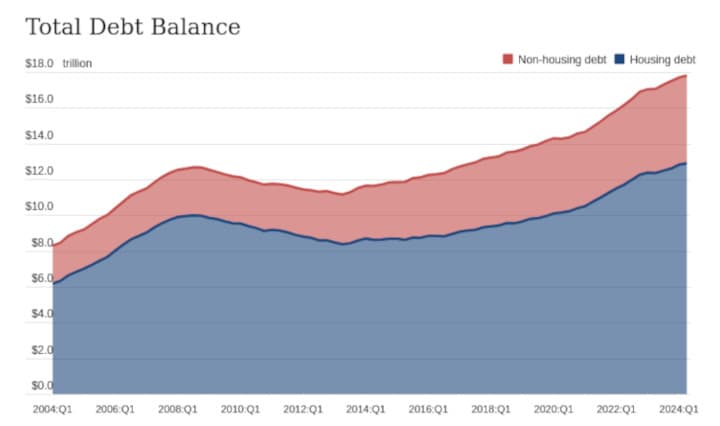

NY Fed Q2 Report on Household Debt & Credit: Total household debt rose by $109 billion to reach $17.80 trillion. Auto & credit card delinquency rates remain elevated.

The Federal Reserve Bank of New York’s Center for Microeconomic Data released its Quarterly Report on Household Debt and Credit for Q2, revealing a $109 billion (0.6%) increase in total household debt in Q2 2024, reaching $17.80 trillion.

Key Findings:

* Mortgage balances rose by $77 billion to