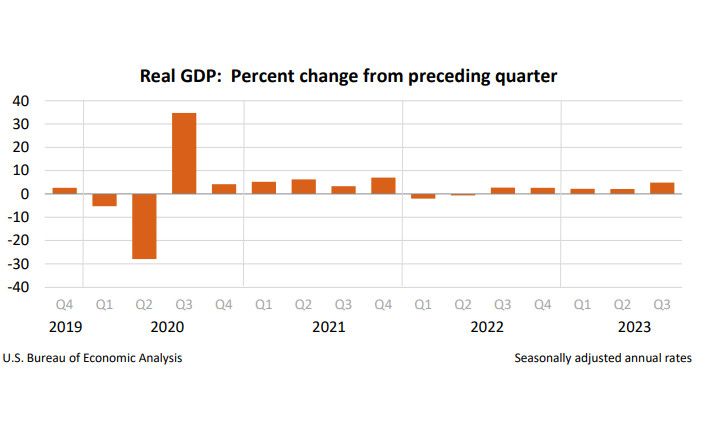

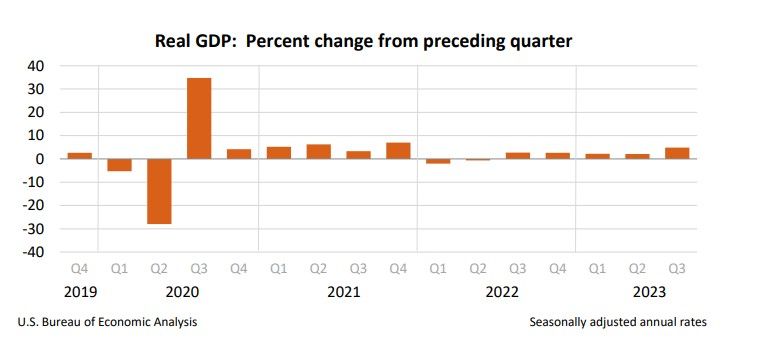

Bureau of Economic Analysis Q3 2023 GDP (Advanced Estimate): +4.9% Growth.

Real gross domestic product (GDP) increased at an annual rate of +4.9% in Q3 of 2023 (following a +2.1% increase in Q2 of 2023), according to the "advance" estimate released by the Bureau of Economic Analysis today.

Wut Mean?

- Consumer spending (~70% of GDP) jumped +4%--the biggest increase since Q4 2021!

- Government spending across the board was up +4.6%!

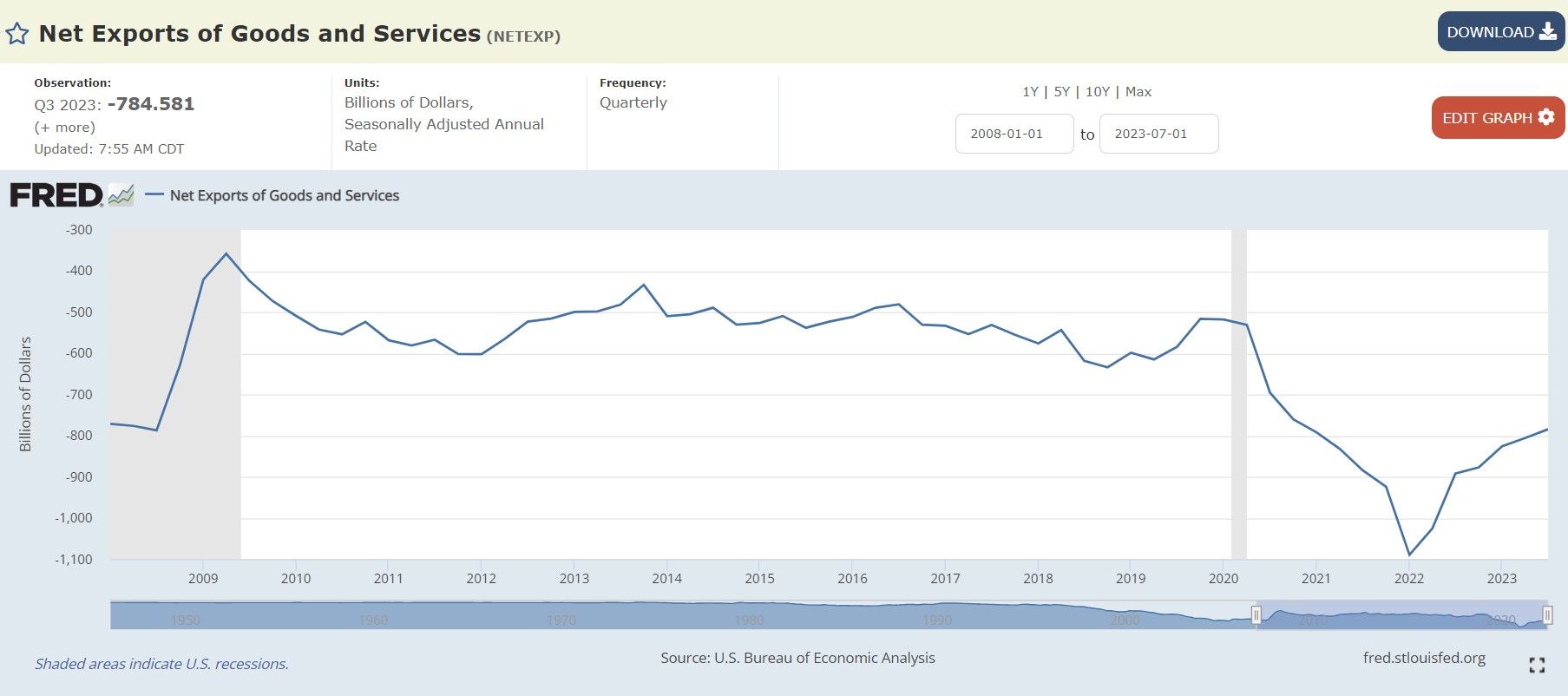

- The trade deficit did not improve for the quarter.

- Private inventories grow.

- Inflation is not slowing down!

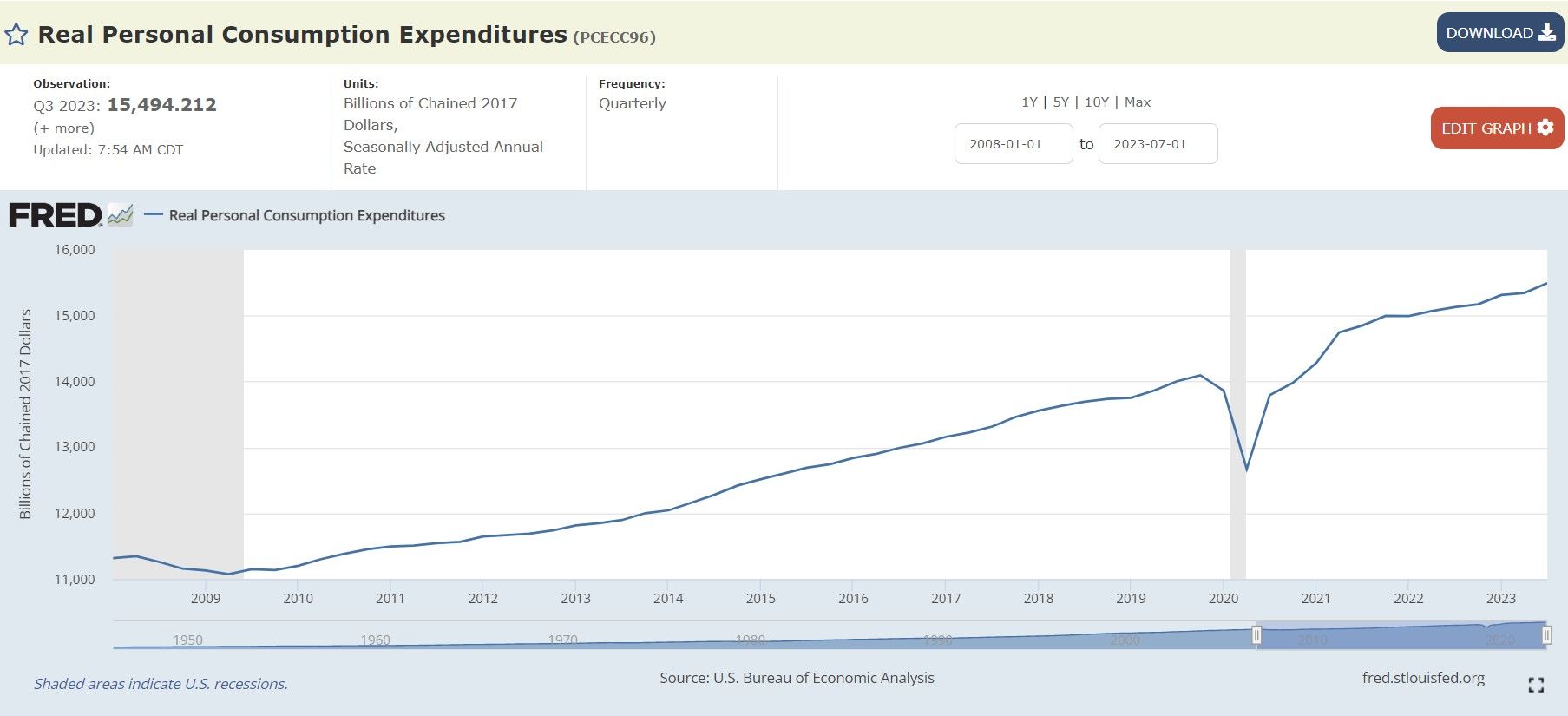

Consumer spending (~70% of GDP) jumped +4%

As called out above, this is the biggest increase since Q4 2021. This tracks with what we have seen in recent data as well. For example, August's consumer credit report saw revolving credit (credit cards) up $14.7 billion in August (13.9%).

Additionally, the Producer Price Index was up .5% in September (the largest increase since April) so prices are still likely to continue rising on all the goods folks are buying.

Speaking of goods, spending jumped bigly from Q2's +.5% all the way to +4% in Q3.

Meanwhile, services jumped +3.6% in Q3 (up from 1% in Q2).

All of this spending is pushing up Real Personal Consumption:

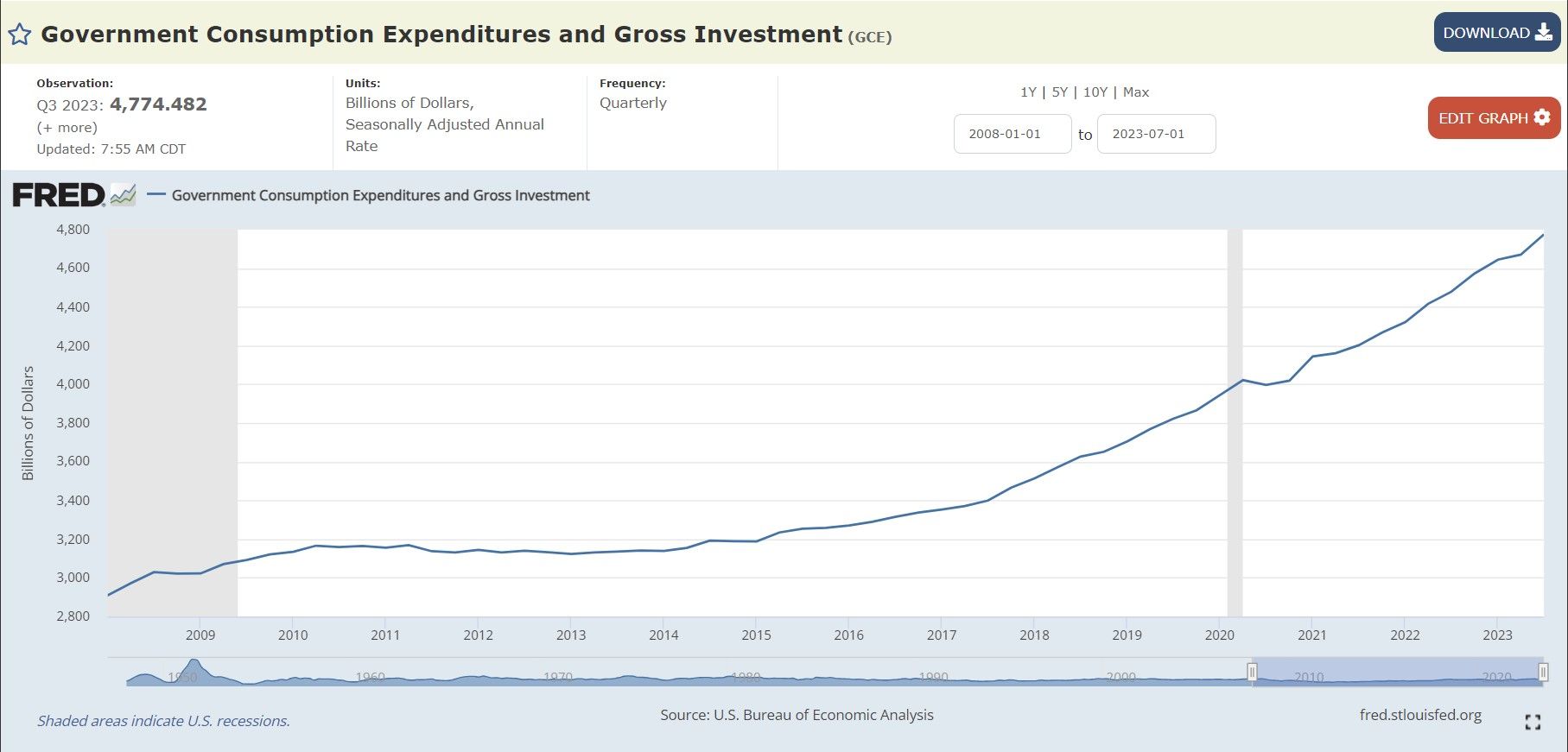

Government spending across the board was up 4.6%

This is a new record. Government spending in this instance does not include transfer payments and other direct payments to consumers (unemployment, Social Security, etc.)--these are counted in GDP when consumers and businesses spend or invest these payments.

- Federal government: +6.2%,

- National defense +8.0%

- Nondefense: +3.9%.

- State and local governments: +3.7%

As for defense spending, I suspect that is going to continue going up with the current administration asking for $105 billion for the efforts in Ukraine and Israel.

Gross private domestic investment

Private fixed investment and change in private inventories. It is measured without a deduction for consumption of fixed capital (CFC), includes replacements and additions to the capital stock, and excludes investment by U.S. residents in other countries.

Gross private domestic investment spiked by +8.4% in Q3 (up from +5.2% in Q2).

- Fixed investments: +0.8%.

- Nonresidential: -0.1%

- Structures: +1.6%.

- Equipment: -3.8%.

- Intellectual property products (software, movies, etc.): +2.6%.

- Residential: +3.9%

The trade deficit is still improving

- Exports were up +6.2%, which adds to GDP

- Imports rose bigly from Q2's -7.6%, to +5.7%, which subtracts from GDP.

- With exports higher (smaller $ amount) than imports (bigger dollar amount), the net export of goods and services improved for the quarter but is still negative.

Private inventories grow

Inventories continue to grow to match consumer's appetites heading into the holiday season. It is looking like there will be no shortage of items available for folks to buy?

Inflation is not slowing down!

Notice how every number we seem to be reviewing is WELL above 2%? This goes against the Fed's 2% objective and is more reason to raise rates while holding them higher for longer.

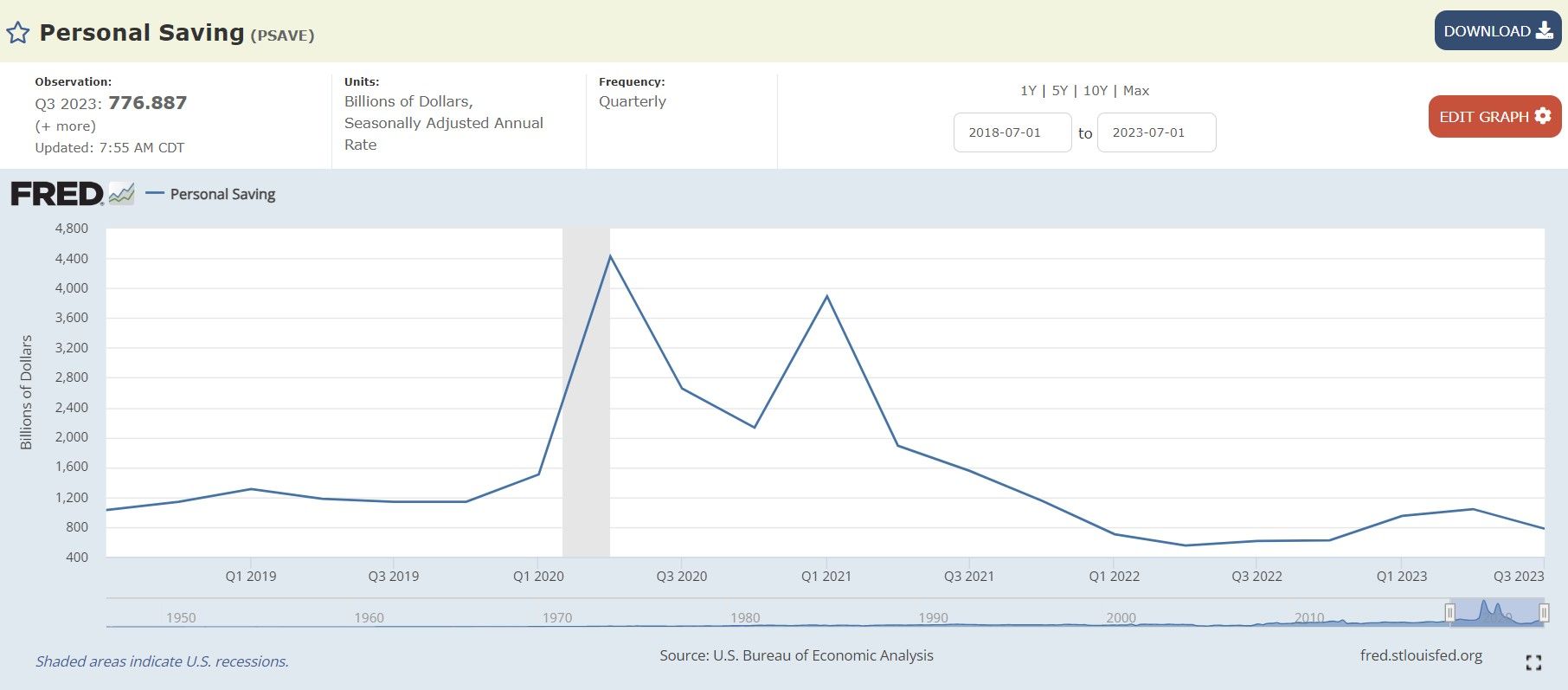

All of this is happening in the backdrop of consumers struggling to keep up. Personal saving was $776.9 billion in Q3, compared with $1.04 trillion in the Q2. The personal saving rate—personal saving as a percentage of disposable personal income— was +3.8% in Q3, compared with +5.2% in Q2.

Savings are dwindling, spending on credit is through the roof to make up for it, and inflation is still raging.

Yikes!

TLDRS:

Real gross domestic product (GDP) increased at an annual rate of +4.9% in Q3 of 2023 (following a +2.1% increase in Q2 of 2023), according to the "advance" estimate released by the Bureau of Economic Analysis today.

- Consumer spending (~70% of GDP) jumped +4% in Q3--the biggest increase since Q4 2021!

- Government spending across the board was up +4.6%!

- The trade deficit improved slightly for the quarter but is still out of whack.

- Private inventories grow ahead of the holiday season, meaning folks shouldn't be running out of stuff to buy anytime soon.

- Inflation is not slowing down!

- I wonder if we hear more complaints about this data being revised upwards in the future?

- Reminder, while banks have the liquidity fairy, 'we' get the promise of more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.