SEC Adopts Amendments to Rules Governing Beneficial Ownership Reporting. The amendments also clarify the disclosure requirements of Schedule 13D with respect to derivative securities.

295 pages of 'light' reading...

Fact Sheet:

What are folks saying about this?

Chair Gary Gensler:

Today, the Commission adopted final rules to shorten the deadlines by which beneficial owners of a company — those who own more than 5 percent of the company — must inform the public of their position. I am pleased to support this adoption because it updates these reporting requirements for modern markets, ensures investors receive material information in a timely way, and reduces information asymmetries.

Today’s adoption updates rules that first went into effect more than 50 years ago. In 1968, in the wake of abuses in the 1960s in the mergers and acquisitions field, Congress passed an important law known as the Williams Act. While the legislation offered important investor protections regarding tender offers, it also included provisions requiring public disclosure from individuals with large positions—known as beneficial owners—in the process of accumulating shares in a company with the potential to change or influence control of the company.

Indeed, ahead of the law’s passage, then-SEC Chair Manuel Cohen testified that such disclosure would be important. In his 1967 testimony prior to the law’s passage, Chair Cohen said that the then-current law “does not give the public stockholders adequate information about the arrangements surrounding the acquisition or the purchaser’s intentions with respect to the company.”[1]

In 1970, Congress lowered the threshold for filing a beneficial ownership report from those who own more than 10 percent of a public company’s equity securities to those who own more than 5 percent. Under current rules, beneficial owners who have control intent have 10 days to report their ownership (via Schedule 13D) after acquiring more than 5 percent of a public company’s equity securities.

Congress also updated this disclosure regime in 1977 to ensure that significant owners without control intent also provided disclosure to the market (via Schedule 13G). Congress left those filing deadlines to the discretion of the Commission.

These were the rules in place when I first took a job on Wall Street working in a mergers and acquisitions department. For me, it seems just like yesterday. Needless to say, for many readers, that was a long time ago. What matters, though, is the reality today—and in today’s fast-paced markets, it shouldn’t take 10 days for the public to learn about an attempt to change or influence control of a public company. I say that particularly given the rapidity of current markets and technologies. Frankly, these deadlines from half a century ago feel antiquated.

That’s why I’m glad that, in the wake of the 2008 financial crisis, Congress came back to the issue of Schedule 13D filings. Under the Dodd-Frank Act, Congress gave the SEC the authority to shorten the beneficial ownership reporting deadline.

Today’s adoption makes use of that Dodd-Frank authority. At its core, today’s adoption is about reducing overall information asymmetries in the market, promoting transparency, allowing better-informed decision-making by investors, and improving liquidity, by shortening the filing deadlines for Schedules 13D and 13G.

First, today’s adoption shortens the initial filing deadlines for Schedule 13D from 10 calendar days to 5 business days. When someone acquires shares in a company with the intent to control that company, that can be market-moving information. Delayed disclosure can create information asymmetry. In an era of 24-hour media cycles and high-frequency trading, shortening this deadline brings Schedule 13D filings more into modern times.

Second, today’s adoption shortens the initial filing deadlines for Schedule 13G. In particular, the final rules require qualified institutional investors and exempt investors to file their initial Schedule 13G filings after quarter-end rather than year-end. Further, the final rules require passive investors who are not qualified institutional investors to file their initial Schedule 13G filings within five business days rather than 10 days.

The amended deadlines—for Schedules 13D and 13G—reflect changes from the proposing release in response to public comment.

Additionally, in response to public feedback, we did not adopt two proposed changes to the regulatory text.

First, rather than the proposed changes to regulatory text, the Commission provided guidance to help clarify the circumstances under which two or more persons form a single “group” for the purposes of beneficial ownership reporting. This guidance is consistent with the Commission's proposed amendments, which were intended to clarify and affirm the applicable legal standards with respect to group formation.

Second, similarly, the Commission provided guidance to set forth the circumstances under which holding certain cash-settled derivatives count towards the 5 percent threshold for reporting.

Taken together, the final rules will benefit markets and the investing public.

I’d like to thank members of the SEC staff for their work on these final rules, including:

Erik Gerding, Mellissa Duru, Ted Yu, Nicholas Panos, Valian Afshar, Elizabeth Murphy, Robert Errett, Chris Windsor, Anne Krauskopf, Katherine Bagley, Emma O’Hara, and Pearl Crawley in the Division of Corporation Finance;

Megan Barbero, Bryant Morris, Dorothy McCuaig, Ken Alcé, David Russo, Rachel McKenzie, and Brooke Wagner in the Office of the General Counsel;

Jessica Wachter, Lyndon Orton, Charles Woodworth, Parhaum Hamidi, Michael Pessin, Greg Scopino, Vlad Ivanov, Julie Marlowe, Erin Smith, Lauren Moore, Oliver Richard, and Mike Willis in the Division of Economic and Risk Analysis;

Carol McGee, Rajal Patel, and Pam Carmody in the Division of Trading and Markets;

Sarah G. ten Siethoff, Brian Johnson, Melissa Roverts Harke, Adele Murray Kitterdge, and Angela Mokodean in the Division of Investment Management;

Jonathan Cowen, Jeffrey Weiss, and Armita Cohen in the Division of Enforcement; and

Rosemary Filou, Laurita Finch, and Lidian Pereira in the EDGAR Business Office.

Commissioner Hester M Peirce:

Although better than the proposed rule,[1] the final beneficial ownership reporting rule continues to rest on flawed economics. Accordingly, I cannot support it.

The heart of the final rule is a shortening of the filing windows for Schedules 13D and G, which report an investor’s holding of large positions in a company’s shares. Although the original filing timelines are not necessarily the Platonic ideal, a decision to shorten the timeframes should be well justified. Here, a justification is lacking.

According to the Commission, shortening the 13D window will mitigate information asymmetries between everyday investors, on the one hand, and 13D filers and “informed bystanders,” on the other hand. By the Commission’s logic, narrowing the filing window should enable uninformed traders to share in profits created by the diligent efforts of more informed investors. But, absent a compelling reason, people who lawfully possess information should not have to hand that information over to their uninformed counterparties.

The Commission’s position ignores that disparities in information and perspective are central to the functioning of our markets.[2] Different people come to the market with different views of what a particular asset is worth and different levels of interest in buying or selling it. One person may desperately want to buy something that someone else is equally eager to sell. Hence, a market is made. The buyers and sellers generally do not have to explain their motivations. The prices speak for themselves.[3]

Of particular concern are rules that prevent someone who has worked hard to identify a mismanaged company and develop a strategy for improving it from getting adequately compensated for that work and the associated risk.[4] Indeed, the Commission acknowledges that “the initial information asymmetry between a prospective filer and the market is not a market failure because in its absence, the filer may not be sufficiently rewarded for the expenses of its efforts expended in information acquisition and in pursuing changes at the issuer, which often have market-level benefits.”[5] As one commenter explained, “permitting buyers to make a profit from their asymmetric information is often needed to induce them to invest effort to discover firms that are mismanaged.”[6]

Recognizing “that benefits may stem from the information asymmetry between a Schedule 13D filer and the market” and “that the information advantage of Schedule 13D filers results, in general, from their own expenditures . . . or efforts,” the adopting release emphasizes the informational advantages of so-called “informed bystanders.”[7] These informed bystanders are opportunistic traders who, observing the market, suspect that something is afoot or have become aware of the filer’s plans. The Commission worries that their consequent “informational advantage . . . over the selling shareholders in these transactions and the associated wealth transfers may be perceived by some market participants to be unfair.”[8] But it is unclear that we should give any weight to this concern. The release provides little evidence that informed bystanders are a large population.[9] Even if they were, they arguably contribute to price formation and market functioning.[10]

Economic principles have not changed since 1968, when the Williams Act, which forms the basis for the Section 13D mandate, became law.[11] The Commission points out that technology has changed and that those technological changes may enable investors to file their Schedules 13D faster[12] and accumulate “a large equity stake more quickly.”[13] However, as the Commission acknowledges, other technological[14] and legal[15] developments could increase costs for activists. Today, as a half-century ago when the Williams Act passed, the basic principle remains that people will not go to the trouble of identifying ways in which companies can improve unless they are rewarded for that work. And if investors pare back their monitoring of companies, other investors and the broader economy could suffer. The Commission’s economic analysis takes great pains to show that the changes will not impair activist investors that much, but in the process demonstrates that the rule will have substantial effects on how these investors proceed.[16] The result could be fewer potentially corporate value-enhancing campaigns.[17] This “modernization” effort might better be characterized as an insulation effort—insulating corporate managers from scrutiny.[18] Each campaign must be judged on its own merits, of course, and other reforms could be useful in ensuring that public company managers can respond to activists and present their side of the story to shareholders.

My concerns extend also to the 13G changes, which would shorten filing timelines for large investors with no control intent.[19] Shortening filing deadlines for investors who generally have no plans to effect a change in control lacks any economic rationale. Under the amendments, 13G filers will have to give up their intellectual property earlier than they do now and thus subject themselves to copycatting and frontrunning.[20] This cost to one group of investors is not outweighed by a corresponding benefit to other investors. As commenters noted, 13G information is not of immediate interest to market participants who are not trying to front run.[21] Amendments to reflect changes in the amount of holdings by 13G filers are particularly uninteresting.[22] Moreover, the costs of speedier filings for these investors, some of whom are small and not financial firms, are likely to be high.[23] Meeting the final rule’s timelines for filing amended 13Gs, although more reasonable than what was proposed, will nevertheless be costly and difficult.[24] The Commission pointed to a rationale for shortening the 13G initial filing window for passive investors: some investors improperly hide their control intent by filing a 13G instead of a 13D.[25] If this problem is real, why not address the errant filers’ violations directly by enforcing existing regulations governing 13G eligibility? Rather than dragging 13G filers along for the ride in a release that is focused on 13D filers, the Commission should have, as one commenter recommended, set aside this issue for study.[26]

Much of commenters’ attention was focused on aspects of the rule other than filing timetables; the proposal also included guidance about cash-settled derivatives and the definition of group. The adopting release also addresses these topics, albeit more practically than did the proposing release. The adopting release, however, continues to raise questions. For example, how clear is the analytical framework with respect to cash-settled derivative securities that the Release imports from the 2011 security-based swaps release? Does the group guidance inappropriately downplay the importance of an “agreement” in group formation?[27] Is the group guidance unnecessarily accommodating to activists whose objectives are not to increase the value of the company at issue, but to further a cause that is either neutral or detrimental to the value of the company?[28] It would have been easier to answer these questions had the Commission put this guidance out for proposal.

While I cannot support this rule, I am thankful to the Commission staff for their excellent and diligent work on this rulemaking. I particularly appreciated a number of lively, thought-provoking conversations about the rule. Among others, I want to thank Corey Klemmer in the Chair’s office, Valian Ashfar, Ted Yu, and Nick Panos in the Division of Corporation Finance, the Division of Economic and Risk Analysis, the Office of General Counsel, and others throughout the Commission.

Commissioner Mark T. Uyeda:

The Commission has approved amendments to shorten the filing deadlines for initial and amended beneficial ownership reports filed on Schedules 13D and 13G.[1] The final amendments reflect consideration of the concerns raised by commenters in response to the proposal.[2]

With respect to Schedule 13D filings, the amended deadline for initial filings has been set at five business days, which is a meaningful change from the proposed deadline of five calendar days. Additionally, the final amendments exclude: (1) proposed changes to Rule 13d-5(b) under the Securities Exchange Act of 1934 (“Exchange Act”), which would have amended the standard for forming a group for purposes of Sections 13(d)(3) and 13(g)(3) of the Exchange Act, and (2) the proposed addition of paragraph (e) to Rule 13d-3 under the Exchange Act, which would have deemed certain holders of cash-settled derivative securities as beneficial owners of the reference covered class.

Instead – with respect to the question of group formation for purposes of Sections 13(d)(3) and 13(g)(3) – the Commission explains that the appropriate legal standard for determining whether a group is formed is found in the statute itself, and that the standard generally is satisfied only if two or more persons take concerted actions for the purpose of acquiring, holding, or disposing of securities of an issuer. With respect to cash-settled derivatives, the Commission provides a framework for analyzing whether holders of these securities are deemed to be beneficial owners of the reference covered class for purposes of Rule 13d-3. The guidance on beneficial ownership determination is consistent with the treatment of security-based swaps set forth in a prior Commission release.[3]

Collectively, these changes reflect a recognition by the Commission that “a reduction in investment research and in significant shareholdings by [activist investors] could reduce market efficiency…because of the role that investments based on such research and analysis play in moving stock prices closer to their fundamental values.”[4] Importantly, the Commission “acknowledge[s] that benefits may stem from the information asymmetry between a Schedule 13D filer and the market,” which results “from their own expenditures on research and analysis or from their efforts and expenditures to pursue changes at the issuers in which they accumulate these shareholdings.”[5]

The final amendments also will affect persons who make filings on Schedule 13G, including investment advisers to mutual funds and ETFs. Under the final amendments, the deadline for initial Schedule 13G filings made by Qualified Institutional Investors[6] and Exempt Investors[7] is forty-five (45) calendar days after the calendar quarter in which the ownership threshold is crossed. The same deadline applies for Schedule 13G amendments. The proposal would have required initial and amended filings within five business days after month-end. Since many Schedule 13G filers are also institutional investment managers that are required to make filings on Form 13F, the Schedule 13G filing deadlines have been aligned with the filing deadlines for Form 13F and will likely produce regulatory efficiency.

The amendments to filing deadlines for Schedules 13D and G are appropriate in light of advances in the communications and technology used by market professionals since those timeframes were first established in 1968, while at the same time recognizing the importance of shareholder activism. Accordingly, I support the final amendments. I thank the staff in the Divisions of Corporation Finance and Economic and Risk Analysis, as well as the Office of the General Counsel, for their efforts.

Press Release:

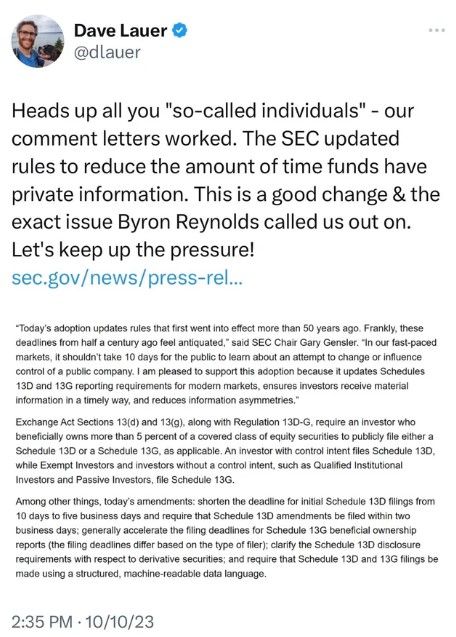

The Securities and Exchange Commission today adopted rule amendments governing beneficial ownership reporting under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934. The amendments update Regulation 13D-G to require market participants to provide more timely information on their positions to meet the needs of investors in today’s financial markets.

“Today’s adoption updates rules that first went into effect more than 50 years ago. Frankly, these deadlines from half a century ago feel antiquated,” said SEC Chair Gary Gensler. “In our fast-paced markets, it shouldn’t take 10 days for the public to learn about an attempt to change or influence control of a public company. I am pleased to support this adoption because it updates Schedules 13D and 13G reporting requirements for modern markets, ensures investors receive material information in a timely way, and reduces information asymmetries.”

Exchange Act Sections 13(d) and 13(g), along with Regulation 13D-G, require an investor who beneficially owns more than 5 percent of a covered class of equity securities to publicly file either a Schedule 13D or a Schedule 13G, as applicable. An investor with control intent files Schedule 13D, while Exempt Investors and investors without a control intent, such as Qualified Institutional Investors and Passive Investors, file Schedule 13G.

Among other things, today’s amendments: shorten the deadline for initial Schedule 13D filings from 10 days to five business days and require that Schedule 13D amendments be filed within two business days; generally accelerate the filing deadlines for Schedule 13G beneficial ownership reports (the filing deadlines differ based on the type of filer); clarify the Schedule 13D disclosure requirements with respect to derivative securities; and require that Schedule 13D and 13G filings be made using a structured, machine-readable data language.

Further, the adopting release provides guidance regarding the current legal standard governing when two or more persons may be considered a group for the purposes of determining whether the beneficial ownership threshold has been met, as well as how, under the current beneficial ownership reporting rules, an investor’s use of certain cash-settled derivative securities may result in the person being treated as a beneficial owner of the class of the reference equity securities.

The adopting release is published on SEC.gov and will be published in the Federal Register, and the amendments will become effective 90 days after publication in the Federal Register. Compliance with the revised Schedule 13G filing deadlines will be required beginning on Sept. 30, 2024. Compliance with the structured data requirement for Schedules 13D and 13G will be required on Dec. 18, 2024. Compliance with the other rule amendments will be required upon their effectiveness.

EDIT: This is exciting!

TLDRS:

- SEC Adopts Amendments to Rules Governing Beneficial Ownership Reporting.

- The amendments also clarify the disclosure requirements of Schedule 13D with respect to derivative securities.

- Gensler supports, Peirce opposes.