Failed Iowa bank (Citizens Bank) closed for bad trucking loans? Is a freight recession becoming a banking bloodbath?

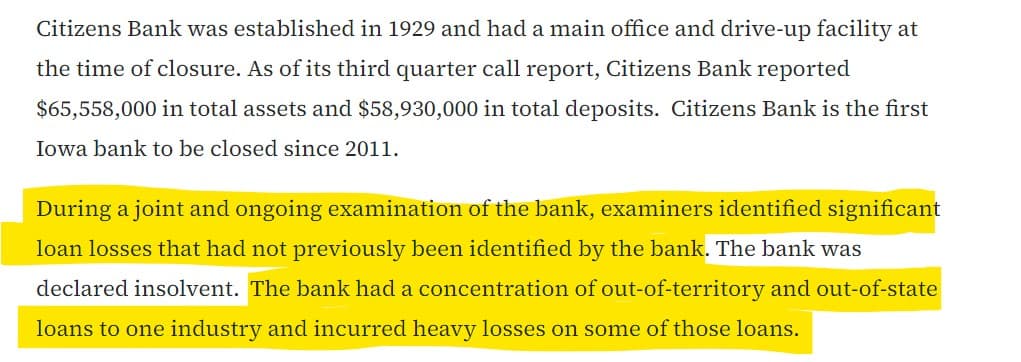

As we discussed last week, Iowa Trust & Savings Bank, Emmetsburg, Iowa, Assumes All of the Deposits of Citizens Bank, Sac City, Iowa.

- Citizens Bank in Sac City, Iowa, was closed by the Iowa Division of Banking.

- The Federal Deposit Insurance Corporation (FDIC) was appointed as the receiver.

- FDIC entered a Purchase and Assumption Agreement with Iowa Trust & Savings Bank to assume all deposits of Citizens Bank.

- Citizens Bank branches will reopen as Iowa Trust & Savings Bank branches on Monday.

- As of September 30, 2023, Citizens Bank had about $66 million in assets and $59 million in deposits.

- Iowa Trust & Savings Bank will purchase most of the failed bank’s assets.

- The estimated cost to the Deposit Insurance Fund for this failure is $14.8 million.

- Citizens Bank is the fifth U.S. bank to fail in the current year.

Did the bank fail because of bad trucking loans?

Jeff Plagge (the superintendent of the Iowa Division of Banking (IDOB)), also issued a statement:

However, prior to its failure, Citizens Bank, the FDIC, and IDOB entered into a consent order in August:

So they knew this could be coming back in August.

We have talked about trucking before!

Congressman French Hill on Treasury's previous $700 million bailout of Yellow: “I think the Treasury is undercollateralized. I’ll leave it at that” Treasury owns 15.94 million shares

- The loan was broken up into two tranches, with the $300 million tranche A dedicated to YRC’s “near-term contractual obligations and non-vehicle capital expenditures.”

- Tranche B provided “$400 million for capital investments made pursuant to capital plans subject to approval by Treasury,” the summary said, noting that both tranches mature on Sept. 30, 2024.

- As taxpayer compensation, the Treasury Department also received shares, equal to 29.6% of YRC’s common stock on a fully diluted basis, to be held in a voting trust. With its stake of 15.94 million shares, the U.S. Treasury is Yellow’s second-largest shareholder.

An affiliate of Ken Griffin’s Citadel has acquired roughly $485 million in Yellow Corp. debt previously owned by Apollo Global Management Inc. & other senior lenders to the bankrupt trucking firm

- With its stake of 15.94 million shares, the U.S. Treasury is Yellow’s second-largest shareholder.

However, I would like to draw your attention to this thread from Twitter and their recap of ongoing coverage on FreightWaves.

The freight market is experiencing a severe recession and bloodbath and it now appears to be making it to the banks:

The freight market is experiencing a severe recession and bloodbath.

— Craig Fuller 🛩🚛🚂⚓️ (@FreightAlley) November 4, 2023

Here is a round-up of the doom and gloom headlines that have occurred in one of the worst downturns in freight market history.

Full articles and ongoing coverage on FreightWaves.

1/🧵

From Craig Fuller

TLDRS:

- Citizens Bank in Sac City, Iowa, was closed by the Iowa Division of Banking.

- The Federal Deposit Insurance Corporation (FDIC) was appointed as the receiver.

- Iowa Trust & Savings Bank will purchase most of the failed bank’s assets.

- The estimated cost to the Deposit Insurance Fund for this failure is $14.8 million.

- In august, the bank, IDOB, and FDIC entered into a consent order over their the Bank’s commercial trucking loan portfolio.

- The freight market is experiencing a severe recession and bloodbath and it now appears to be making it to the banks.

- Citizens Bank is the fifth U.S. bank to fail in the current year so far...