Consumer credit increased at a seasonally adjusted annual rate of 2.4% during Q2. Revolving credit (credit cards) up 1.2%, while nonrevolving credit up 2.9%.

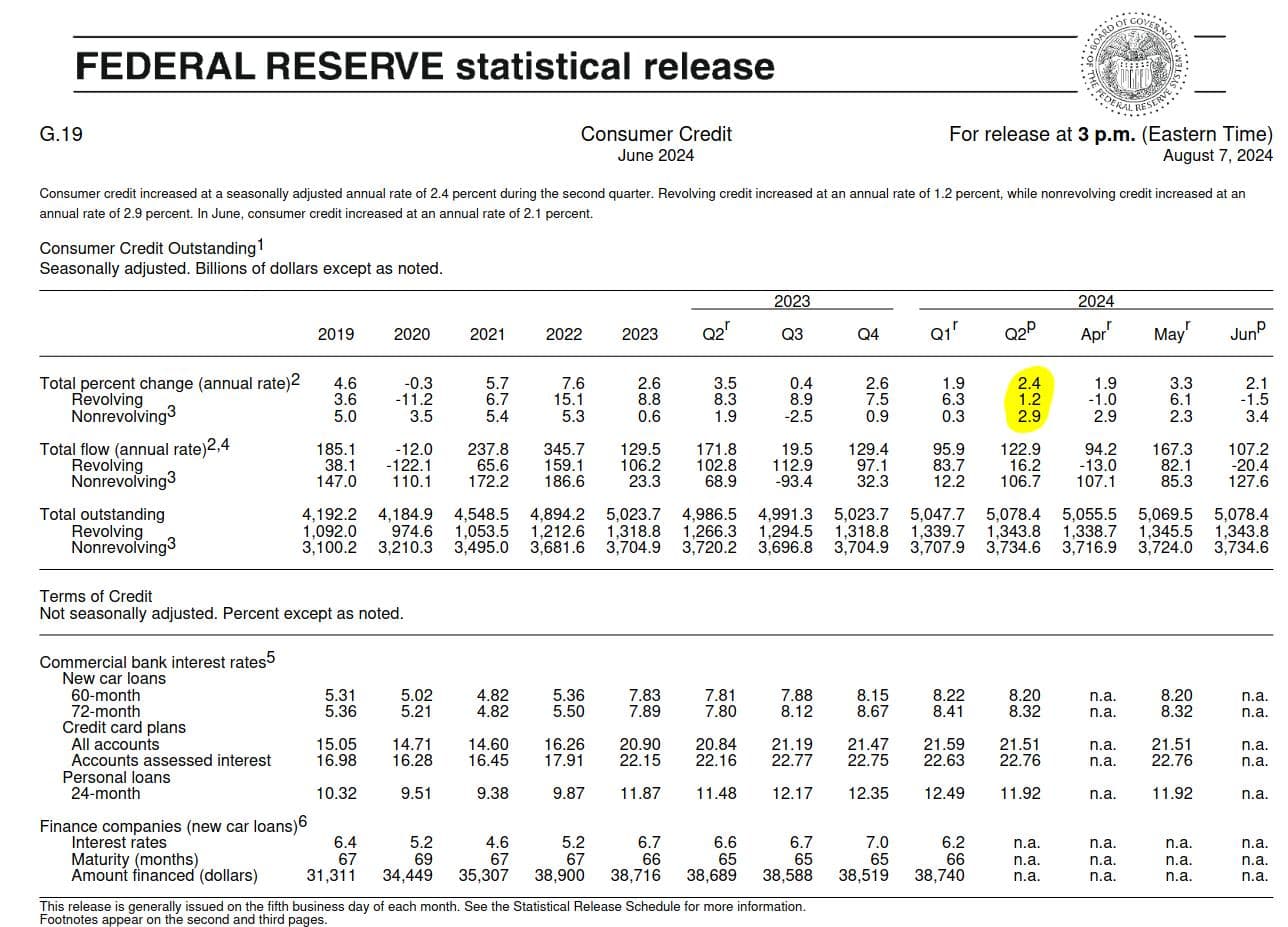

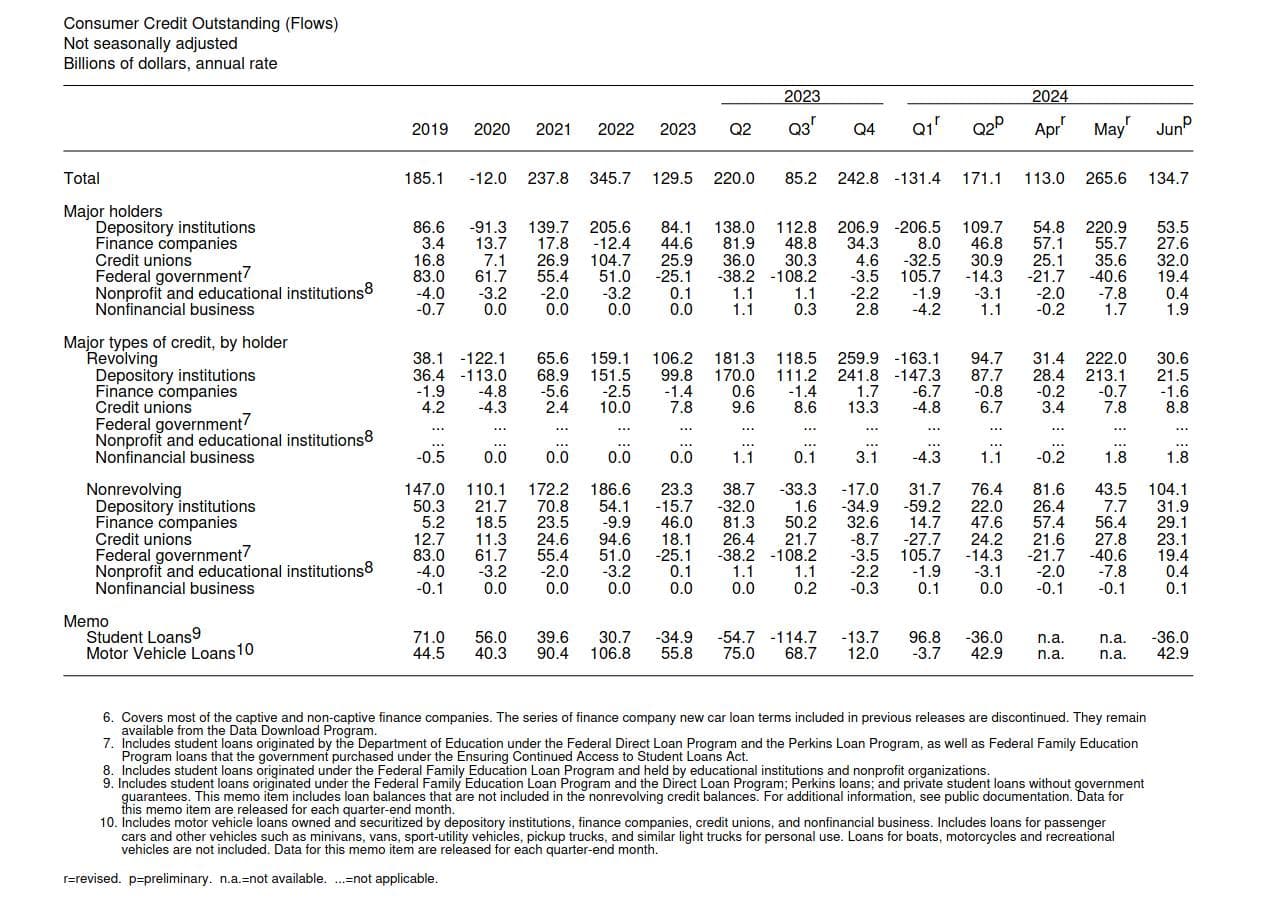

Consumer credit increased at a seasonally adjusted annual rate of 2.4% during the second quarter. Revolving credit (credit cards) increased at an annual rate of 1.2%, while nonrevolving credit increased at an annual rate of 2.9%. In June, consumer credit increased at an annual rate of 2.1%.

Consumer credit & non-revolving credit are still growing faster then the Fed's 2% inflation goal--more evidence to hold rates higher longer.

What is Consumer Credit?:

Consumer credit refers to the various forms of personal lending extended to individuals to purchase goods and services. This type of credit is typically offered by banks, credit unions, and other financial institutions and includes products like credit cards, personal loans, auto loans, and lines of credit. Consumer credit enables individuals to borrow money for immediate needs or wants and pay it back over time, often with interest. The terms and conditions of consumer credit, including interest rates, repayment schedules, and fees, vary depending on the type of credit and the borrower's creditworthiness.

Consumer spending is a major driver of the U.S. economy and the GDP (total value of goods and services produced in a country over a specific period).

Remember, revolving credit allows borrowers to access a fixed credit limit that replenishes as the borrowed amount is repaid, like with credit cards.

Non-revolving credit, on the other hand, provides a one-time loan amount that cannot be reused once repaid, such as with student or auto loans.

Revolving credit offers flexibility with no fixed repayment term, whereas non-revolving credit typically has a set repayment schedule and fixed monthly payments and while taking on debt allows consumers to spend beyond their immediate earnings (for instance, buying a house with a mortgage or purchasing goods with a credit card), there's a limit to how much debt is sustainable.

However, as we have previously covered, expectations for future credit availability deteriorated. In June, perceptions of credit access compared to a year ago deteriorated slightly with a smaller share of respondents reporting that it is easier to obtain credit than 12 months ago., with the share of respondents expecting it will be harder to obtain credit in the year ahead increasing.

Recall, almost a year ago now that the Fed's Beige Book August 2023 showed "Some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending."

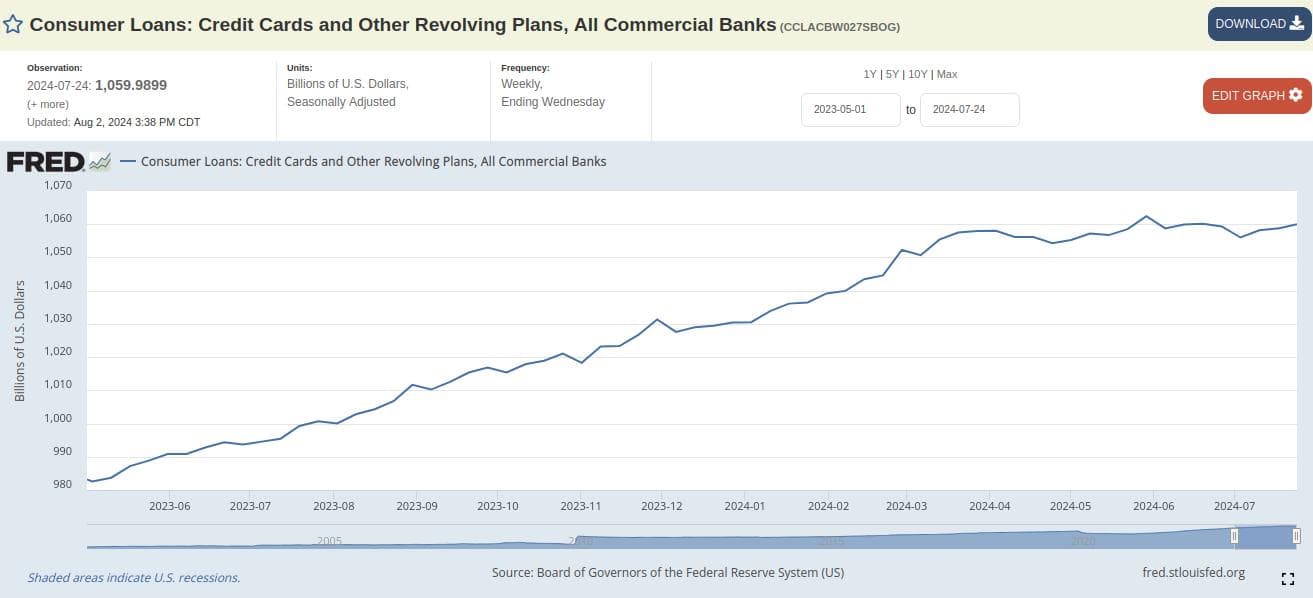

So growth could slow if folks continue pile up too much debt and are then forced to cut back on this spending but boy are they still piling it on!:

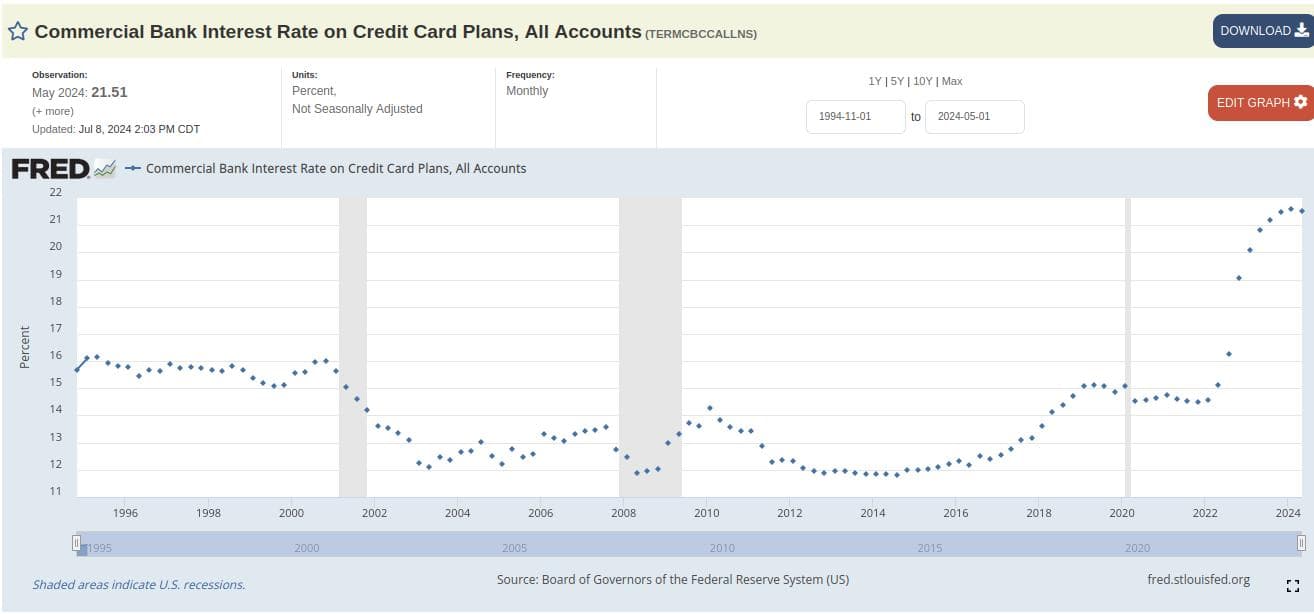

It just keeps climbing over $1 trillion all at killer interest:

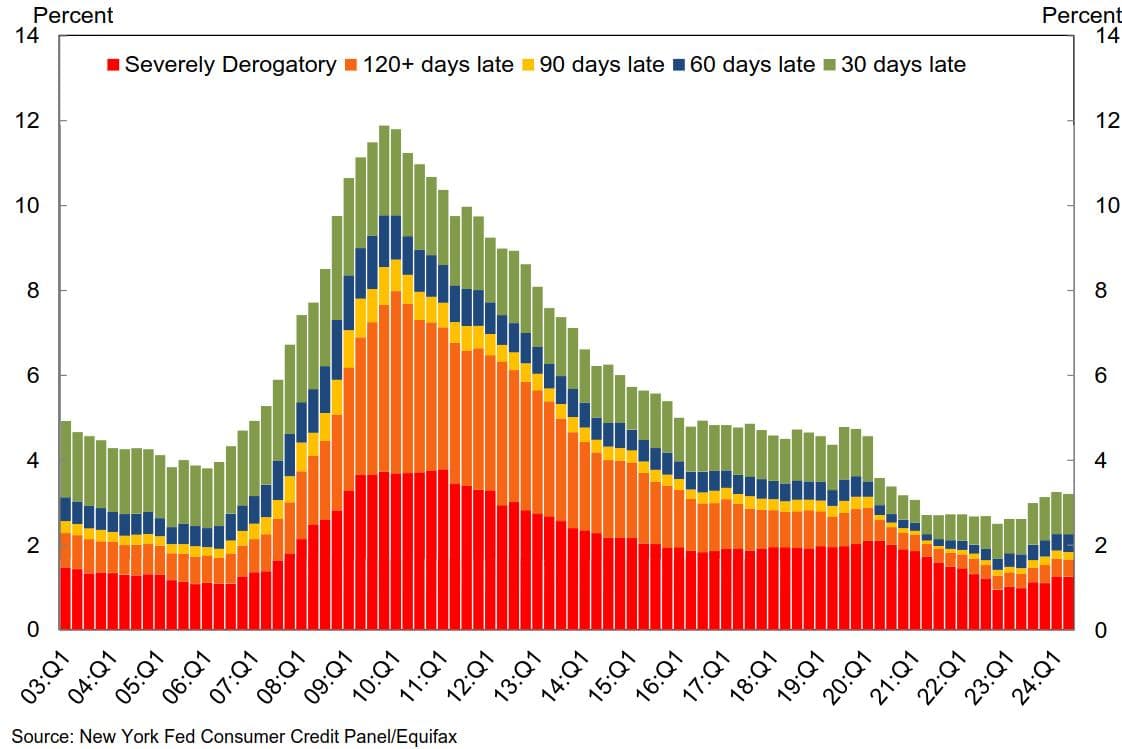

Delinquencies are on the rise as well!

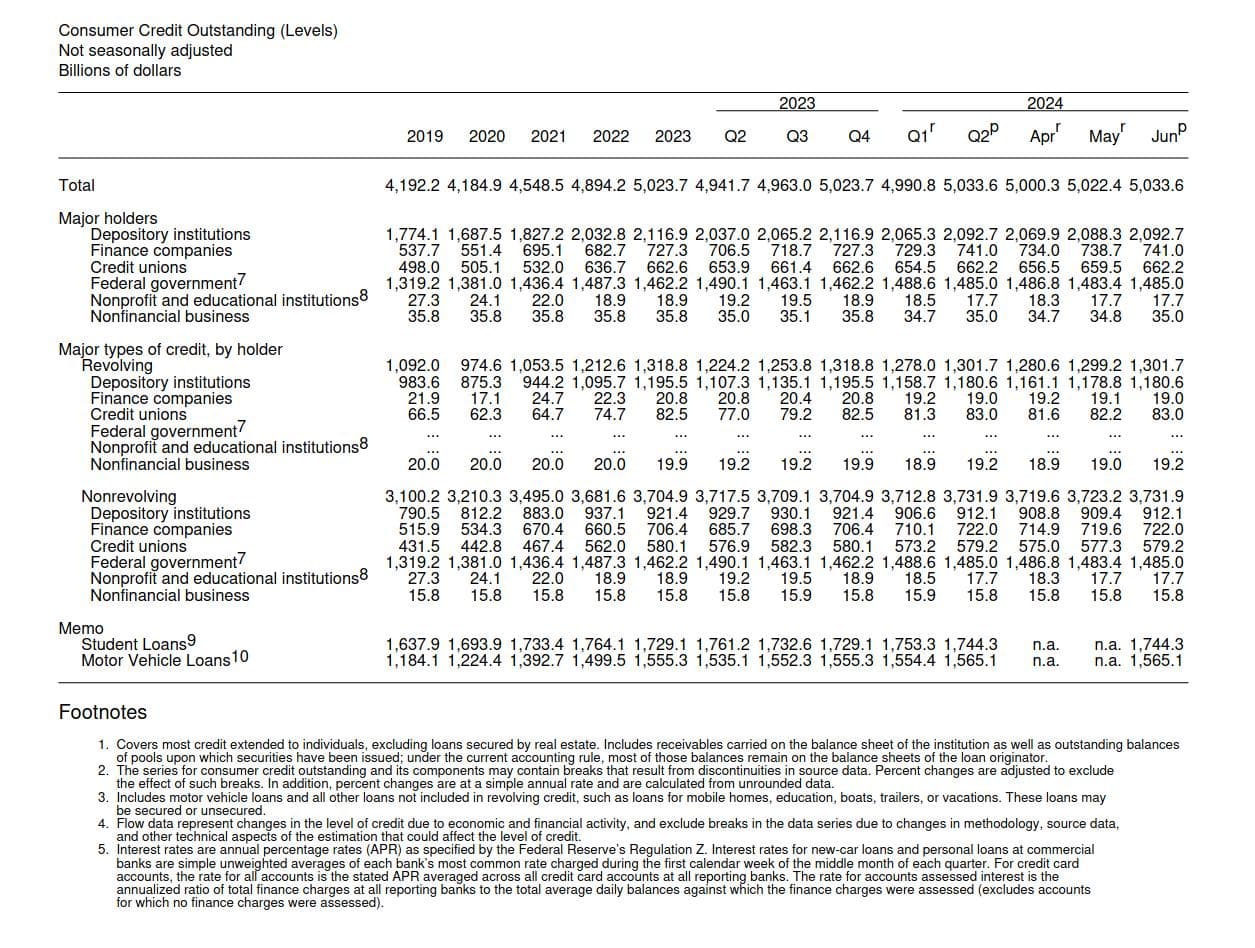

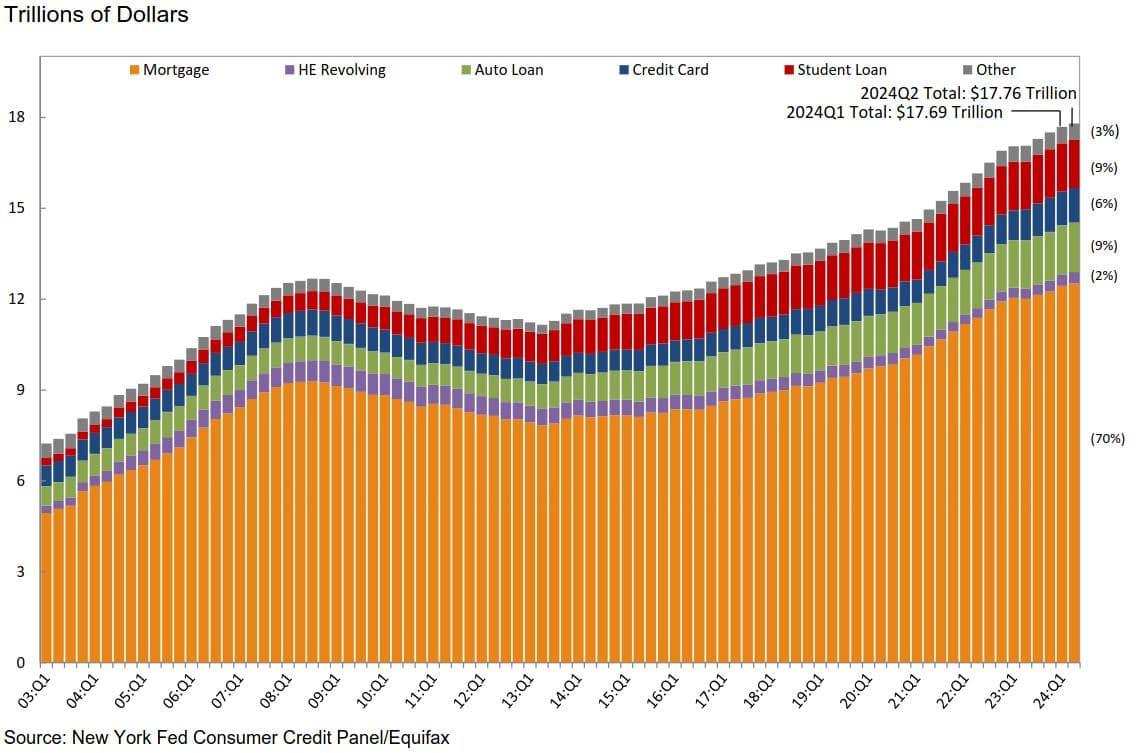

Yesterday, the Federal Reserve Bank of New York’s Center for Microeconomic Data released its Quarterly Report on Household Debt and Credit for Q2, revealing a $109 billion (0.6%) increase in total household debt in Q2 2024, reaching $17.80 trillion.

- Mortgage balances rose by $77 billion to $12.52 trillion.

- Mortgage originations remained low, mainly due to subdued refinancing activity.

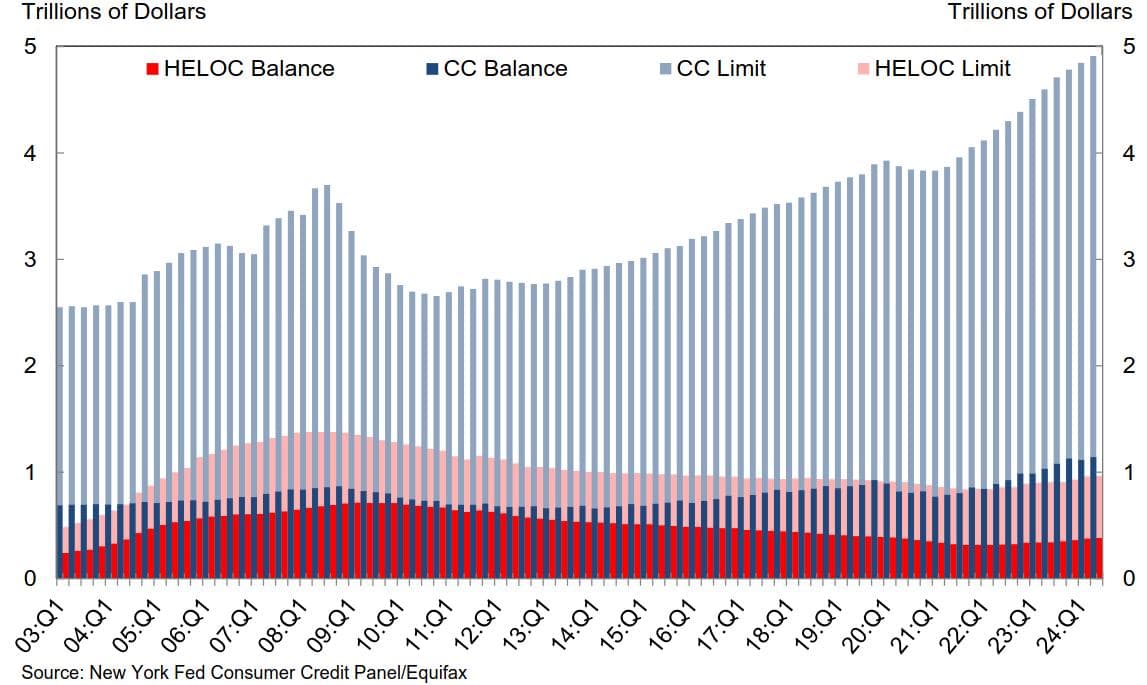

- Home equity lines of credit (HELOC) balances increased by $4 billion, marking the ninth consecutive quarterly rise since Q1 2022, reaching $380 billion.

- This is a $63 billion increase from the low in Q3 2021, as it appears homeowners using HELOCs to extract home equity.

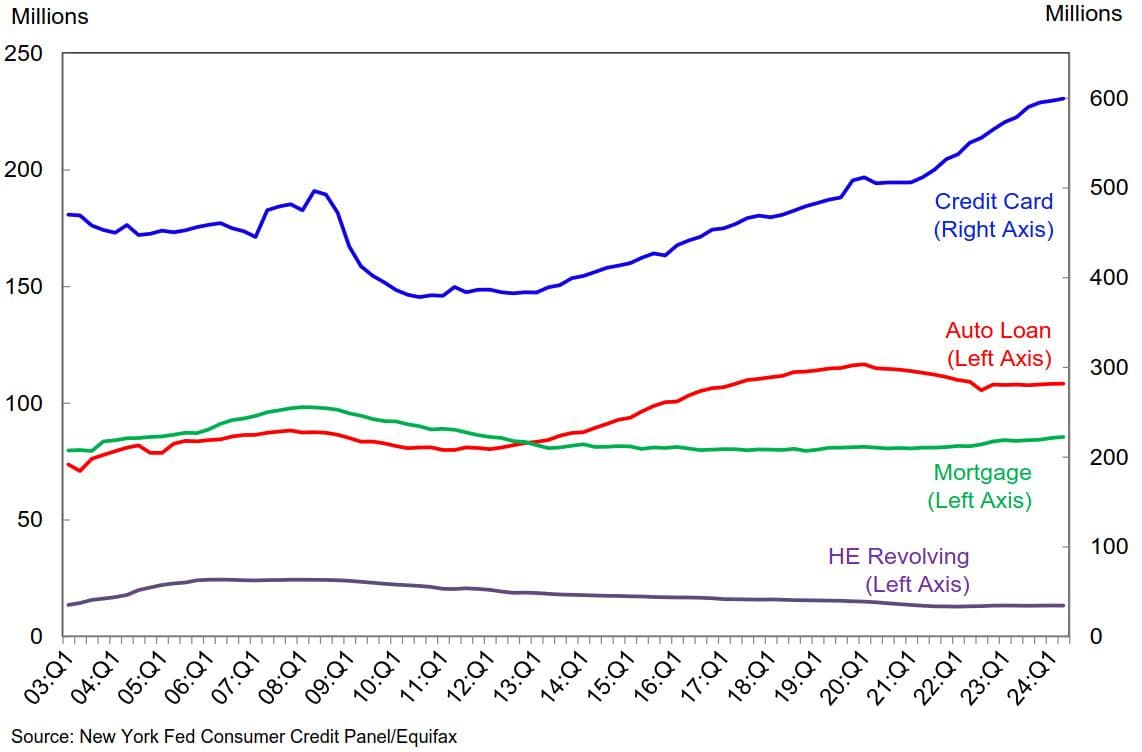

- Credit card balances increased by $27 billion to $1.14 trillion, and auto loan balances rose by $10 billion to $1.63 trillion.

- Outstanding student loan debt fell and stood at $1.59 trillion in 2024Q2.

- Missed federal student loan payments will not be reported to credit bureaus until 2024Q4.

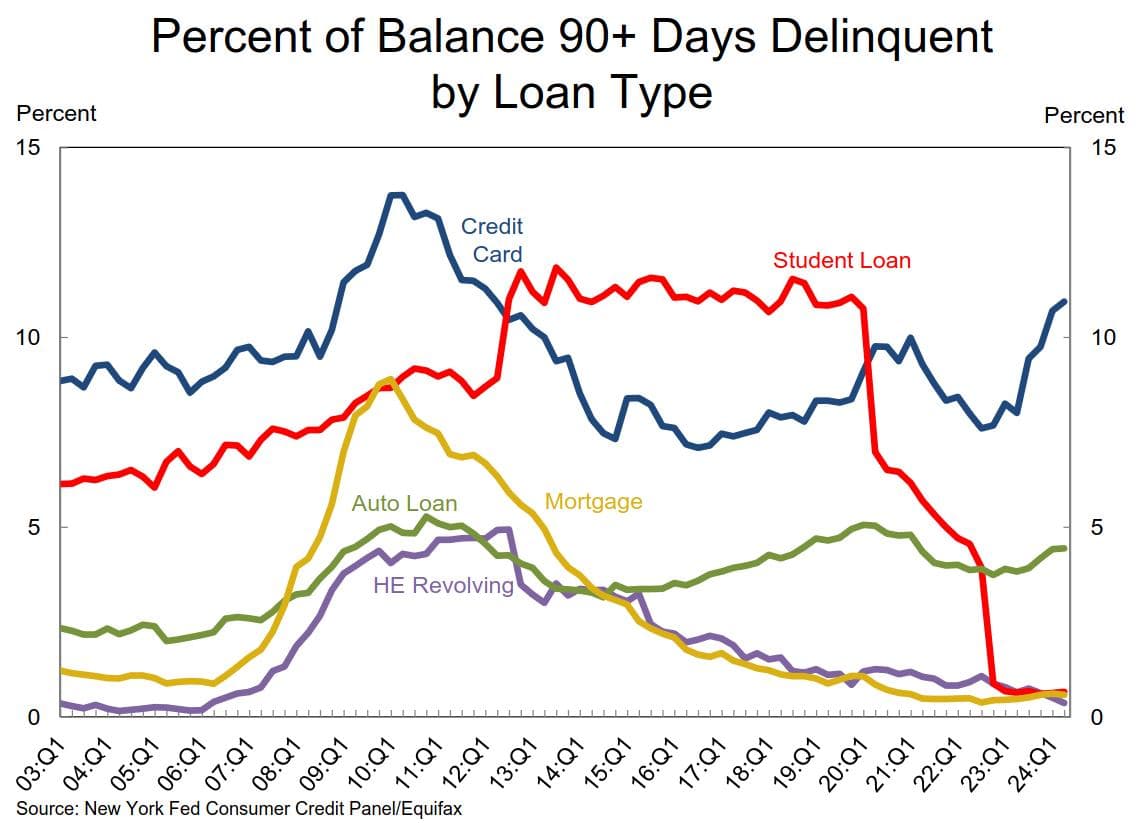

- Because of these policies, less than 1% of aggregate student debt was reported 90+ days delinquent or in default in 2024Q2 and will remain low until at least 2024Q4.

- Aggregate limits on credit card accounts increased by $69 billion (1.4%), and HELOC limits increased by $3 billion, continuing a nine-quarter upward trend.

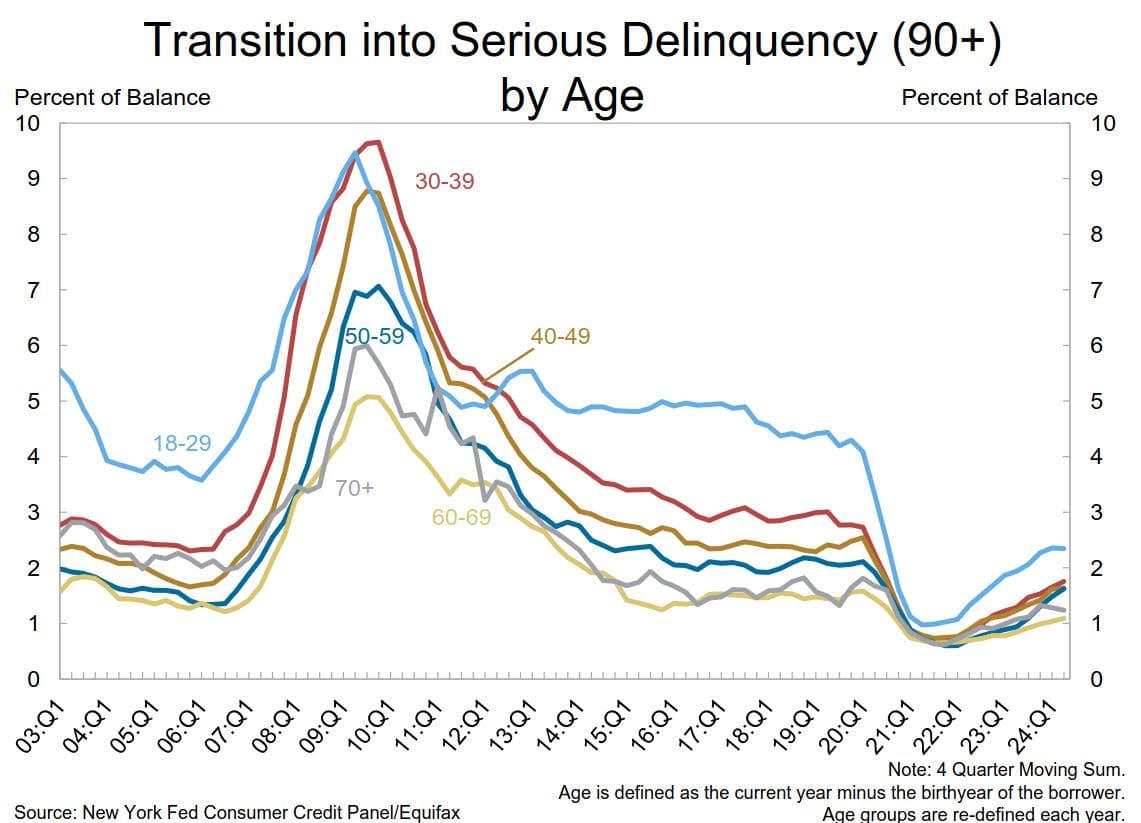

- Aggregate delinquency rates held steady at 3.2%.

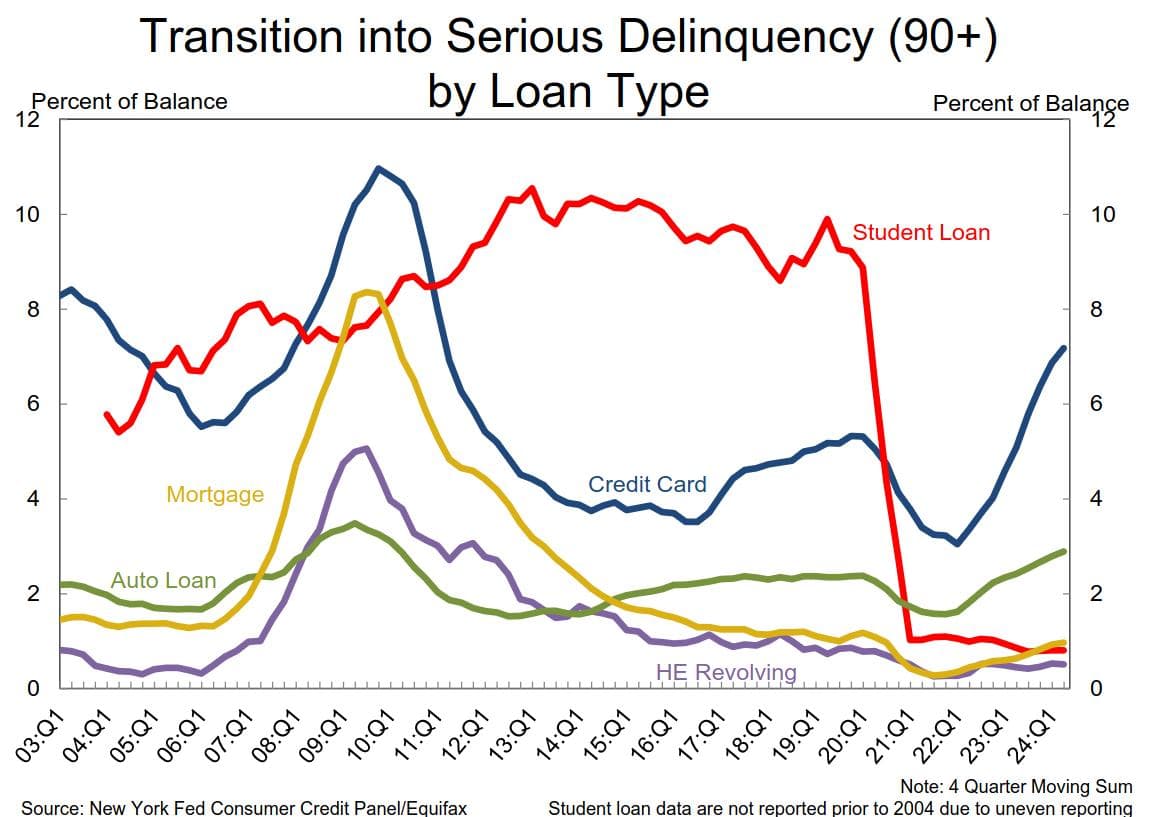

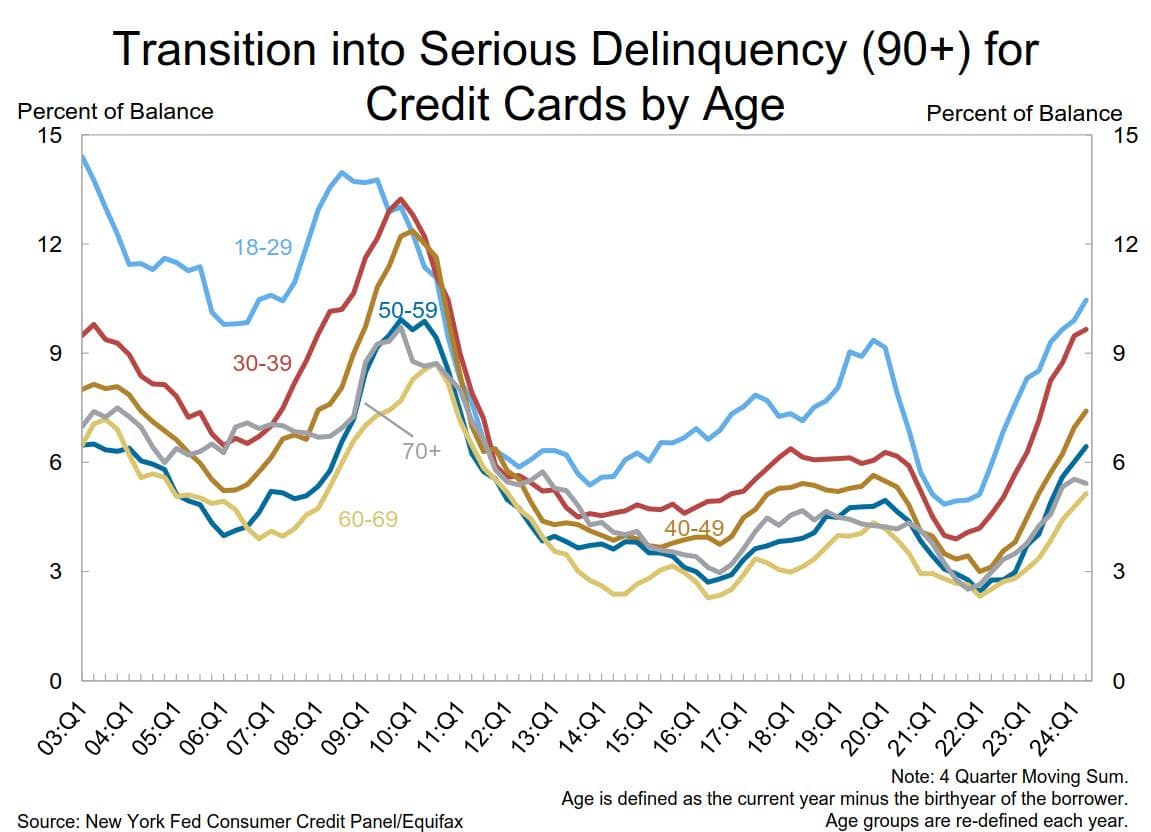

- However, delinquency transition rates for credit cards, auto loans, and mortgages saw slight increases.

- Approximately 9.1% of credit card balances and 8.0% of auto loan balances transitioned into delinquency over the past year.

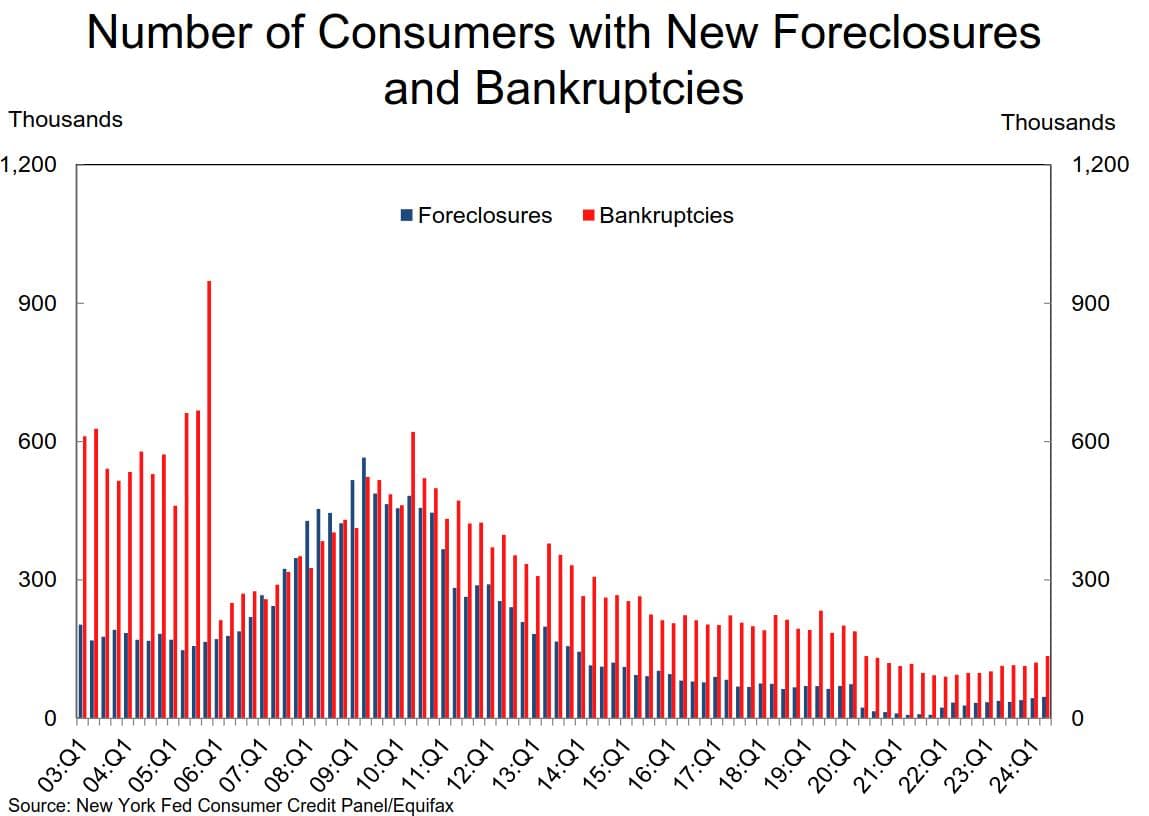

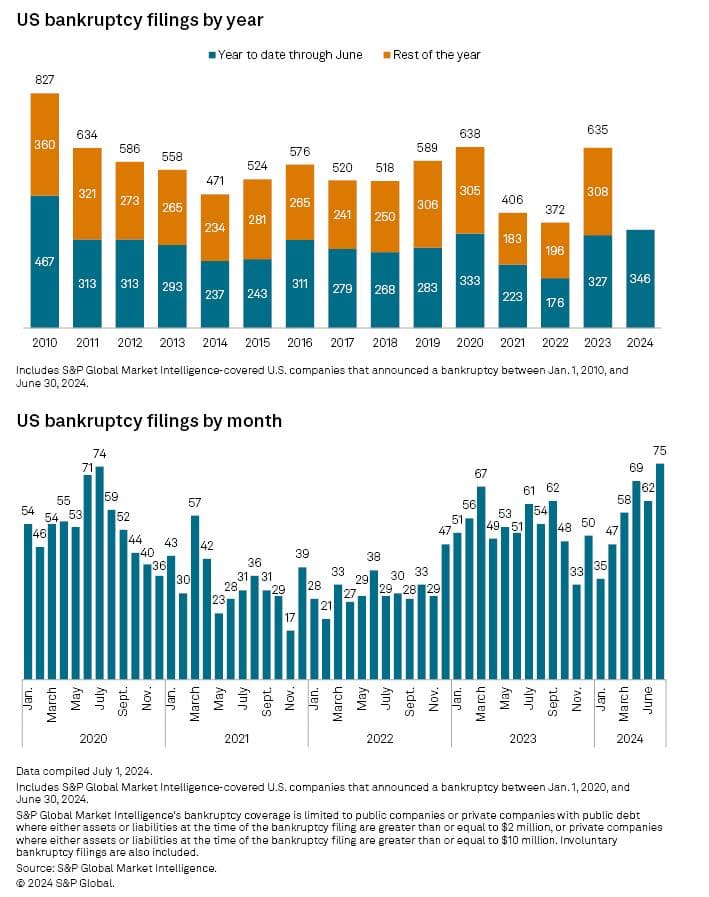

- Around 136,000 consumers had a bankruptcy notation added to their credit reports in Q2 2024, an increase from the previous quarter.

Adding, Andrew Haughwout, Director of Household and Public Policy Research at the New York Fed, noted the rise in HELOC balances as homeowners seek alternative ways to

Total Debt Balance and its Composition:

Number of Accounts by Loan Type:

Credit Limit and Balance for Credit Cards and HE Revolving:

Total Balance by Delinquency Status:

Percent of Balance 90+ Days Delinquent by Loan Type:

Transition into Serious Delinquency (90+) by Loan Type:

Number of Consumers with New Foreclosures and Bankruptcies:

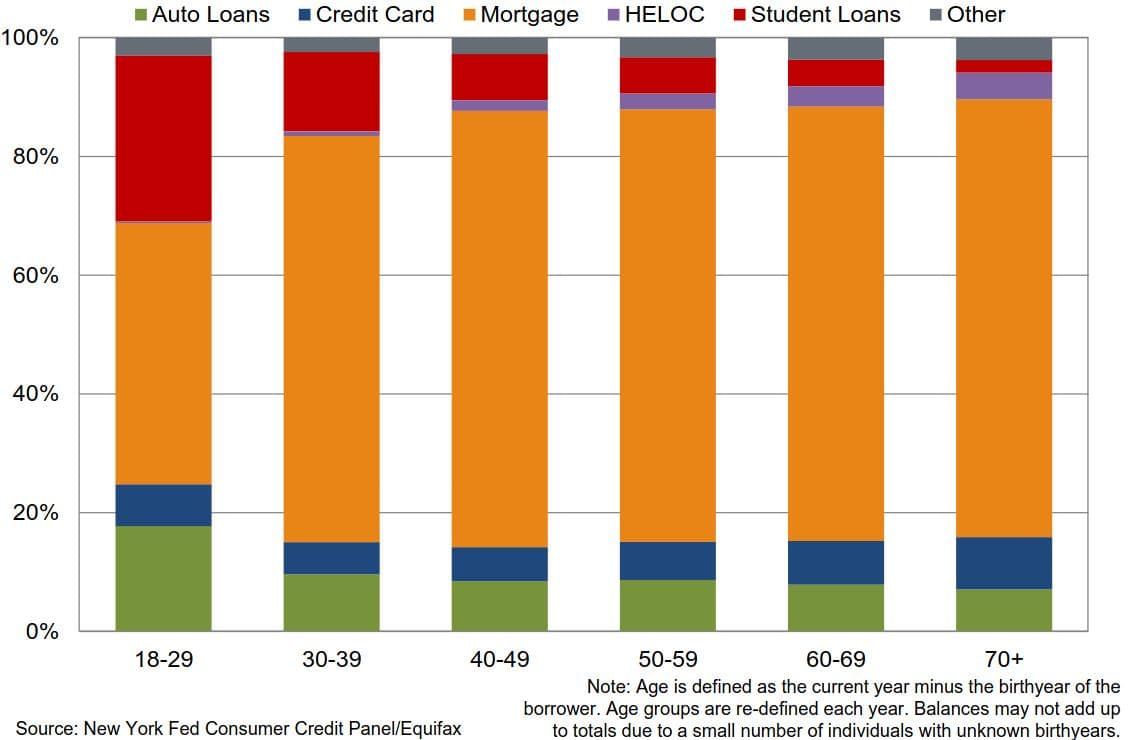

Debt Share by Product Type and Age (2024 Q2):

Transition into Serious Delinquency (90+) by Age:

Transition into Serious Delinquency (90+) for Credit Cards by Age:

Things aren't better on the corporate side:

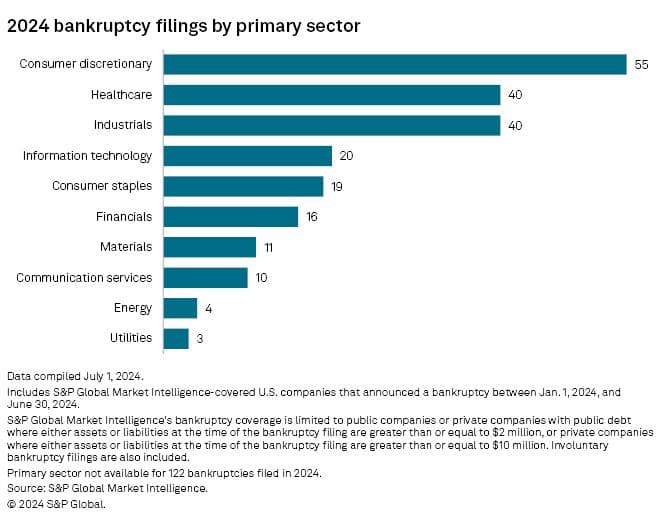

June witnessed an unprecedented increase in US corporate bankruptcy filings, marking the highest number recorded in a single month since early 2020 and surpassing half-year totals not seen in over a decade.

According to S&P Global Market Intelligence, there were 75 new corporate bankruptcy filings in June. This uptick from the first months of 2024 is comparable only to the busiest months of 2020 when the pandemic caused a surge in bankruptcies. The total of 346 filings in 2024 so far is the highest in the last 13 years.

S&P calls out companies continue to struggle with high interest rates, supply chain issues, and slowing consumer spending.

Consumer discretionary sector continued to lead others in 2024, with 55 total bankruptcy filings.

TLDRS:

- Consumer credit increased at a seasonally adjusted annual rate of 2.4 percent during the second quarter.

- Revolving credit (credit cards) increased at an annual rate of 1.2 percent.

- Nonrevolving credit increased at an annual rate of 2.9 percent.

- In June, consumer credit increased at an annual rate of 2.1 percent.

- Consumer Credit use continues to outpace the Fed's 2% inflation goal!

- Fed Chair Jerome Powell testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, highlighting economic expansion despite moderating GDP growth in the first half of the year."we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. Incoming data for the first quarter of this year did not support such greater confidence."Second quarter should not give confidence they have it tamed.

- A combination of slower wage growth, higher interest rates, and depleted savings indicate that the headwinds will continue to work against consumers.

- Approximately 9.1% of credit card balances and 8.0% of auto loan balances transitioned into delinquency over the past year, and around 136,000 consumers had a bankruptcy notation added to their credit reports in Q2 2024, up from the previous quarter.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold or even interest rates--causing further stress to businesses and households.

- Reminder, consumer spending is a major factor in the U.S. economy and its GDP, it goes down, companies fail.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

Consumer credit increased at a seasonally adjusted annual rate of 2.4% during Q2. Revolving credit (credit cards) up 1.2%, while nonrevolving credit up 2.9%. Consumer credit & non-revolving credit are still growing faster then the Fed's 2% inflation goal--more evidence to hold rates higher longer.

by u/Dismal-Jellyfish in Superstonk

Consumer credit increased at a seasonally adjusted annual rate of 2.4% during Q2. Revolving credit (credit cards) up 1.2%, while nonrevolving credit up 2.9%--still growing faster then the Fed's 2% inflation goal.https://t.co/M5AWkW79eN

— dismal-jellyfish (@DismalJellyfish) August 7, 2024