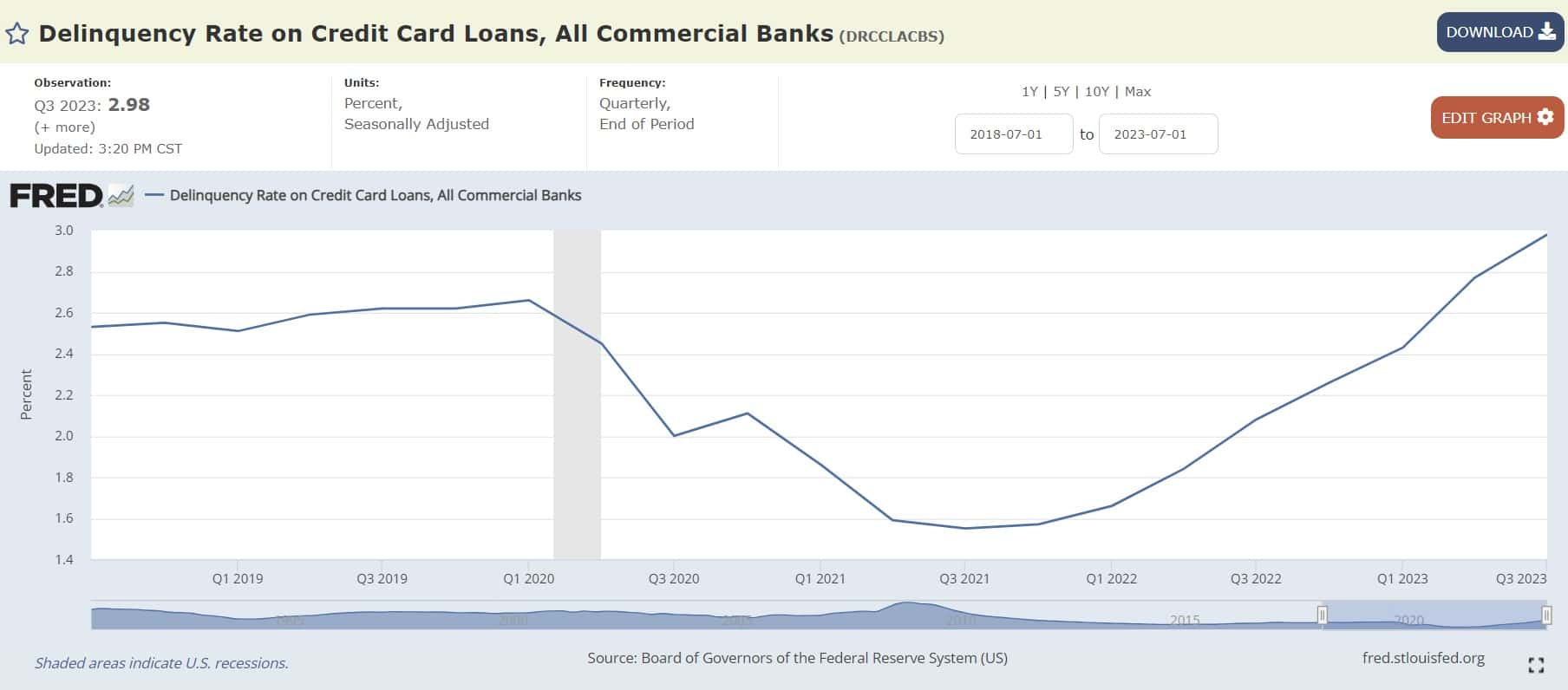

Delinquency Rates on Loans and Leases at Commercial Banks are spiking!

Source: https://www.federalreserve.gov/releases/chargeoff/delallsa.htm

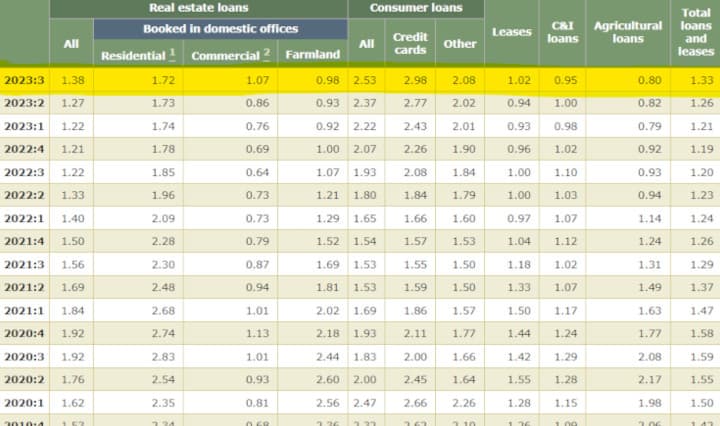

Credit Cards:

All Consumer Loans:

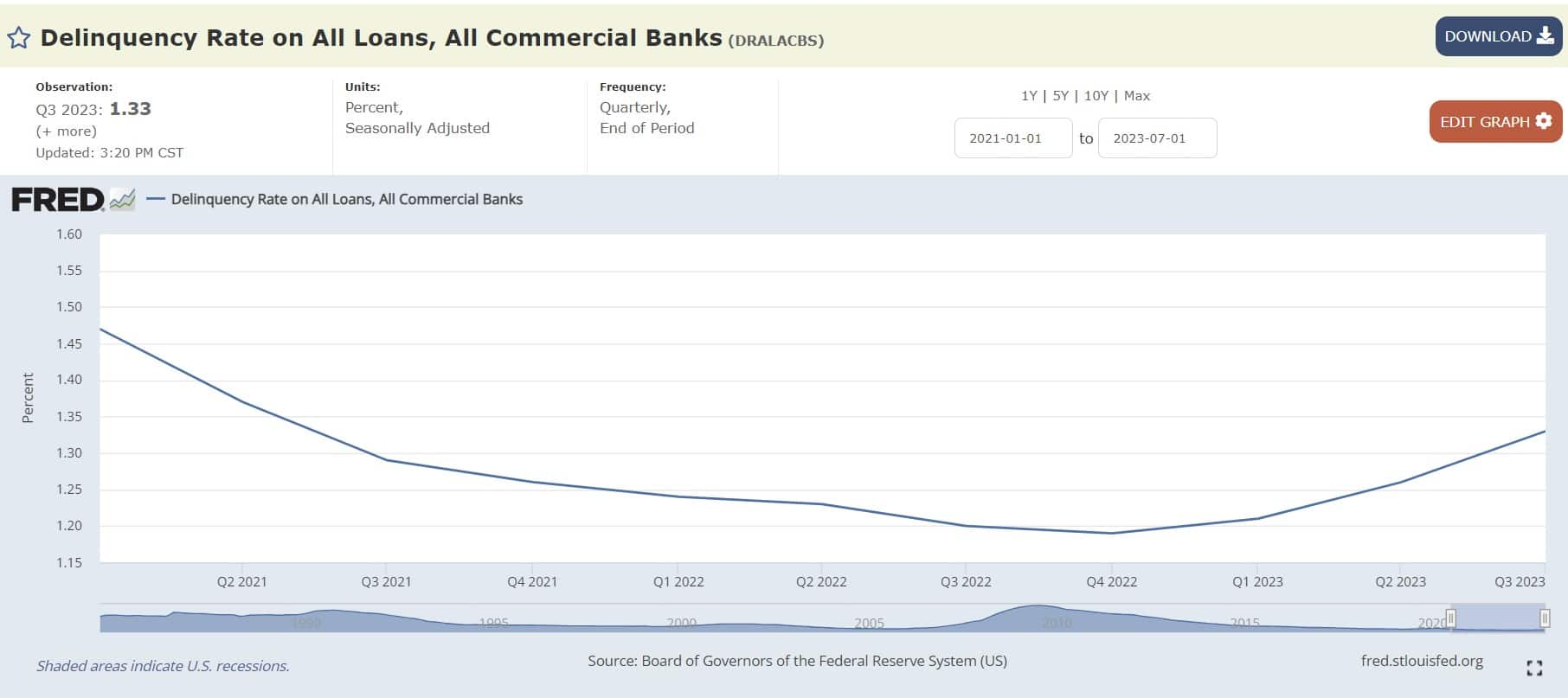

Delinquency Rate on All Loans, All Commercial Banks:

On the consumer side, this lines up with the Survey of Consumer Expectations: U.S. households probability of being able to come up with $2,000 if an unexpected need arose within the next month falling to its lowest level since 2013.

- Credit Demand and Application Rates (2023):

- Overall decline in consumer credit demand.

- Decreased application rates for most credit types; increase for credit card limit increases.

- Notable drop in mortgage loan applications to 4.3%.

- Rejection Rates and Creditworthiness:

- Rise in rejection rates for credit cards, auto loans, and mortgage refinancing.

- Decrease in rejection rates for new mortgage applications and credit card limit extensions.

- Applicants for new mortgages in 2023 showed higher creditworthiness.

- Future Credit Application Expectations:

- Decreased likelihood of applying for new credit cards, auto loans, and mortgages in the next 12 months.

- Increased perceived likelihood of future credit application rejections for all loan types.

- Financial Fragility of U.S. Households:

- Decreased probability of raising $2,000 for unexpected needs, the lowest since 2013.

- Voluntary and Involuntary Account Closures:

- Rise in lender-initiated account closures for any type of credit in 2023.

- It's a good thing GameStop has Apes holding down the balance sheet in an economy facing headwinds!

TLDRS

- Delinquency Rates on Loans and Leases at Commercial Banks are spiking!

- Credit Card delinquencies up!

- All consumer loan deliquesces are up!

- Delinquency Rate on All Loans, All Commercial Banks is up!

- It's a good thing GameStop has Apes holding down the balance sheet in an economy facing headwinds!