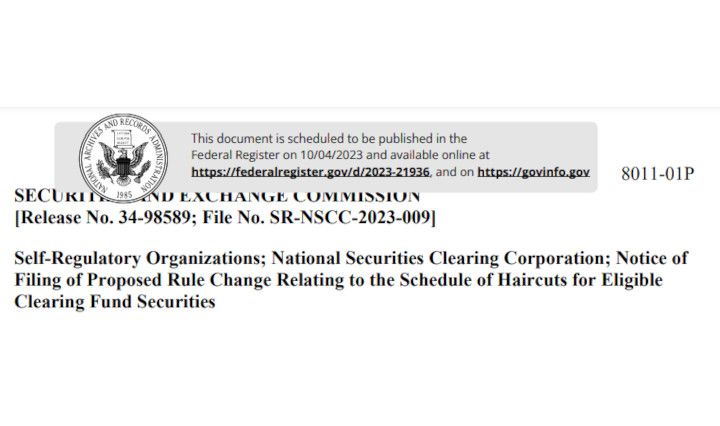

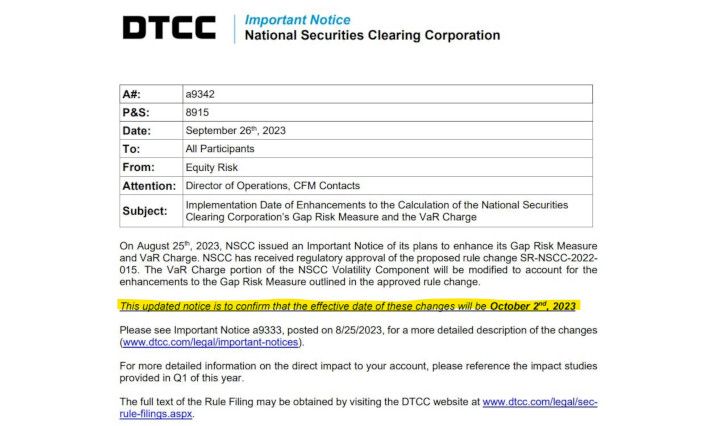

NSCC Alert! New Haircut schedule APPROVED by the commission & effective within 60 days of 11/8/23. Why? IDIOSYNCRATIC RISK!

We have talked about this before and I was confused about timing (sorry!), as the item published in the federal register was for an additional waiting period for comments before being approved by the commission (which it was 11/8)

60 days from November 8, 2023, falls on January 7,