FINRA 'discipline' Alert! From January 2019-March 2023, SoFi required retail customers, as a condition of opening an account, consent to their securities lending program--more than two million customers were automatically enrolled.

FACTS AND VIOLATIVE CONDUCT

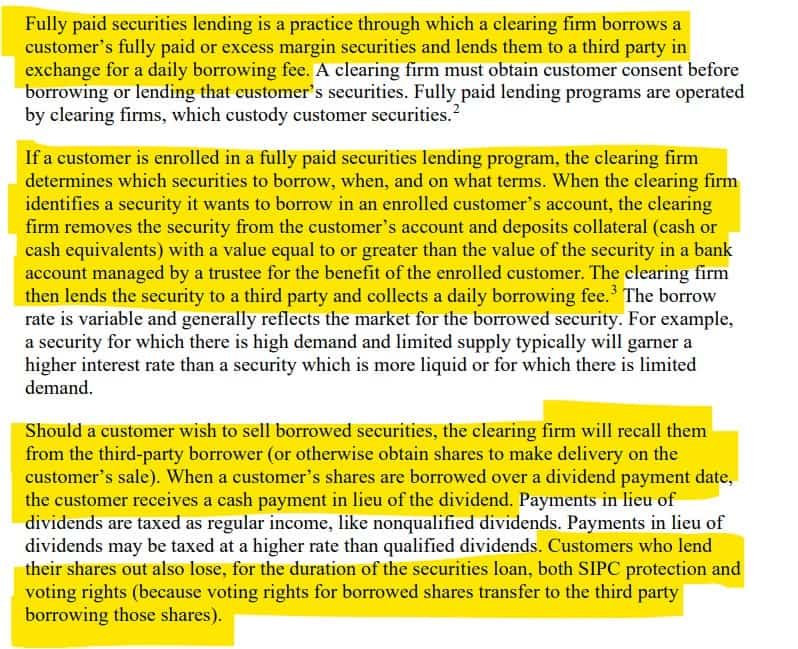

Fully paid securities lending in general:

Customers who lend their shares out also lose, for the duration of the securities loan, both SIPC protection and voting rights (because voting rights for borrowed shares transfer to the third party borrowing those shares)

SoFi’s fully paid securities lending business:

Both the MSLA and disclosure document were drafted by SoFi’s clearing firm. From January 2019 through March 2023, SoFi required that its retail customers, as a condition of opening an account at the firm, consent to the MSLA.

SoFi failed to establish, maintain, and enforce a reasonably designed supervisory system or WSPs for fully paid securities lending:

Instead, all new customers were enrolled in the FPLP at account opening. From January 2019 through March 2023, more than two million customers were automatically enrolled in the FPLP as part of the account opening process. SoFi received over $8 million in revenue (its share of the daily borrowing fees) from its clearing firm for the lending of its customers’ shares. However, none of that revenue was paid to SoFi’s customers. Customers lost, for the duration of the securities loan, both SIPC protection and voting rights.

SoFi distributed documents to customers that contained misrepresentations regarding the compensation that customers would receive for participating in the FPLP:

Penalty?:

How does this affect GameStop?

- 2 million plus retail customers unknowingly lent out shares and, for the duration of the securities loan, LOST both SIPC protection and voting rights (because voting rights for borrowed shares transfer to the third party borrowing those shares)

- Any of those accounts holding GameStop saw SoFi actively working against their investment by loaning out their shares for shorting while not even compensating them!

- For the retail investors, there's a conflict of interest. If their own securities are being used to facilitate short selling, it could contribute to downward pressure on the stock prices, negatively impacting their investment, especially if the stock is heavily shorted like GameStop.

TLDRS:

- Not your name, not your shares!

- From January 2019-March 2023, SoFi required retail customers, as a condition of opening an account, consent to their securities lending program--more than two million customers were automatically enrolled.

- SoFi received over $8 million in revenue (its share of the daily borrowing fees) from its clearing firm for the lending of its customers’ shares.

- However, none of that revenue was paid to SoFi’s retail customers.

- Retail lost, for the duration of the securities loan, both SIPC protection and voting rights while their investment potentially used against them by short sellers!

- Penalty? Without admitting or denying the findings, a censure, $500k fine, ~$200k in restitution.