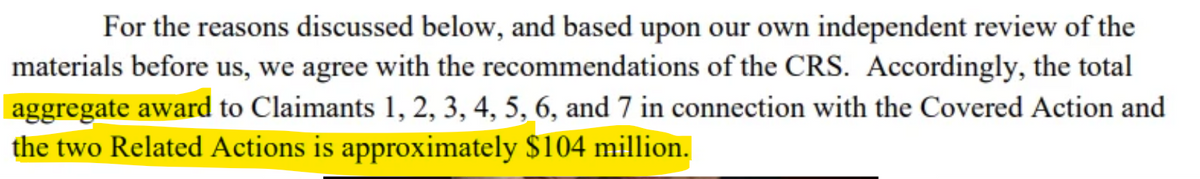

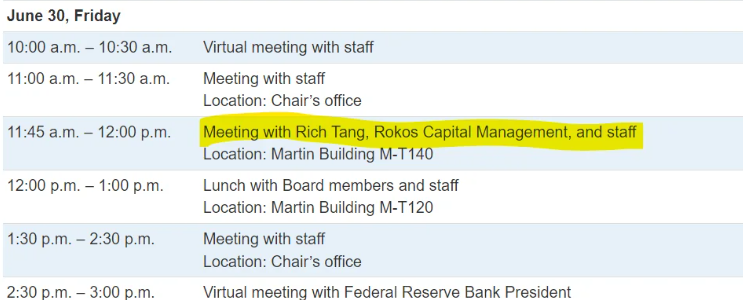

6/30 JPow met with Rich Tang, Rokos Capital Management. At the end of March, Rokos (a hedge fund) decided to de-risk, following double-digit losses. Why the meeting with JPow? Is this hedge fund getting ready to blow up?

London-based hedge fund Rokos Capital Management told investors in a letter on Saturday that it has decided to de-risk, following double-digit losses this month.

"We have de-risked following this month's market price action," the hedge fund said in the letter which was seen by Reuters. It