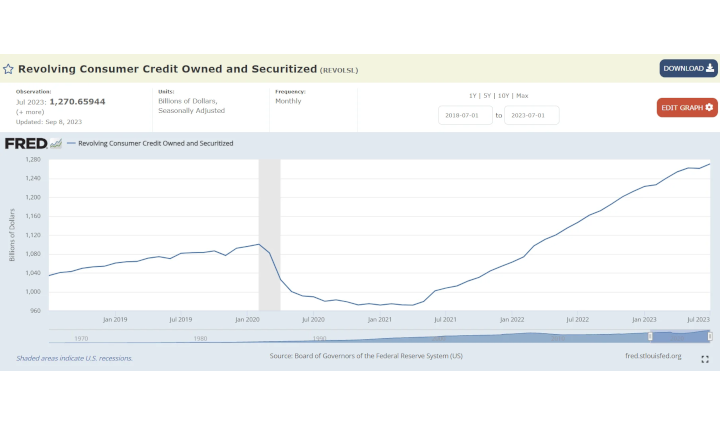

In July, consumer credit (AKA DEBT) increased at a seasonally adjusted annual rate of 2.5 percent. Revolving credit (Credit cards) increased at an annual rate of 9.2 percent

TLDRS:

- Total consumer credit increased at an annual rate of 2.5% in July 2023.

- Revolving credit (which includes credit cards) grew at an annual rate of 9.2% in July 2023.

- Nonrevolving credit (which includes loans for things like cars and education) increased at .2%.

- Regarding the total outstanding consumer credit as of July 2023:

- The total outstanding consumer credit was $4,984.7 billion (NEW ALL TIME HIGH)

- Revolving credit accounted for $1,270.7 billion of the total outstanding consumer credit. (NEW ALL TIME HIGH)

- Nonrevolving credit constituted $3,714.5 billion of the total outstanding consumer credit. (JUST OFF LAST MONTH'S ALL TIME HIGH)

- I try and show it is setup to start getting worse come October.

- Reminder, while banks have the liquidity fairy, 'we' get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

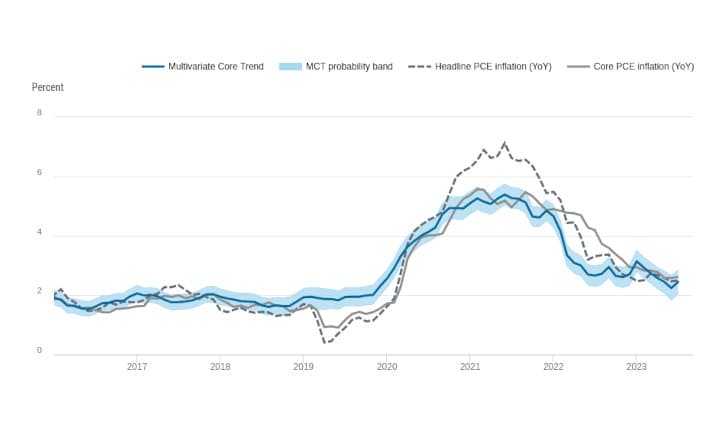

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

Examples of revolving credit: credit cards--is a type of credit that can be used repeatedly up to a certain limit as long as the account is open and payments are made on time.

Examples of non revolving credit: student loans, auto loans--things that can't be used again once they have been repaid.

https://www.federalreserve.gov/releases/g19/current/default.htm

https://fred.stlouisfed.org/series/TOTALSL

https://fred.stlouisfed.org/series/REVOLSL

https://fred.stlouisfed.org/series/NONREVNS

Wut mean?

- Total consumer credit increased at an annual rate of 2.5% in July 2023.

- Revolving credit (which includes credit cards) grew at an annual rate of 9.2% in July 2023.

- Nonrevolving credit (which includes loans for things like cars and education) increased at an annual rate of 0.2% in July 2023.

Regarding the total outstanding consumer credit as of July 2023:

- The total outstanding consumer credit was $4,984.7 billion.

- Revolving credit accounted for $1,270.7 billion of the total outstanding consumer credit.

- Nonrevolving credit constituted $3,714.5 billion of the total outstanding consumer credit.

This just keeps going up! For example:

- Total consumer credit increased at an annual rate of 1.8% in May 2023.

- Revolving credit (which includes credit cards) grew at an annual rate of 8.2% in May 2023.

- Nonrevolving credit (which includes loans for things like cars and education) decreased at an annual rate of 0.4% in May 2023.

Total outstanding consumer credit as of May 2023:

- The total outstanding consumer credit was $4,864.9 billion.

- Revolving credit accounted for $1,253.5 billion of the total outstanding consumer credit.

- Nonrevolving credit constituted $3,611.4 billion of the total outstanding consumer credit.

Remember, Total household debt rose by $16 billion to reach $17.06 trillion in the second quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit. Credit card balances saw brisk growth, rising by $45 billion to a series high of $1.03 trillion. Other balances, which include retail credit cards and other consumer loans, and auto loans increased by $15 billion and $20 billion, respectively. Student loan balances fell by $35 billion to reach $1.57 trillion, while mortgage balances were largely unchanged at $12.01 trillion.

However, unlike the banks, there are no liquidity fairy to keep households afloat in this inflating economy--and boy are households starting to feel it, especially in the areas like services and housing (that are BIG components of CPI--and way more 'sticky' than goods).

To try and further drive home the shaky ground households are on, let's revisit the Fed's Economic Well-being US Household 2022.

- "fewer adults reported having money left over after paying their expenses. 54% of adults said that their budgets had been affected "a lot" by price increases."

- "51% of adults reported that they reduced their savings in response to higher prices."

- The share of adults who reported that they would cover a $400 emergency expense using cash or its equivalent was 63 percent.

It is the younger generations seeing itself break into delinquency now:

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2023Q2

This has been artificially suppressed and is ready to pick back up....

Student Loan repayments restarting in October WILL lead to more defaults:

https://www.marketwatch.com/story/bidens-student-loan-on-ramp-explained-missed-payments-wont-hurt-credit-but-interest-keeps-adding-up-1bcbbae5

People are going to die because of this

To meet the rising need for food and nutrition assistance during the pandemic in the United States, all states were approved to provide Emergency Allotments (EA) to households enrolled in the Supplemental Nutrition Assistance Program (SNAP). In this analysis, we use the Census Bureau’s Household Pulse Surveys and exploit staggered state-level variation in dissolution of the SNAP EA payments to study whether the end of EA is associated with food-related challenges and economic hardships. Our findings indicate that EA termination is followed by a decrease in the likelihood that adult survey respondents had sufficient food for consumption and an increase in the probability of experiencing difficulty in paying meeting with usual household expenses. These findings provide policy-relevant insights into the potential impact of the nationwide termination of the EA payments that came into effect in early 2023.