Investors celebrate advocacy win as the SEC rule raises stakes, demanding greater transparency & accelerated reporting for short sellers.

The stakes are raised for short sellers. SEC rule calls for greater transparency threatening regulatory scrutiny, compliance challenges, legal consequences, and pressure for integrity

Today, we come together to applaud another triumph for household investors, celebrating their persistent efforts and successes in reforming our financial markets.

The courage displayed by these individuals has propelled Wall Street one step closer to relinquishing its advantage.

This achievement is a testament to those who actively engage with rules and regulations, offering insightful comments to shape and enhance the landscape of our financial systems.

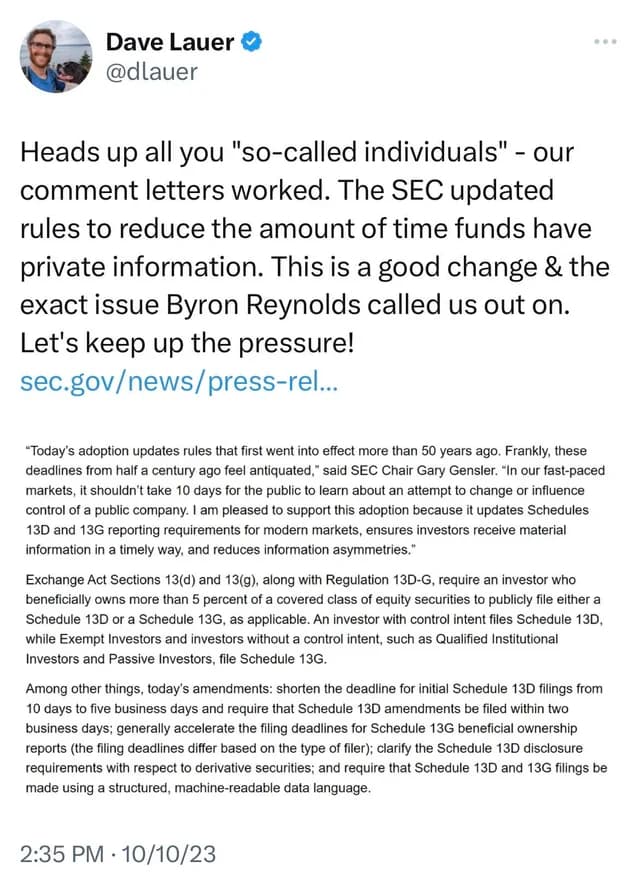

So without any further ado, here's Dave from WeTheInvestors to introduce the good news.

This tweet not only serves as an inspiring testament to the impact of our voices and ongoing efforts in shaping positive market structure reforms, but it also underscores the noticeable awakening within Wall Street and the pressure as mounting against them.

It also serves to sheds light on SEC Chairman Gary Gensler's intensified commitment to safeguarding and fortifying our financial markets, aiming to establish a leveled playing field that benefits all investors.

And who doesn't love seeing market reform in action?

Let's deep dive into what this rule means and why we're hearing about it now:

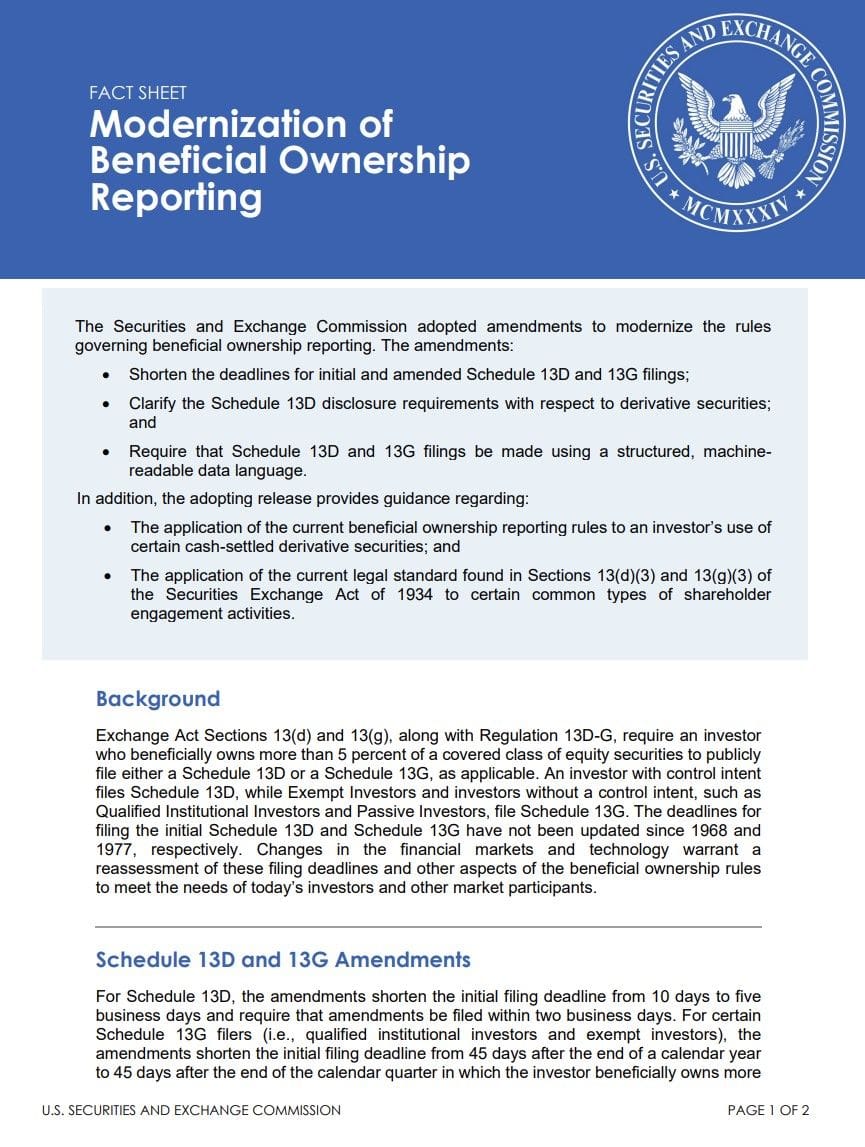

File No. S7-06-22 - Modernization of Beneficial Ownership Reporting

Resources here so you can perform your own due diligence:

As the Final Rule is about 295 pages long, I'm going to do my best to summarise based on the Fact Sheet.

For a more in-depth exploration of this topic and the impactful contributions from esteemed members of the r/Superstonk Community, delve into the details by checking out the following links here:

WhatCanIMakeToday

Modernizing Beneficial Ownership Reporting - We Won This Battle!

Dismal-Jellyfish:

SEC Adopts Amendments to Rules Governing Beneficial Ownership Reporting. The amendments also clarify the disclosure requirements of Schedule 13D with respect to derivative securities.

The Securities and Exchange Commission (SEC) has updated rules regarding how investors report their ownership of more than 5% of a company's stock. The changes are aimed at making this reporting more timely and clear.

For example, if someone intends to control a company, they file a Schedule 13D, and the time to do this is now shorter, from 10 to 5 business days.

Investors without control intent, like certain institutional or passive investors, file Schedule 13G, and their initial filing time is also shortened.

Amendments to these filings must now be done within two business days. The updates also make it clearer what types of derivative securities investors need to disclose, and all filings must now be in a structured, machine-readable format.

These changes to align with modern financial markets and ensure investors receive relevant information promptly.

The new rules will be effective 90 days after being officially published.

TL:DR -

SEC has updated rules to speed up and clarify reporting of ownership exceeding 5% in a company's stock, reducing filing times and enhancing disclosure for investors.

✅ The SEC aims to enhance transparency and provide more timely information to investors and market participants.

✅ By shortening filing deadlines, clarifying disclosure requirements for derivative securities, and requiring structured, machine-readable data, the SEC seeks to make the reporting process more efficient and accessible.

✅ By streamlining the reporting process, the SEC is ensuring that regular people have quicker access to relevant information, empowering them to make more informed investment decisions.

✅ These changes are designed to meet the evolving needs of investors and ensure that relevant information is disseminated in a timely manner, reducing information disparities and enhancing overall market transparency.

TL:DR -

The SEC's reforms, including faster filings and clearer disclosure rules, aim to empower regular investors by providing quicker access to crucial information, fostering informed decision-making and reducing information gaps in the market.

Examining the impacts of this rule on short sellers:

💀 Risk of Increased Scrutiny:

The rule changes emphasise transparency and timely reporting, which may lead to increased scrutiny by regulatory authorities. If an entity is engaged in activities that involve an excessive number of shares, such as naked short selling beyond legal limits, the enhanced reporting requirements may expose such practices.

💀 Market Impact:

The more timely reporting of ownership changes, especially in the case of attempts to control a company, may influence market sentiment and impact the value of shares. For entities holding large positions, including potentially naked short positions, quicker disclosure could lead to faster market reactions, affecting the value of their positions.

💀 Potential for Regulatory Action:

If an entity is found to be engaging in illegal or manipulative practices, such as naked short selling in excess of legal limits, the regulatory authorities may take enforcement actions. The increased transparency and reporting requirements may aid regulatory efforts to detect and address such practices.

💀 Operational Challenges:

Entities involved in naked short selling beyond legal limits could face operational challenges in complying with the rules. The need for more accurate and timely reporting could expose discrepancies in positions, leading to potential regulatory inquiries or legal consequences.

💀 Market Integrity:

The overarching goal of these regulatory changes is to enhance market integrity and transparency. Entities holding excessive naked short positions may find it challenging to operate discreetly and face increased pressure to align with market regulations.

To add the finishing touch, SEC Chairman Gary Gensler made the following statement in the press release:

“Today’s adoption updates rules that first went into effect more than 50 years ago. Frankly, these deadlines from half a century ago feel antiquated,” said SEC Chair Gary Gensler.

“In our fast-paced markets, it shouldn’t take 10 days for the public to learn about an attempt to change or influence control of a public company. I am pleased to support this adoption because it updates Schedules 13D and 13G reporting requirements for modern markets, ensures investors receive material information in a timely way, and reduces information asymmetries.”

What does this mean in layman's terms?

These updates by SEC Chair Gary Gensler really are cause for celebration.

These changes are beneficial as they modernise outdated rules, ensuring timely disclosure of attempts to influence public companies and aim to protect investors, reduce information imbalances, and enhance overall transparency in the fast-paced financial markets.

The voting has been done, and this rule is being put into action.

The amendments will become effective 90 days after publication in the Federal Register.

Compliance with the revised Schedule 13G filing deadlines will be required beginning on September 30, 2024. This indicates when market participants must adhere to the new deadlines for filing Schedule 13G reports.

Compliance with the structured data requirement for Schedules 13D and 13G will be required on December 18, 2024. This is the deadline for market participants to ensure that their filings use a structured, machine-readable data language.

The walls are closing in around short sellers.

Gary Gensler is truly smashing it out of the park as the Chairman of the SEC, evidenced by the intense scrutiny from Wall Street attempting to have him removed.

But household investors have been fighting back by contacting their congress representatives to stop Wall Streets' attempt to defund the SEC by slipping in changes to a House appropriations bill to kill market reform.

You can check out more information about that here and here (includes content from Dave Lauer & We The Investors).

However, Gary, rest assured, you have our support. Keep steadfast in carrying out your responsibilities to safeguard the markets. 👍

And should we need reminding of his commitment to Household Investors, let's cast our minds back to the the time he engaged with Platinumsparkles and Dave Lauer on Superstonk:

Check out the full video here.

Appreciation & Closing Thoughts:

The Securities and Exchange Commission (SEC) has undertaken updates enhance transparency.

This includes updated rules for reporting ownership exceeding 5%, shortening filing times for control intent (Schedule 13D) from 10 to 5 business days, reducing filing times for non-control investors (Schedule 13G), requiring amendments within two business days, specifying derivative securities disclosures, and mandating structured, machine-readable filings—all aimed at aligning with modern markets and ensuring prompt information for investors, effective 90 days after official publication.

In recognising these pivotal changes, it's crucial to acknowledge the instrumental role played by advocacy, a diverse investor base persistently influencing a shift in the regulatory paradigm.

This transformation, ensuring timely and relevant information for investors, stands as a direct outcome of their efforts. Their advocacy not only contributed to these changes but is also cause for celebration, promising a financial ecosystem that is more accessible and responsive to investor needs. As we acknowledge this accomplishment, appreciation for the collective influence driving these changes is well-deserved.

While celebrating this milestone, it serves as a reminder of the ongoing regulatory journey, with continued engagement undeniably shaping the future dynamics of our financial market – the collective voice remaining a driving force for constructive change.

That's all folks.

Be excellent to each other.