FDIC Second Quarter Quarterly Banking Profile: "The vast majority of community banks (96.7%) reported unrealized losses on securities."

Today the FDIC released second quarter financial results in its latest Quarterly Banking Profile published today.

U.S. commercial banks and savings institutions insured by the FDIC reported $71.5 billion in net income for Q2 2024, a $7.3 billion (11.4%) increase from the previous quarter, driven by lower noninterest expenses and one-time gains.

The profit increase was primarily due to reduced noninterest expenses (down $3.6 billion) and one-time gains on equity security transactions ($10 billion) and the sale of an institution’s insurance division, contributing an after-tax $4.9 billion gain.

FDIC-insured community banks reported a modest net income increase to $6.4 billion, up 1.1% from Q1 2024, largely due to higher net interest and noninterest income.

The industry’s net interest margin (NIM) decreased slightly by one basis point to 3.16%, driven by larger banks with over $250 billion in assets, while community banks saw a seven basis-point increase in NIM.

Total loan balances increased by $125.8 billion (1.0%) from the previous quarter, led by loans to nondepository financial institutions and consumer loans. Annually, loans grew by $244.5 billion (2.0%).

The net charge-off rate increased to 0.68%, the highest since Q2 2013, with credit card net charge-offs rising to 4.82%, the highest since 2011.

Domestic deposits fell by $197.7 billion (1.1%) from Q1 2024, with decreases in savings and transaction deposits, partially offset by small time deposit growth.

The Deposit Insurance Fund balance grew by $3.9 billion, bringing the reserve ratio up four basis points to 1.21%.

The total number of FDIC-insured institutions dropped by 29 to 4,539 in Q2 2024, primarily due to mergers and one bank failure.

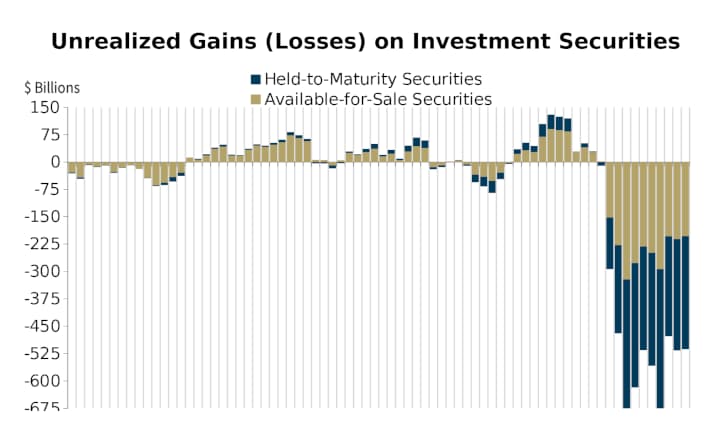

Unrealized losses on securities totaled $54.8 billion in second quarter 2024, down $775.7 million (1.4%) from the previous quarter and down $7.7 billion (12.3%) from the previous year. Unrealized losses on held-to-maturity securities ($9.1 billion) and available-for-sale securities ($45.7 billion) both decreased quarter over quarter. The vast majority of community banks (96.7%) reported unrealized losses on securities.

"However, the banking industry still faces significant downside risks from uncertainty in the economic outlook, market interest rates, and geopolitical events. In addition, weakness in certain loan portfolios, particularly office properties, credit cards, and multifamily loans, continues to warrant monitoring.”

— FDIC Chairman Martin J. Gruenberg

Remember, "As of Q4 2023, 185 banks with $524 billion of assets had unrealized securities losses that exceeded their shareholders’ equity."

The 2023 bank failures revealed banks' vulnerability to unrealized securities losses and rapid uninsured deposit withdrawals. Despite this, many banks still hold significant unrealized securities losses and uninsured deposits at risk of major commercial real estate (CRE) loan losses. This analysis from the Office of Financial Research (OFR) identifies which banks are most susceptible to these losses.

Banks are heavily invested in CRE debt, with many having concentrations that have been problematic in the past. Without reducing their CRE exposure, banks face heightened risk, particularly if the office sector continues to underperform.

The uncertainty regarding banks' resilience to CRE loan losses could lead to a loss of confidence among investors and depositors. Following the 2023 bank failures, many shifted their funds to larger banks, a trend that could recur for today's vulnerable banks.

If future CRE loan losses match those of past downturns, numerous banks might see combined CRE and unrealized securities losses surpassing their shareholders' equity, even in a better interest rate environment....

"CRE Downturns and Bank Failures"

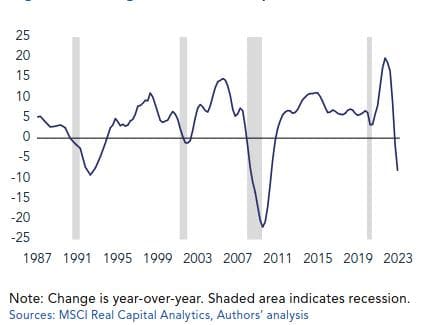

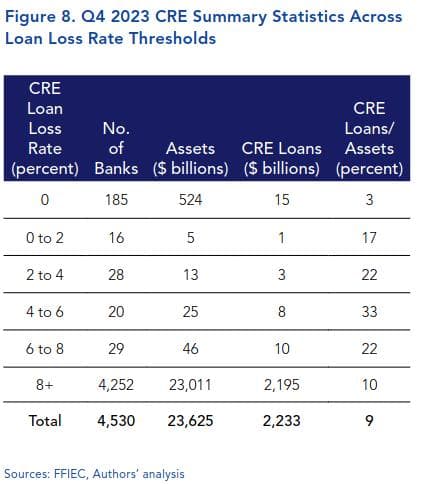

Since 1987, five downturns in CRE have coincided with recessions or high-interest rate periods. As of Q4 2023, banks are heavily invested in CRE debt, holding $2.2 trillion in CRE loans, including $406 billion in construction loans, making up 9% of their total assets.

Historically, CRE loan losses have been a major factor in bank failures, notably during the 2008-11 and 1987-90 periods. While multiple factors can lead to bank failures, CRE loan losses have frequently been the catalyst during these times.

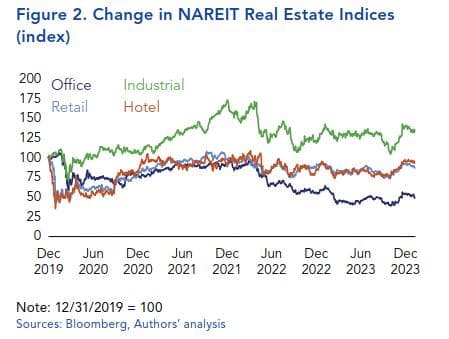

"The Office Sector Is Weighing Down CRE Performance"

CRE is experiencing a modest downturn due to higher interest rates and reduced liquidity. However, the analysis calls out that the office sector is significantly under-performing, primarily due to the widespread adoption of work-from-home (WFH)--companies are cutting back on office space as leases come up for renewal, leading to a gradual but steady increase in vacancies.

The sector's declining valuations and cash flows have resulted in higher delinquencies and defaults. The stock market performance of office Real Estate Investment Trusts (REITs) mirrors this trend, with office REIT prices dropping 52% since early 2020. In contrast, industrial REITs have seen a 33% increase, highlighting the varying impacts within the CRE market.

"How Many Banks Are Vulnerable to CRE Loan Losses?"

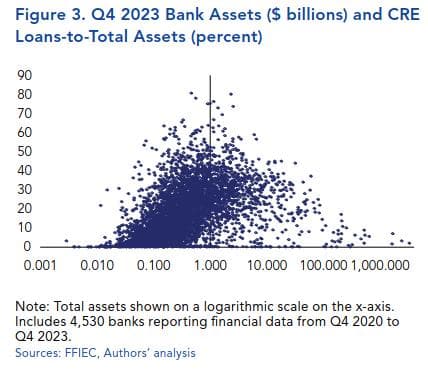

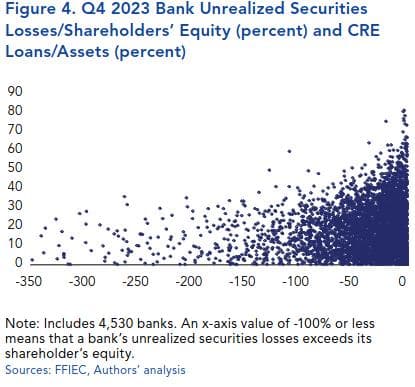

An analysis assessing bank vulnerability to commercial real estate (CRE) loan losses used data from the 2023 failures of Silicon Valley Bank (SVB), Signature Bank (SB), and First Republic Bank (FR-B). A bank is considered vulnerable if it has above-average CRE loan exposure, significant unrealized securities losses, and a high level of unsecured deposits.

CRE Loan Exposure: Small banks (assets ≤ $1 billion) tend to have higher CRE loan concentrations.

- As of Q4 2023, 102 small banks with $109 billion in combined assets had a CRE loans-to-assets ratio of 50%.

- Conversely, larger banks with over $250 billion in assets had an average CRE-to-assets ratio of 4%.

Significant Unrealized Securities Losses: High CRE loan concentrations alone do not necessarily indicate risk. However, many banks with high CRE concentrations also have substantial unrealized securities losses.

- As of Q4 2023, 185 banks with $524 billion in assets had unrealized securities losses exceeding their shareholders’ equity.

- Among these, 21 banks with $21 billion in assets had a CRE concentration of 25% or more.

- Additionally, 764 banks with $1.2 trillion in assets had unrealized losses equal to 75% of shareholders’ equity, including 120 banks with $130 billion in assets and a CRE concentration of 25% or more.

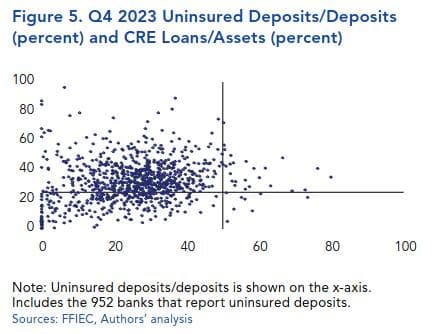

Deposits, essentially short-term loans from depositors, fund nearly 80% of banks’ assets. A lack of confidence can lead to deposit withdrawals, destabilizing banks. The 2023 failures of SVB, SB, and FR-B highlighted this risk, triggering significant official-sector intervention to prevent a wider banking crisis.

- As of Q4 2023, 81 banks had an uninsured deposits ratio of 50% or higher, exceeding FR-B’s 48% before its failure.

- Among these, 54 banks with $187 billion in assets also had a CRE concentration of 25% or more.

"Deterioration of the Credit Quality of CRE Loans"

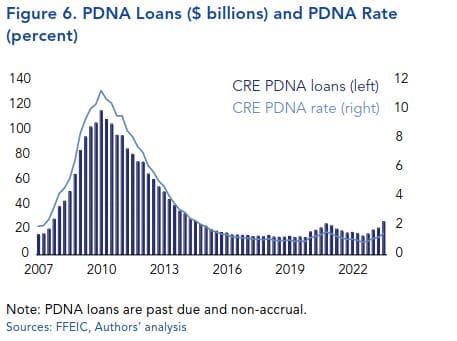

The credit quality of bank CRE loans has recently deteriorated, evidenced by a sharp rise in past due and non-accrual (PDNA) CRE loans.

- As of Q4 2023, PDNA CRE loans totaled $28.7 billion, marking a $12.0 billion or 72% increase since the beginning of the year.

- The PDNA rate rose to 1.28%, up from 0.77% a year ago, reaching its highest level since Q3 2015.

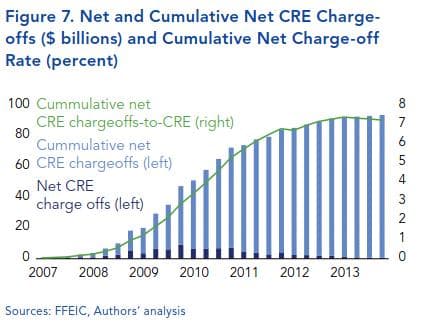

Currently, aggregate CRE net charge-offs are under $1 billion, but these typically lag behind the growth of PDNA loans. Historically, during a CRE downturn, loan losses can be substantial. For instance, the authors call out that during the 2007-2009 financial crisis, cumulative net CRE loan losses escalated to $93 billion, corresponding to a 7.3% CRE net charge-off rate, though these losses were realized over several years.

"Estimated CRE Loan Losses"

The authors state potential future losses from CRE loans remain uncertain, but historical net charge-off rates provide a reference. During the 2007-2009 financial crisis, CRE loan losses peaked at 7.3%. If banks faced a similar rate today, they would incur a $163 billion charge-off. Even at a 4% loss rate, banks would see an $89 billion impairment.

Using these estimates, vulnerable banks—those where CRE loan losses plus unrealized securities losses exceed shareholders' equity—were identified. As of Q4 2023, 185 banks with $524 billion in assets already had unrealized securities losses surpassing their equity. If CRE loan losses hit 4%, 229 banks with $542 billion in assets would be underwater. At an 8% loss rate, 278 banks with $614 billion in assets would be affected.

As of Q4 2023, 185 banks with $524 billion in assets already had unrealized securities losses surpassing their equity. If CRE loan losses hit 4%, 229 banks with $542 billion in assets would be underwater. At an 8% loss rate, 278 banks with $614 billion in assets would be affected.

These 278 banks are generally small, with assets of $1 billion or less, and are mainly located in the Midwest and South. The Midwest has 102 vulnerable banks with $50 billion in assets, while the South has 141 banks with $494 billion in assets. The Northeast and Pacific regions have fewer at-risk banks, with none in New England.

Many of the vulnerable banks have high CRE loan concentrations and large unrealized securities losses. Of the 37 banks reporting uninsured deposits, 18 have an uninsured deposits-to-total deposits ratio of 33% or higher, and seven exceed 50%.

Three states have the highest concentration of vulnerable banks: Texas (43 banks with $442 billion in assets), Alabama (20 banks with $9 billion in assets), and Minnesota (19 banks with $6 billion in assets). These states have 33 banks with significant CRE loan concentrations, and their loan performance is below average, with a Q4 2023 aggregate PDNA rate of 1.94%, compared to the overall bank average of 1.28%.

"The Effect of Changing Interest Rates on Unrealized Securities Losses"

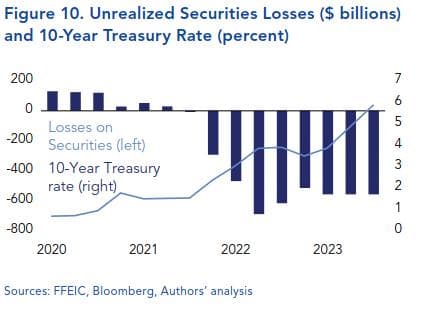

Banks' securities portfolios, largely composed of long-term, fixed-rate debt securities, have suffered significant fair-value losses due to rising interest rates. By Q4 2023, banks faced $478 billion in unrealized securities losses. This shift began when the Federal Open Market Committee (FOMC) started raising rates in March 2022, pushing the federal funds rate target range from 0.25% to 5.50% by July 2023.

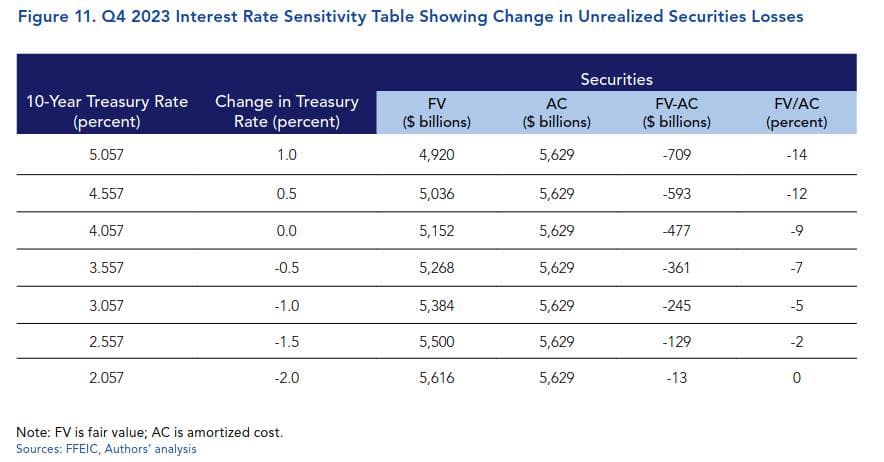

As of Q4 2023, every 50-basis-point change in the 10-year Treasury rate results in a $118 billion change in the aggregate fair value of banks' securities. A 100-basis-point decrease to 3.057% would reduce unrealized losses to $245 billion, while a 100-basis-point increase to 5.057% would raise losses to $709 billion.

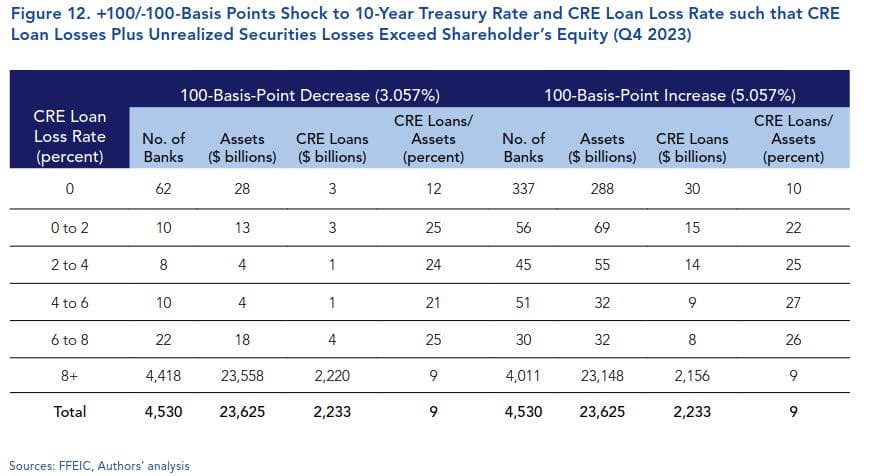

Using different interest rate scenarios, the analysis projects the impact on banks' securities portfolios and their vulnerability to commercial real estate (CRE) loan losses. In a scenario with a 100-basis-point rate decrease and no CRE loan losses, 62 banks with $28 billion in assets would have unrealized securities losses exceeding their equity. If CRE loan losses reach 4%, 80 banks with $45 billion in assets would be impacted; at an 8% loss rate, 112 banks with $67 billion in assets would be affected.

Conversely, in a scenario with a 100-basis-point rate increase, 337 banks with $288 billion in assets would have unrealized securities losses surpassing their equity. At a 4% CRE loan loss rate, 438 banks with $412 billion in assets would be vulnerable; at an 8% loss rate, 519 banks with $477 billion in assets would face combined realized and unrealized losses exceeding their shareholders' equity.

The authors conclude that many banks are still grappling with conditions similar to those that led to the significant bank failures in 2023, including substantial unrealized securities losses and high levels of uninsured deposits. The added prospect of CRE loan losses heightens the risk, particularly for smaller banks with assets of $1 billion or less. Even if interest rates decrease this year, hundreds of banks with substantial total assets remain at risk unless they significantly reduce their CRE exposure or bolster their resilience.

- The Fed staff characterized the U.S. financial system's vulnerabilities as notable. Asset valuation pressures remained elevated, with risk premiums low compared to historical standards.

- House prices were still high relative to fundamentals, and commercial real estate (CRE) prices continued to decline, particularly in the multifamily and office sectors, where vacancy rates increased.

- The staff provided an update on its assessment of the stability of the U.S. financial system and, on balance, continued to characterize the system's financial vulnerabilities as notable.

- The staff judged that asset valuation pressures remained elevated, with estimates of risk premiums across key markets low compared with historical standards. House prices remained elevated relative to fundamentals.

- CRE prices continued to decline, especially in the multifamily and office sectors, and vacancy rates in these sectors continued to increase.

- Participants generally noted that some banks and nonbank financial institutions likely have vulnerabilities associated with high CRE exposures through loan portfolios and holdings of CMBS.

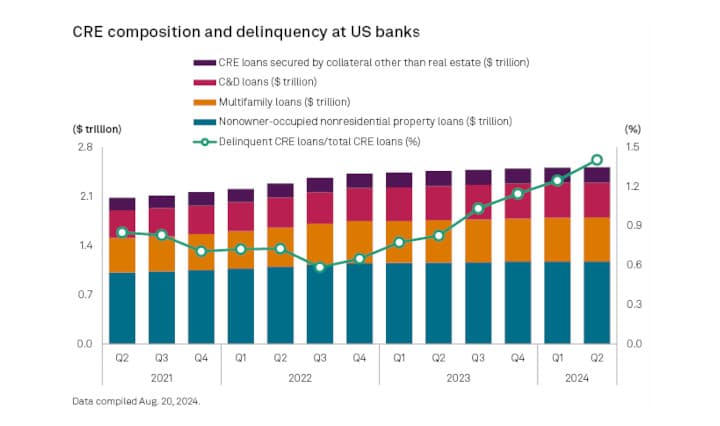

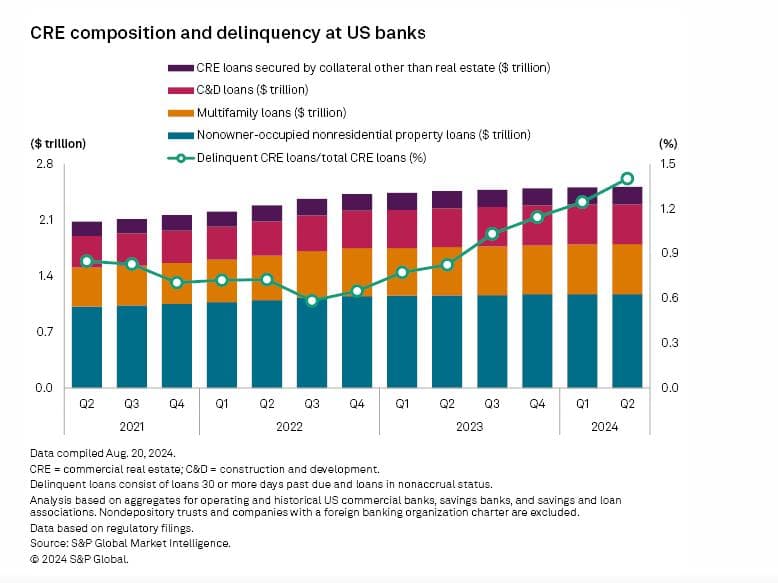

According to data from S&P Global Market Intelligence, the delinquency rate for commercial real estate (CRE) loans across U.S. banks increased to 1.40% in the second quarter, reflecting ongoing stress in the office sector.

CRE borrowers are under pressure from higher interest rates as loans mature, though potential Federal Reserve rate cuts might offer some relief. The office sector, in particular, continues to struggle with high vacancy rates and declining property values, leading banks to increase loss reserves.

Additionally, CRE loan growth has slowed significantly, with year-over-year growth dropping to 2.2% in the second quarter from 12.1% in the third quarter of 2022. The largest category, nonowner-occupied, nonresidential property loans, saw only 1.2% growth, while construction and development loans grew by 2.0%, both well below recent peaks. The slowdown reflects declining property values and stricter lending standards.

TLDRS:

- The FDIC reported that U.S. commercial banks and savings institutions earned $71.5 billion in net income for Q2 2024, up $7.3 billion (11.4%) from Q1, driven by lower noninterest expenses and one-time gains.

- The profit increase was mainly due to a $3.6 billion reduction in noninterest expenses and $10 billion in gains from equity security transactions and a $4.9 billion after-tax gain from the sale of an institution’s insurance division.

- Community banks' net income rose modestly to $6.4 billion, up 1.1% from Q1 2024, due to higher net interest and noninterest income.

- The industry’s net interest margin (NIM) declined by one basis point to 3.16%, driven by larger banks, while community banks saw a seven basis-point increase in NIM.

- Total loan balances grew by $125.8 billion (1.0%) quarter-over-quarter, with the largest increases in loans to nondepository financial institutions and consumer loans. Annually, loans increased by $244.5 billion (2.0%).

- The net charge-off rate rose to 0.68%, the highest since Q2 2013, while credit card net charge-offs increased to 4.82%, the highest since 2011.

- Domestic deposits decreased by $197.7 billion (1.1%) from Q1 2024, driven by declines in savings and transaction deposits, though small time deposits grew.

- The Deposit Insurance Fund (DIF) balance increased by $3.9 billion, raising the reserve ratio by four basis points to 1.21%.

- The number of FDIC-insured institutions fell by 29 to 4,539 in Q2 2024 due to mergers and one bank failure.

- Unrealized losses on securities totaled $54.8 billion, down 1.4% from Q1 2024 and 12.3% year-over-year, with most community banks (96.7%) reporting unrealized losses.

- Remember, "As of Q4 2023, 185 banks with $524 billion of assets had unrealized securities losses that exceeded their shareholders’ equity."

- Even if interest rates decrease this year, hundreds of banks with substantial total assets remain at risk unless they significantly reduce their CRE exposure or bolster their resilience.

FDIC Second Quarter Quarterly Banking Profile: "The vast majority of community banks (96.7%) reported unrealized losses on securities."https://t.co/gbXTEK8n8r

— dismal-jellyfish (@DismalJellyfish) September 5, 2024