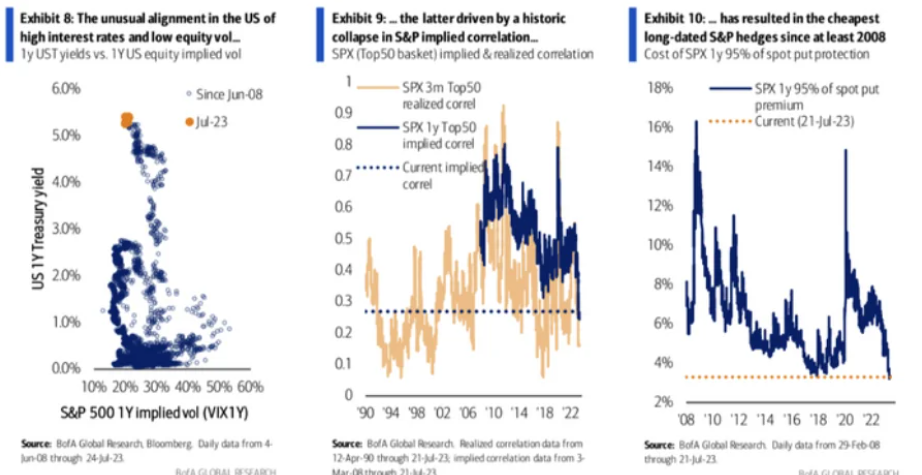

BofA's Benjamin Bowler: Cost of betting on a stock-market crash is cheapest since 2008. “Since our data began in 2008, it has never cost less to protect against an S&P drawdown in the next 12 months,”

Wut Mean?:

The cost of hedging against a stock market downturn using S&P 500 put options is at its lowest since 2008, says Benjamin Bowler of BofA Global Research.

- They state this low cost is due to a combination of low implied equity volatility, decreased correlation in stock market sectors, and increasing interest rates.

- BofA's team highlights that it's cheaper now to buy S&P 500 puts than in 2017 when the volatility index (VIX) was at its historic low.

- Reminder, a put option allows traders to profit from a decline in the stock or index, and a put spread strategy offsets the cost of one option by selling another.

- Despite the current low cost of bearish options, there seem to be more potential risks in the stock market now than in 2017.

TLDRS:

- BofA's Benjamin Bowler says hedging against a market downturn with S&P 500 put options is the cheapest it's been since 2008.

- This is due to factors like low equity volatility, decreased stock market sector correlation, and rising interest rates.

- Currently, S&P 500 put options are even cheaper than in 2017 when the VIX, a volatility measure, hit an all-time low.

- Despite cheap bearish options, the stock market appears riskier now than in 2017.