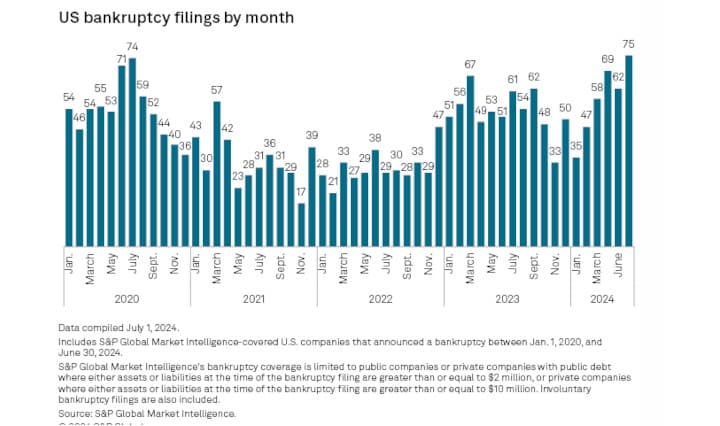

Office of Financial Research: "As of Q4 2023, 185 banks with $524 billion of assets had unrealized securities losses that exceeded their shareholders’ equity."

The 2023 bank failures revealed banks' vulnerability to unrealized securities losses and rapid uninsured deposit withdrawals. Despite this, many banks still hold significant unrealized securities losses and uninsured deposits at risk of major commercial real estate (CRE) loan losses. This analysis from the Office of Financial Research (OFR) identifies