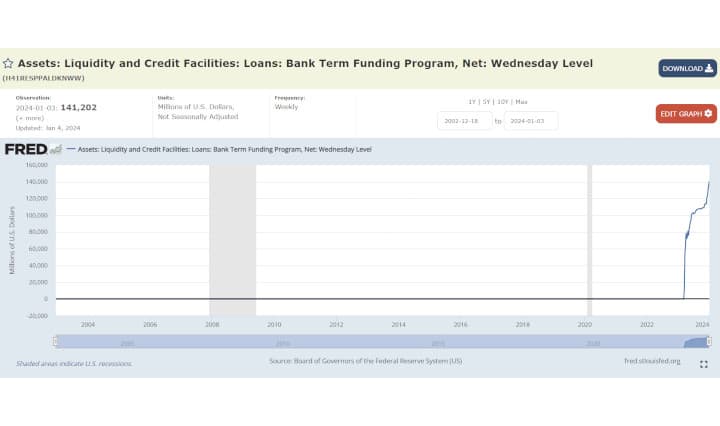

Part of the ticking time bomb fueling the explosive reverse repo growth? Banks have lent $2.4trn to commercial property in America alone. But they have brought loan-to-value ratios down from the dizzying heights of the financial crisis.

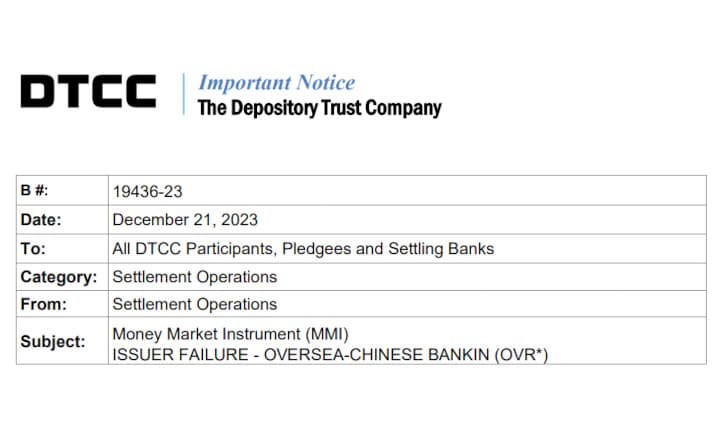

Another example, On April 7, The Wallstreet Journal reported that Destiny USA’s owner, Pyramid Management Group, hired representation to look into restructuring the mall’s debt, which includes CMBS and municipal securities known as PILOTs (Payments In-Lieu of Property Taxes). I don’t know much about PILOTs but I only bring it up because the PILOT debt is senior to the larger of Destiny USA’s two CMBS.

These two debt issues represent a total of roughly $716 million in outstanding principal ($286 Million in PILOT and $430 million in CMBS).

However, appraisers lowered the mall’s valuation to just $203 million. That is not even enough to even cover the $286 million in PILOT bonds (which would get paid first!), leaving CMBS investors holding the bag.

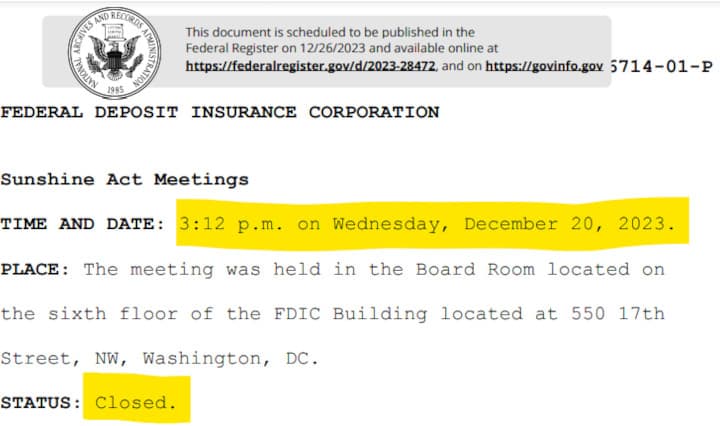

Fed intervention and inflated bond ratings will continue to prop up zombie CMBS, but they are a ticking time bomb.