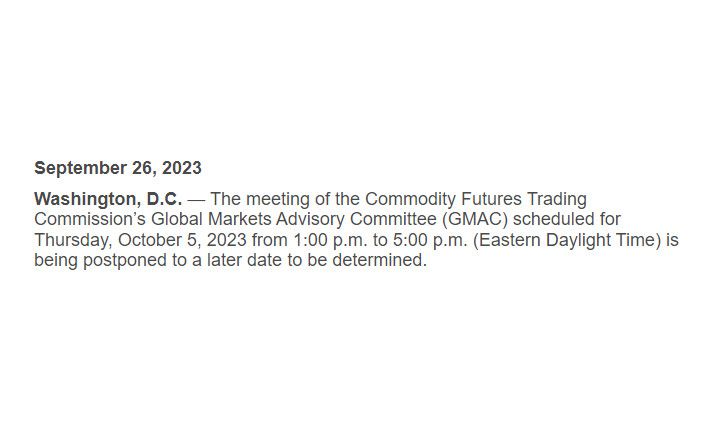

POSTPONED: October 5, 2023 Meeting of the Global Markets Advisory Committee. Was to be a presentation on swap market oversight, tokenized assets, & NFT Regulation.

88 FR 62068:

* At this meeting, the GMAC will hear a presentation from the GMAC’s Global Market Structure Subcommittee on the Subcommittee’s workstreams involving U.S. Treasury market reforms, global standards and best practices for market volatility controls and circuit breakers, improving liquidity across asset classes, and international