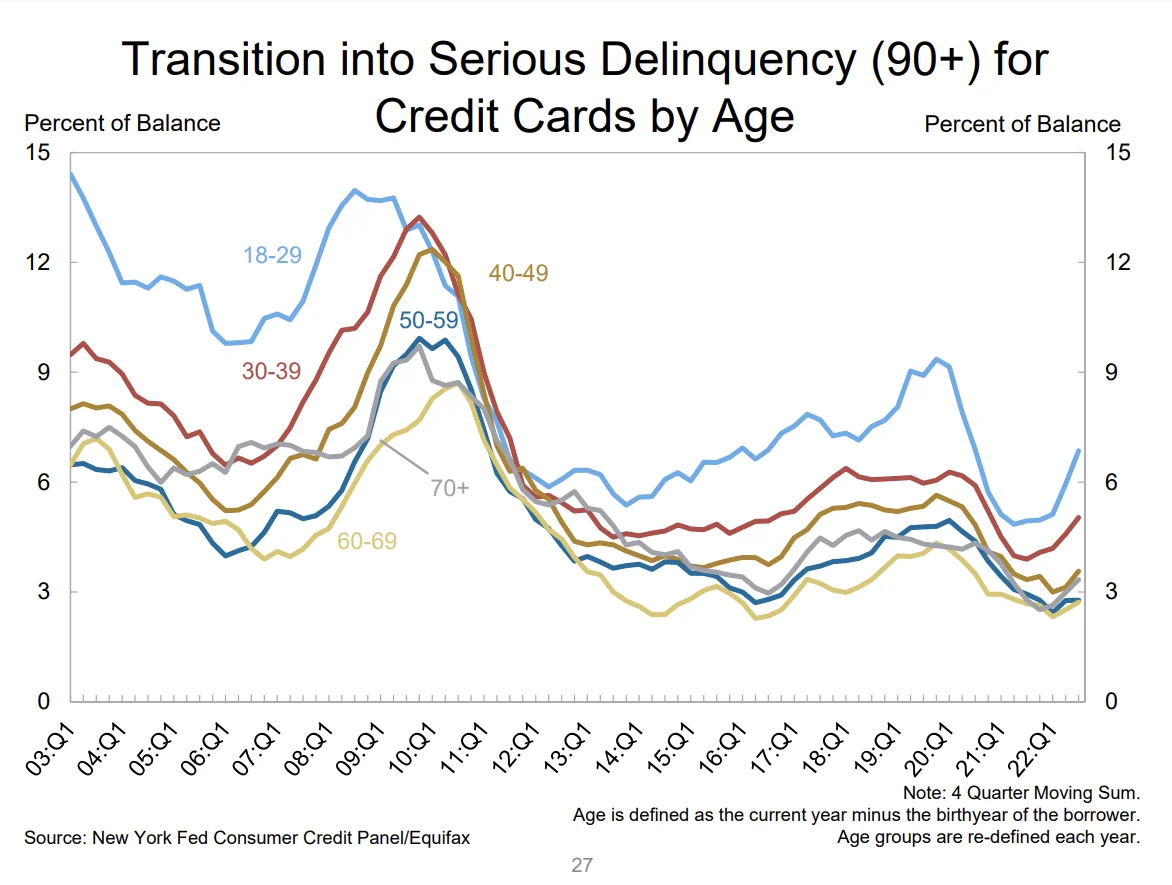

Total household debt rose by $351 billion, or 2.2 percent, to reach $16.51 billion in the third quarter of 2022, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances—the largest component of household debt—climbed by $282 billion and stood at $11.67 trillion at the end of September. The 15 percent year-over-year increase in credit card balances marked the largest in more than twenty years. The share of current debt transitioning into delinquency increased for nearly all debt types, following two years of historically low delinquency transitions.

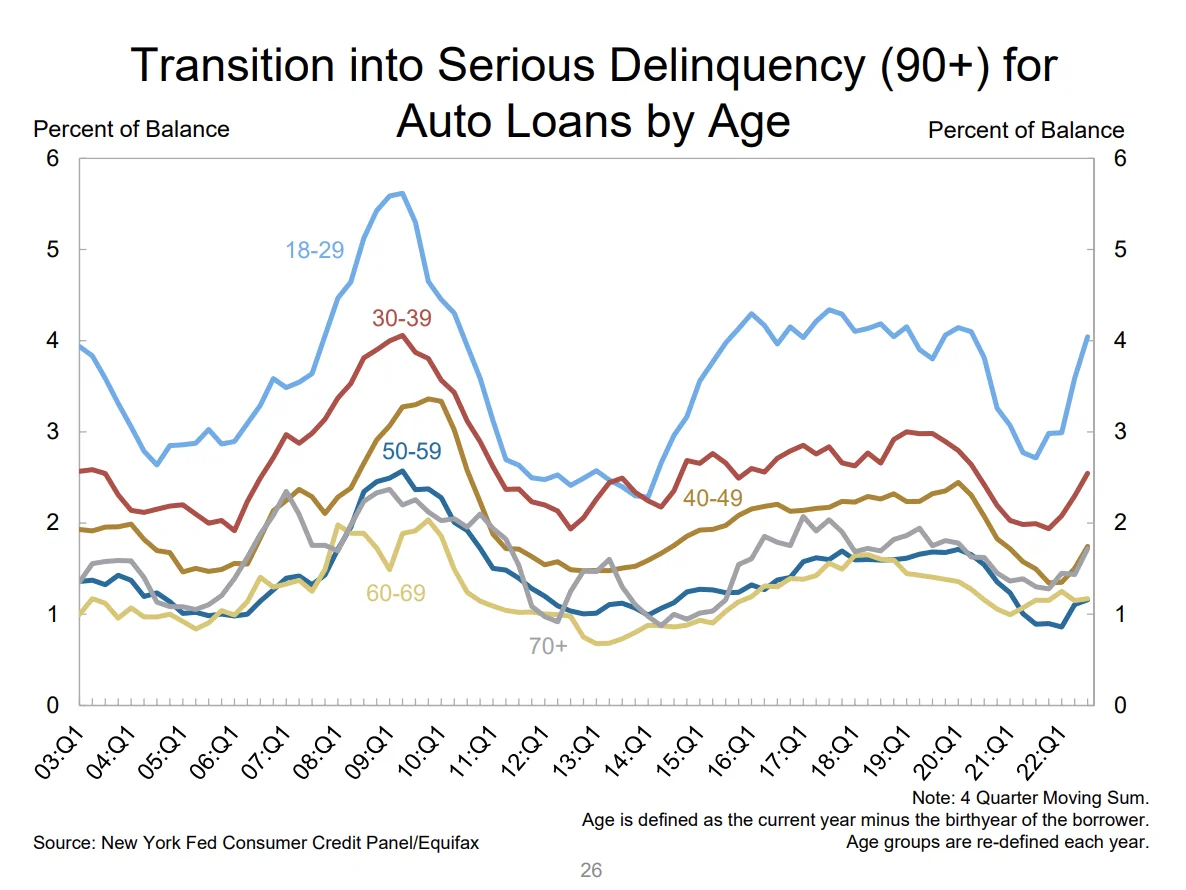

And it is hitting younger folks harder:

Other Notes

- Mortgage balances shown on consumer credit reports increased by $282 billion during the third quarter of 2022 and stood at $11.67 trillion at the end of September, up by $1 trillion since the previous year.

- Balances on home equity lines of credit (HELOC) increased by $3 billion, the second consecutive quarterly increase after years of declining balances; the outstanding HELOC balance stands at $322 billion.

- Credit card balances saw a $38 billion increase since the second quarter, a 15% year-over-year increase marked the largest in more than 20 years. Credit card balances are nearing their pre-pandemic levels, after sharp declines in the first year of the pandemic.

- Auto loan balances increased by $22 billion in the third quarter, continuing the upward trajectory that has been in place since 2011.

- Other balances, which include retail cards and other consumer loans, increased by $21 billion, following the $25 billion increase last quarter.

- Offsetting these increases, student loan balances contracted slightly, and now stand at $1.57 trillion, down from the second quarter of 2022. In total, non-housing balances grew by $66 billion.

Student Loans

- Outstanding student loan debt stood at $1.57 trillion in Q3 2022. The decline likely reflects some of the discharged debt due to the Closed School Discharge and Public Service Loan Forgiveness programs, offsetting the typical seasonal originations with the start of the academic year.

- About 4% of aggregate student debt was 90+ days delinquent or in default in Q3 2022. The lower level of student debt delinquency reflects the continued repayment pause on student loans, which is scheduled to end on January 1, 2023.