Office of Financial Research (OFR) unveils new hedge fund monitor for Public use

Today, the Office of Financial Research (OFR) introduced the Hedge Fund Monitor, an interactive data visualization tool designed to make aggregated data on hedge fund activities more accessible to the public. This tool, available for public use, allows users to download data through an application programming interface (API).

Key Features:

- The Hedge Fund Monitor provides easy access to aggregated hedge fund data, with downloadable options via an API.

- The monitor aggregates data from four primary sources:

- SEC Form Private Fund (Form PF) filings

- CFTC Commitments of Traders reports (provide data on aggregate holdings of futures and options positions across a number of asset classes)

- Federal Reserve Board’s Senior Credit Officer Opinion Survey (includes information about the availability and terms of credit in securities financing and over-the-counter derivatives markets)

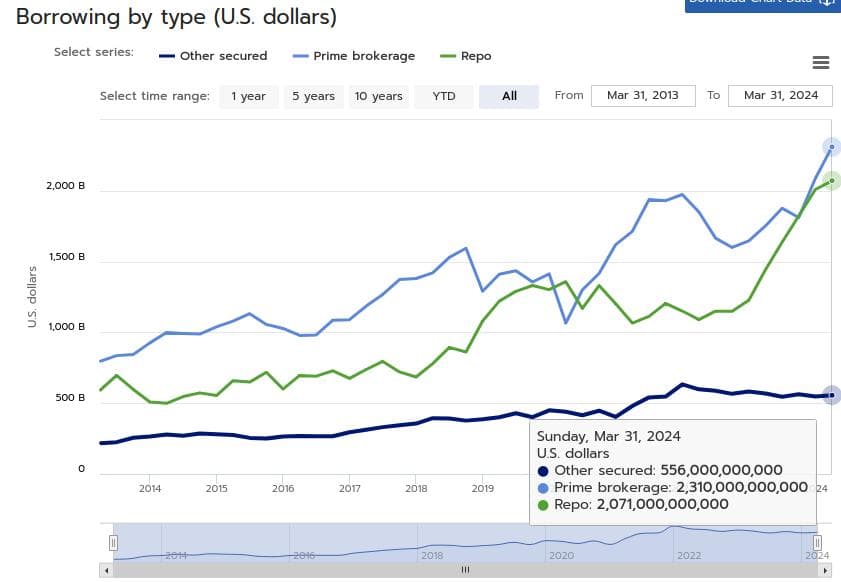

- Fixed Income Clearing Corporation (FICC) aggregated sponsored repo data (nclude secured borrowing transactions in which a dealer that is a FICC member sponsors non-dealer counterparties (e.g., hedge funds) onto FICC’s cleared repurchase agreement (repo) platform.)

Role of Hedge Funds:

OFR calls out hedge funds play a significant role in the global financial marketplace by enhancing market depth, performing arbitrage, and providing risk transfer and diversification. However, their activities can involve risks such as high leverage and reliance on short-term funding.

James Martin, Acting Director of the OFR, emphasized the tool’s importance in fulfilling the OFR’s mission to inform public and policy decisions without revealing confidential entity-level information about hedge fund advisers or the funds they manage.

Overview:

Hedge funds provide a number of benefits to financial markets. For example, they perform arbitrage that reduces or eliminates mispricing across similar securities and instruments. They provide liquidity in periods of calm and stress. They add depth and breadth to capital markets. Finally, they take risks that otherwise would have remained on the balance sheets of other financial institutions, thereby providing an important source of risk transfer and diversification. However, some of these activities include risks, such as high leverage or reliance on short-term funding. Further, hedge funds may pull back from activities that provide the above-mentioned benefits. The Hedge Fund Monitor aggregates data across public and private sources and presents these data in an easy-to-use tool.

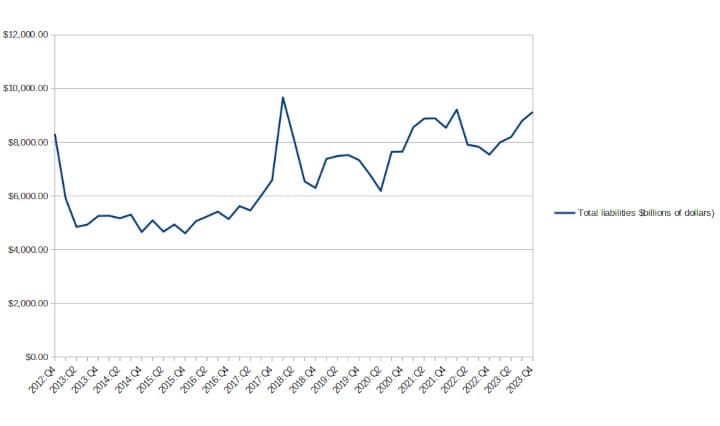

Size:

Related Charts:

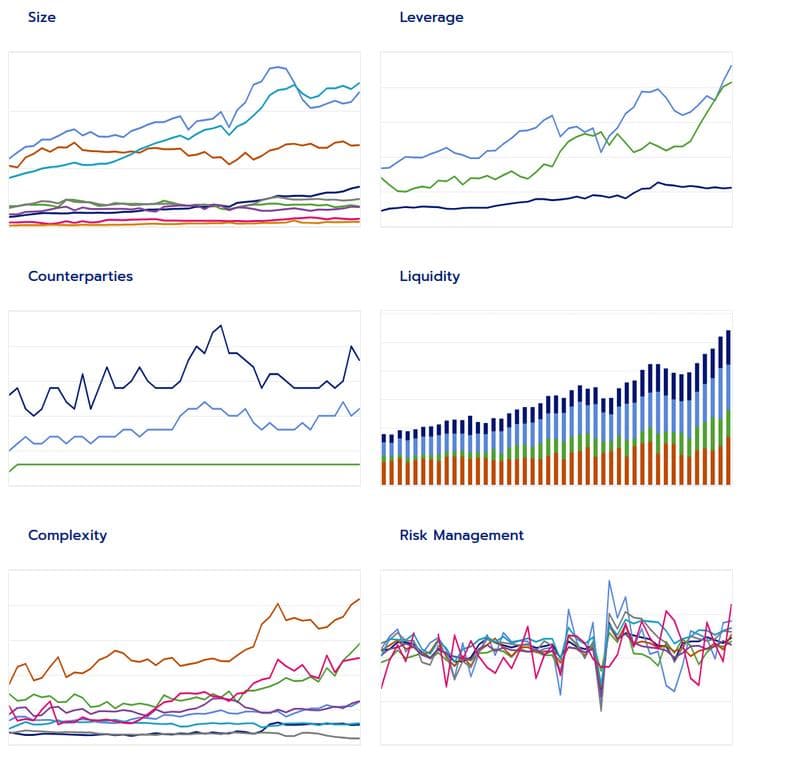

Leverage:

Related Charts:

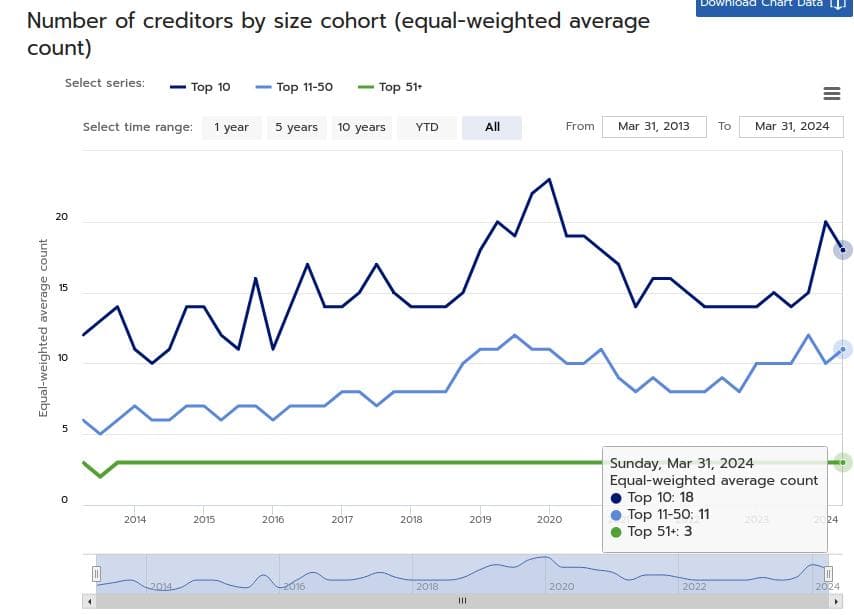

Counterparties:

Related Charts:

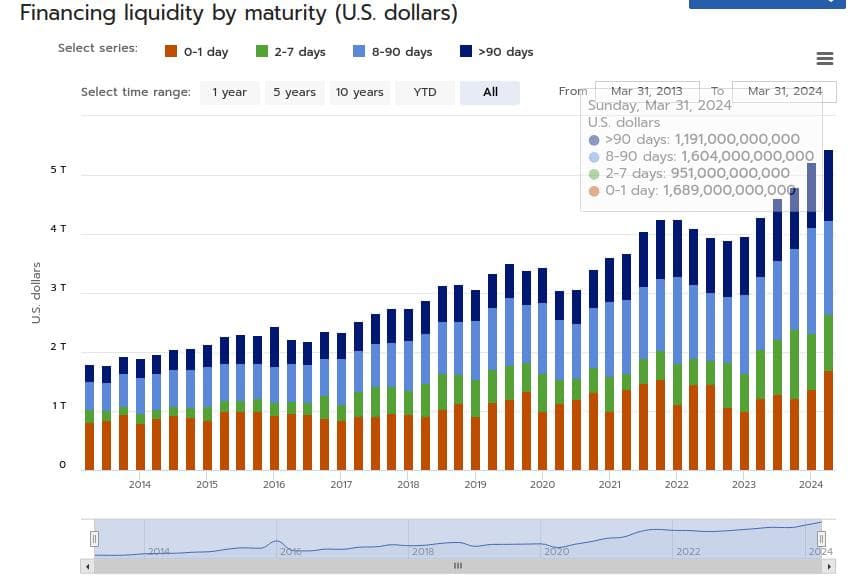

Liquidity:

Related Charts:

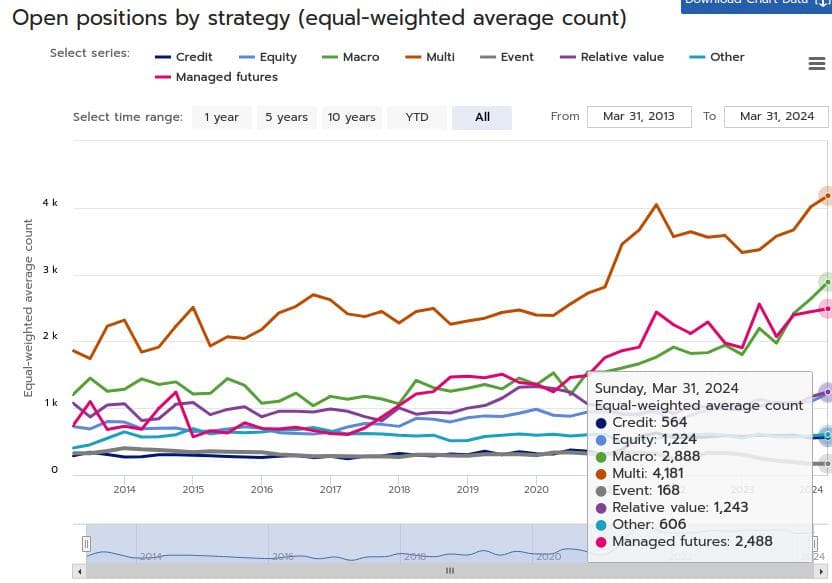

Complexity:

Related Charts:

| Chart Name |

|---|

| Derivative volume traded over the counter by size cohort (percent) |

| Open positions by strategy (equal-weighted average count) |

| Top 10 hedge funds’ share of open positions (percent of total) |

Risk Management:

Related Charts:

TLDRS:

- The Office of Financial Research (OFR) launched the Hedge Fund Monitor, an interactive tool for public access to aggregated hedge fund data.

- The tool provides easy data access and download options via an application programming interface (API).

- It aggregates data from four primary sources: SEC Form Private Fund (Form PF) filings, CFTC Commitments of Traders reports, Federal Reserve Board’s Senior Credit Officer Opinion Survey, and FICC aggregated sponsored repo data.

- The data includes information on aggregate holdings of futures and options, credit terms in securities financing, and secured borrowing transactions on FICC's repo platform.

Office of Financial Research (OFR) unveils new hedge fund monitor for public use to make aggregated data on hedge fund activities more accessible to the public.

by u/Dismal-Jellyfish in Superstonk

Office of Financial Research (OFR) unveils new hedge fund monitor for public use to make aggregated data on hedge fund activities more accessible to the public.https://t.co/iYVffcMNea

— dismal-jellyfish (@DismalJellyfish) July 31, 2024