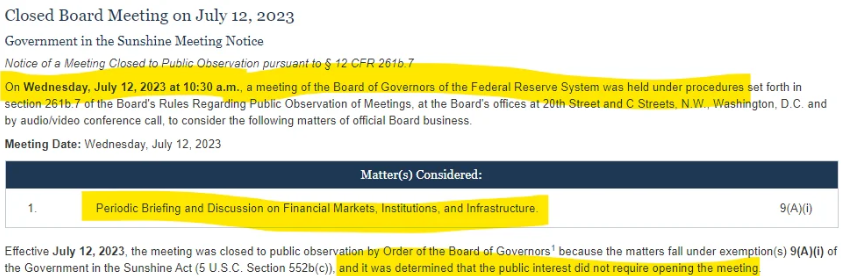

Federal Reserve Alert! Today, a CLOSED meeting of the Board of Governors was held under expedited procedures as it was determined that the public interest did not require opening the meeting.

https://www.federalreserve.gov/aboutthefed/boardmeetings/20230712closed.htm

Interesting they are talking Financial Markets, Institutions, and Infrastructure behind CLOSED doors when the SEC has THIS going on tomorrow now in their CLOSED door Sunshine meeting:

https://public-inspection.federalregister.gov/2023-14986.pdf

'Consideration of amici participation' added to the