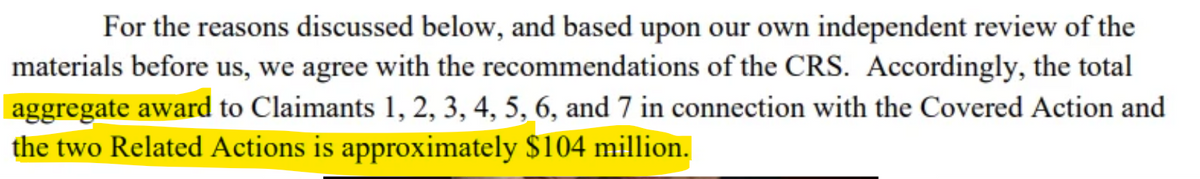

Whistleblower Alert! SEC Awards More Than $104 Million to Seven Whistleblowers the fourth largest in the SEC’s whistleblower program’s history.

Since the award can range from 10% to 30% of the fine, the award given is somewhere in this range:

* Given that the award is $104 million, the equation could be represented as:

* 0.10x≤$104 million

* 0.30x≥$104 million

* The fine for this award ranged between $346.67