🚨🇬🇧 UK Government Unveils Draft Legislation to Replace EU Short Selling Rules, Prompting Need For Public Scrutiny.

Post-Brexit, UK revises Short Selling rules. New UK SSR risks include: loose definitions, selective enforcement, lack of transparency, broad powers, regulatory challenges with government involvement concerns.

notable

During its tenure as a European Union member, the UK followed the regulations outlined in the EU Short Selling Regulation. However, following Brexit, the UK government - led by PM Rishi Sunak, formerly associated with Goldman Sachs - is actively engaged in revising and amending these regulations.

As such, the UK Government has released a draft statutory instrument as part of the process to change the laws surrounding Short Selling.

The emphasis within the proposal is on tailoring the rules to better suit the post-Brexit financial landscape and address specific considerations that may arise in the UK's evolving regulatory framework.

However - as you may well expect - skepticism looms, fueled by widespread mistrust in the government's dedication to the public's best interests.

And there's a prevailing sense that these moves might be more about self-serving motives than genuine concern for the people and given all we have uncovered with with the UK Digitisation Taskforce, and how little the UK Government has done to champion public inclusion within these discussions.

That said, let's not judge a book by it's cover.

Let's check it out:

UK GOV page here: https://www.gov.uk/government/publications/short-selling-regulations-2024

Short Selling Regulations 2024 – Draft SI

PDF, 181 KB, 9 pages

Short Selling Regulations 2024 – Policy note

PDF, 139 KB, 18 pages

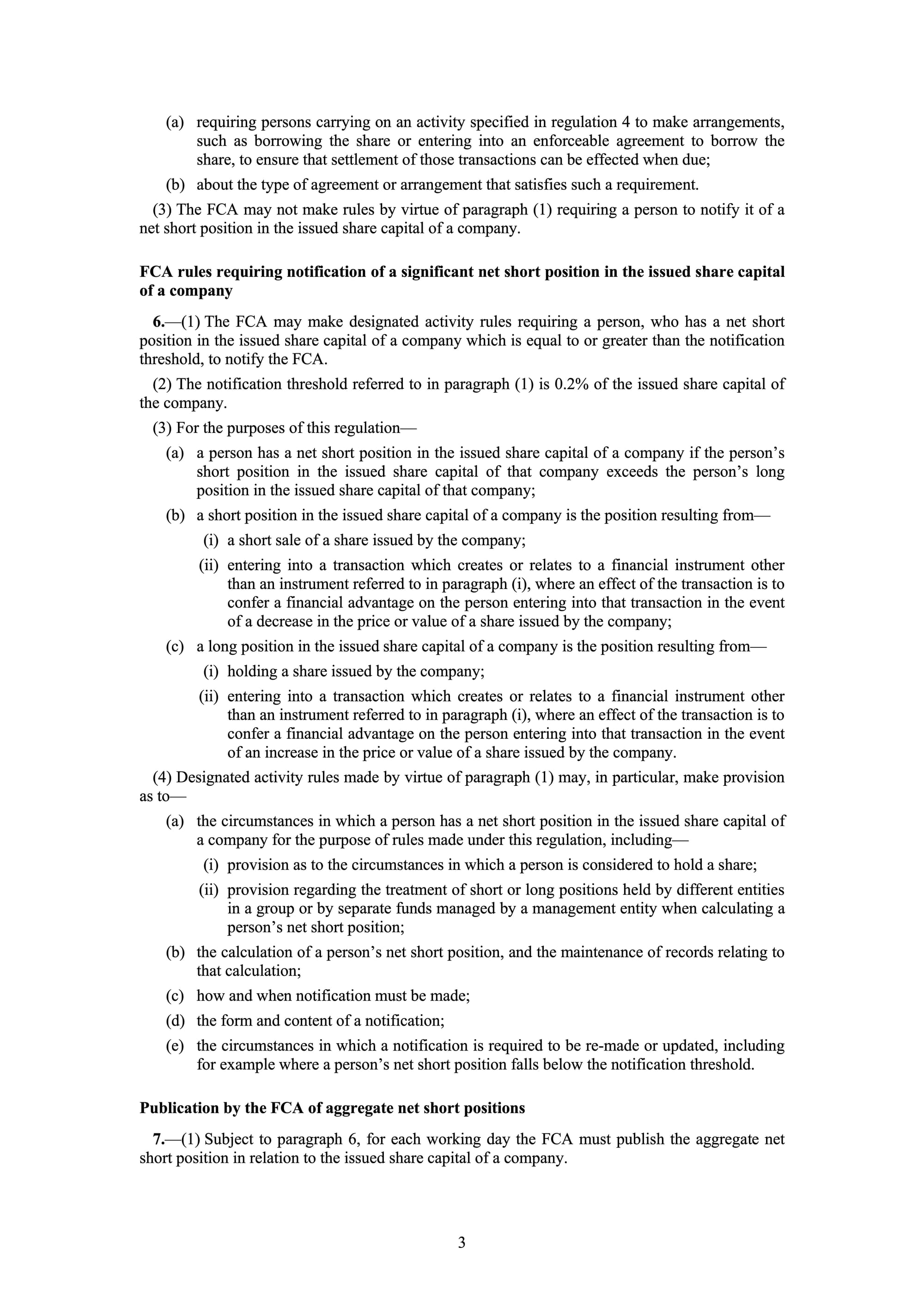

Here's the Draft SI -

With all rules, there are nuances that we need to delve into and assess, alongside championing the greater intentions in aspects of any proposal.

We remain wary of the risks, and as we continue to seek clarity and address loopholes that can permit systematic abuse in its implementation.

With such a consideration in mind, we turn our heads to the Policy Note for Short Selling Regulations 2024

It's crucial to scrutinise the regulatory framework comprehensively to ensure that it not only serves its intended purpose but also guards against potential exploitation and market distortions.

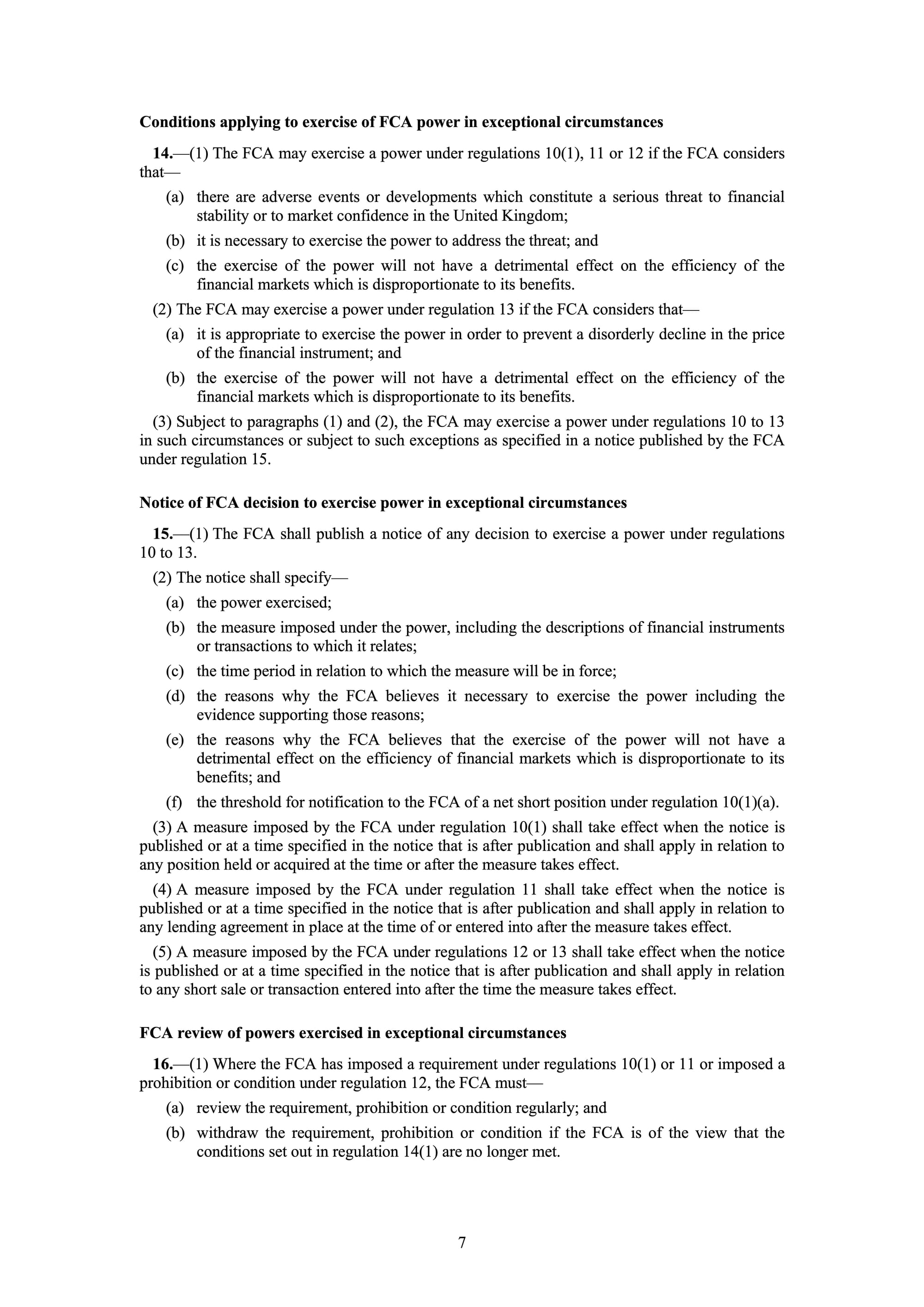

Summary of Key Points in Part 2 - Regulatory Framework for Short Selling:

Introduction and Scope:

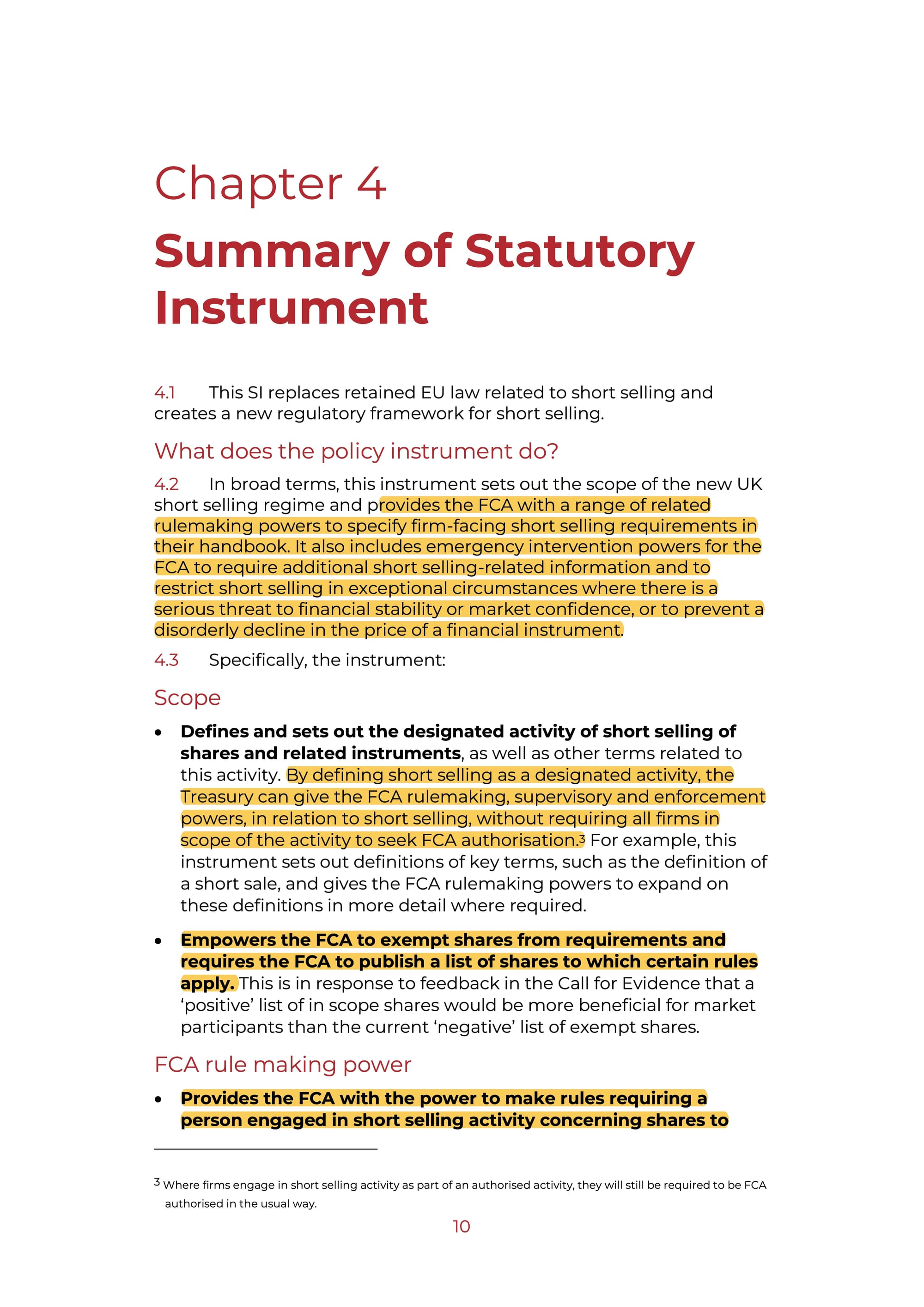

- The policy instrument replaces retained EU law related to short selling & establishes a new regulatory framework for the UK.

Objectives and Powers of the FCA:

- Grants the FCA rule-making powers related to short selling requirements.

- Provides emergency intervention powers for the FCA to address serious threats to financial stability or market confidence.

- Empowers the FCA to exempt shares from requirements and publish a list of shares subject to rules.

FCA Rule-Making Power:

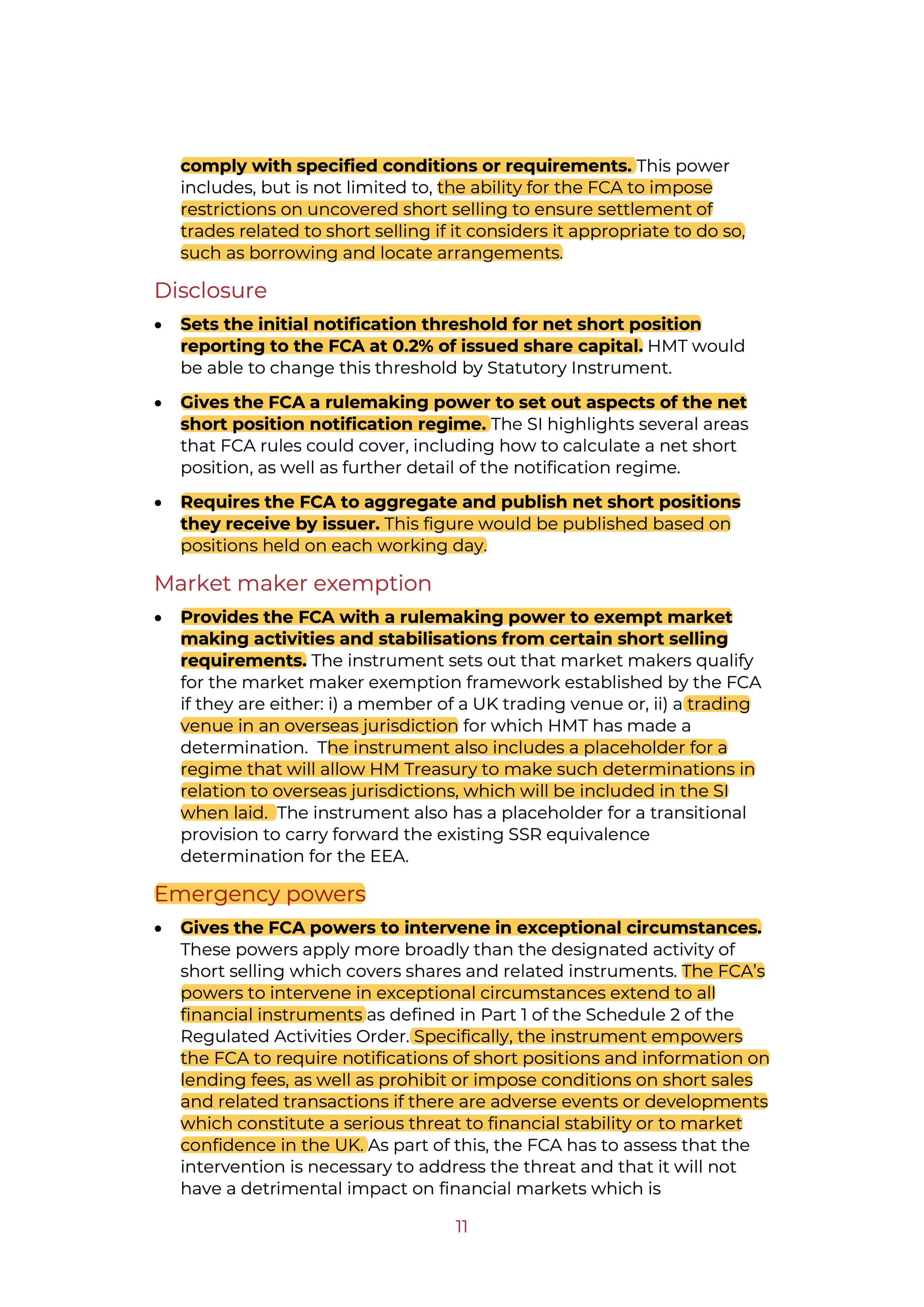

- Grants the FCA the power to make rules requiring compliance with specified conditions or requirements for short selling activities.

- Includes the ability to impose restrictions on uncovered short selling.

Disclosure Requirements:

- Sets the initial notification threshold for net short position reporting to the FCA at 0.2% of issued share capital.

- Gives the FCA rule-making power to specify aspects of the net short position notification regime.

- Requires the FCA to aggregate and publish net short positions received by issuer.

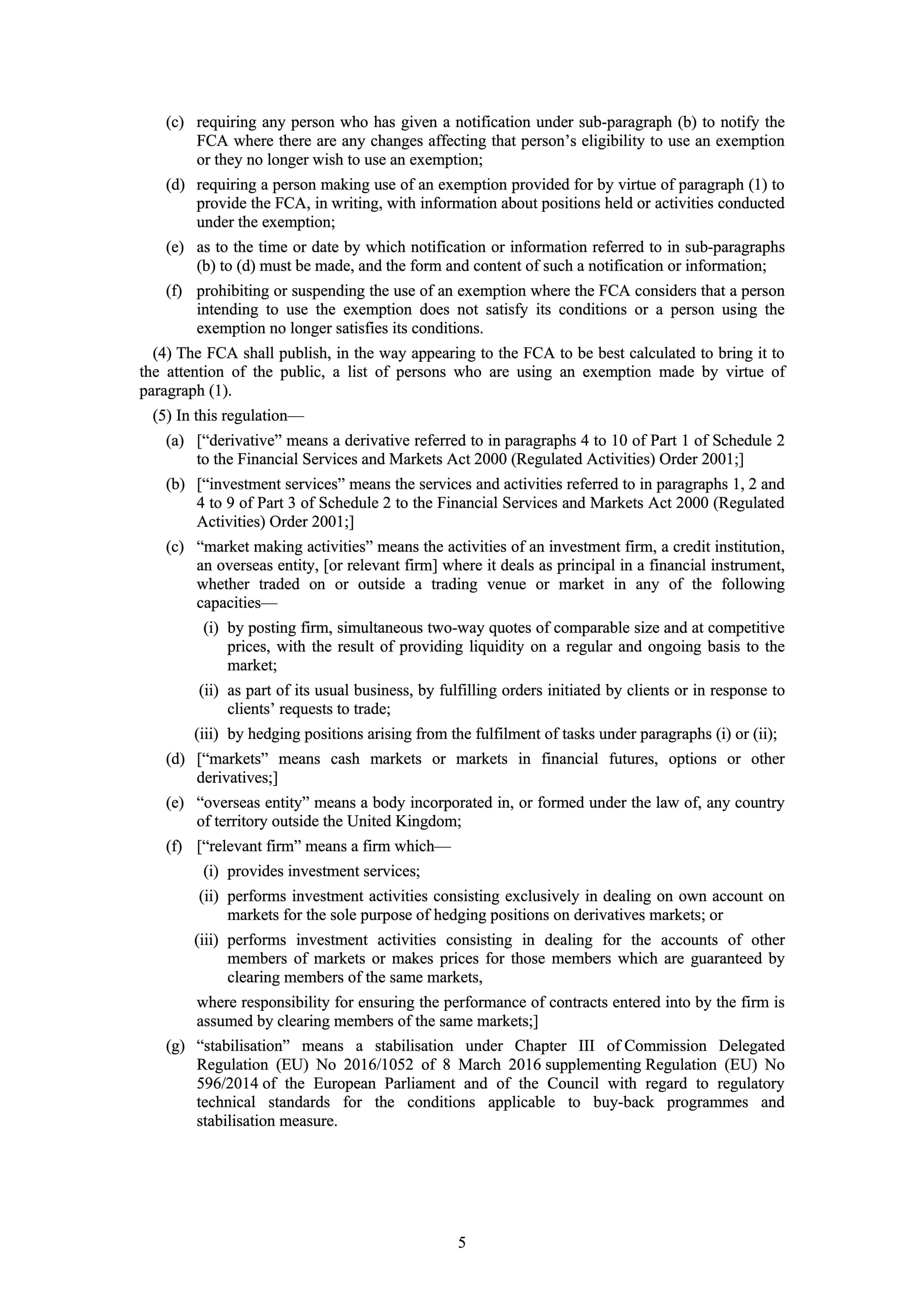

Market Maker Exemption:

- Provides the FCA with the power to exempt market making activities and stabilizations from certain short selling requirements.

- Defines criteria for market makers to qualify for exemptions.

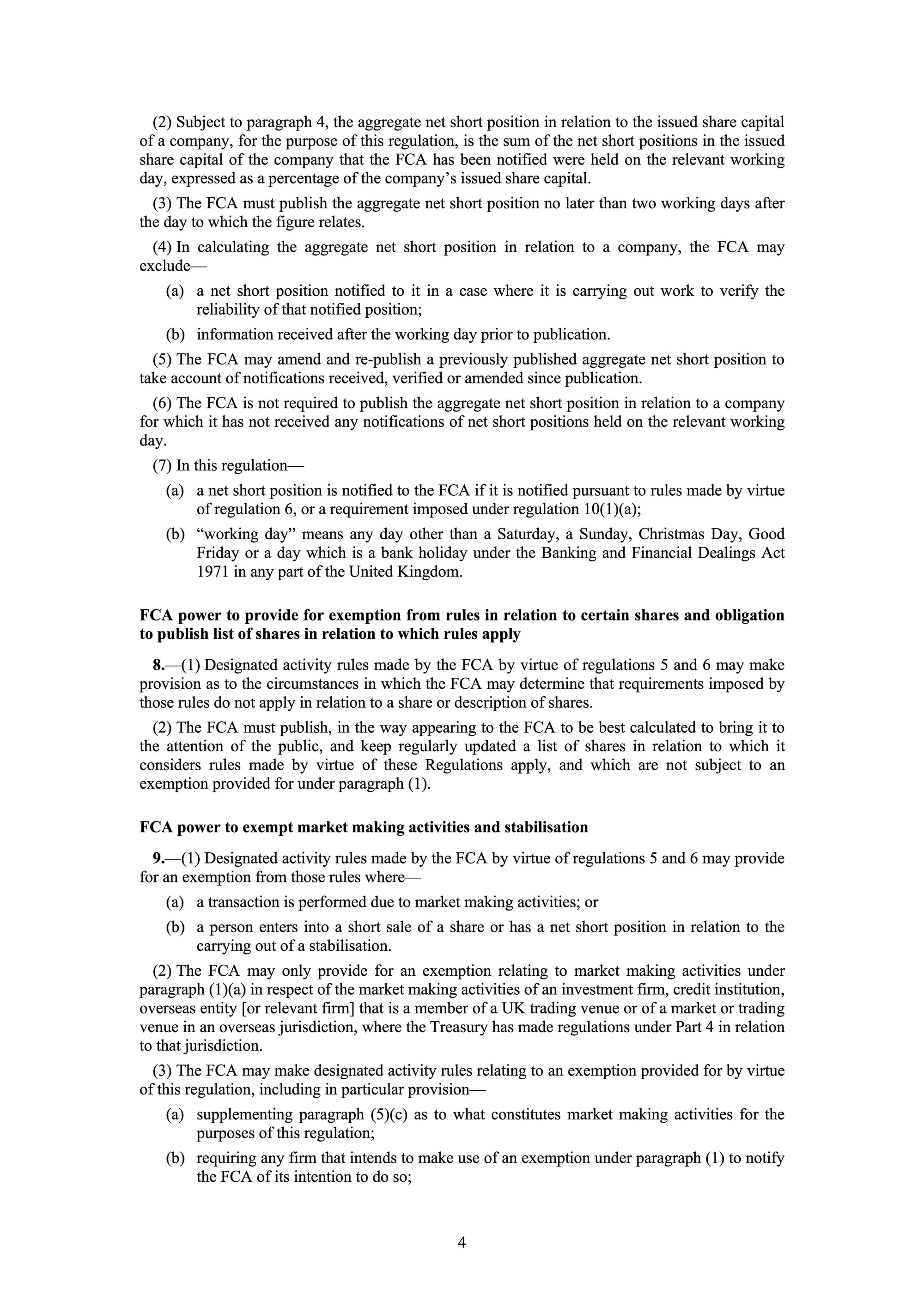

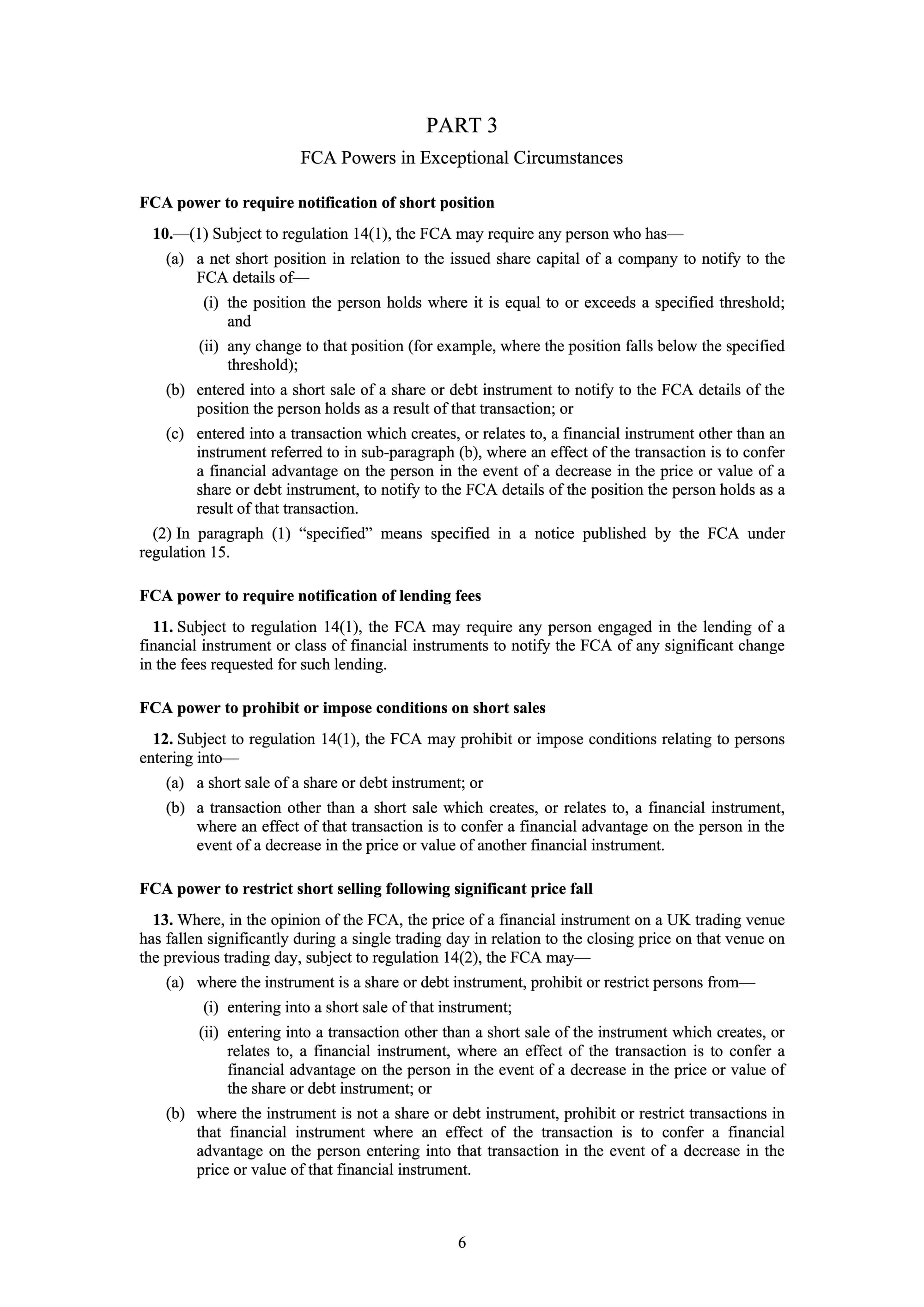

Emergency Powers:

- Grants the FCA powers to intervene in exceptional circumstances for all financial instruments, not limited to designated short selling activities.

- Allows the FCA to require notifications of short positions, information on lending fees, and impose restrictions or prohibitions on short sales.

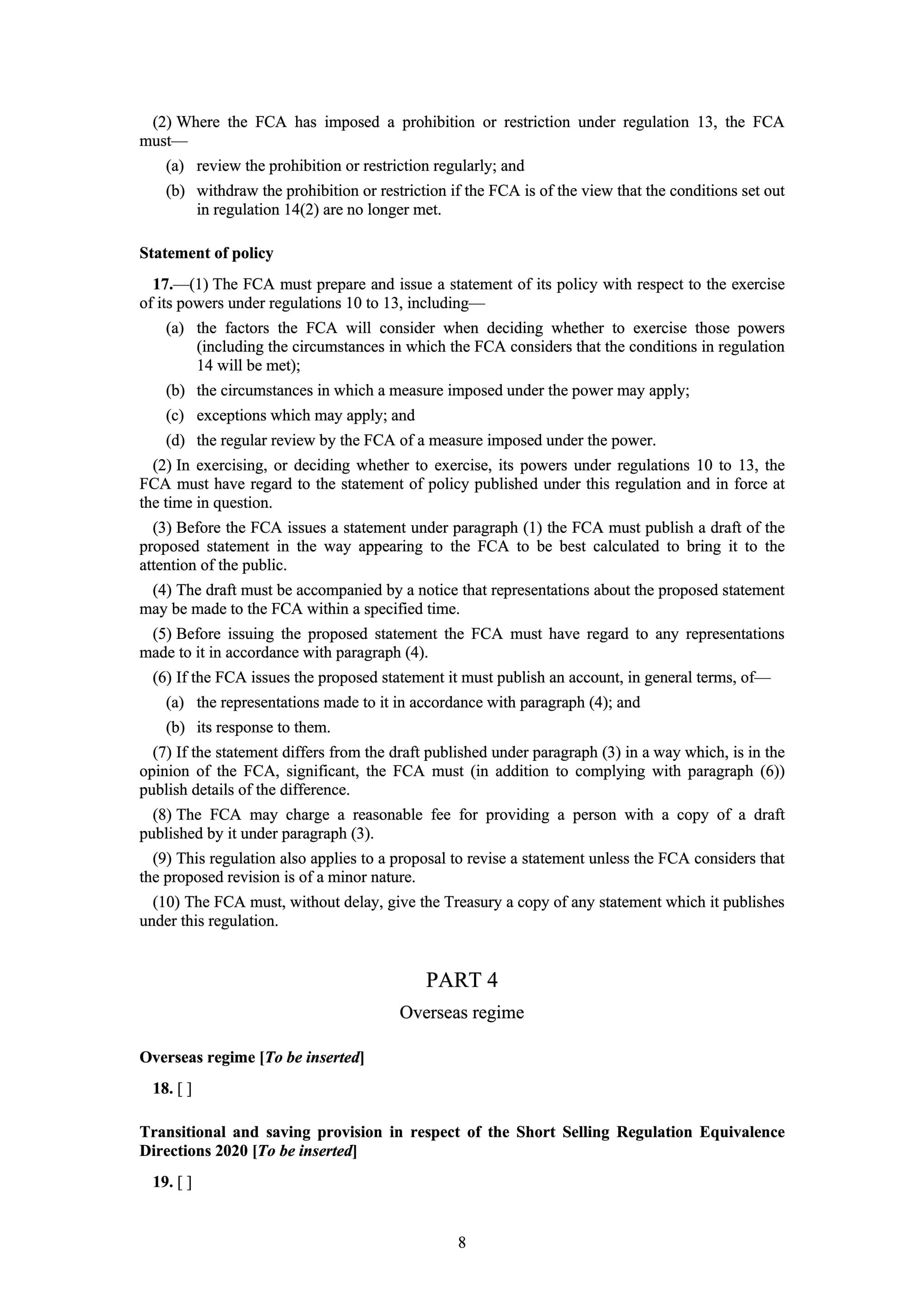

Publication of Statement of Policy:

- Requires the FCA to publish a statement of policy detailing how it will use its powers to intervene in exceptional circumstances.

Changes Compared to Previous EU Provisions:

- Shifts from detailed EU provisions to a model where the FCA sets detailed rules within a framework set by the government.

- Changes the scope of financial instruments covered compared to the previous SSR.

- Specific changes include replacing individual net short position disclosure with aggregated net short position disclosure.

Regulator's Role:

- The FCA will collaborate with the government to develop the legislative framework.

- Detailed approach for rule-making powers will be consulted with market participants - areas of consultation include restrictions on short selling, reporting net short positions, exemptions for market making, emergency intervention powers, and arrangements for publishing aggregated net short position reports.

There's much to unpack, some notable issues include: loose definitions, selective enforcement, lack of transparency, broad emergency powers, transition challenges, regulatory arbitrage.

But a consistent concern revolves around the problematic aspect of government intervention in these rules.

And why is increased government interference a problem?

This is not a deep dive post but an introduction, providing an opportunity for us all to look at this with fresh eyes and see if we can't discover something here together.

With note to the following outline as left at the bottom of this page:

So, the bad news is that the deadline for 'technical' comments ended on 10th January 2024...

But the good news is that:

- This is still just a draft, so nothing has been finalised yet.

- Public input remains essential at every stage, regardless of deadlines or how comments are categorised. Nothing holds more significance than upholding democratic representation.

Our government's role is to serve us.

Our participation isn't bound by deadlines, our engagement should consistently take center stage as an integral part of our collective governance. Engaging with government initiatives should be an ongoing commitment, reflecting the active involvement of the public in shaping our shared future.

It must be said though - it remains little frustrating that all these rather important rules consistently go under the radar.

If only our governments felt the need to raise attention to such important issues, opposed to letting them slip through unnoticed...

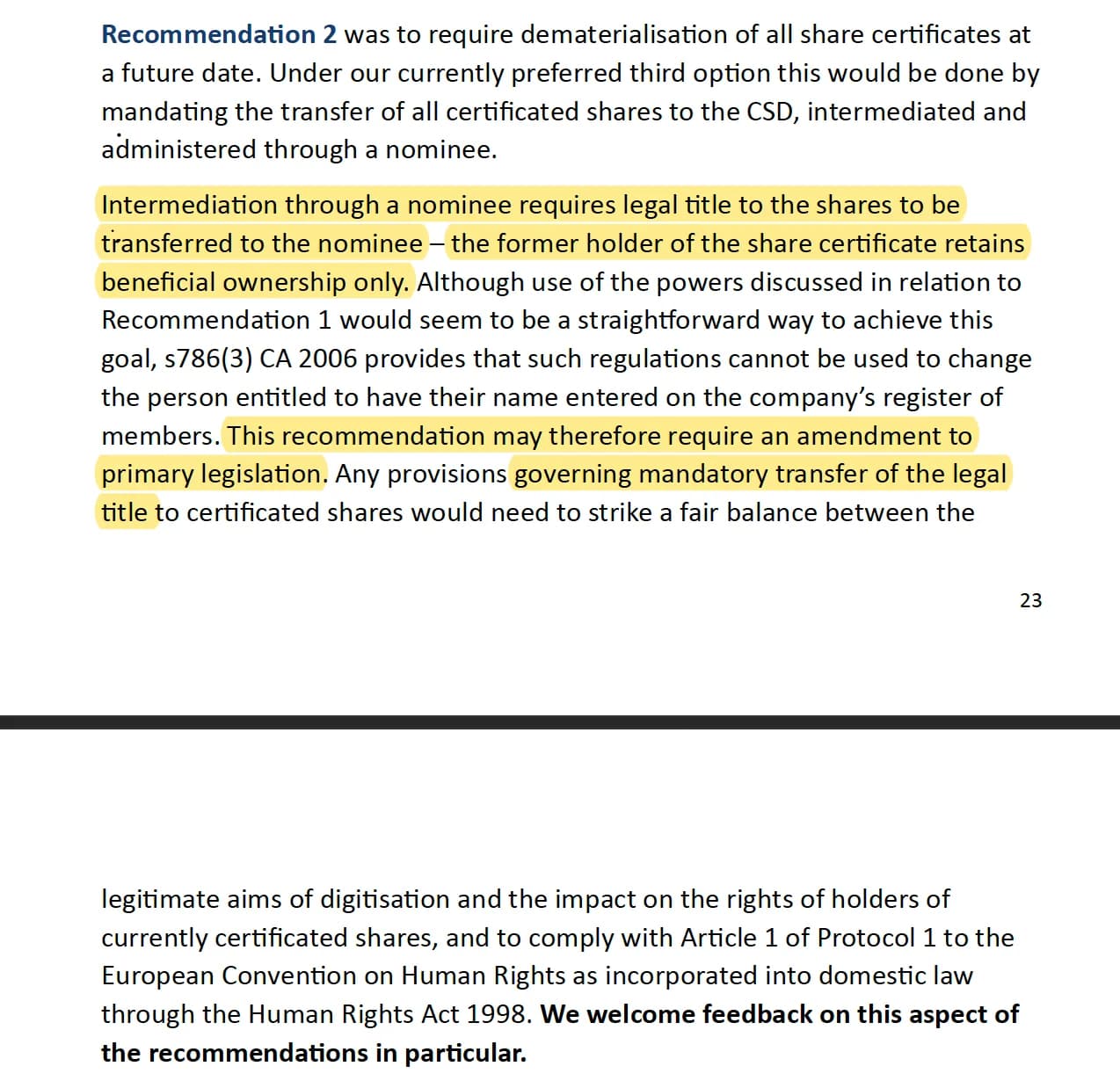

But then again - given all that we have uncovered recently, such as the UK Digitisation Taskforce's recent recommendation to mandate the legal ownership of shareholder assets to a CSD, achieved by changing primary legislation, essentially forcing shareholders to become the beneficiaries of their own stock... (more detail here)

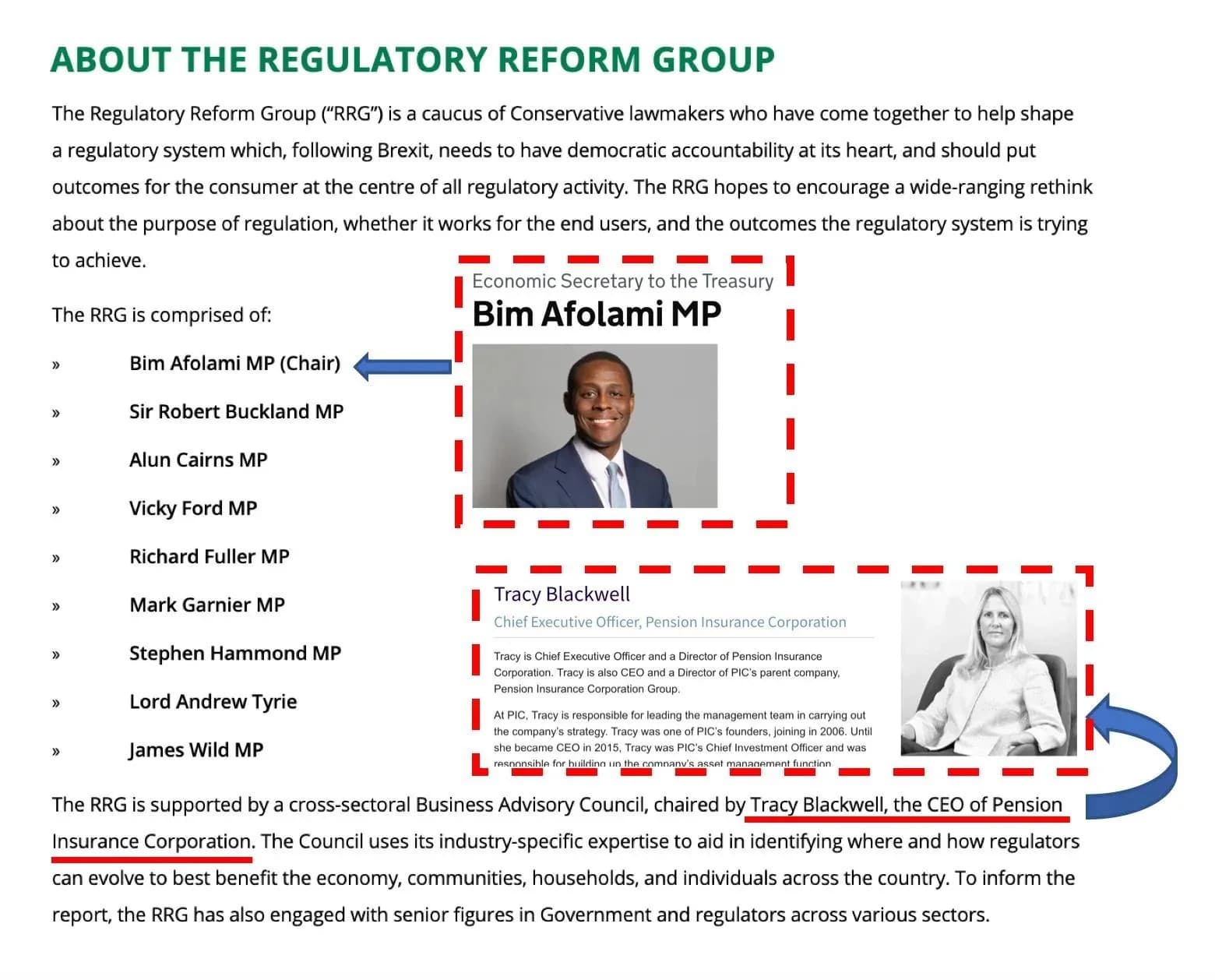

Or the news that Economic Secretary Bim Afolami (as part of the RRG) & Tracy Blackwell, CEO of the Pension Insurance Corporation are teaming up as they petition to issue themselves "Significant Power" over our financial regulators.... (more detail here)

Check out page 33. of the "The Purpose of Regulation" report from the RRG.

Perhaps they see public input as "interference" 🤷♂️

But we remain steadfast as we strive for positive change, contributing to meaningful differences in our financial markets and look forward to the opportunity of dissecting these proposed rule changes and learning more about the UK's plans for the future of short selling regulation.

That's all folks.

Be excellent to each other.