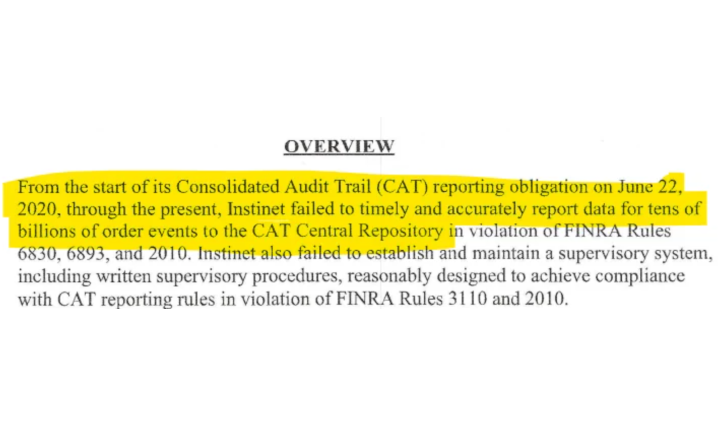

FINRA 'discipline' Alert! "From the start of its Consolidated Audit Trail (CAT) reporting obligation on June 22, 2020, through the present, Instinet failed to timely and accurately report data for tens of billions of order events to the CAT."

CAT reporting requirements:

Wut Mean?:

* All proprietary trading, including market-making, falls under CAT reporting.

* FINRA relies heavily on CAT data for its automated market surveillance to detect potential market manipulations and violations.

* Proper, timely reporting ensures a quality regulatory audit trail and assists in accurate market event reconstruction.

Instinet failed