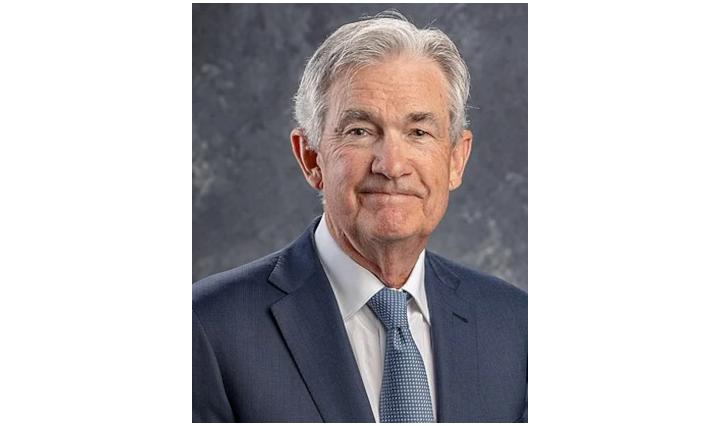

Fed Chair Jerome Powell: "We have tightened policy significantly over the past year." "Inflation has moved down from its peak...it remains too high"

"We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident"

https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm

Highlights:

* "It is the Fed's job to bring inflation down to our 2 percent goal,