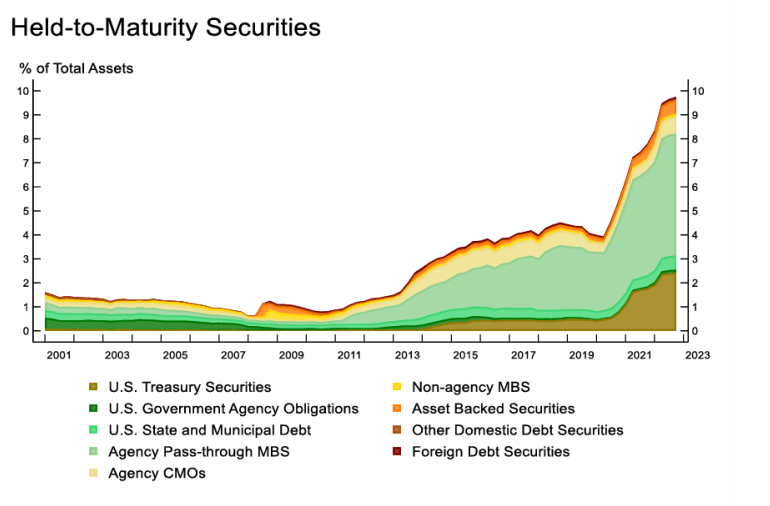

Quarterly Trends for Consolidated U.S. Banking Organizations 4th quarter 2022: Held-to-Maturity assets ~10% of assets. Remember, unrealized losses on available–for–sale and held-to-maturity securities totaled $620 billion in the 4th quarter.

Recipe for systemic stress for the broader banking system?

Source: https://www.reddit.com/r/Superstonk/comments/12xf7he/quarterly_trends_for_consolidated_us_banking/

Why are Held-to-Maturity assets interesting? Remember:

- Unrealized losses on available–for–sale and held-to-maturity securities totaled $620 billion in the fourth quarter

- The combination of a high level of longer-term asset maturities and a moderate decline in total deposits underscored the risk that these unrealized losses could become actual losses should banks need to sell securities to meet liquidity needs.

- This latent vulnerability within the banking system would combine with several other prevailing conditions to form a key catalyst for the subsequent failure of SVB and systemic stress experienced by the broader banking system.