Treasury International Capital Data for August: China sells the most U.S. securities in 4 years.

Wut Mean?:

- China sold nearly $14.867 billion in long-dated Treasuries in August, along with $5.113 billion in U.S. stocks.

- China sold $1.34 billion mortgage bonds.

- All told, Chinese institutions and funds sold $21.1 billion in U.S. assets.

- China has sold $235 billion in Treasuries since early 2022.

Press Release:

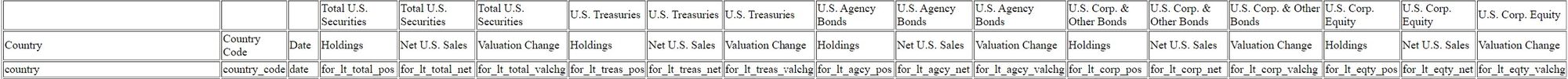

The U.S. Department of the Treasury today released Treasury International Capital (TIC) data for August 2023. The next release, which will report on data for September 2023, is scheduled for November 16, 2023.

The sum total in August of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a net TIC inflow of $134.4 billion. Of this, net foreign private inflows were $140.9 billion, and net foreign official outflows were $6.5 billion.

Foreign residents increased their holdings of long-term U.S. securities in August; net purchases were $61.3 billion. Net purchases by private foreign investors were $56.3 billion, while net purchases by foreign official institutions were $5.0 billion.

U.S. residents decreased their holdings of long-term foreign securities, with net sales of $2.2 billion.

After including adjustments, such as estimated foreign portfolio acquisitions of U.S. stocks through stock swaps, overall net foreign purchases of long-term securities are estimated to have been $63.5 billion in August.

Foreign residents increased their holdings of U.S. Treasury bills by $39.0 billion. Foreign resident holdings of all dollar-denominated short-term U.S. securities and other custody liabilities increased by $39.5 billion.

Banks’ own net dollar-denominated liabilities to foreign residents increased by $31.4 billion.

Complete data are available on the Treasury website at:

https://home.treasury.gov/data/treasury-international-capital-tic-system

About TIC Data

The monthly data on holdings of long-term securities, as well as the monthly table on Major Foreign Holders of Treasury Securities, reflect foreign holdings of U.S. securities collected primarily on the basis of custodial data. These data help provide a window into foreign ownership of U.S. securities, but they cannot attribute holdings of U.S. securities with complete accuracy. For example, if a U.S. Treasury security purchased by a foreign resident is held in a custodial account in a third country, the true ownership of the security will not be reflected in the data. The custodial data will also not properly attribute U.S. Treasury securities managed by foreign private portfolio managers who invest on behalf of residents of other countries. In addition, foreign countries may hold dollars and other U.S. assets that are not captured in the TIC data. For these reasons, it is difficult to draw precise conclusions from TIC data about changes in the foreign holdings of U.S. financial assets by individual countries.

TLDRS:

- Treasury International Capital Data for August: China sells the most U.S. securities in 4 years.

- China sold nearly $14.867 billion in long-dated Treasuries in August, along with $5.113 billion in U.S. stocks.

- China sold $1.34 billion mortgage bonds.

- All told, Chinese institutions and funds sold $21.212 billion in U.S. assets.

- Are they trying to protect a weakening yuan?

- China has sold $235 billion in Treasuries since early 2022.

- Foreign buyers bought $134.4 billion in U.S. assets in August, as both Treasuries and stocks saw net inflows.

- Of this private buyers bought $140.9 billion.