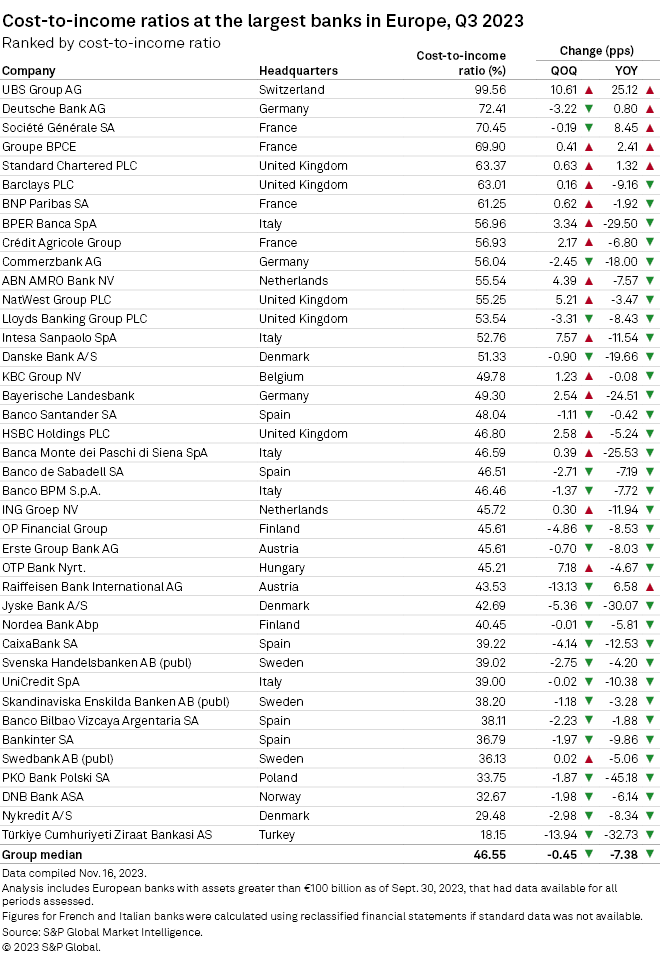

S&P Global Market Intelligence: UBS is least efficient bank in Europe in Q3 2023.

The Swiss bank recorded a third-quarter cost-to-income ratio of 99.56%, representing a 10.61-percentage-point increase from the previous quarter.

UBS posted a third-quarter net loss attributable to shareholders of $785 million, compared to a $1.73 billion profit booked a year ago. Operating expenses surged 91% to $11.64 billion due to the ongoing integration of Credit Suisse, which the bank is aiming to complete and transition to a single US intermediate holding company by the first half of 2024.

What could be causing UBS woes?:

- Federal Reserve announces consent order & $268.5 million fine with UBS Group AG, of Zurich, Switzerland, for misconduct by Credit Suisse. The misconduct involved Credit Suisse's unsafe & unsound counterparty credit risk management practices with Archegos.

- UBS found to have inadequate short selling supervision & system flaws exploited--fueling potential naked shorting and abuse in GameStop.

- u/welp007: UBS has reported a higher-than-forecasted net loss of $785 million for Q3 and its first quarterly loss in 6 years. A loss of only $444 million was expected for Q3 according to an internal UBS poll. Archegos bags are indeed heavier to kick than UBS previously thought. 🦵 💰

- u/Le_Ran: UBS is probably (LOL) the bagholder for GME naked shorts , look this data

- u/TermoTerritorial999:

UBS is probably (LOL) the bagholder for GME naked shorts - IMPORTANT UPDATE!!!!!!!! HELLO CITADEL!!!

TLDRS:

- S&P Global Market Intelligence: UBS is least efficient bank in Europe in Q3 2023.

- UBS posted a third-quarter net loss attributable to shareholders of $785 million, compared to a $1.73 billion profit booked a year ago.

- Operating expenses surged 91% to $11.64 billion due to the ongoing integration of Credit Suisse.

- Those Credit Suisse bags sure are heavy!