SEC Adopting Security-Based Swap (SBS) Execution and Registration and Regulation of Security-Based Swap Execution Facilities (SBSEFs) Rules. Would create a regime for the registration & regulation of SBSEFs & SBS execution issues.

- The Securities and Exchange Commission (“SEC” or “Commission”) is adopting a set of rules and forms under the Securities Exchange Act of 1934 (“SEA”) that would create a regime for the registration and regulation of security-based swap execution facilities (“SBSEFs”) and address other issues relating to security-based swap (“SBS”) execution generally.

- One of the rules being adopted implements an element of the Dodd-Frank Act that is intended to mitigate conflicts of interest at SBSEFs and national securities exchanges that trade SBS (“SBS exchanges”).

- Other rules being adopted address the cross-border application of the SEA’s trading venue registration requirements and the trade execution requirement for SBS.

- In addition, the Commission is amending an existing rule to exempt, from the SEA definition of “exchange,” certain registered clearing agencies, as well as registered SBSEFs that provide a market place only for SBS.

- The Commission is also adopting a new rule that, while affirming that an SBSEF would be a broker under the SEA, exempts a registered SBSEF from certain broker requirements.

- Further, the Commission is adopting certain new rules and amendments to its Rules of Practice to allow persons who are aggrieved by certain actions by an SBSEF to apply for review by the Commission.

- Finally, the Commission is delegating new authority to the Director of the Division of Trading and Markets and to the General Counsel to take actions necessary to carry out the rules being adopted.

- Currently, SBS trade in the OTC market, rather than on regulated trading venues.

- The existing market for SBS is opaque, with little, if any, pre-trade transparency.

- With limited transparency, the information asymmetry between liquidity providers (i.e., SBS dealers) and end users could be significant.

- Specifically, liquidity providers may observe information about the trading process (e.g., trading interest, quotes, order flows, and trades) that end users typically cannot observe.

- The SBS market also is decentralized such that market participants incur search costs to locate other market participants in order to trade.

- While the SBS market is decentralized, it also is interconnected and global in scope.

- SBS dealers can have hundreds of counterparties, consisting of end users and other SBS dealers. Trading venues may serve hundreds of end user and SBS dealer participants.

- SBS transactions arranged, negotiated, or executed by personnel located in the U.S. may involve wholly foreign counterparties.

- Furthermore, U.S. persons may choose to trade SBSs on foreign venues, which are subject to OTC derivatives regulations imposed by local regulatory authorities.

- The adopted rules and amendments will affect SBSEFs, SBS exchanges, foreign SBS trading venues, and ECPs (i.e., SBS dealers and end users).

- In addition, the adopted rules and amendments will affect entities that act as third-party service providers to SBSEFs.

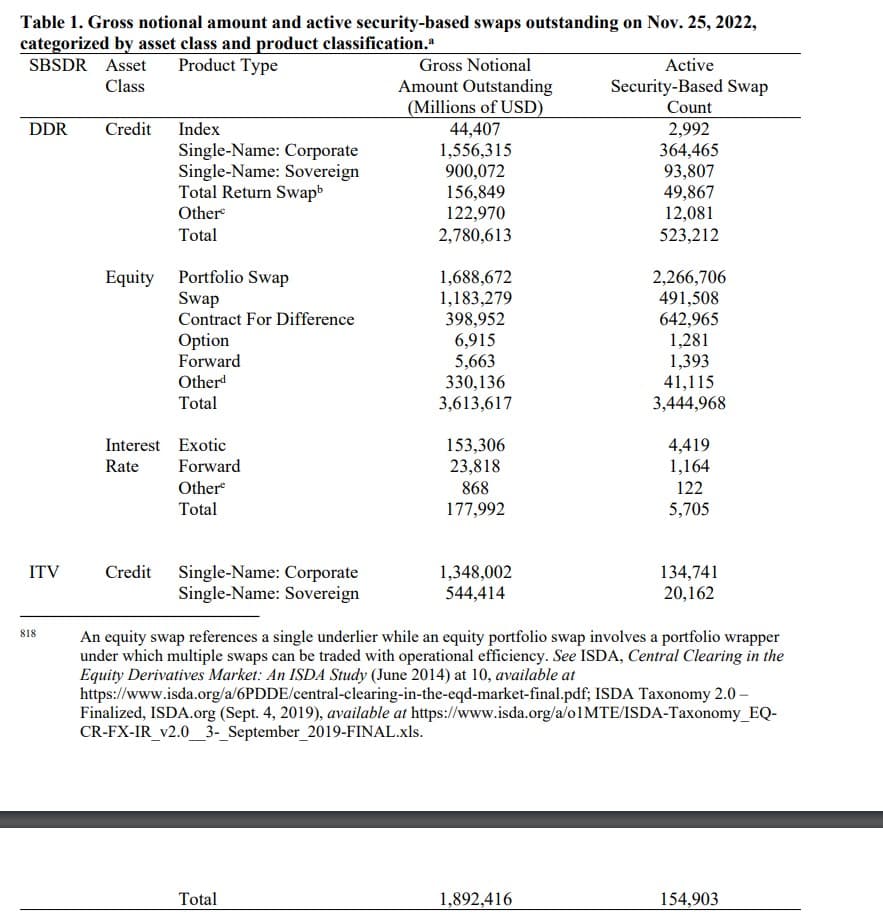

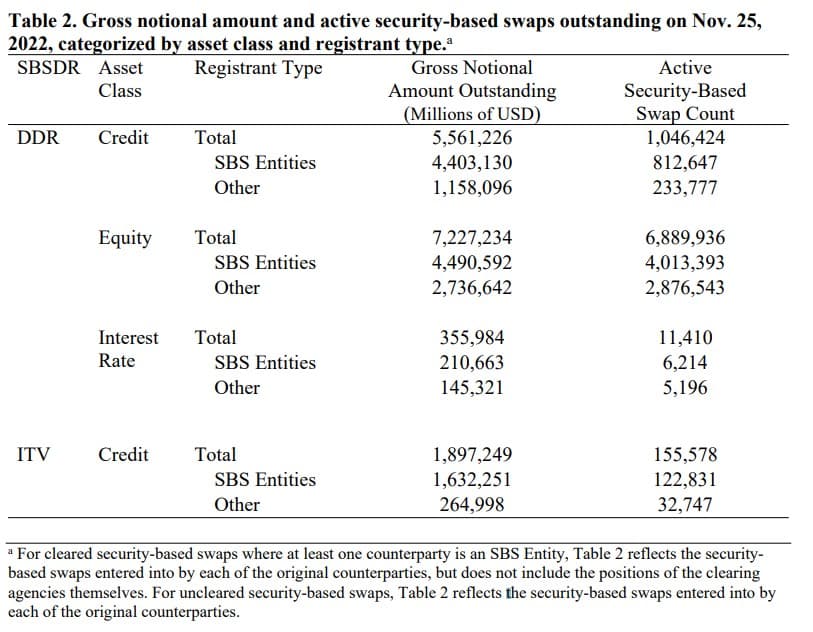

- As of November 25, 2022, there were approximately 523,000, 3.4 million, and 5,700 active security-based swaps in the credit, equity, and interest rate asset classes, respectively.

- The gross notional amounts outstanding in the credit, equity, and interest rate asset classes were respectively, approximately $2.8, $3.6, and $0.18 trillion.

- As of November 25, 2022, there were approximately 155,000 active credit security-based swaps with gross notional amount outstanding of approximately $1.9 trillion.

- As of November 25, 2022, for active credit security-based swaps, single-name corporate CDS constitute the largest product type, with approximately 364,000 active CDS and $1.6 trillion gross notional amount outstanding.

- The second largest active credit security-based swaps product type consists of single-name sovereign CDS, with approximately 94,000 active CDS and $0.9 trillion gross notional amount outstanding.

- For active equity security-based swaps, equity portfolio swaps constitute the largest product type, with approximately 2.3 million active equity portfolio swaps and $1.7 trillion gross notional amount outstanding.

- The second largest active equity security-based swaps product type consists of equity swaps, with approximately 492,000 active equity swaps and $1.2 trillion gross notional amount outstanding.

- In the interest rate asset class, exotics constitute the largest product type, with approximately $0.1 trillion gross notional amount and 4,400 active exotic swaps outstanding.

- As of November 25, 2022, active credit security based swaps fall into two product types.

- Single-name corporate CDS constitute the largest product type, with approximately 135,000 active CDS and $1.3 trillion gross notional amount outstanding.

- The second largest active credit security-based swaps product type consists of single-name sovereign CDS, with approximately 20,000 active CDS and $0.5 trillion gross notional amount outstanding.

- As of November 25, 2022, SBS Entities and non-SBS Entities had, respectively, entered into approximately 813,000 and 234,000 active credit security-based swaps.

- The gross notional amounts outstanding of the active credit security-based swaps held by SBS Entities and non-SBS Entities were, respectively, approximately $4.4 and $1.2 trillion.

- In the equity asset class, SBS Entities and non-SBS Entities had, respectively, entered into approximately 4.0 million and 2.9 million active equity security-based swaps.

- The gross notional amounts outstanding of the active equity security-based swaps held by SBS Entities and non-SBS Entities were, respectively, approximately $4.5 and $2.7 trillion.

- In the interest rate asset class, SBS Entities and non-SBS Entities had, respectively, entered into approximately 6,200 and 5,200 active interest rate security-based swaps.

- The gross notional amounts outstanding of the active interest rate security-based swaps held by SBS Entities and non-SBS Entities were, respectively, approximately $0.2 and $0.1 trillion.

- As of November 25, 2022, SBS Entities and nonSBS Entities had, respectively, entered into approximately 123,000 and 33,000 active credit security-based swaps.

- The gross notional amounts outstanding of the active credit security-based swaps held by SBS Entities and non-SBS Entities were, respectively, approximately $1.6 and $0.3 trillion.

- Non-SBS dealer single-name CDS market participants include, but are not limited to, investment companies, pension funds, private funds, sovereign entities, and industrial companies.

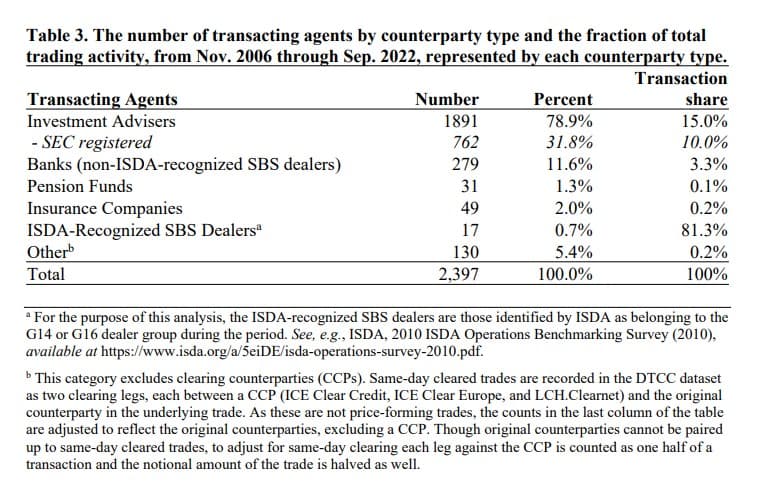

- The Commission observes that most users of CDS that are not SBS dealers do not engage in trading directly, but trade through banks, investment advisers, or other types of firms, which are collectively referred to as transacting agents, consistent with DTCC-TIW terminology.

- Based on an analysis of DTCC-TIW data, there were 2,397 transacting agents that engaged directly in trading between November 2006 and September 2022.

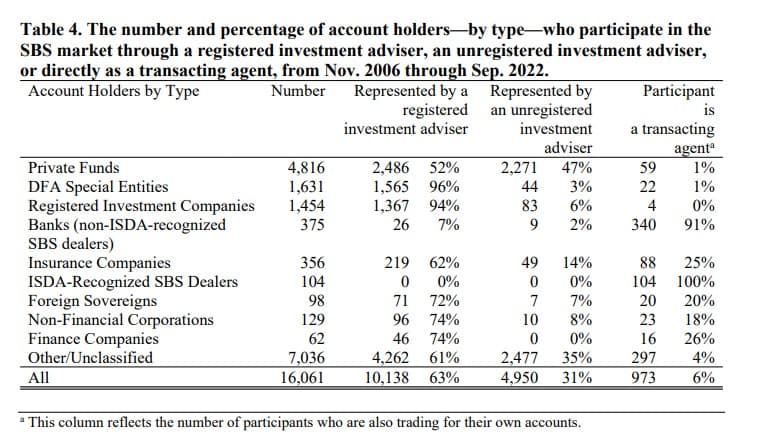

- Principal holders of CDS risk exposure are represented by “accounts” in DTCC-TIW.826 The staff’s analysis of these accounts in DTCC-TIW shows that the 2,397 transacting agents classified in Table 3 represent 16,061 principal risk holders.

- Table 4 below classifies these principal risk holders by their counterparty type and whether they are represented by a registered or unregistered investment adviser.

- For instance, banks in Table 3 allocated transactions across 375 accounts, of which 35 were represented by investment advisers.

- In the remaining instances, banks traded for their own accounts.

- Meanwhile, ISDA-recognized SBS dealers in Table 3 allocated transactions across 104 accounts.

- Private funds are the largest type of account holders that the Commission was able to classify.

- Most of the funds that could not be classified appear to be private funds. For the purposes of this discussion, “private fund” encompasses various unregistered investment vehicles, including hedge funds, private equity funds, and venture capital funds.

- There remain over almost 7,000 DTCC-TIW accounts unclassified by type.

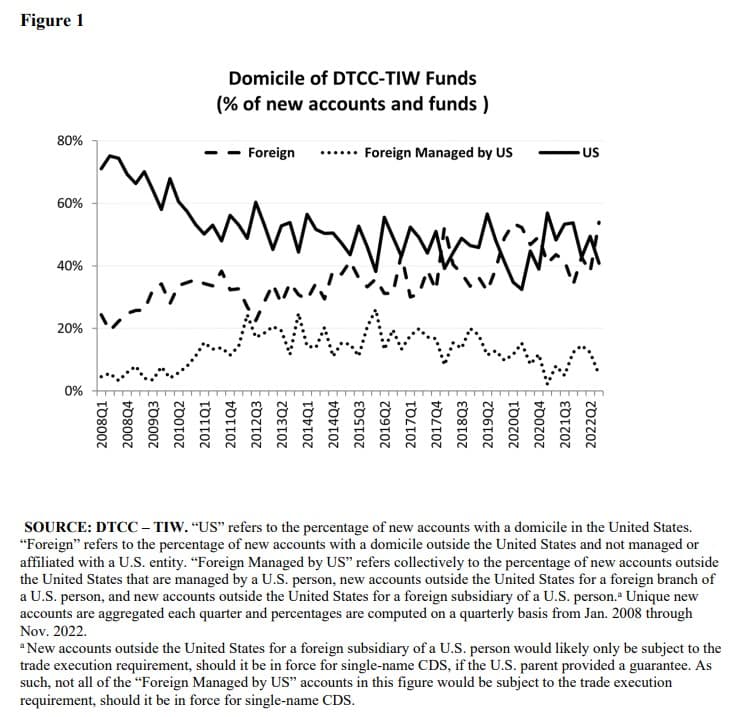

- As depicted in Figure 1 below, domiciles of new accounts participating in the single-name CDS market have shifted over time.

- It is unclear whether these shifts represent changes in the types of participants active in this market, changes in reporting, or changes in transaction volumes in CDS referencing particular underliers.

- For example, the percentage of new entrants that are foreign accounts increased from 24.4% in the first quarter of 2008 to approximately 53% in the third quarter of 2022, which might reflect an increase in participation by foreign account holders in the single-name CDS market, though the total number of new entrants that are foreign accounts decreased from 112 in the first quarter of 2008 to 62 in the third quarter of 2022.

- Additionally, the percentage of the subset of new entrants that are foreign accounts managed by U.S. persons increased from 4.6% in the first quarter of 2008 to 5.2% in the third quarter of 2022, and the absolute number changed from 21 to 6, which also might reflect more specifically the flexibility with which market participants can restructure their market participation in response to regulatory intervention, competitive pressures, and other incentives.

- At the same time, apparent changes in the percentage of new accounts with foreign domiciles might also reflect improvements in reporting by market participants to DTCC-TIW, an increase in the percentage of transactions between U.S. and non-U.S. counterparties, and/or increased transactions in single-name CDS on U.S. reference entities by foreign persons.

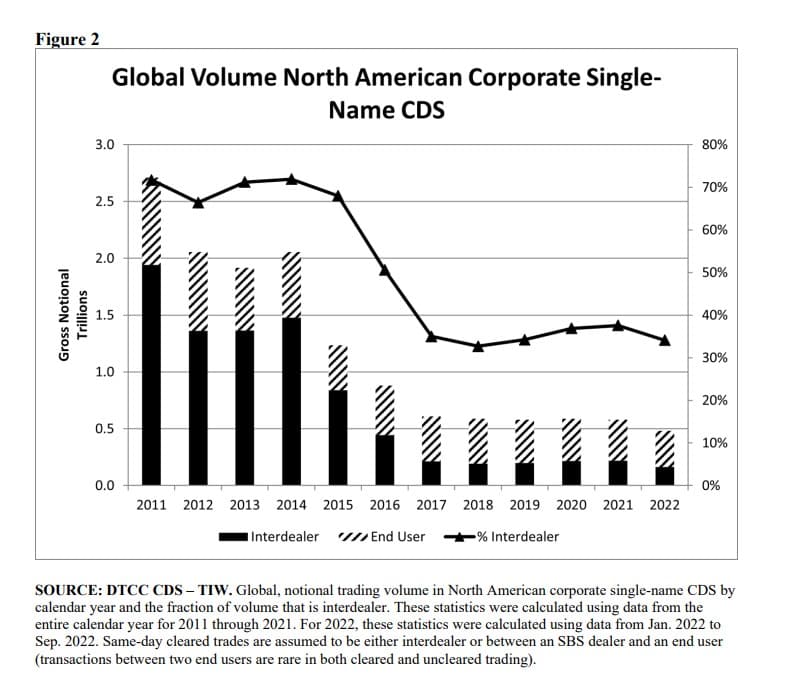

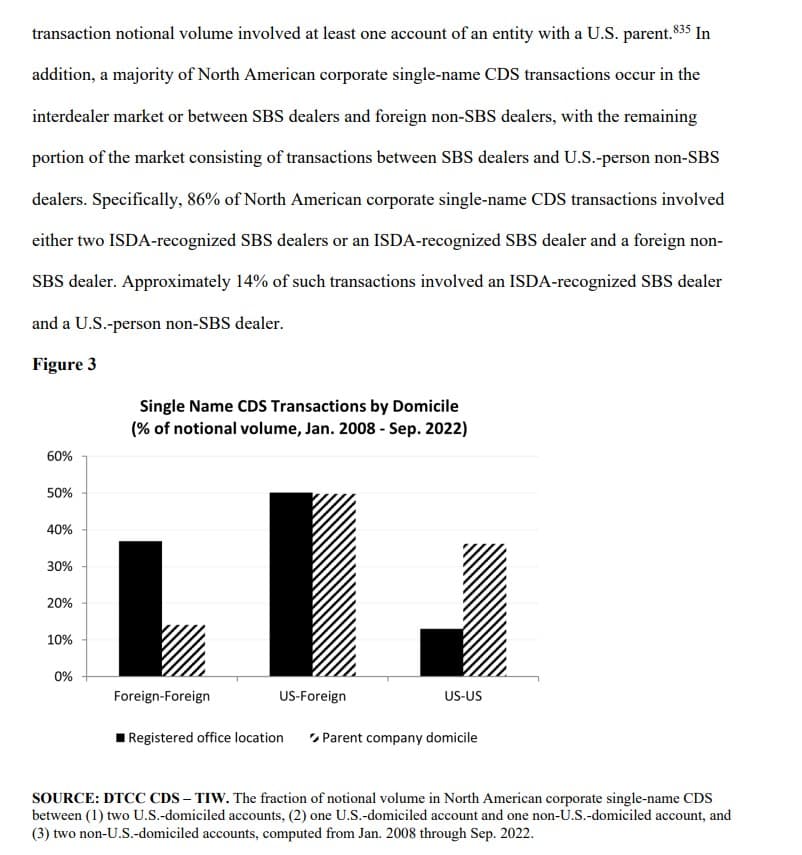

- Figure 2 below describes the percentage of global, notional transaction volume in North American corporate single-name CDS reported to DTCC-TIW between January 2011 and September 2022, separated by whether transactions are between two ISDA-recognized SBS dealers (“interdealer transactions”) or whether a transaction has at least one non-SBS dealer counterparty.

- Figure 2 also shows that the portion of the notional volume of North American corporate single-name CDS represented by interdealer transactions has remained fairly constant through 2015, before falling from approximately 68% in 2015 to under 40% in 2022.

- This change corresponds to the availability of clearing to non-SBS dealers. Interdealer transactions continue to represent a significant fraction of trading activity, even as notional volume has declined over the past 12 years, from just under $2 trillion in 2011 to less than $500 billion in 2022.

Overarching Benefits of the Rules and Amendments:

- Improved Transparency: The final rules would enable the Commission to obtain information about SBSEFs, thereby facilitating the Commission’s oversight of these entities.

- In addition, the requirements relating to pre-trade transparency would increase pre-trade transparency in the market for SBS.

- Increased pre-trade price transparency should allow an increased number of market participants to better see the trading interest of other market participants prior to trading, which should lead to increased price competition among market participants.

- The requirements with respect to pre-trade price transparency should lead to more efficient pricing in the SBS market.

- Evidence from the swap market suggests that an increase in pre-trade transparency is associated with improved liquidity and reduced transaction costs.

- Improved oversight of trading: Regulation SE requires, among other things, that SBSEFs maintain an audit trail and automated trade surveillance system; conduct real-time market monitoring; establish and enforce rules for information collection; and comply with reporting and recordkeeping requirements.

- These requirements are designed to provide an SBSEF with sufficient information to oversee trading on its market, including detecting and deterring abusive trading practices.

- Additionally, an SBSEF shall permit trading only in SBS that are not readily susceptible to manipulation and adopt rules that are reasonably designed to allow the SBSEF to intervene as necessary to maintain markets with fair and orderly trading and to prevent or address manipulation or disruptive trading practices.

- Improved access and competition: Currently, the SBS market is dominated by a small group of SBS dealers.

- A mandatory clearing determination by the Commission, followed by a MAT determination by one or more SBSEFs or exchanges, should help foster greater competition in the trading of SBS by promoting greater order interaction and increasing access to and participation on SBSEFs.

- Furthermore, Rule 827 is designed to promote competition generally by prohibiting an SBSEF from adopting any rules or taking any actions that unreasonably restrain trade or imposing any material anticompetitive burden on trading or clearing.

- Improved Commission oversight: One of the goals of the Dodd-Frank Act is to increase regulatory oversight of SBS trading relative to the existing OTC SBS market.

- Regulation SE would provide the means for the Commission to gain better insight into and oversight of SBSEFs and the SBS market by, among other things, allowing the Commission to review new rules, rule amendments, and product listings by SBSEFs and to obtain other relevant information from SBSEFs.

- Additionally, Rule 826(b) requires every SBSEF to keep full, complete, and systematic records of all activities relating to its business with respect to SBS.

- In addition, Rule 819(f) requires an SBSEF to capture and retain a full audit trail of activity on its facility.

- The records required to be kept by an SBSEF would help the Commission to determine whether an SBSEF is operating in compliance with the SEA and the Commission’s rules thereunder.

- The audit trail data required to be captured and retained would facilitate the ability of the SBSEF and the Commission to carry out their respective obligations under the SEA, by facilitating the detection of abusive or manipulative trading activity, allowing reconstructions of activity on the SBSEF, and generally understanding the causes of both specific trading events and general market activity.

- Improved automation: To comply with Regulation SE’s requirements relating to recordkeeping and surveillance, an SBSEF potentially would need to invest in and develop automated technology systems to store, monitor, and communicate a variety of trading data, including orders, RFQs, RFQ responses, and quotations.

- Conflicts of Interest: Rule 831, among other things, requires the CCO to resolve material conflicts of interest that may arise in consultation with the governing board or the senior officers of the SBSEF.

- Relative to the bilateral OTC SBS market, SBSEFs and SBS exchanges promote competition between liquidity providers, potentially forcing them to lower their prices for supplying liquidity (e.g., narrowing bid-ask spread) and reducing their profits from liquidity provision.

- However, if SBS dealers or major SBS participants were able to restrict access to such venues by, for example, exercising their voting interest in an SBSEF or SBS exchange, they could stifle competition in SBSEFs and SBS exchanges and preserve their profits from liquidity provision.

- Regulation SE, by mitigating such conflicts of interest could help ensure access to SBSEFs and SBS exchanges and in turn increase competition in liquidity provision and lower transaction costs.

- Structured Data Requirements: Rule 825(c)(3) requires an SBSEF to publish a Daily Market Data Report on its website without charge or usage restrictions and in a downloadable and machine-readable format using the most recent version of the associated XML schema and PDF renderer as published on the Commission’s website.

TLDRS:

- The SEC is adopting a new set of rules and forms to establish a regulatory framework for the registration and regulation of security-based swap execution facilities (SBSEFs) and to address general issues related to security-based swap (SBS) execution.

- These rules include implementing aspects of the Dodd-Frank Act designed to reduce conflicts of interest in SBSEFs and national securities exchanges trading SBS.

- The new rules also clarify the cross-border application of trading venue registration requirements and the trade execution requirement for SBS.

- The SEC is amending an existing rule to exempt certain registered clearing agencies and SBSEFs that only provide a marketplace for SBS from the definition of “exchange” under the SEA.

- Additionally, a new rule exempts registered SBSEFs from specific broker requirements, acknowledging that an SBSEF would be considered a broker under the SEA.

- The rules include amendments to the SEC’s Rules of Practice, enabling aggrieved parties to seek review by the Commission for certain actions taken by an SBSEF.

- The Commission is also delegating authority to the Director of the Division of Trading and Markets and to the General Counsel to facilitate the implementation of these new rules.

- These rules require SBSEFs to maintain a comprehensive audit trail, automated trade surveillance systems, and adhere to strict reporting and recordkeeping requirements, thereby enabling them to effectively monitor trading activities and deter abusive practices.

- The regulation seeks to foster greater competition in the SBS market, which is currently dominated by a few dealers.

- Mandatory clearing and trade execution requirements are expected to encourage broader participation and interaction in SBSEFs.

- Regulation SE will enhance the SEC’s oversight of SBSEFs by allowing the Commission to review new rules, amendments, and product listings, and by requiring SBSEFs to keep detailed records of all SBS-related activities, facilitating the detection of manipulative trading activities.

- The regulation also addresses conflicts of interest, such as those potentially arising from SBS dealers' influence on SBSEFs, by mandating conflict resolution procedures and promoting competition between liquidity providers.

- Additionally, it includes structured data requirements for SBSEFs to publish daily market data reports in accessible, machine-readable formats.