Public Input Sought on Proposed CFTC Rule: The Protection of Clearing Member Funds Held by Derivatives Clearing Organizations

The CFTC proposes rule changes, protecting clearing members' funds through segregation, central bank locations, aligned investments, strict controls, daily reconciliation, and foreign DCO exemptions. Open for public comments.

Amidst the dynamic landscape of rules and regulations, our focus shifts once again to the latest developments in the US Financial Markets.

And now it seems like we're getting to the stage of things where financial institutions are putting safeguards in place to ensure they aren't left in the hot seat when the economy enviably begins to collapse.

CFTC Protection of Clearing Member Funds Held by Derivatives Clearing Organizations

Rule Sourced Courtesy of Dismal-Jellyfish.

The Commodity Futures Trading Commission (CFTC) - a U.S. government agency overseeing commodity futures markets - have proposed a new rule change, in which the SEC is seeking comments.

If you're anything like me, simplicity helps.

So let's break things down a little so we can all get on the same page.

The proposed rule by Commodity Futures Trading Commission (CFTC) - a U.S. government agency overseeing commodity futures markets - aims to establish regulations ensuring the proper treatment of Clearing Member funds and assets in the event of a Derivatives Clearing Organization (DCO) entering bankruptcy.

The rule mandates the segregation of clearing member funds from the DCO's own funds, requiring them to be held separately in designated accounts that unmistakably identify them as belonging to clearing members. Additionally, it introduces measures to address the treatment of proprietary funds, enhancing safeguards and preventing misuse.

What is a Derivatives Clearing Organisation:

Who Are The Clearing Members:

Clearing Members, such as brokerage firms like Charles Schwab, banks like J.P. Morgan, and financial institutions like Goldman Sachs, provide services to investors, encompassing both individual traders and institutional clients.

Customers of Clearing Members, who trust these financial entities with their funds, engage in various derivative transactions through these members.

Many financial institutions use the Derivatives Clearing Organisation (DCO) to facilitate these financial transactions.

This can be used for stock trading, investments and other financial services as an example.

In addition to the mentioned brokerages, several other well-known financial institutions and trading platforms use the Derivatives Clearing Organisation (DCO) to facilitate financial transactions. Additional names include:

- J.P. Morgan

- Goldman Sachs

- Morgan Stanley

- Citigroup

- Deutsche Bank

- Bank of America Merrill Lynch

- CME Group (operates clearinghouses)

- Nasdaq (utilizes clearing services)

- Chicago Board Options Exchange (CBOE)

- London Stock Exchange Group (LSEG)

As such, this new CFTC rule indicates a proactive move by major financial players to safeguard their interests amid anticipated challenges in the financial markets.

By strengthening protections for clearing member funds, particularly proprietary funds, and ensuring their proper treatment and segregation in the face of potential financial challenges or DCO bankruptcy - it could signal a strategic effort by financial institutions to fortify their defenses and safeguard assets, possibly indicating a defensive posture as they anticipate or navigate market disruptions.

Proprietary funds refer to the capital and financial assets belonging to a financial institution, such a brokerage firm, as opposed to funds held on behalf of customers. These funds are distinct from customer funds.

The CTFC rule priortises Clearing Members interests, with their assets protected from a failing counterpart (DCO) by means of separation. These same clearing members that hold customer funds. Although there is no guarantee that these same institutions will extend the same protection to their own customers in certain situations.

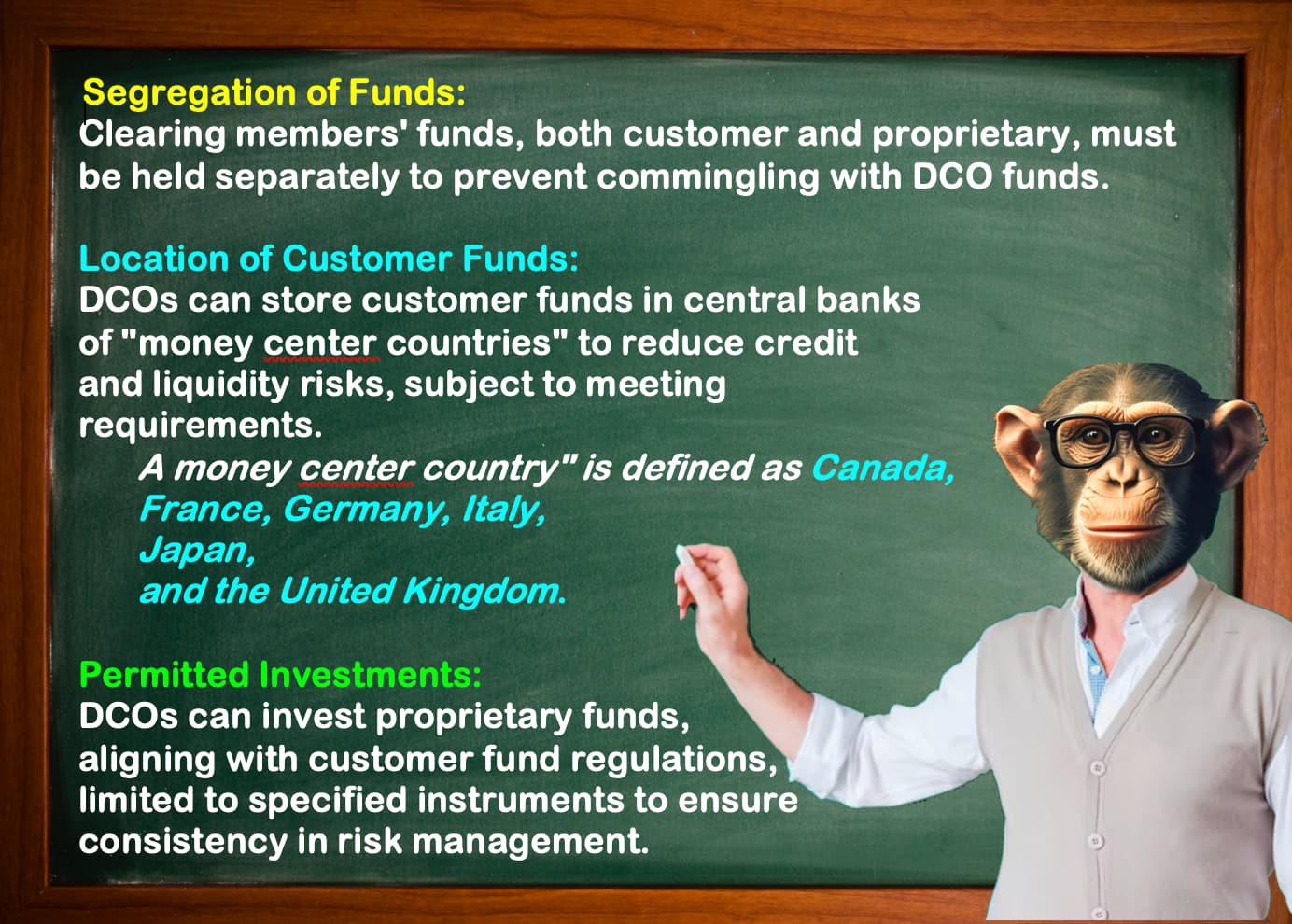

Clearing members' funds, both customer and *proprietary, would be required to be held in separate accounts, minimising the risk of commingling with the DCO's funds.

The term "proprietary funds" is defined to encompass all money, securities, and property held in a proprietary account on behalf of clearing members, used for various purposes, including margining and securing contracts.

⭐️⭐️⭐️

Proposed Rule Changes:

§ 39.15(b)(3)

Holding Customer Funds at Central Banks:

§ 39.15(b)(3) proposes a change regarding the location where Derivatives Clearing Organizations (DCOs) can hold customer funds. The amendment suggests allowing DCOs to deposit customer funds at the central bank of a "money center country."

A "money center country" is defined as Canada, France, Germany, Italy, Japan, and the United Kingdom.

This proposed change is expected to provide potential advantages to clearing members by limiting credit and liquidity risks associated with holding funds in central banks of these specific countries. However, to implement this, DCOs would need to meet certain requirements, and a modified written acknowledgment from the central bank would be necessary. This acknowledgment serves as confirmation that the funds deposited are customer funds and are held in compliance with relevant regulations.

§ 39.15(b)(3) aims to let the DCO store customer funds in major countries' central banks, ⚠️ intending to mitigate credit and liquidity risks for clearing member ⚠️ subject to meeting set requirements and obtaining written acknowledgment from the central bank.

⭐️⭐️⭐️

§ 39.15(e)

Permitted Investments:

This section proposes an amendment to align the investment of proprietary funds with the regulations governing customer funds. DCOs would be permitted to invest proprietary funds only in instruments allowed for customer funds under § 1.25. The rule specifies that any losses from such investments would be borne by the DCO. The list of permissible investments includes U.S. government obligations, state or municipal bonds, certificates of deposit, and interests in money market funds. The proposed alignment ensures consistency in risk management for all types of clearing members.

§ 39.15(e) allows Derivatives Clearing Organizations (DCOs) to invest proprietary funds, but limits these investments to the same types of instruments allowed for customer funds held by clearing members under § 1.25.

⭐️⭐️⭐️

§ 39.15(f)

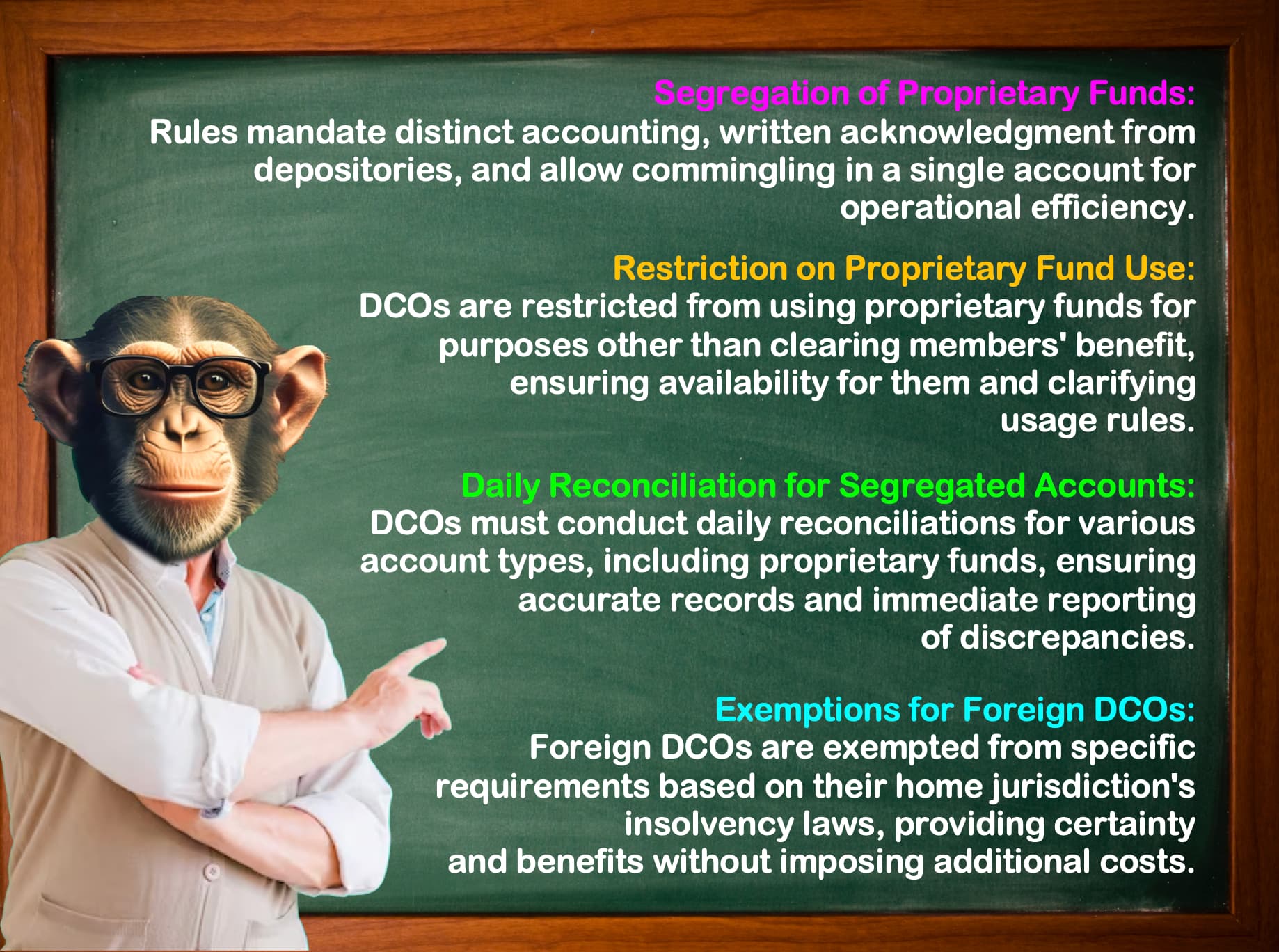

The Segregation of Proprietary Funds:

- § 39.15(f)(1)) requires distinct accounting and naming of funds belonging to clearing members. It mandates the DCO to maintain sufficient resources to cover the total value of proprietary funds owed, preventing misuse or rehypothecation.

- § 39.15(f)(2) introduces a written acknowledgment requirement from depositories holding proprietary funds, emphasizing exclusive ownership by clearing members and facilitating oversight and identification in the event of a DCO bankruptcy. The rules necessitate that clearing member funds, including proprietary funds, be securely held in depositories. The depository must explicitly acknowledge in writing that the funds are the rightful property of clearing members, imposing an additional layer of assurance and delineating ownership boundaries. In practical terms, if a bank is utilized by a DCO to store clearing members' proprietary funds, the bank must furnish a written acknowledgment certifying the proprietary nature of these funds and their exclusive ownership by clearing members. This proprietary funds letter would explicitly affirm that the proprietary funds held by the DCO on behalf of clearing members are dedicated exclusively to their intended purpose and cannot be utilized for any other purposes."

- § 39.15(f)(3) permits commingling of proprietary funds from multiple clearing members in a single account, streamlining operational processes while maintaining a clear separation from the DCO's own funds and customer funds.

§ 39.15(f) ensures that the DCO separates and safeguards clearing members' proprietary funds, requiring distinct accounting, a written acknowledgment from depositories, and allowing commingling of funds in a single account for operational efficiency.

⭐️⭐️⭐️

§ 39.15(f)(4)

Restriction on Proprietary Fund Use:

Seeks to restrict the use of proprietary funds by Derivatives Clearing Organizations (DCOs) and their depositories exclusively for the benefit of clearing members. This includes specifying permissible uses for Futures Commission Merchant (FCM) funds. The primary benefits lie in ensuring the availability of proprietary funds for clearing member requirements and providing clarity on acceptable uses, thereby avoiding impediments to risk management. Anticipated costs are minimal, as the amendment essentially formalizes existing risk management principles.

§ 39.15(f)(4) Restricts Derivatives Clearing Organizations (DCOs) from using proprietary funds for anything other than clearing members' benefit, ensuring these funds are available for them and clarifying usage rules, with minimal expected costs.

⭐️⭐️⭐️

§ 39.15(g)

Daily Reconciliation for Segregated Accounts:

Introduces a requirement for DCOs to conduct daily reconciliations for each type of segregated account, including futures customer funds, cleared swaps customer collateral, and proprietary funds. The rule would obligate the DCO to conduct a daily calculation of the owed amounts to clearing members. This practice, which encompasses proprietary funds, would mandate records are up-to-date and any discrepancies promptly identified and rectified - guaranteeing that the DCO has enough money to cover any amounts owed to its participants. As an illustration, the DCO would undertake a thorough daily review of the proprietary funds owed to each clearing member, cross-referencing the figures with the actual funds held to maintain precision.

- § 39.15(g)(1), (2), and (3): Requires the DCO to calculate and reconcile the amounts of futures customer funds, cleared swaps customer collateral, and proprietary funds owed to each clearing member. This ensures that the DCO maintains sufficient funds in each relevant account type to cover its aggregate obligations to clearing members.

- § 39.15(g)(4): Specifies the method for conducting calculations, including the segregation of duties, valuation of securities, handling currency mismatches, and treatment of commingled funds in different types of customer accounts.

- § 39.15(g)(5): Requires immediate reporting to the Commission of any discrepancies in calculations or reconciliations, indicating a failure to maintain sufficient segregated funds.

§ 39.15(g) mandates DCOs to perform daily checks on different accounts, ensuring they have enough funds to cover obligations, and promptly report any discrepancies to the Commission.

⭐️⭐️⭐️

§§ 39.15(g) & 39.19(c)(4)(xxvi)

Daily Fund Checks and Reporting:

The focus is on requiring DCOs to conduct daily calculations and reconciliations for various fund categories, with an obligation to report any discrepancies immediately to the Commission. This procedural change aims to facilitate the prompt detection of missing funds, prevent misuse through independent approval, and ensure the Commission is immediately informed of any discrepancies. The associated costs revolve around the daily operational aspects of calculations and reconciliations, with an estimated Paperwork Reduction Act (PRA) cost of $100 per burden hour.

§§ 39.15(g) and 39.19(c)(4)(xxvi) require Derivatives Clearing Organizations to do daily checks on their funds, quickly report any issues to the Commission, and estimate it could cost $100 per hour for paperwork.

⭐️⭐️⭐️

§ 39.15(h)

Exemptions for Foreign DCOs

Addresses foreign DCOs, exempting them from specific requirements based on the insolvency law of their home jurisdiction. This exemption provides certainty regarding the application of insolvency law for foreign DCOs and benefits the clearing members associated with these entities. Importantly, there are no expected costs for foreign DCOs, as the amendment aligns with existing treatment under the law of their home jurisdiction. § 39.15(h) excludes certain DCOs organized outside the United States (foreign DCOs) from specific member property protections related to permitted investment of proprietary funds, proprietary funds, and daily reconciliation of proprietary funds. This exclusion is based on potential conflicts with foreign insolvency proceedings.

§ 39.15(h) provides exemptions for Foreign DCOs, aligning with their home jurisdiction's insolvency laws to offer certainty and benefit clearing members, without imposing additional costs.

⭐️⭐️⭐️

Additional:

§ 39.19(c)(4)(xxvi) includes the reporting requirement from § 39.15(g)(5), mandating DCOs to report any discrepancies in the amount of proprietary or customer funds they hold. This consolidated reporting section aims to assist DCOs in tracking their reporting obligations.In case the DCO goes bankrupt, these rules make sure that the money owed to the Clearing Members gets repaid first before other debts are settled.

The rule in full is here: https://public-inspection.federalregister.gov/2023-28767.pdf

Put simply:

The CFTC is asking for public opinions (comments) on these rules.

- CFTC Comments Portal: Visit https://comments.cftc.gov, find the link for this specific rulemaking under “Submit Comments,” and follow the instructions provided on the Public Comment Form.

- Mail: Address your comments to Christopher Kirkpatrick, Secretary of the Commission, Commodity Futures Trading Commission, at Three Lafayette Centre, 1155 21st Street, NW, Washington, DC 20581.

- Hand Delivery/Courier: Deliver your comments to the same address as for mail submissions, following the same guidelines.

With much appreciation to Dismal-Jellyfish for the sourcing the rule as above. For more information, see the original post here.

- Choose Only One Method: Submit your comments through only one of the above methods. Submissions via the CFTC Comments Portal are particularly encouraged.

- Language Requirement: Comments should be in English. If submitted in another language, they must be accompanied by an English translation.

- Public Posting: Comments will be posted as received on https://comments.cftc.gov.

- Only submit information you are comfortable making public.

- Moderation and Accessibility: The Commission reserves the right to review, prescreen, filter, redact, refuse or remove any submission deemed inappropriate for publication, such as those containing obscene language.

- However, all submissions, even those redacted or removed, that contain comments on the merits of the rulemaking will be retained in the public comment file.

- They will be considered as required under the Administrative Procedure Act and other applicable laws, and may be accessible under the FOIA.

TL;DR

- RULE NAME: 17 CFR Part 39 / RIN 3038-AF39 / Protection of Clearing Member Funds Held by Derivatives Clearing Organizations

- RULE DOCUMENT: https://public-inspection.federalregister.gov/2023-28767.pdf

- RULE SUMMARY: Proposed rules aim to protect clearing members' funds by segregating them, specifying central bank locations for customer funds, aligning proprietary fund investments, enforcing strict usage controls, and implementing daily reconciliation, with exemptions for foreign DCOs based on their home jurisdiction's laws.

- DEADLINE: Friday 16th February 2024

- Send your comment via https://comments.cftc.gov, find the link for this specific rulemaking under “Submit Comments, (and follow the instructions provided on the Public Comment Form.

Get involved with shaping YOUR markets. Submit your comments.

If you have thoughts on how this proposal could be better or if you're concerned about something, sharing your comments below to help shape the final rules in a way that's fair and sensible.

Remember: Change starts with us.

That's all folks.

Be excellent to each other.