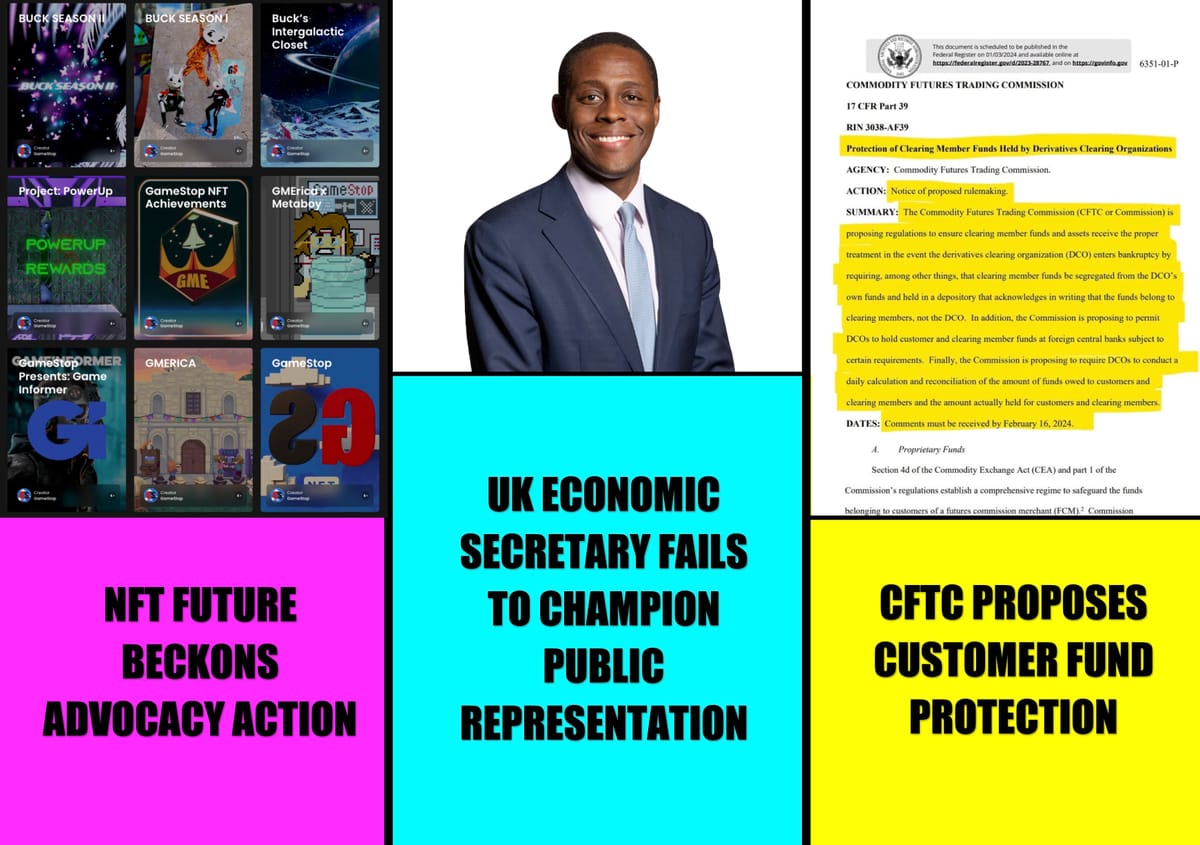

⚠️ ❗️ UK Economic Secretary Bim Afolami's RRG & Pension Insurance Corp. are teaming up to petition for "significant power" over independent UK regulators - looks like they want control over the financial markets.

It looks like the UK Government and the Pensions could be in trouble, and the Economic Secretary to the UK Treasury: Bim Afolami is at risk of using his position as Economic Secretary to get more momentum behind the proposals as being put forward by a Regulatory Reform Group (that he chairs) to give the UK Government more power over independent UK regulators AKA - more control over UK Rule Makers.

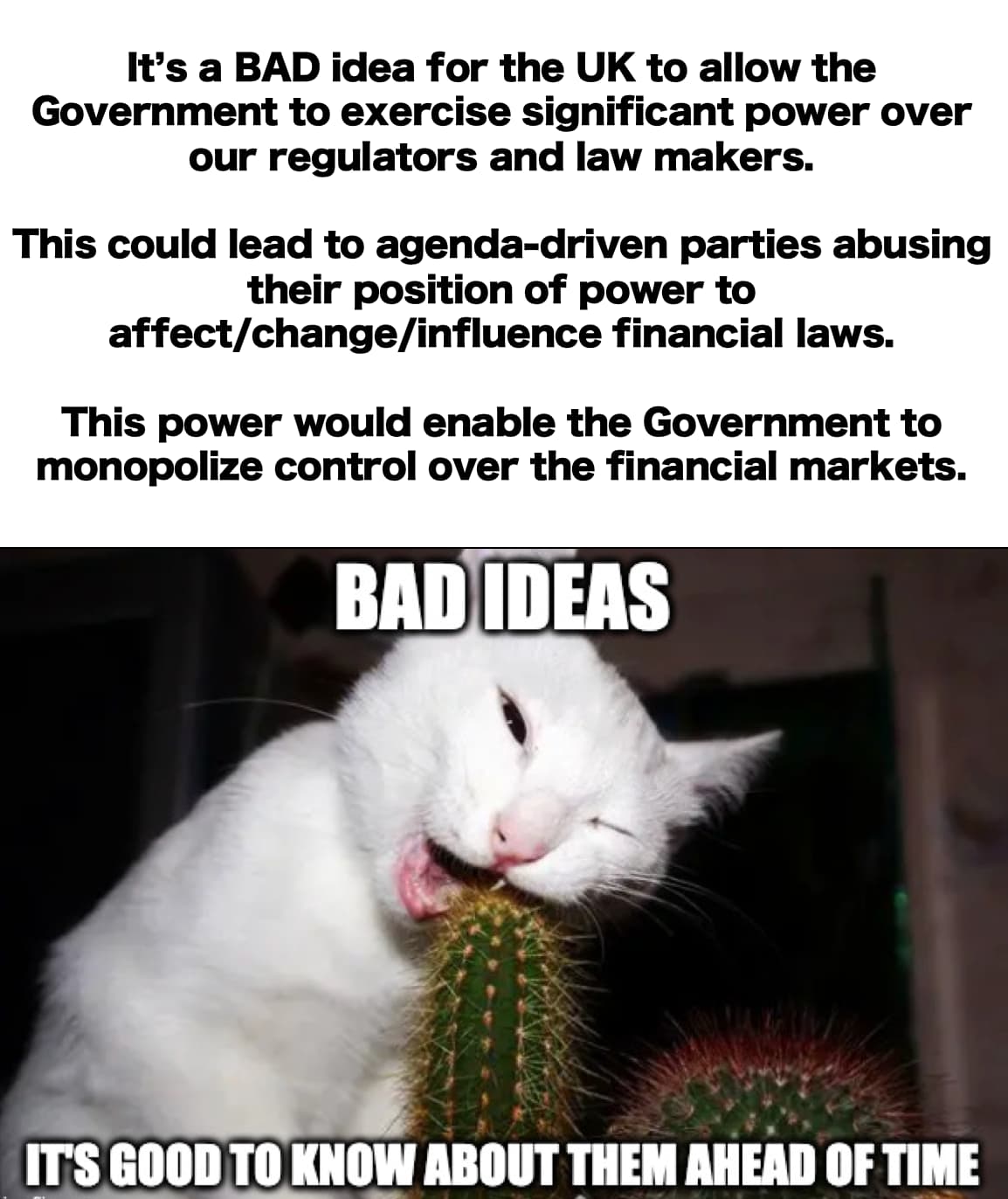

And why is the UK Government wanting control over our independent regulators/rule makers bad?

Well imagine you have a game, like say - football, where different players are required to follow set rules to make it fair.

Now, what if one player, who is also the referee, changes the rules during the game to help their team win halfway through the game?

That wouldn't be fair, right?

Similarly, if the government, who are pushing to set the rules for the financial game, changes them to favour certain businesses or their own interests any time they please - I'm sure we can all agree it's going to lead to a fair bit trouble.

This can expose us up to all shades of dangerous systematic abuse.

Check out the overview here:

Let's deep dive, shall we?

So to recap:

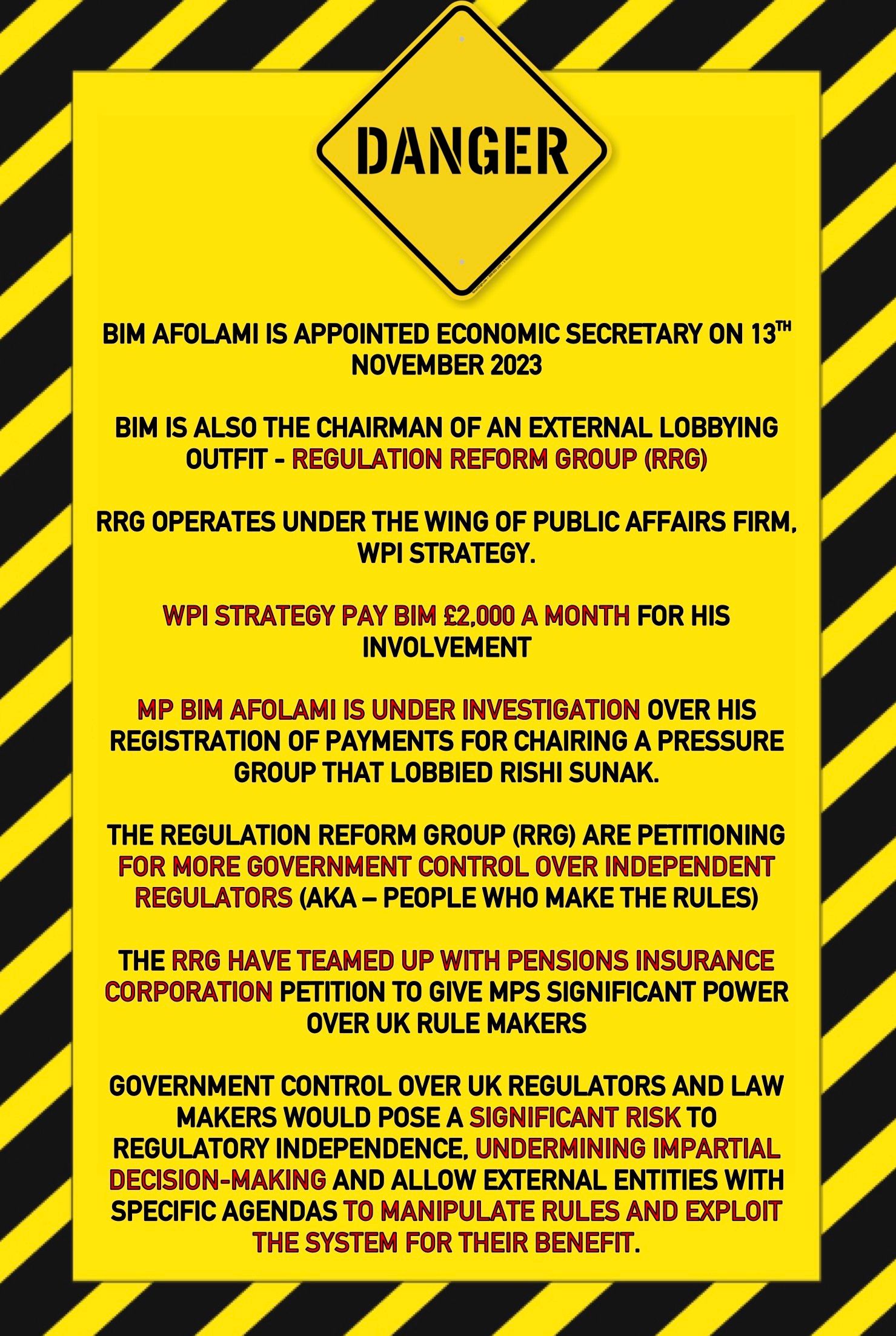

- Bim Afolami is appointed Economic Secretary on 13th November 2023

- Bim is also the Chairman of an external lobbying outfit - Regulation Reform Group (RRG)

- WPI Strategy pay Bim £2,000 a month for his involvement

- RRG operates under the wing of public affairs firm, WPI Strategy.

And in all it's glory, this is the news that has been making the rounds:

Related articles [here] & [here].

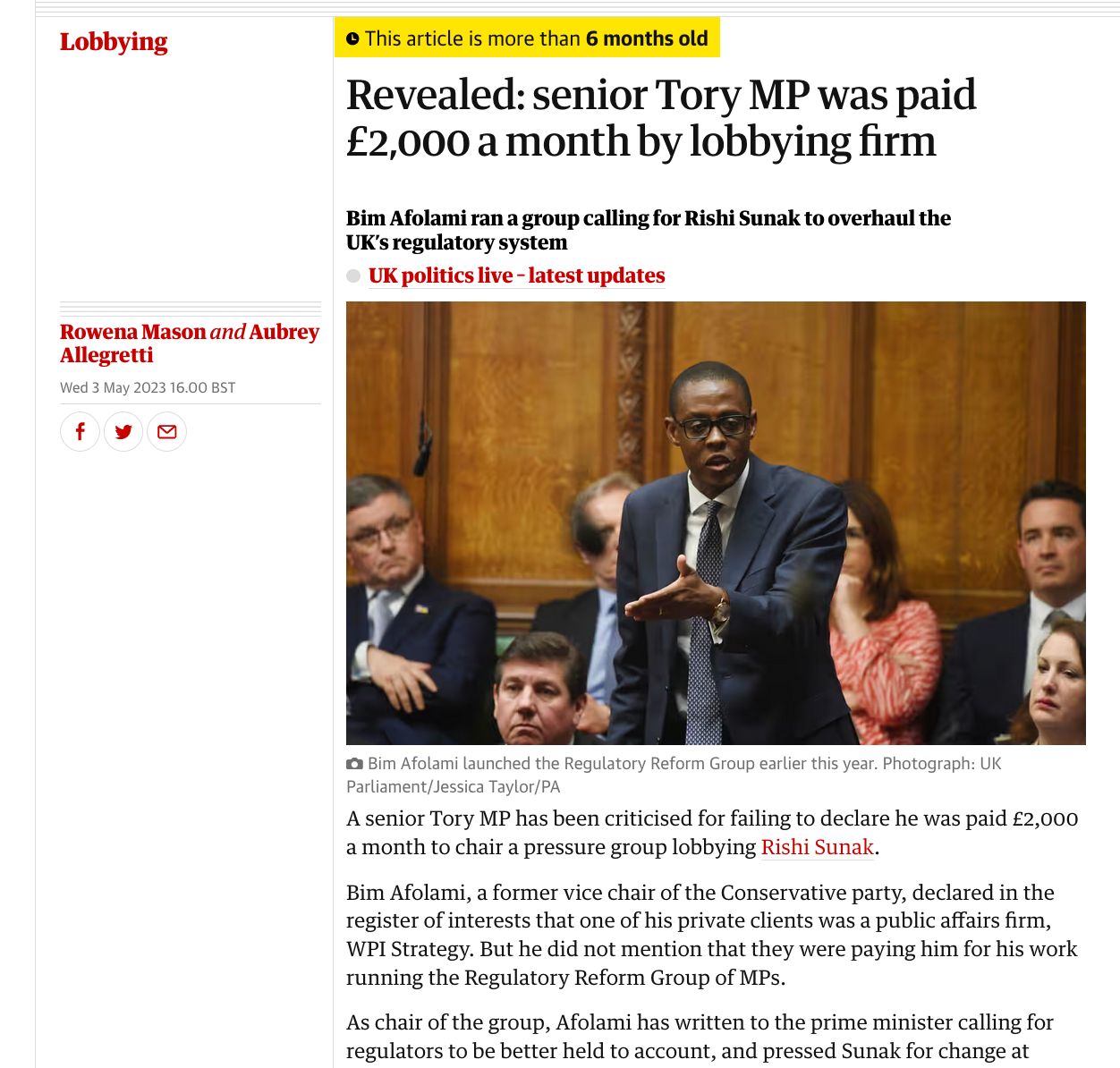

So according to The Guardian:

"The standards watchdog has opened an investigation into the Conservative MP Bim Afolami over his registration of payments for chairing a pressure group that lobbied Rishi Sunak. The commissioner on parliamentary standards launched the inquiry over “registration of interests” under the code of conduct."

SOURCE

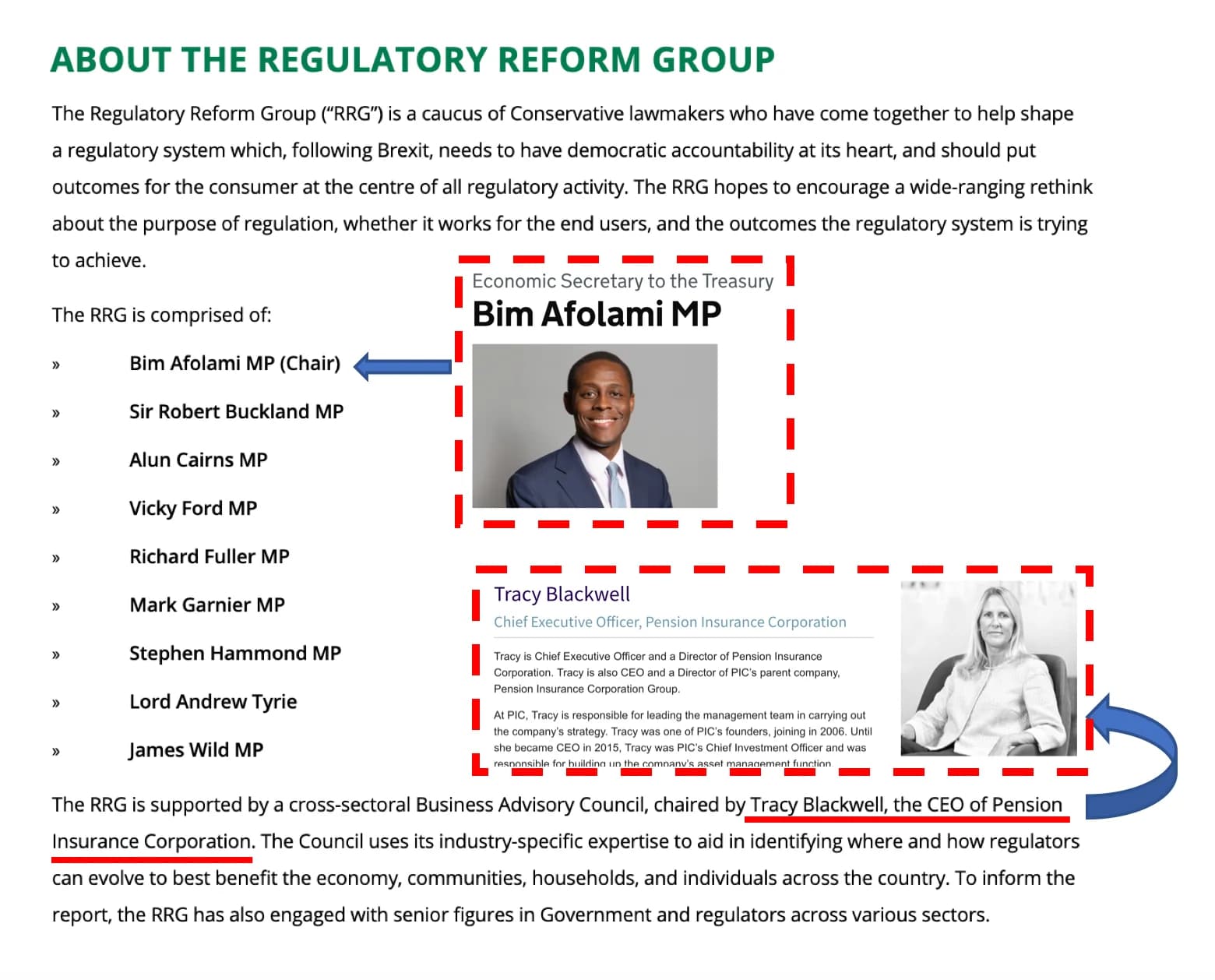

Bim is the chairman for Regulation Reform Group (RRG)

And when I think of regulation and reform, I tend to think about the work we do here. Particularly in our efforts to fight for:

- Increased Transparency.

- Equal opportunities.

- Level playing fields.

- Shareholder Representation.

- Freedom, investor empowerment and independence.

But that doesn't look like what we're dealing with here.

Looks like WPI Strategy's The Regulatory Reform Group - chaired by AM - could have a plan of their own to manage the fall out of the incoming crash...

And it wouldn't look good if our elected government officials are abusing their publicly elected positions to pursue self-serving government agendas to leverage further control over the financial markets.

Check this out:

So let's critically assess this for a minute.

The WPI Strategy team - who pay Economic Secretary of the Treasury, Bim Afolami, £2,000 a month for his participation in a Reform Regulatory Group (RRG) that he personally chairs - have presented a report, called "The Purpose of Regulation" suggesting that:

"....the lack of democratic oversight of regulators is holding back UK productivity and economic growth."

Check out the full report [here].

Right.

So I don't know about you but it seems like the Regulation Reform Group (RRG) are assigning blame to our independent regulators (aka, the guys who write and reinforce the rules) for the lack of "UK productivity and economic growth."

Whereas I was more of the understanding that the current pitfalls in our crippled economy are better attributed to the following;

- Government oversight failures allowing financial institutions (like Market Makers) to engage in financial market manipulation practices, such as predatory naked short selling.

- Governments diverting significant UK tax funds into bailing out banks, prioritising financial institutions over public welfare.

- MPs indulging in lavish expenditures on MP expenses/bonuses, indicating a misuse of public resources.

- Government failing to impose adequate taxes on major corporations operating within the UK, contributing to economic challenges and inequality.

- Amongst many, many more

And yet, they opt to focus blame on the regulators?

......

Let's check out what this Taskforce hopes to gain from this report they've mustered up:

Welcoming a second opinion here but this is how it's reading for me:

- The Regulatory Reform Group (RRG), a group of conservative politicians, released a report saying that regulators (aka - the people who make rules) need more "oversight" from the government to help the UK grow.

- They claim that without proper supervision, regulators might not be as effective in promoting economic growth and protecting consumers.

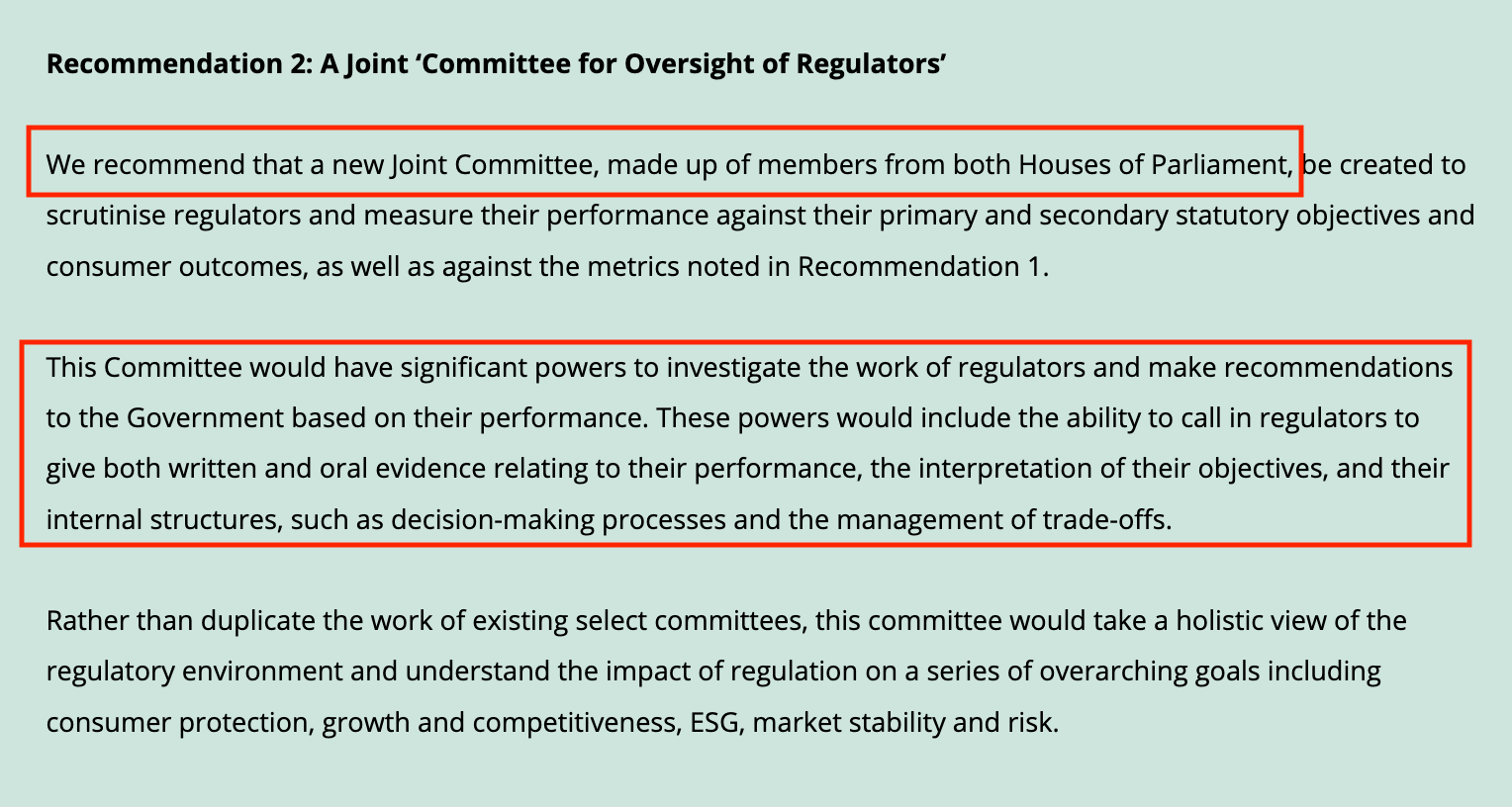

- Rather than advocating for the removal of rules, they propose an alternative approach to overseeing regulators, such as establishing a new Government "committee" of whom will have "significant powers" (as per pg.33) over the work of the regulators.

Uh - oh 🚩🚨 🚩🚨 🚩

RED FLAG ALERT

⚠️ ❗️ RRG are petitioning to bring in a Government Committee who will have "significant powers" to control the work as carried independent financial regulators (aka - the people who make rules).

And why is this bad, I hear you ask?

Well here are just a few reasons:

🚨 Due to financial challenges, the government may tweak regulations to favor certain industries, like banking or pensions, disrupting market dynamics.

🚨 To maintain the status quo, the government might resist necessary changes, like adopting blockchain, hindering innovation in the financial sector.

🚨 With increased government control, financial regulators may prioritise short-term political interests over the public's welfare, risking long-term economic stability.

🚨 More government influence may weaken regulatory independence, making it harder to hold wrongdoers accountable and raising the risk of financial misconduct.

🚨 Government control could limit competition by favouring specific players, stifling opportunities for new entrants and innovation.

🚨 If regulatory decisions are seen as politically motivated, investors and the public might lose trust in financial markets, leading to reduced confidence and participation.

Hmmmm.

So what if Bim's Regulation Reform Group (RRG) are blaming the UK regulators for their inability to foster UK economic growth during a global economic crisis in order to leverage full control over the rules that condition the market ahead of the crash.

Much like how the HM Treasury is trying to leverage control over our shares by forcing them into a CSD (as proposed in the UK's Digitisation Proposal) which will require legally transferring the legal ownership title of shareholder assets into a nominee as controlled by the state.

Remember:

❗️ Independence from monopolising Government control in regulatory matters is very important. ❗️

It helps prevent potential conflicts of interest, ensures impartiality, and fosters a regulatory environment focused on the public interest rather than political agendas.

Supporting regulatory reform proposals that emphasise democratic accountability and independence contributes heavily to a more transparent, fair, and effective regulatory system, reducing the risk of undue influence or monopolisation of rules governing financial activities.

Which is very important to remember as we are dealing with a desperate government who are on the verge of bankruptcy.

So it's really important that the Government do NOT have control over these systems as there is no means to safeguard it from systematic abuse.

Which, might pose itself as a bit of a problem as that's looks like exactly what they are trying to make happen.

Check out page 33. of the "The Purpose of Regulation" report from the RRG.

Which really - sounds a little bit terrifying.

Because if the government have overall control of the rules, they can kinda do whatever they want. And that's not going to end well for anyone.

But to add to this -

And not only do we know that Bim is being funded by WPI Strategy (£2,000 a month, in addition to his actual salary), for his participation in the RRG (that he personally chairs), whats more:

Bim's also getting support from Tracy Blackwell: The CEO of Pension Insurance Corporation

No really, look -

It makes you wonder what the Pension Insurance Corporation has to benefit from teaming up with the UK Government who are petitioning to issue themselves "Significant Power" over our financial regulators....

Seems to me that this partnership would certainly be ideal in a scenario where the pensions were absolutely and catastrophically fucked.

Especially if the Government were the ones responsible for gambling away the funds, and the insurance companies don't have enough funds to recover the costs.

Hmmm....

And if you folks, want to let WPI Strategy know that you think this report needs some tweaking - you can do that here:

- [email protected]

- Or you can write to them: 5-6 St Matthew St, London SW1P 2JT

So really there are a number of reasons off the top of my head why this is inherently a really bad idea.

Here are some of those reasons here:

- The government's economic history suggest they aren't the best fit for overseeing regulatory roles. We should consider specialists with a more reliable track record.

- Petition oversimplifies blaming regulators for the UK's economic performance, ignoring government accountability for UK's financial downfall.

- The petition overlooks the importance of investing in people and public welfare for genuine economic growth and progression.

- Petition neglects exploring alternatives options - risking bias and potential abuse in the absence of impartial operators.

- There's an elevated likelihood of a conflict of interest with the government's role within such a proposed committee, which introduces ethical concerns, jeopardising the impartiality of regulatory decisions.

- The government's attempt to change rules amidst potential market risks sparks suspicions about their motives.

But if you fancy making your own assessment - you can do this here: The Purpose of Regulation

Really this should go without question.

Simply put - Government MPs are not the right candidates for the job.

I mean, I think we knew this already.

But for sake of clarity, let's get everyone on the same page.

The government is becoming increasingly challenged in curating a thriving economy for the benefit of everyone.

AKA - We live in an economy where only the 1% are thriving.

Setting aside the rather overwhelming concerns about:

- corruption/criminality

- greed

- incompetence

- ignorance

- arrogance

As exist within our economic and political structures, as a matter of observation, the government's economic track record raises questions about its suitability for the proposed role of managing, overseeing, and influencing "significant power" over regulators.

The absence of evidence regarding government officials' financial expertise raises doubts about their competency for effective market regulation.

Financial markets are complex and dynamic, requiring a nuanced understanding of various economic factors, risk management strategies, and global market trends. The absence of demonstrated expertise may lead to suboptimal decision-making, as officials may struggle to anticipate and navigate the intricacies of market dynamics.

Effective regulation demands a comprehensive comprehension of the financial landscape to ensure that policies are not only well-informed but also adaptable to evolving market conditions. Without a proven track record of expertise in financial intricacies, there is a legitimate concern that the MP government representatives may lack the depth of knowledge necessary to navigate and regulate the modern, complex financial landscape.

In essence, the absence of evidence regarding the requisite expertise raises questions about the government's suitability for the proposed role, as their ability to make well-informed decisions and navigate the complexities of financial markets is fundamental to effective regulation.

Consequently, entrusting them with the responsibility of overseeing independent regulators raises gave concerns, and given the current lack of supporting evidence indicating their ability to execute the role effectively - there seems no reason for this sentiment to change.

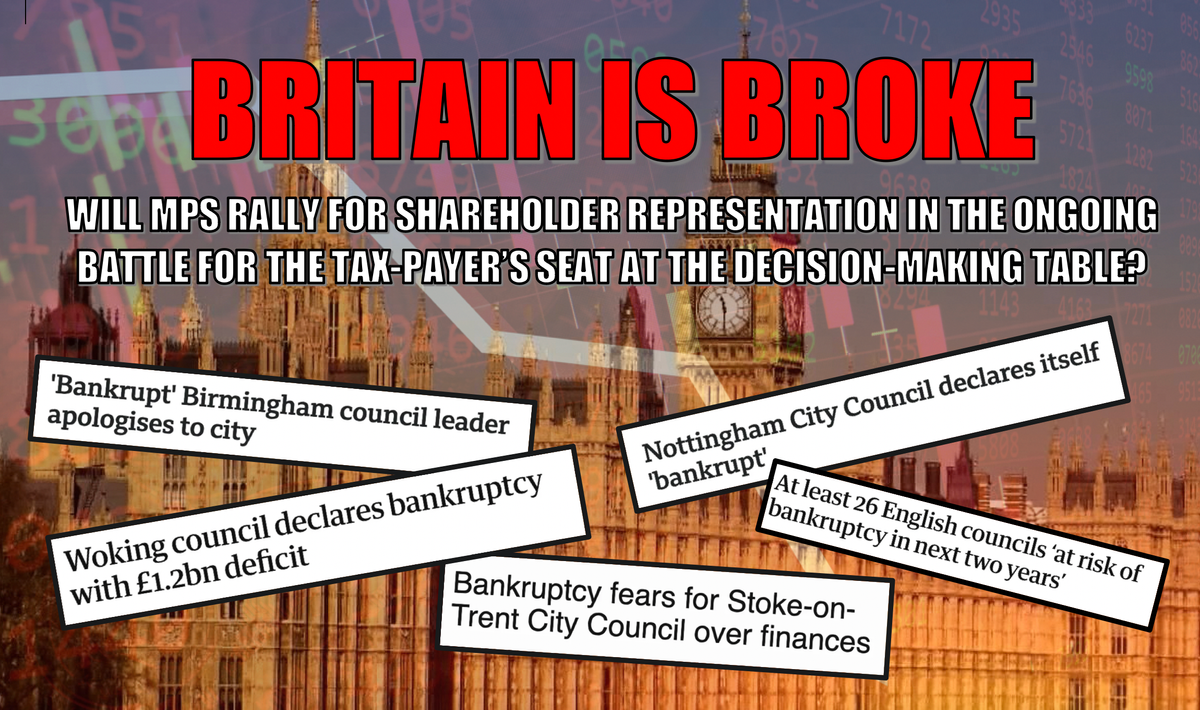

And it's not as if the UK have a great track record of thriving, successful economies.

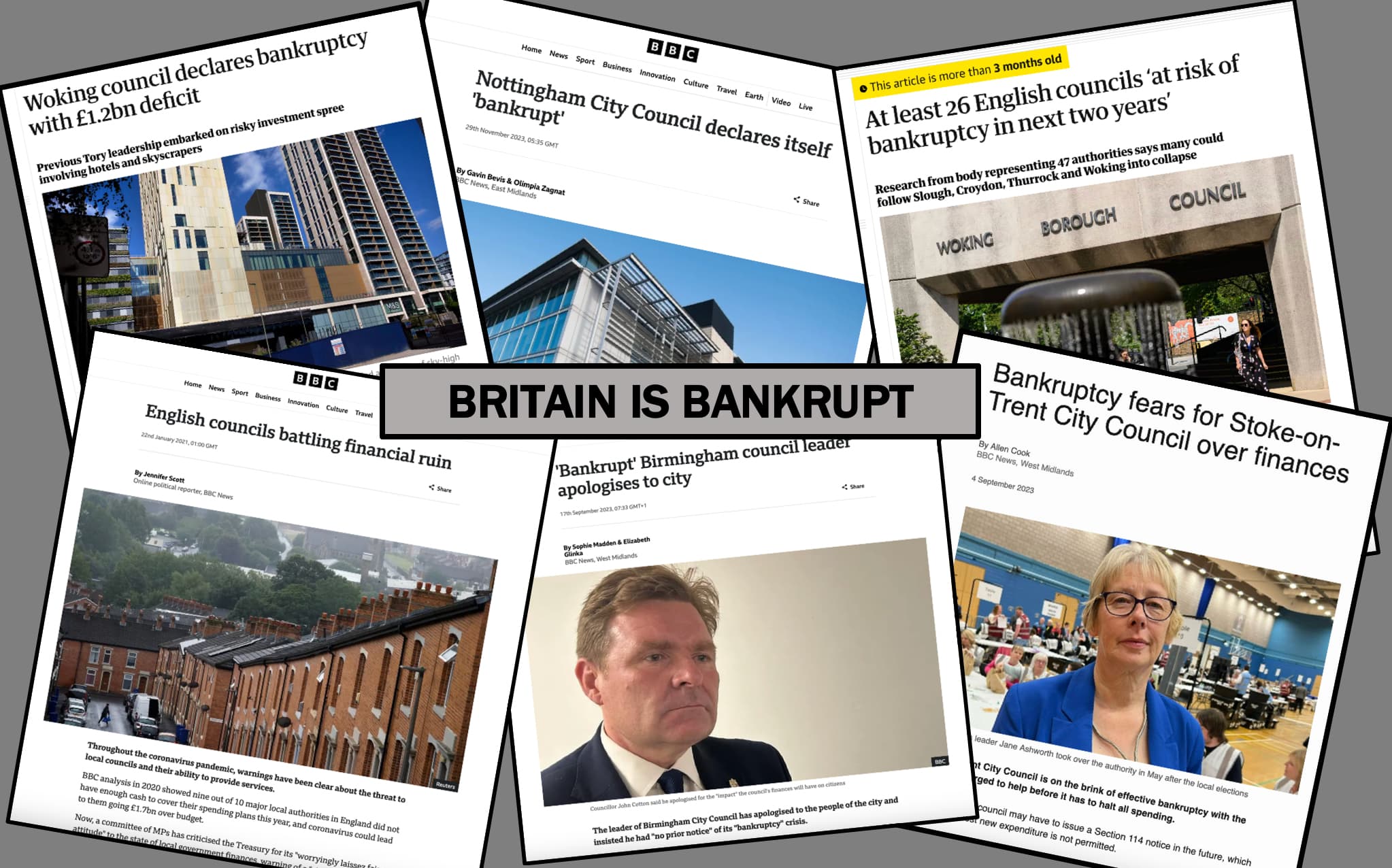

Case in point.

There is no confidence or trust in the Government to manage matters of a financial nature as best fitting for the UK.

Furthermore, where is there any public support for this idea?

There must be a rigorous process of public approval and absolute scrutiny for this proposal. Trust in this UK Government organisation to assume the role of "regulators of the regulators" is notably lacking - and cannot be assumed as this position seeks to have MPs positioned in this significant role of power and influence.

Given the government's track record, it's rather presumptuous for the Government to equally assume they are the best fit for the job without clear evidence of public backing. Such an assumption raises concerns about the potential risks it may pose to safeguarding the public's best interests, especially given the perceived monopolizing influence.

Without clear evidence that the government can be trusted with such responsibilities or has demonstrated capability, there's grave concern about the negative impact this could have on public interests, exacerbated when there's a perception that the government might exert undue control.

And really - what we want to know is:

- Where is the evidence that people endorse this proposition?

- Has there been any effort to consult the public on this matter?

Because blind faith in our Government body to do right by the people should not to be assumed.

✅ ALTERNATIVE PROPOSED SOLUTION:

To enhance regulatory performance, RRG MPs should enlist the help of impartial specialists - individuals who are independent and objective, far removed from politics. In this role, specialists would have the time, knowledge, and experience to educate, train, inspire, motivate, and guide those within the regulatory agency, as well as assist those responsible for writing our laws in managing their workloads more effectively. The sole purpose of their presence would be to help, rather than direct, influence, manipulate, or dictate performance.

Furthermore, additional financial investment may be necessary to ensure the fostering of a more effective working agency. This investment aims to allow rulemakers to flourish, benefiting not only the individuals but also contributing to the prosperity of the UK.

It is equally stressed that creating a work culture that is rich with trust, motivation, inspiration, freedom, respect, and appreciation, while nurturing growth, is a far more effective method to elicit the best work from individuals. This stands in contrast to the suggested approach of heightened scrutiny and micromanagement proposed in the petition. Should the government feel that it is their responsibility to rectify any perceived issues in the regulatory office, instilling these positive elements would benefit all and improve the quality of work, most likely eliminating the need for government interference altogether.

The Government want increased control over the laws, which is more than a little problematic.

👀 Imagine this scenario with the pensions for example:

UK Government decides to gamble recklessly with people's savings, including pension funds.

They invest these funds in risky ventures without considering the long-term consequences.

The market eventually crashes - and impact is made worse due to these irresponsible moves.

Now, when it's time to cover the losses, the pension insurance companies find themselves short on funds because they too have invested alongside the government's risky schemes.

As a result, they both don't have enough cash to compensate for the lost pensions, which will result in the UK Public outrage.

MPs, recognising the need to deflect blame and avoid accountability, craft a strategic plan to gain control over the rules and regulations that govern the markets.

They create a petition disguised as an attempt to revamp the regulatory system.

They lobby their petition into parliament, aiming to shift blame onto UK regulators for the challenges in fostering UK economic growth during a global economic crisis.

This strategic move is designed to justify and consolidate full control over the rules governing the market, allowing them to leverage power ahead of the impending economic downturn.

This gets approved.

This grants the government unbridled power over all rule and regulation decisions, allowing them to shape the narrative and avoid accountability for the pension crisis.

With newfound control, the government can change rules and regulations to offset any responsibility or consequences for their actions, leaving them with significant influence and allowing them to evade consequences while the UK public suffers.

COULD YOU IMAGINE?

Don't know about you, but even just based on that situation alone - it doesn't sound like it's worth the risk.

________________

But, should we find ourselves in this crazy hypothetical position where the UK government has recklessly gambled away the life savings of millions of people across Britain, and the pension insurance companies can't afford to reimburse these sunk costs to those whose money was stolen, it would undeniably present a conflict of interest for the government to occupy such a role within the regulatory agencies.

So given the tangible risks and the warranted need for accountability, one might question why the government would be considered the optimal choice to put the regulatory department back on track.

I mean, all evidence seems to suggest otherwise.

Other Risky Scenerios include:

⚠️ Government officials with ties to specific industrys might favour related policies - like an MP with close connections to the banking sector may influence policies in favor of banks.

⚠️ Governments prioritising policies for immediate political gains might overlook long-term economic stability. A tax cut aimed at winning votes could neglect its impact on future revenue and economic health.

⚠️ Frequent changes in government regulations, especially when there's a change in leadership, can create uncertainty for businesses and investors, hindering economic growth.

⚠️ Slow and cumbersome bureaucratic processes can delay responses to economic challenges. For instance, delays in passing crucial economic stimulus packages during times of crisis.

⚠️ Instances where government officials responsible for economic decisions face little consequence for failures, contributing to a lack of accountability.

⚠️ Lobbying efforts by powerful industries might lead to regulatory decisions that favour their interests, such as weakening environmental regulations for the benefit of certain corporations.

⚠️ Industries may exert undue influence on regulatory bodies, as seen when financial institutions shape policies to suit their interests, ultimately leading to lax oversight.

⚠️ Governments might implement populist policies, such as unsustainable subsidy programs, to gain public favour without considering the long-term economic impact.

Hmmmm..

Seems to me there are many reasons why the government would be a very, very poor choice to partake in this proposed "committee" to help the regulatory team spark further economic growth into the UK.

✅ ALTERNATIVE PROPOSED SOLUTION:

Again, to enhance regulatory performance, RRG MPs should enlist impartial specialists, addressing conflict concerns and ensuring advice from organizations with robust financial track records. This alternative underscores the critical importance of impartiality in fostering financial strength, growth, and prosperity.

"The Purpose of Regulation" report as put forward by the RRG is positioned in such a way that the government are attribute the lack of "UK Economic Growth" to the supposed failures of the financial regulators.

The petition oversimplifies complex issues by solely blaming regulators for the UK's economic performance without considering other contributing factors nor accepting accountability for the governments own role in current economic crisis climate.

Yet, the solution for UK Productivity and Economic Growth seems SO PAINFULLY OBVIOUS.

It's not the regulators that are the problem, it's the whole system.

We need to start putting people first.

And to help make it easier - here's a list of ways we can do exactly that to help foster economic growth, not just in the UK - but indeed everywhere.

So why isn't this being adopted within Government as the obvious best-working solution?

The fact that it isn't only adds more weight to the concerns that the government's attempt to change rules amidst potential market have ulterior motives in their attempts to seize further control.

✅ THE ULTIMATE SOLUTION:

By focusing on empowering individuals through education, healthcare, affordable housing, and sustainable businesses, we create a robust foundation for economic prosperity without the need for excessive government intervention.

This decentralized approach promotes self-sufficiency, community resilience, and inclusive growth, aligning with a vision that diverges from concentrated regulatory control.

Ultimately, by prioritising the well-being of citizens, we build a strong and independent society that doesn't necessitate overbearing government influence in regulatory authorities.

It's not enough to highlight this as a problem, but we need to DO something about this.

Change starts with us.

Don't let your apathy be the reason nothing changes.

You can reach out to your MP Representative here and ask for shareholders to be increasingly involved with the ongoing talks surrounding the Digitisation Proposal and all other financial matters - as is your right.

You can do that by accessing this link here:

https://www.writetothem.com/

And follow the instructions - in four easy steps:

- Enter Postcode

- Choose Representative

- Write Message

- Send

Your voice matter. Every input matters. Together - we make the impossible happen.

TL;DR 🇬🇧 🦍

- Britain is at breaking point, with councils across the UK on the brink of bankruptcy - the government is running out of cash fast.

- Economic Secretary to the UK Treasury: Bim Afolami is being investigated after it was discovered he was being paid £2,000 by WPI Strategy (a lobbying firm).

- WPI Strategy includes the Regulatory Reform Group (RRG) - which is chaired by the very same Bim Afolami

- The RRG are blaming independent UK regulators (aka - the people who make rules) for a lack of economic growth to leverage more Government control over the financial markets.

- If governments control the rules and regulators, they can control the markets.

- We need to fight back against this petition. UK apes - please contact your local representatives.

That's all folks.

Be excellent to each other.