Without admitting or denying the allegations Credit Suisse Entities to Pay $10 Million for Providing Prohibited Mutual Fund Services.

- Section 9(a)(2) of the Investment Company Act prohibits individuals or entities from serving as investment advisers, depositors, or principal underwriters for registered investment companies if they are enjoined by a court from engaging in securities-related activities due to misconduct.

- The Consent Order issued by the New Jersey Court against CSS on October 24, 2022, which prohibited CSS from violating the New Jersey Uniform Securities Law, made CSS ineligible to engage in Fund Service Activities as per Section 9(a)(2).

- Section 9(a)(3) extends this prohibition to any company affiliated with an individual or entity barred under Section 9(a)(2). An "affiliated person" is defined as anyone in control, controlled by, or under common control with another person.

- Despite the Consent Order, the Respondents (including CSS, CSAM, and CSAM Ltd.) continued to engage in Fund Service Activities after October 24, 2022, during the Relevant Period.

- Consequently, Credit Suisse willfully violated Section 9(a) of the Investment Company Act, which makes it unlawful for certain individuals or entities to serve in various capacities within registered investment companies if they are subject to a court order related to securities misconduct.

Press Release:

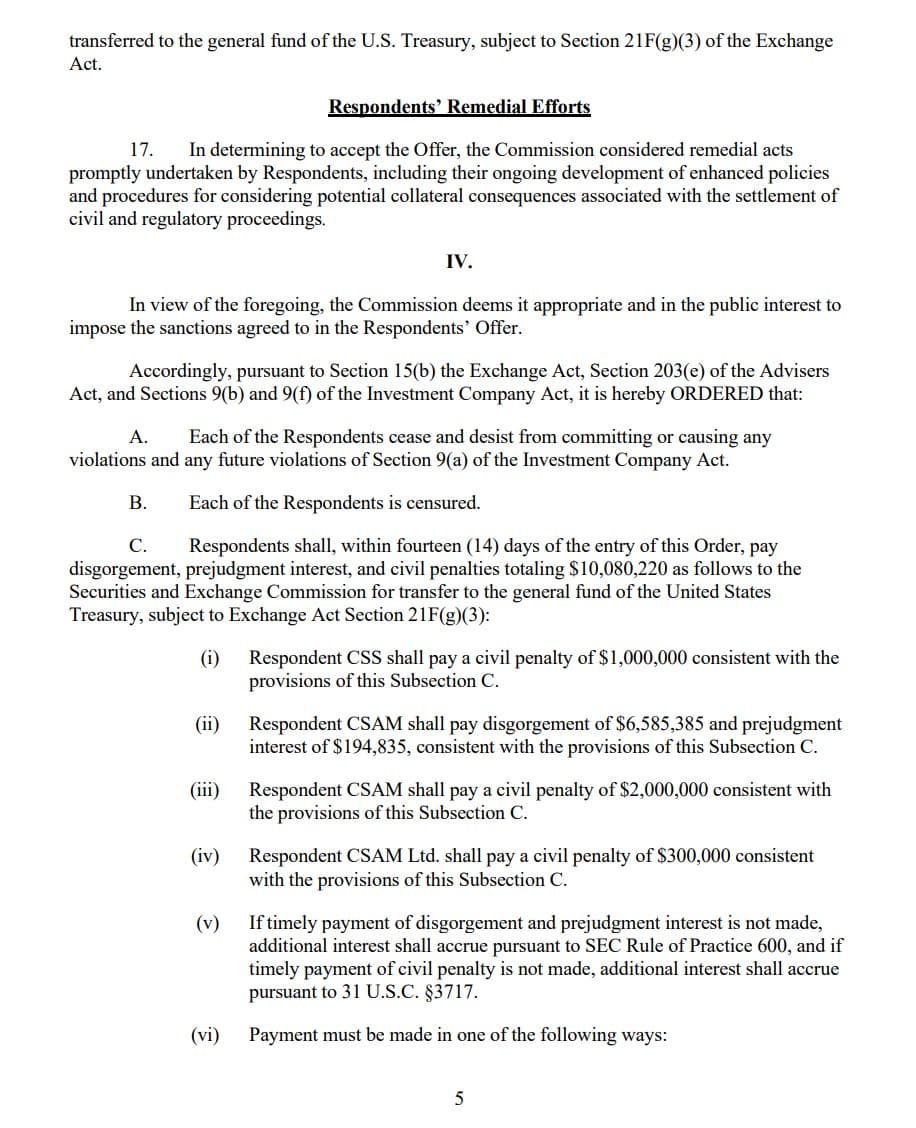

The Securities and Exchange Commission today announced that Credit Suisse Securities (USA) LLC and two affiliated Credit Suisse entities (collectively, the Credit Suisse Entities) agreed to pay more than $10 million to settle the SEC’s charges that they provided prohibited underwriting and advising services to mutual funds.

In October 2022, the Superior Court of New Jersey entered a consent order that resolved a case alleging that Credit Suisse Securities violated the antifraud provisions of the New Jersey Securities laws in connection with its role as underwriter to residential mortgage-backed securities. According to the SEC’s order, because the New Jersey court ordered that Credit Suisse Securities shall not violate New Jersey securities laws, Credit Suisse Securities and its affiliates were prohibited from serving as principal underwriter or investment adviser to mutual funds and employees’ securities companies pursuant to the Investment Company Act of 1940. The SEC order finds, however, that the Credit Suisse Entities continued serving in these prohibited roles until the Commission granted them time-limited exemptions on June 7, 2023. Credit Suisse was acquired by UBS Group AG on June 12, 2023.

“Today’s action holds the Credit Suisse Entities accountable for not complying with eligibility requirements,” said Corey Schuster, Asset Management Unit Co-Chief. “This action reinforces the need for entities to properly monitor for events that may cause disqualification and proactively seek and obtain waivers from the Commission before becoming disqualified, or refrain from performing prohibited services.”

Without admitting or denying the SEC’s findings, the Credit Suisse Entities agreed to pay more than $6.7 million in disgorgement and prejudgment interest and civil penalties totaling $3.3 million.

The SEC’s investigation was conducted by Cynthia Storer Baran and Bradley Lewis and was supervised by Jeffrey Shank, Mr. Schuster, and Andrew Dean, all of the Division of Enforcement’s Asset Management Unit.

TLDRS:

- Credit Suisse Securities (USA) LLC and two affiliated entities (collectively, the Credit Suisse Entities) have agreed to pay over $10 million to settle charges by the SEC for providing prohibited underwriting and advising services to mutual funds.

- The settlement follows a 2022 court order from the Superior Court of New Jersey, which found Credit Suisse Securities in violation of New Jersey's securities laws. This court order rendered Credit Suisse Securities and its affiliates ineligible to serve as principal underwriters or investment advisers to mutual funds as per the Investment Company Act of 1940.

- Despite this prohibition, the Credit Suisse Entities continued to serve in these roles until the Commission granted them time-limited exemptions in June 2023.

- Without admitting or denying the allegations, the Credit Suisse Entities agreed to pay more than $6.7 million in disgorgement and prejudgment interest, and civil penalties totaling $3.3 million.