FINRA Names Bill St. Louis as New Head of Enforcement. St. Louis will be responsible for the management of approximately 350 enforcement staff in 11 offices across the United States and will report directly to FINRA CEO Robert Cook.

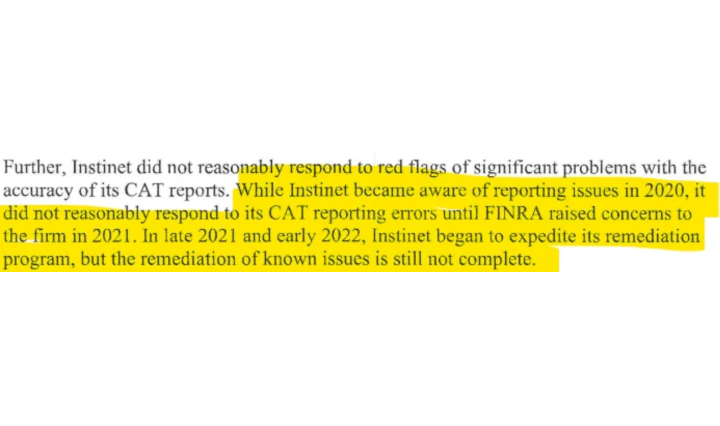

Steps into the ongoing Instinet enforcement matter...

https://www.finra.org/media-center/newsreleases/2023/finra-names-bill-st-louis-new-head-enforcement

FINRA announced today that it has appointed Bill St. Louis as Head of Enforcement, effective immediately. St. Louis, an Executive Vice President, was most recently head of FINRA’s National Cause and Financial Crimes Detection