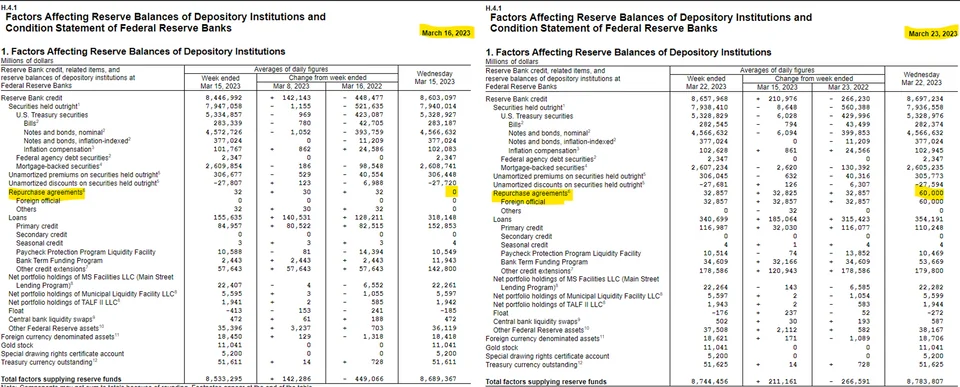

There is always money in the Fed: Repurchase agreements Foreign Official 3/16 $0. Repurchase agreements Foreign Official 3/23 $60 Billion. I wonder what Foreign Official needed $60 billion so quickly?...

Sources: https://www.federalreserve.gov/releases/h41/20230316/ https://www.federalreserve.gov/releases/h41/20230323/

I am willing to bet this is why the Central Bank Liquidity swaps did not jump bigly this week--they went here instead?

Also, with Primary Credit dropping by $40 billion and the Bank Term Funding Program (BTFP) jumping about the same, seems they are moving the lending there for the 1 year loan term vs shorter term Primary Credit?

More details on all of this here:

EDIT: typo in headline, the dates should be 3/15 and 3/22. The reports are as of 3/16 and 3/23.