Dismantling Rule SR-OCC-2024-001 - The Exposed Threat of Margin Erosion and Risk Escalation

The OCC's recurrent use of idiosyncratic choices, adjusting margin requirements amid persistent market volatility, urgently raises concerns about systemic risks.

As we gear up for further discussions on the rules and regulations that shape our shared financial markets, fueled by the inspiring engagement of household investors advocating for market reform worldwide, we're taking the time out today to delve into the specifics of the SR-OCC-2024-001 proposal.

Understanding the nuances of this rule will empower us to articulate our concerns effectively in our ongoing efforts as we submit our comments to the SEC to oppose this proposal.

First, let's establish the purpose of the proposed rule.

SOURCE: https://www.sec.gov/files/rules/sro/occ/2024/34-99393.pdf

🙋♀️ ❔🙋♂️ What does this mean?

The purpose of this rule is the codify OCC's process for making adjustments during high volatility periods.

This means that The Options Clearing Corporation - aka a clearinghouse that facilitates the clearing, settlement, and risk management of financial contracts in the options and futures markets - want to establish a clear and formal set of rules for adjusting certain parameters in its system when the markets it serves are experiencing high volatility.

What this doesn't mean -

- Is that this is a brand new rule.

- The mechanics of margin policy are changing (financial institutions can make their margin or suffer the consequences if they don't, same as before).

BUT - even though the margin requirements remain the same, how they calculate the thresholds for margin is not.

And understanding how the OCC intends to codify these thresholds and how they are calculated, especially in connection to margin requirements, is important.

🙋♀️ ❔🙋♂️ What does it mean to "codify OCC's process for making adjustments during high volality"?

To "codify OCC's process for making adjustments during high volatility" means to formally document and establish a set of rules or procedures regarding how the Options Clearing Corporation (OCC) handles adjustments in its operations when the markets it serves experience significant and unpredictable price fluctuations (high volatility).

🚀 Like say, in the event of a potential short squeeze triggered by an idiosyncratic stock.

In theory - this rule should provide transparency, consistency, and a clear framework for how such adjustments are handled. This includes clearly outlining the proposed thresholds for calculating margin.

However, that goal that would be better attained if most of the supporting evidence for said proposal wasn't [REDACTED].

But we'll explore that in more detail later.

🙋♀️ ❔🙋♂️ So why is this proposed rule SR-OCC-2024-001 important?

The OCC has the authority to adjust margin requirements globally or for individual securities to prevent triggering a systemic financial crisis.

🙋♀️ ❔🙋♂️ And how is this related to reducing Margin Call Requirements?

I recently noted a submission from a contributor on r/Superstonk who argued that the proposed rule SR-OCC-2024-001 does not reduce margin requirements for clearing members at the discretion of OCC.

There is a discernible challenge in interpreting the proposed rule - granted - and I understand how they came to that conclusion, with equal appreciation for their insight and input.

While the document does not overtly declare a reduction in margin requirements for clearing members at the discretion of the OCC, the risk remains at large.

The Risk:

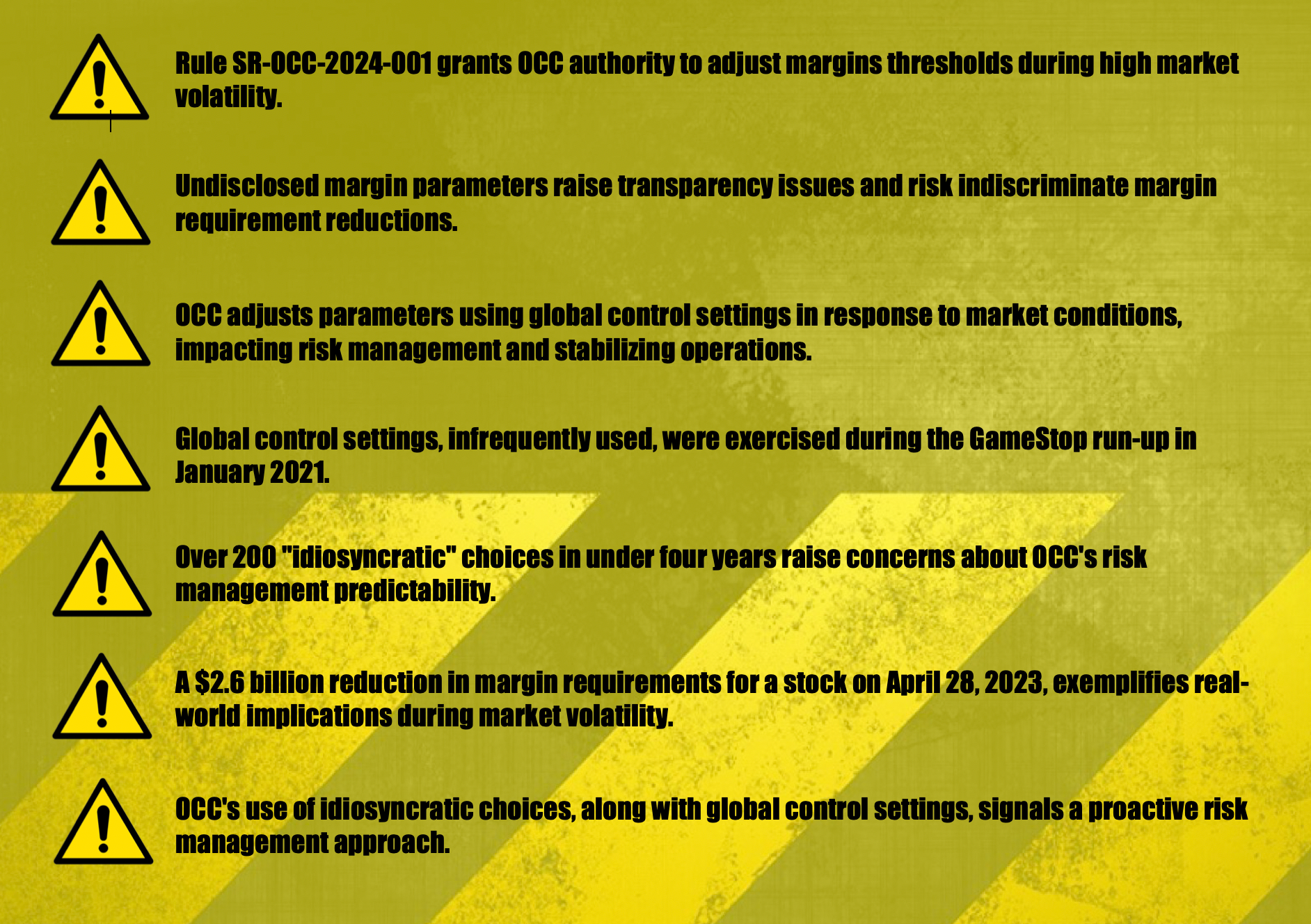

Rule SR-OCC-2024-001 poses a threat to reducing margin call requirements by providing the OCC extensive authority to adjust margin thresholds based on undisclosed parameters during periods of high market volatility.

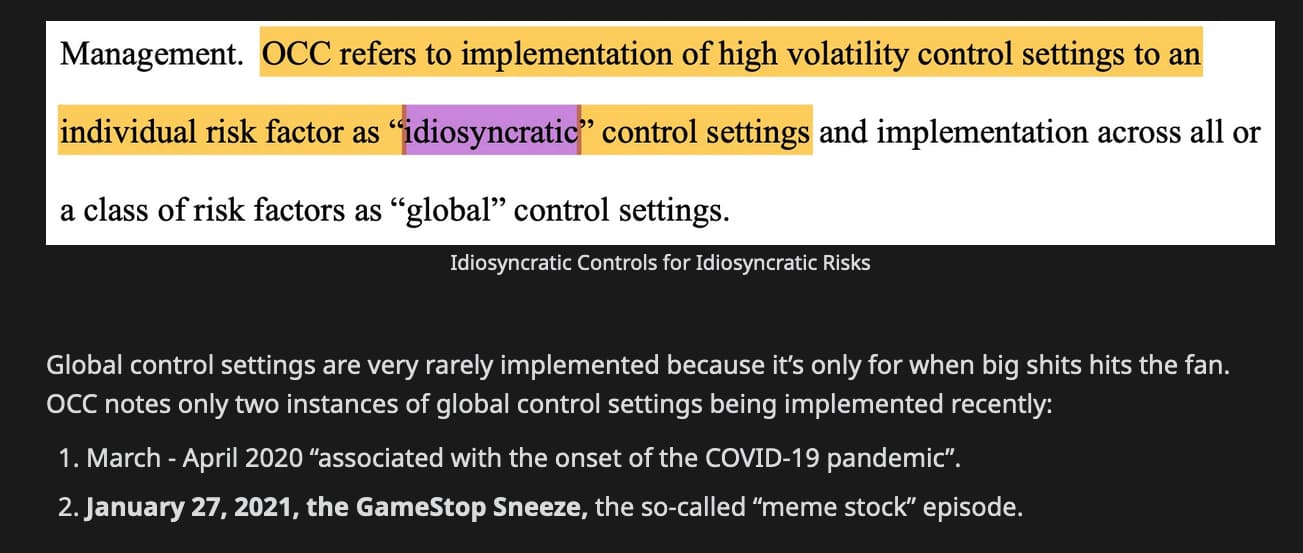

While global control settings are infrequently employed, the rule permits their use in critical events - and was notably exercised during the GameStop run up in January 2021.

The undisclosed nature of the margin calculation parameters raises transparency issues and introduces a risk of indiscriminate reduction in margin requirements.

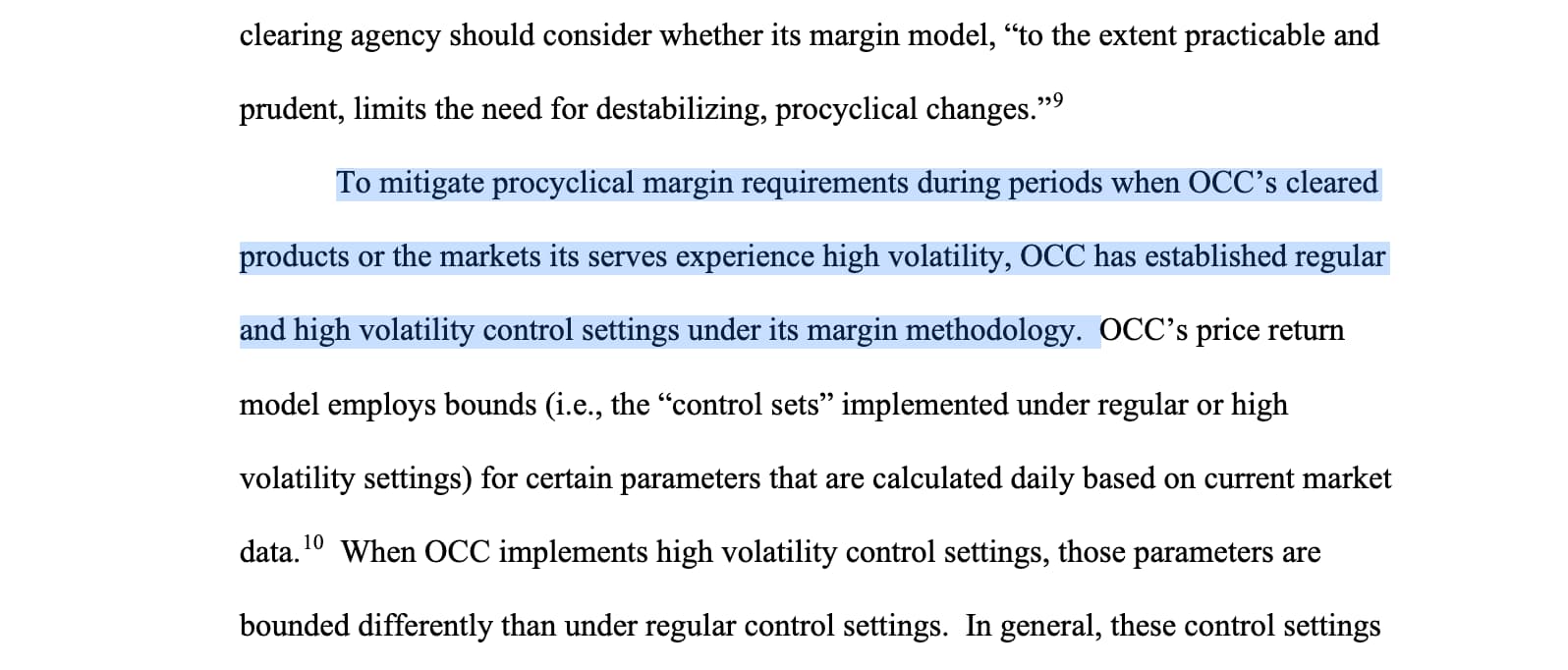

During heightened market volatility, the Options Clearing Corporation (OCC) has the ability to adjust certain undisclosed parameters within its model. These adjustments are initiated when predefined thresholds, known as global control settings, are breached - meaning the OCC can tweak internal factors in response to specific market conditions and events to address risks and stabilise its operations.

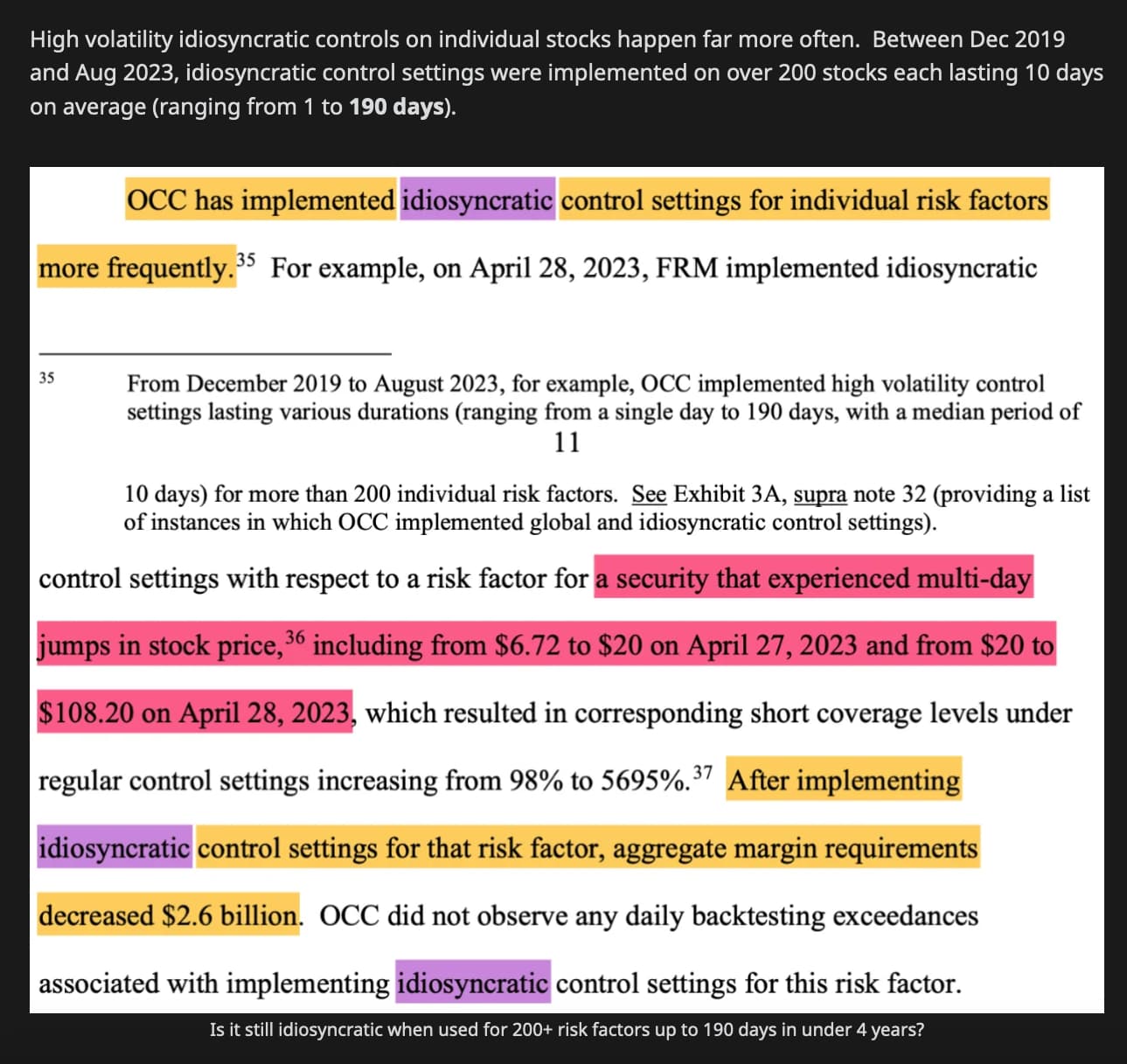

This recurrent utilisation of "idiosyncratic" choices by the OCC, surpassing 200 instances in less than four years, and the frequent application exceeding 50 times annually, raises concerns about the stability and predictability of the OCC's risk management practices. The tangible example of a $2.6 billion reduction in margin requirements for a specific stock on April 28, 2023, highlights the real-world implications of these decisions in response to market volatility, directly affecting the threshold for triggering margin calls.

By implementing these idiosyncratic choices, coupled with the use of "global" control settings during significant market events, the OCC is actively adjusting its risk management approach and seemingly reducing margin requirements with "idiosyncratic volatility control settings" anytime a Clearing Member needs help.

In summary:

With much appreciation and gratitude extended to Dismal-Jellyfish & WhatCanIMakeToday for their work as produced on this subject matter - we are going to explore this topic in more detail as below.

🔍 📈 Looking at GME from an idiosyncratic viewpoint.

What does it mean to be an Idiosyncratic stock?

An idiosyncratic stock is one whose performance is significantly influenced by unique factors specific to that particular company, such as company-specific news, events, or market dynamics that set it apart from broader market trends. These individualised elements make the stock's behavior less predictable and more distinct from the overall market movements.

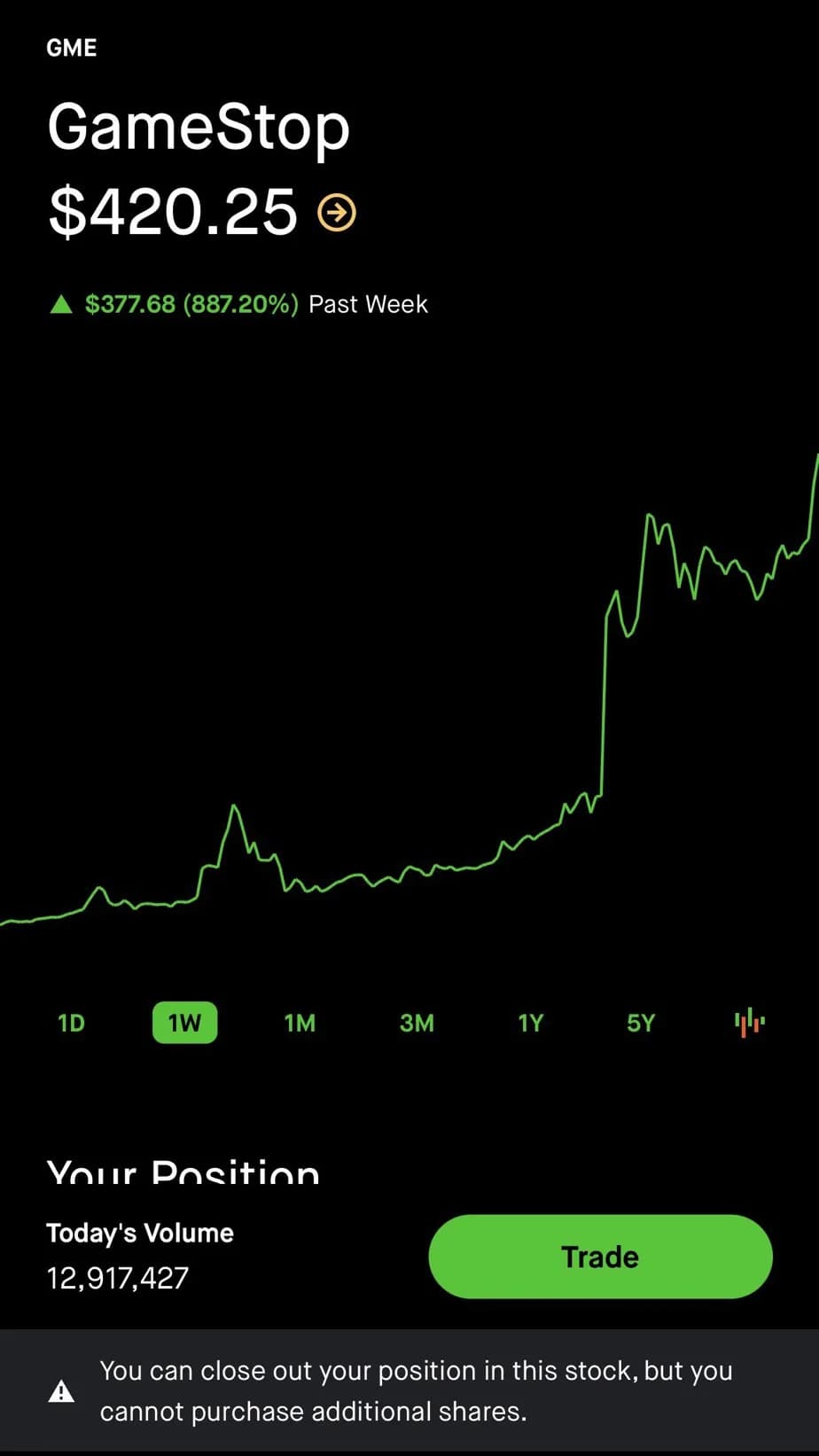

This characterisation could aptly apply to the GME stock. Case in point, check out this snapshot taken during the run up as seen in January, 2021.

So going back to the rule:

The Options Clearing Corporation (OCC) has the authority to adjust margin requirements for Clearing Members based on market conditions. These settings can be applied globally or to individual securities, referred to as "idiosyncratic" control settings.

While global control settings are rarely implemented, they were used during critical events such as the onset of the COVID-19 pandemic (2020) and the GameStop “meme stock” run up in January 2021.

Let's check out WhatCanIMakeToday's most recent DD:

In context of this rule - the OCC may implement "global control settings" to adjust margin requirements either across all risk factors or for a specific class of risk factors with thresholds calculated based on specific parameters, possibly including measures of market volatility, liquidity, and other relevant factors.

⚠️ ❗️ The specific parameters by which margin will be calculated in the proposed rule SR-OCC-2024-001 are unknown as all supporting evidence has been [REDACTED].

When instances occur that require "global control settings" to be enacted, the breaches of these thresholds trigger an escalation process to decision-makers for evaluation and potential adjustment of the OCC's model parameters, which are connected to margin requirements.

And as such - during high volatility, the OCC may adjust certain parameters (again, with no detail here how or to what extent) within the model to accommodate for these market conditions and stabilise the situation.

🔍 📈 For issues of Idiosyncratic Controls on Individual Stock.

High volatility idiosyncratic controls on individual stocks happen far more often.

Let's go back and check out WhatCanIMakeToday's most recent DD again:

A really excellent point is raised here.

On April 28, 2023, OCC's idiosyncratic control settings were applied to a stock (without listed options) that underwent significant multi-day price jumps, going from $6.72 on April 27, 2023, to $108.20.

The OCC’s idiosyncratic control settings reduced the margin requirements for this stock by $2.6 billion.

A reduction of margin for $2.6 billion on just one security. Boggles the mind, doesn't it?

This is problematic for any market participant because it clearly demonstrates the OCC will reduce margin requirements using “idiosyncratic” and “global” control settings to avoid triggering a systemic financial crisis.

The reason this kind of behaviour is problematic, is as followed:

- Market Stability: Significantly reducing margin requirements for a single security with substantial price jumps may impact overall market stability, as it implies a lower financial cushion for potential risks associated with that security.

- Systemic Risk: Waiving margin calls without clear justification could contribute to systemic risk, as it might encourage risk-taking behaviour by Clearing Members, assuming that the OCC can intervene with reductions in margin requirements.

- Risk of Moral Hazard: If Clearing Members perceive that the OCC is readily willing to reduce margin requirements in times of volatility, it may create a moral hazard by incentivising excessive risk-taking, knowing that potential losses could be mitigated by the OCC.

- Fairness and Equity: Such discretionary reduction of margin requirements may raise concerns about fairness among Clearing Members. If some members receive preferential treatment, it could lead to an uneven playing field and impact market integrity.

- Transparency: The lack of transparency in the criteria and decision-making process for implementing idiosyncratic control settings raises questions about how and when such reductions are justified. Clear guidelines and transparency are essential for maintaining market confidence.

- Potential for Abuse: Without clear guidelines, there is a risk of potential abuse or misuse of the idiosyncratic control settings. This lack of specificity may open avenues for manipulation or strategic exploitation of the system.

Furthermore - as very rightfully highlighted by WhatCanIMakeToday, he outlines the following in his work:

".....the OCC has made this “idiosyncratic” choice over 200 times in less than 4 years (from December 2019 to August 2023) of varying durations up to 190 days (with a median duration of 10 days). The OCC is choosing to waive away margin calls for Clearing Members over 50 times a year; which seems too often to be idiosyncratic. In addition to waiving away margin calls for 50 idiosyncratic risks a year, the OCC has also chosen to implement “global” control settings in connection with long tail [6] events including the onset of the COVID-19 pandemic and the so-called “meme-stock” episode on January 27, 2021. [7].

WCIMT raises a very good point.

🚨 🚩The OCC has made over 200 "idiosyncratic" choices in less than 4 years, lasting up to 190 days, with a median duration of 10 days.

🚨 🚩This equates to waiving margin calls for Clearing Members over 50 times annually, a frequency that challenges the notion of idiosyncrasy.

Which - in short, translates as:

The OCC are reducing margin requirements with "idiosyncratic volatility control settings" anytime a Clearing Member needs help.

The OCC's recurrent use of idiosyncratic choices, adjusting margin requirements amid persistent market volatility, urgently raises concerns about systemic risks.

This frequent practice may undermine effective risk management, creating an imminent need for regulatory scrutiny and intervention to prevent a broader financial crisis.

Essentially, a systemic risk looms due to insufficiently capitalised and over-leveraged Clearing Members, where a single failure could trigger a cascade effect, resembling a Wall Street domino effect with Clearing Members risking more than they can afford to lose.

Which poses the essential question: is it acceptable for the OCC to consistently reduce margin requirements using "idiosyncratic volatility control settings" whenever a Clearing Member faces challenges?

📚👀 For more DD - please do check out the following links:

CREDIT: Dismal-Jellyfish.

Options Clearing Corporation is looking to adjust parameters for calculating margin requirements during periods when the products it clears & the markets it serves experience high volatility. OPEN for comment! https://dismal-jellyfish.com/occ-revamps-idiosyncratic-margin-requirements-volatility-controls/

CREDIT: WhatCanIMakeToday

OCC Proposes Reducing Margin Requirements To Prevent A Cascade of Clearing Member Failures: https://www.reddit.com/r/Superstonk/comments/1ae0toi/occ_proposes_reducing_margin_requirements_to/

Which takes us onto our next train of thought.

Who do you think is going to have the all encompassing power of implementing these idiosyncratic control settings?

Answer:

⚠️ 👮♂️ The FRM Officer.

FRM stands for Financial Risk Management. The FRM Officer is an individual responsible for managing financial risk within the Options Clearing Corporation (OCC).

Under the section "How OCC Implements and Terminates High Volatility Control Settings"

The following statement is made:

And to summarise the role of the FRM Officer within this context, Dismal-Jellyfish:

The FRM Officer has the authority to approve idiosyncratic control settings based on additional considerations like market moves, risk contribution of expected shortfall, and changes in Clearing Member positions. They may implement these settings even if a security narrowly misses an element of the Idiosyncratic Thresholds but meets other criteria.

That's a lot of power for one person.

The significant authority given to role of the Financial Risk Management (FRM) for approving idiosyncratic control settings introduces significant risk and it poses a conflict as they are required to safeguard both OCC's interests and at-risk Clearing Members.

See this extract here from WhatCanIMakeToday's letter to the SEC:

While the FRM Officer’s position is allegedly to protect OCC’s interests, the situation outlined by the OCC proposal where a Clearing Member failure exposes the OCC to financial risk necessarily requires the FRM Officer to protect the Clearing Member from failure to protect the OCC. Thus, the FRM Officer is no more than an administrative rubber stamp to reduce margin requirements for Clearing Members at risk of failure. Unfortunately, rubber stamping margin requirement reductions for Clearing Members at risk of failure vitiates the protection from market risks associated with Clearing Member’s positions provided by the margin collateral that would have been collected by the OCC.

The FRM Officer, tasked with protecting OCC's interests, may paradoxically function as an administrative rubber stamp for reducing margin requirements, potentially compromising market risk protection.

aka -

The FRM Officer will rubber stamp any protection for a Clearing Member because a CM failing will cause the OCC to take a hit.

To note - the policy also allows the FRM Officer discretionary power to adjust the duration of idiosyncratic control settings based on unforeseen situations introduces an element of uncertainty into the risk management framework. This discretion implies that the duration of idiosyncratic control settings may not follow a rigid or predefined schedule, creating ambiguity about how long such settings could remain in effect.

The uncertainty regarding the duration introduces challenges for market participants and stakeholders who may struggle to anticipate and adapt to the changing risk management landscape, potentially impacting their decision-making and risk mitigation strategies.

🙋♀️ 🙋♂️❔ So what does all this mean in terms of volatile stock in the markets, or in cases of hypothetical short squeezes?

A single person can make the decision to adjust margin requirements, potentially impacting the market dynamics and outcomes for Clearing Members.

🙋♀️ 🙋♂️❔ Why is the consolidating decision-making power of a FRM Officer problematic?

Concentrating significant decision-making authority in a single individual may inherently risk conflicts of interest or potential abuse of power.

🚨 The authority to approve idiosyncratic control settings based on additional considerations provides room for subjective decision-making. Abuse could occur if the FRM Officer favors certain market participants or securities without clear and objective criteria, leading to potential unfair advantages or disadvantages.

🚨 The idiosyncratic control settings may be implemented even if a security narrowly misses an element of the Idiosyncratic Thresholds but meets other criteria. Abuse could occur if the FRM Officer applies these settings selectively or without proper justification, potentially impacting market integrity.

🚨 The FRM Officer's decisions may also be influenced by personal biases or conflicts of interest. For instance, they may have relationships with specific Clearing Members or hold positions in certain securities, influencing their decision-making inappropriately.

Why is the decision-making authority being entrusted to just one person? And how can that be considered the best way to manage risks and ensure overall market stability?

It's hard to have so much trust in one entity, especially when there's so little information surrounding the decision-making process.

Which coincidentally takes us on to the next point:

Issues with Transparency.

If this rule's purpose is to ascertain parameters in the OCC's proprietary system for calculating margin requirements during high volatility - why are we not provided with the specific details on how these parameters will be calculated?

This is a fundamental flaw with the proposed rule - and on this basis alone, it is a reason for its dismissal.

For example, see here the Table of contents as related to this rule:

Yet, when we examine the information as included to support the claims in the proposal - it appears that everything is [REDACTED].

Case in point:

I mean seriously - this is what it looks like to scroll through the 205 pages of the table of contents:

Where is the transparency?

How can we make well-informed decisions about the calculation of these margin thresholds and the appropriateness of the guidelines and structure for the market when crucial information is lacking?

And it makes it equally difficult to get behind this rule when they have not solicited comments for public input either - and have no intention to do so.

Case in point.

This is dangerously problematic for a number of reasons.

The absence of solicited comments may raise questions about transparency and fairness in the rule-making process. In a regulatory environment, transparency and the inclusion of diverse perspectives are crucial to ensure that rules are well-rounded and address potential concerns from different parties.

So much so that regulatory bodies, like the SEC, often emphasise the importance of engaging with stakeholders to ensure accountability and responsiveness to the needs of the market and the lack of solicited comments might be seen as a departure from these principles.

Without actively seeking input, there is a risk that the OCC overlook important considerations or unintended consequences associated with the proposed rule change. Input from stakeholders can help identify and address potential issues that may not be immediately apparent.

Case in point with the risks as being outlined in this very post.

The lack of transparency is serious issue - and on that basis alone, how can household investors lend any support to such a rule change proposal?

There are a lot of nuances to this rule, but in an attempt to condense -

These are the headlines:

- The redaction of specific details, especially related to the calculation of parameters and margin thresholds, prevents market participants from assessing the fairness and effectiveness of these measures. this raises concerns about the transparency of the OCC's risk management processes.

- The consistent use of idiosyncratic control settings, totaling over 200 within a span of less than four years, raises questions about whether they are applied uniformly or under varying circumstances.

- The reliance on idiosyncratic control settings, especially during high volatility, poses potential systemic risks. The OCC waiving away margin calls for Clearing Members over 50 times a year is too often to be idiosyncratic. If these adjustments become a routine response, it might indicate a lack of robustness in the overall risk management framework.

- The high frequency of adjustments in response to market conditions or specific challenges faced by Clearing Members raises concerns about the stability and predictability of the OCC's risk management practices. Such frequent interventions indicate a dynamic and reactive approach to risk management, leading to uncertainties in how risk is assessed, mitigated, and communicated to market participants.

- The proposal appears to make Clearing Members, even those poorly managing risks, de facto "Too Big To Fail," risking financial system stability.

- The reliance on GARCH parameters for forecasting risk and setting margin requirements assumes the accuracy and relevance of these parameters. Any shortcomings in the model or miscalculations could lead to inadequate risk coverage.

- The FRM Officer, tasked with protecting OCC's interests, may paradoxically function as an administrative rubber stamp for reducing margin requirements, potentially compromising market risk protection as they seek to protect the Clearing Member from failure to protect the OCC.

- Concentrating significant decision-making authority in a single individual, such as the FRM Officer, to approve the implementation of idiosyncratic control settings may inherently create the risk of conflicts of interest or potential abuse of power in their role.

- The policy outlines general guidelines for the duration of idiosyncratic control settings, the discretionary power given to the FRM Officer to adjust the duration based on unforeseen situations introduces an element of uncertainty.

- The proposal exposes the OCC to financial risks by potentially depleting its pre-funded financial resources in the event of a sufficiently large Clearing Member default - aka - the OCC’s Clearing Member Default Rules and Procedures, losses are allocated first to the OCC's own pre-funded financial resources ("skin-in-the-game") before utilising clearing fund deposits of non-defaulting firms. In the event of a sufficiently large Clearing Member default, if both the margin deposits and clearing fund deposits are depleted, it automatically poses a financial risk to the OCC.

- If approved, the rule would undermine the first line of protection outlined in OCC's default rules and procedures—margin collateral from at-risk Clearing Members. This contradicts the usual risk management strategy of increasing collateral for higher-risk scenarios.

- Focusing on potential liquidity issues for non-defaulting Clearing Members indicates the OCC's concern about risks depleting its pre-funded financial resources, raising questions about the sustainability of its risk management approach.

✅ And these are the suggested improvements:

Because what's the point of identifying the issues if we can't propose solutions?

- Strengthen and enforce margin requirements in alignment with the risks inherent in Clearing Member positions, as opposed to reducing these requirements. Clearing Members should be incentivised to structure their portfolios to withstand challenges posed by stressed market conditions and long-tail risks. The current rule proposal creates a potential incentive for Clearing Members to pursue a "Too Big To Fail" strategy, exerting pressure on the OCC through heightened risk and leverage, which may result in more frequent implementation of idiosyncratic controls, privatising profits, and socialising losses.

- Introduce external auditing and supervision as a "fourth line of defense," enhancing transparency and proactive risk management with public reporting.

- Incorporate public input through consultations and hearings in the rulemaking process, fostering inclusivity and making regulatory actions more representative of diverse perspectives.

- Advocate for public accessibility of stress testing results, showcasing the effectiveness of risk management measures and building trust among market participants.

- Consider establishing an external oversight committee comprised of industry experts, academics, and investor advocacy representatives to ensure impartial evaluation and scrutiny of risk management practices.

- Reorder the Loss Allocation waterfall by prioritizing Clearing fund deposits of non-defaulting firms over OCC's pre-funded financial resources and the EDCP Unvested Balance. This adjustment aims to foster self-regulation among Clearing Members, ensuring they actively monitor and enforce risk management measures, as their Clearing Fund deposits would be at risk after a suspended firm's deposits are depleted. The proposed modification enhances protection for both the OCC, a Systemically Important Financial Market Utility (SIFMU), and the public by allocating losses to the clearing corporation after Clearing Member deposits are exhausted, thereby reducing the potential need for a bailout of the clearing agency.

- Enhance transparency requirements, ensuring clear and accessible disclosure in reporting and decision-making processes related to risk management measures. This includes public disclosure of how the OCC will ascertain parameters in its proprietary system for calculating margin requirements during high volatility, with specific details on how these parameters will be calculated.

- Strengthen oversight mechanisms, involving regulatory bodies more actively to maintain accountability and address emerging risks during periods of heightened market volatility.

- Provide clear guidelines for the application of idiosyncratic controls, preventing misuse and proposing a structured evaluation framework for consistency and full disclosure for public reviewal.

- Consider establishing an external oversight committee comprised of industry experts, academics, and investor advocacy representatives to ensure impartial evaluation and scrutiny of risk management practices.

We have until 4th March, 2021 to exercise our voice to the SEC to address these issues. Let's be a catalyst for change 🤘 🎸

📱 🖥️ ✉️ Submit your comments to: [email protected]

✅ Include the file number: SR-OCC-2024-001 - in the subject line of your email.

_________________________________________________________

In short, you've just gotta ask yourself this question:

If this rule is to ascertain parameters in the OCC's proprietary system for calculating margin requirements during high volatility - why are we not provided with the specific details on how these parameters will be calculated?

And why is there confidence in granting the OCC's FRM Officer unchecked authority to make unilateral decisions during periods of high market stress?

This. This is the issue we are tackling here.

That's all folks.

Be excellent to each other.