CFTC Approves Proposed Amendments to Regulations Regarding Real-Time Public Reporting and Swap Data Recordkeeping and Reporting Requirements

Background:

The Commission’s real-time public reporting and swap data reporting regulations were first adopted in 2012, and are located in parts 43 and 45 of the Commission’s regulations. The 2012 Real-Time Public Reporting of Swap Transaction Data Final Rule (the “2012 RTR Final Rule”) set forth regulations that require swap counterparties, swap execution facilities (“SEFs”), and designated contract markets (“DCMs”) to report publicly reportable swap transactions (“PRST”) to swap data repositories (“SDRs”). Additionally, the 2012 RTR Final Rule set forth regulations that require SDRs to publicly disseminate swap transaction and pricing data (“STAPD”) in real-time, subject to certain exceptions.

In the 2012 Swap Data Recordkeeping and Reporting Requirements Final Rule (“2012 SDRR Final Rule”), the Commission implemented the swap data reporting rules. The part 45 regulations require SEFs, DCMs, and reporting counterparties (“RCPs”) (collectively, “Reporting Entities”) to report swap data to SDRs. SDRs collect and maintain data related to swap transactions, making such data electronically available for regulators or the public.

In 2013, the Commission adopted a block trade rule to implement the statutory requirements of Commodity Exchange Act (“CEA”) section 2(a)(13)(E)(i)–(iv). In 2016, the Commission amended part 45 to set forth swap data reporting obligations with respect to cleared swaps.

In 2020, the Commission amended part 43 and part 45 by issuing a new Real-Time Public Reporting Requirements final rule (the “2020 RTR Final Rule”) and Swap Data Recordkeeping and Reporting Requirements final rule (the “2020 SDRR Final Rule”) (collectively the “2020 Final Rules”). The 2020 RTR Final Rule revised the method and timing for real-time reporting and public dissemination, generally and for specific types of swaps; the delay and anonymization of the public dissemination of block trades and large notional trades; the standardization and validation of real-time reporting fields; the delegation of specific authority to Commission staff; and the clarification of specific real-time reporting questions and common issues.

The 2020 SDRR Final Rule generally revised the reporting regulations to: streamline the requirements for reporting swaps; require SDRs to validate swap reports; permit the transfer of swap data between SDRs; alleviate reporting burdens for non-swap dealer (“SD”)/major swap participant (“MSP”) reporting counterparties; and harmonize with international technical guidance the swap data elements that counterparties are required to report to SDRs.

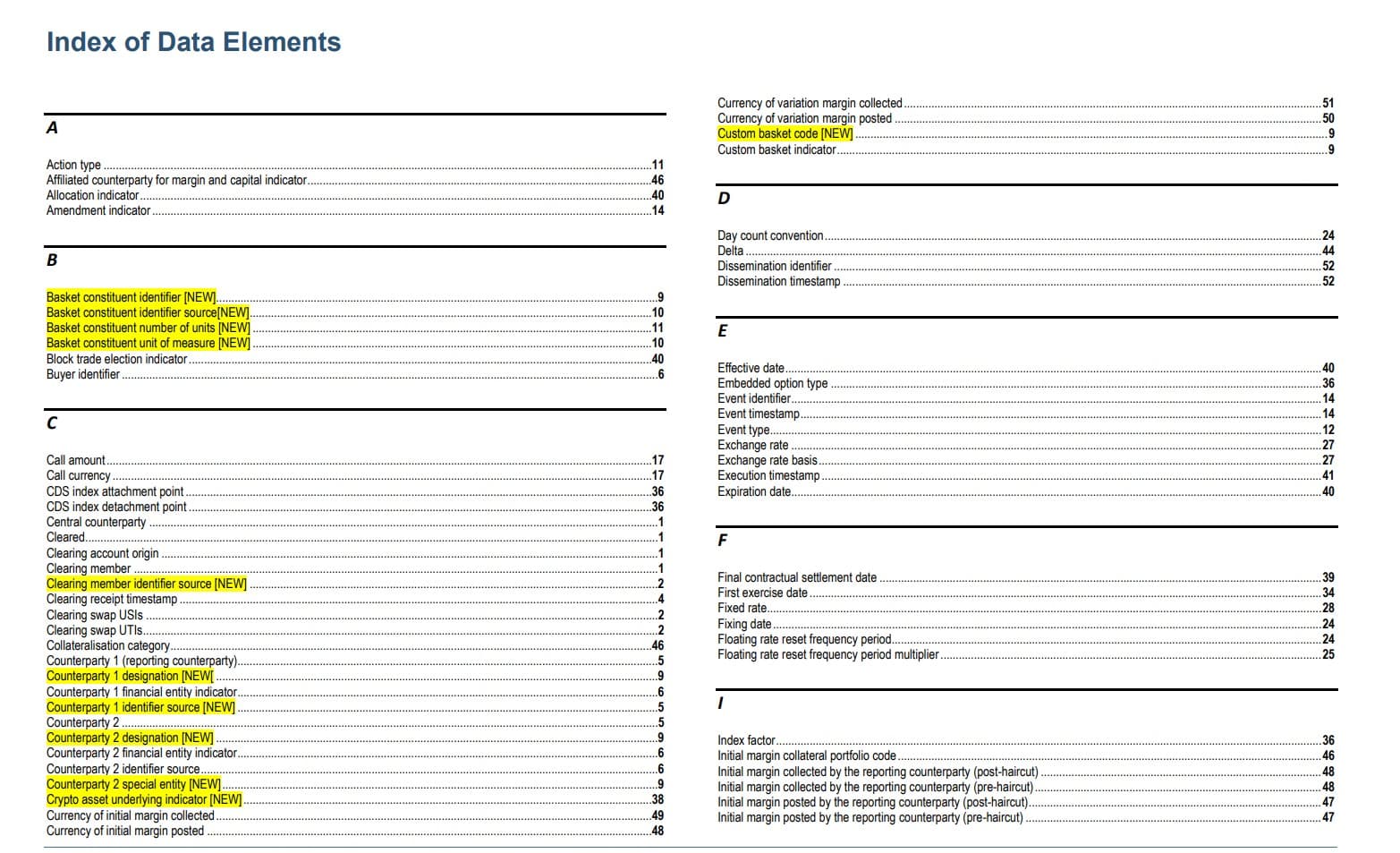

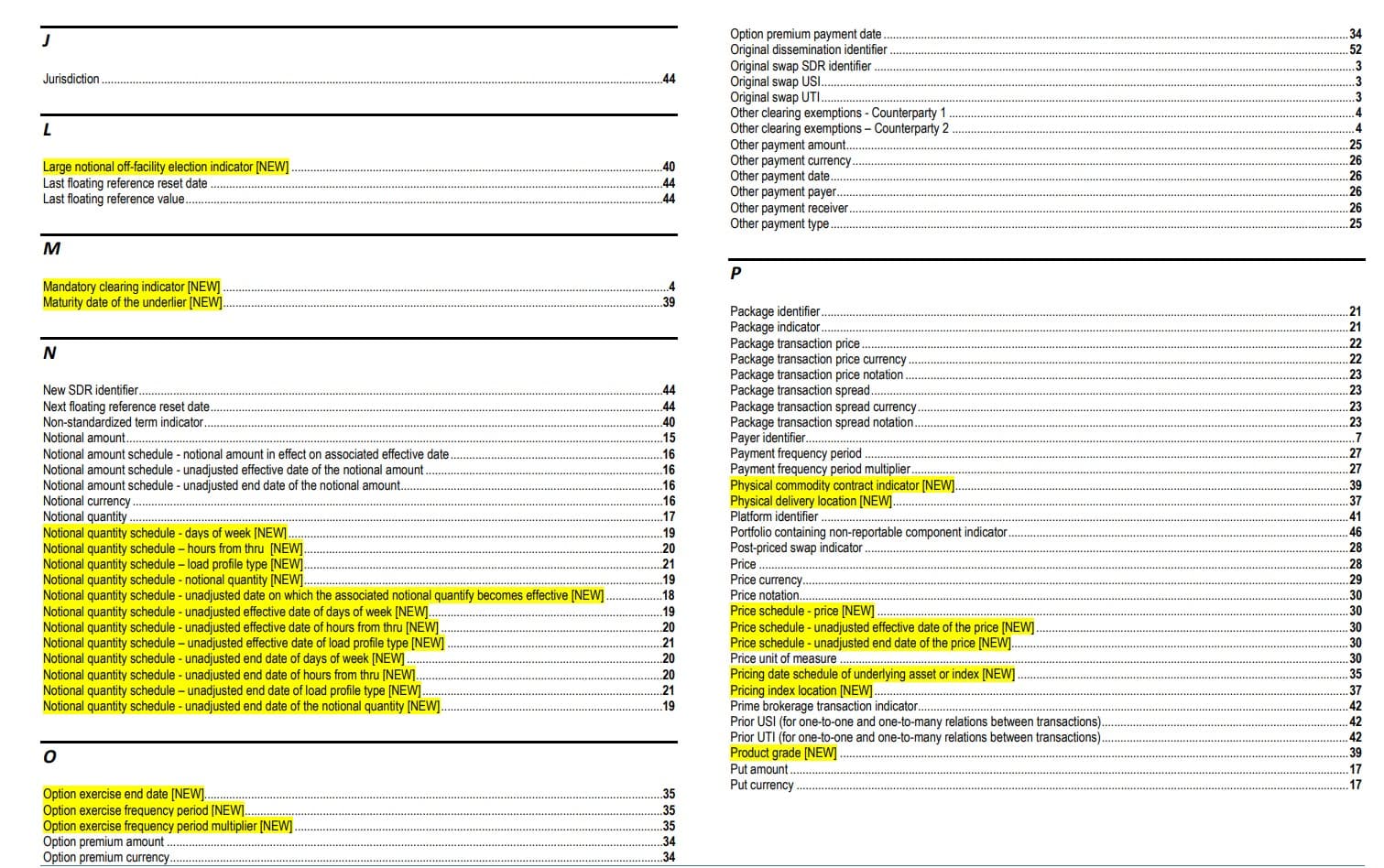

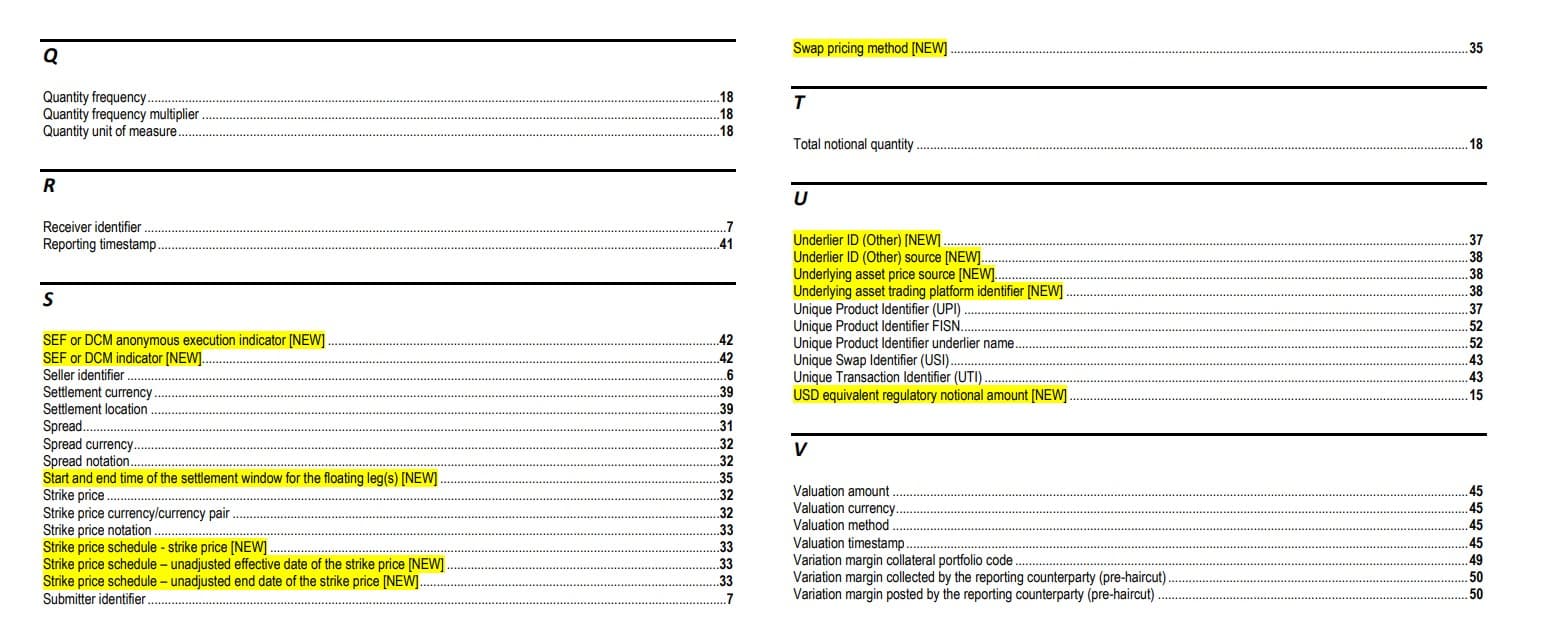

To ensure that the Commission continues to receive accurate and high-quality data on swap transactions for its regulatory oversight role, as well as address international swap reporting developments, the Commission proposes revisions to parts 43 and 45 to: allow for geographic masking after designation of the UPI for swaps falling within the other commodity asset class; implement conforming changes in connection with the geographic masking requirement; add reportable data fields to appendix A to part 43 and appendix 1 to part 45; and implement non-substantive revisions to the descriptions of the existing reportable data elements in such appendices.

Press Release:

The Commodity Futures Trading Commission today announced the approval of a proposed rule to revise CFTC regulations regarding real-time public reporting and swap data recordkeeping and reporting. These proposed measures are part of the agency’s continued efforts towards international data harmonization and to ensure the CFTC continues to receive accurate, complete, and high-quality data on swap transactions.

The proposed amendments to Parts 43 and 45 would allow a unique product identifier and product classification system (UPI) to be implemented for the Other Commodity asset class. On February 16, the CFTC issued an order designating a UPI to be used in swap recordkeeping and data reporting for the Interest Rate, Credit, Foreign Exchange, and Equity asset classes. [See CFTC Press Release No. 8659-23] Use of the UPI for these four asset classes is expected by no later than January 29, 2024. The proposed revisions allow the UPI to be extended to the Other Commodity asset class in the future, in accordance with CFTC regulations.

Additionally, the proposed amendments would modify appendix A to Part 43 and appendix 1 to Part 45 to add certain data elements that will further international harmonization as well as increase data quality, accuracy, and standardization.

Statement of Chairman Rostin Behnam:

I support the proposed rule to amend certain requirements in the Commission’s regulations regarding real-time public reporting and swap data reporting and recordkeeping. Today’s action continues my commitment to improve the CFTC’s dataset and ensure that the agency is a leader in data management and examination. This effort will bolster the CFTC’s ability to monitor micro and macro risk and identify illegal conduct. In addition, today’s proposal will promote international harmonization and market resilience, and ensure that the CFTC continues to receive accurate, complete, and high-quality data on swap transactions.

The proposed amendments to Parts 43 and 45 would allow a unique product identifier and product classification system (UPI) to be implemented for the Other Commodity asset class, in accordance with CFTC regulations. The Commission previously issued an order designating a UPI to be used in swap recordkeeping and data reporting for the Interest Rate, Credit, Foreign Exchange, and Equity asset classes, so today’s proposal, if finalized, will allow the UPI to be extended to the Other Commodity asset class. The proposed amendments also would modify appendix A to Part 43 and appendix 1 to Part 45 to add certain data elements that will further international harmonization and increase data quality, accuracy, and standardization.

I look forward to hearing the public's comments on the proposed amendments to the regulations and the relevant appendices in Part 43 and 45 of the Commission’s regulations. I thank staff in the Division of Market Oversight, Office of the General Counsel, and the Office of the Chief Economist for all of their work on the proposal.

Statement of Commissioner Kristin N. Johnson:

At its peak at the end of 2007, the notional amount outstanding in the credit default swaps market is estimated to have reached a staggering $61.2 trillion.[1] In 2008, the near collapse of the largely bespoke over-the-counter (OTC) swaps market, most notably the credit default swap market, was a precipitating cause of the global financial crisis,[2] which the U.S. Government Accountability Office estimates resulted in roughly $10 trillion in losses, including large declines in employment and household wealth, reduced tax revenues from lower economic activity, and lost output.[3] An exemption from regulation for OTC swaps trading in bilateral markets obscured massively excessive risk-taking and undermined the integrity of global markets. The lack of reporting requirements for swap transactions left regulators with limited visibility into the OTC swaps market.

In the wake of this economic devastation, the G20 leaders met in Pittsburgh in 2009 and agreed to introduce order, transparency, and supervision in the bespoke, bilateral swaps market to ensure that regulators would never again be blind to emerging risks in this market. President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) into law on July 21, 2010. In recognition of the importance of having visibility into the swaps market, among many other things Dodd-Frank mandated centralized clearing and exchange-trading of many OTC derivatives, as well as requiring reporting of all swaps to swap data repositories (SDRs), including those not subject to or exempt from the clearing requirement.

As Dodd-Frank recognized, it is imperative that regulators understand the risk in the market in order to effectively regulate it, and empowered the CFTC to regulate swaps.[4] Taking up this mantle, the Commission adopted real-time public reporting and swap data reporting regulations in 2012, which are located in Parts 43 and 45 of the Commission’s regulations.[5] Under these regulations, swap counterparties, swap execution facilities, and designated contract markets report publicly reportable swap transactions to SDRs.

The Commission’s Division of Market Oversight (DMO), Division of Data (DOD), and Office of the Chief Economist (OCE) are responsible for reviewing the information received from the SDRs and monitoring it for systemic risk, with the goal in part to prevent another collapse from unseen exposure to particular market segments. Due to the nature of derivative contracts, risk can become multiplied several times over, untethered from the exposure to the underlying asset itself. Parts 43 and 45 achieve the necessary visibility for the Commission to effectuate its mandate under Dodd-Frank to monitor the swaps market through this reporting regime. In 2020, the Commission amended parts 43 and 45 to, among other things, streamline the requirements for reporting swaps, require SDRs to validate swap reports, permit the transfer of swap data between SDRs and generally harmonize the swaps data being reported with international guidance.[6]

The new proposed rule furthers the Commission’s ongoing duty to effectively monitor the swaps market by promoting international harmonization, implementing unique product identifiers (UPIs) and allowing for geographic masking. The revisions specifically: (1) allow for geographic masking after designation of UPIs for swaps falling within the other commodity asset class, a key revision to avoid reports to SDRs of UPIs that contain detailed geographic information in contravention of Regulation 43.4(c)(4)(iii) and Appendix E to Part 43; (2) add reportable data fields to Appendix A to Part 43 and Appendix 1 to Part 45 from the current 2023 CDE Technical Guidance; and (3) implement non-substantive revisions to the descriptions of the existing reportable data elements in the forgoing appendices to harmonize with changes made at the international level. I am pleased to support this rule that allows us to continue to fulfill our ongoing commitment to protecting U.S. markets through regulatory oversight.

I commend the staff of the Division of Market Oversight, the Division of Data, and the Office of the Chief Economist for bringing to the Commission a thorough and reasoned proposal for further refining swap data reporting obligations. In particular, I would like to thank Isabella Bergstein, Owen Kopon, Alicia Viguri, and Chase Lindsey of DMO; Kate Michel and Robert Stowsky of DOD; and John Roberts and Lee Baker of OCE.

Statement of Commissioner Summer K. Mersinger:

The Commission’s notice of proposed rulemaking (“NPRM”) to amend the swap data reporting rules in Parts 43 and 45 of its regulations[1] constitutes another step in its years-long effort to implement the swap data reporting regime established by the Dodd-Frank Act,[2] and to enhance the quality of that data to better enable the agency to fulfill Congress’s objectives.

The NPRM would allow for the use of the recently-designated unique product identifier in the “other commodity” asset class by adopting a reporting process that would prevent the “unintended disclosure of the identities, business transactions or market positions of swap counterparties.”[3] I support this part of the NPRM, and I look forward to hearing from market participants as to any concerns they foresee in this regard.

I have serious reservations, however, about the Commission taking the opportunity to also propose requiring the reporting of several new CFTC-specific data elements that are not required by many other jurisdictions. Sadly, this is becoming something of a trend by the Commission—proposing rule amendments for a specific purpose, and then tacking on additional proposals that are poorly sourced, not well justified, and quite burdensome from a compliance perspective.

Of course, the Commission and its staff must have access to swap data they need to perform the mission that Congress has assigned the CFTC in the Commodity Exchange Act. But while I am not an expert in the technology required to report swap data, and while I have never been involved in running a global financial institution, I am quite sure that complying with new requirements to report additional data fields does not involve just flipping a switch.

I fear that we as a Commission often fail to appreciate the incredible amount of effort and resources that market participants must expend whenever we decide to tweak, or issue a new dictate regarding, our swap data reporting requirements. And I wish we would weigh such considerations more heavily before we tack on these additional reporting data fields that are not necessary to harmonize our swap reporting rules with those of the international regulatory community—especially since market participants have just finished the massive job of complying with the substantial revision of our swap reporting regime that the Commission adopted three years ago.[4]

Given these reservations, I cannot endorse this part of the NPRM. But I will vote to concur in putting the full NPRM out for comment so that we can learn about the impact of these additional required fields directly from those who will have to report them.

How to comment:

- Comments on the proposed rule must be submitted within 60 days of its publication in the Federal Register.

- Comments can be submitted via the CFTC Comments Portal at https://comments.cftc.gov. Select the “Submit Comments” link for this rulemaking and follow the instructions provided.

- Alternatively, comments can be mailed to Christopher Kirkpatrick, Secretary of the Commission, at the Commodity Futures Trading Commission, Three Lafayette Centre, 1155 21st Street NW, Washington, DC 20581.

- Comments may also be delivered by hand or courier, following the same instructions as for mailed submissions.

- To ensure efficiency and avoid delays, using the CFTC Comments Portal is encouraged.

- All comments should be in English or accompanied by an English translation and will be posted as received on https://comments.cftc.gov.

- Submissions should only include information intended for public disclosure. For information exempt under the Freedom of Information Act, a petition for confidential treatment can be submitted according to the Commission's regulations in § 145.9.

- The Commission reserves the right to review, filter, redact, or remove submissions deemed inappropriate for publication but will retain and consider all substantive comments for the rulemaking, even those redacted or removed, in compliance with the Administrative Procedure Act and FOIA.

TLDRS:

- The Commodity Futures Trading Commission (CFTC) has proposed a rule to revise its regulations on real-time public reporting and swap data recordkeeping and reporting, aiming to continue receiving accurate and high-quality data on swap transactions and align with international data harmonization.

- The amendments to Parts 43 and 45 of the CFTC regulations would introduce a unique product identifier (UPI) system for the Other Commodity asset class, extending the UPI system already designated for Interest Rate, Credit, Foreign Exchange, and Equity asset classes.

- The proposed rule changes include modifying appendix A to Part 43 and appendix 1 to Part 45 to add new data elements for further international harmonization and improvement in data quality, accuracy, and standardization.

- The CFTC's real-time public reporting and swap data reporting regulations, established in 2012 and located in parts 43 and 45, require swap counterparties, swap execution facilities (SEFs), designated contract markets (DCMs), and swap data repositories (SDRs) to report and publicly disseminate swap transaction data.

- In 2020, the CFTC amended these regulations to streamline swap reporting requirements, require SDRs to validate swap reports, permit transfer of swap data between SDRs, and harmonize reporting with international standards.

- The proposed revisions will also address geographic masking for swaps in the Other Commodity asset class after the UPI designation, include additional reportable data fields, and make non-substantive changes to descriptions of existing reportable data elements.

- These updates are intended to enhance the CFTC's oversight capabilities in the swap market and align its reporting requirements with evolving international standards, ensuring continued access to accurate and comprehensive swap transaction data.

- Comments on the proposed rule must be submitted within 60 days of its publication in the Federal Register.