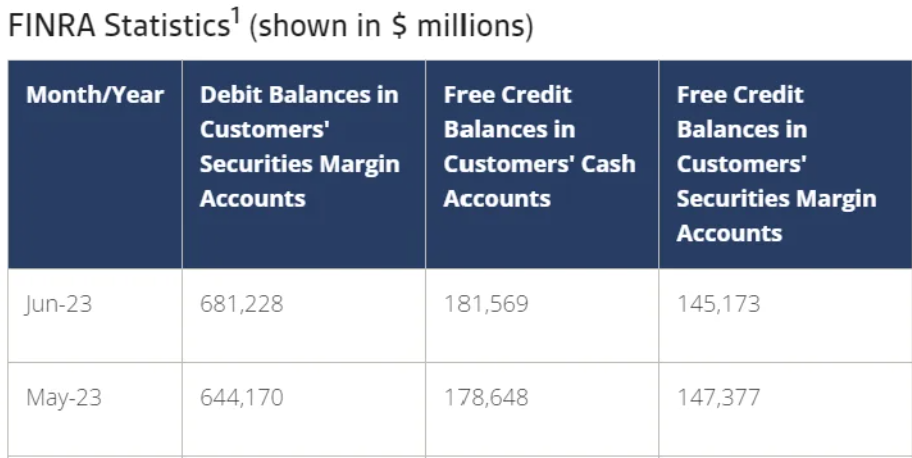

Free Credit Balances (a broker/dealer's liability to customers, which the customers can cash out on demand) in Customers' Securities Margin Accounts the lowest EVER in June. Likely means folks buying more securities or are covering margin requirements.

https://www.finra.org/rules-guidance/key-topics/margin-accounts/margin-statistics

Wut mean?:

According to FINRA Rule 4521(d), FINRA member firms with customer margin accounts must report by the last business day of each month:

1. Total debit balances in securities margin accounts.

2. Total free credit balances in all cash and