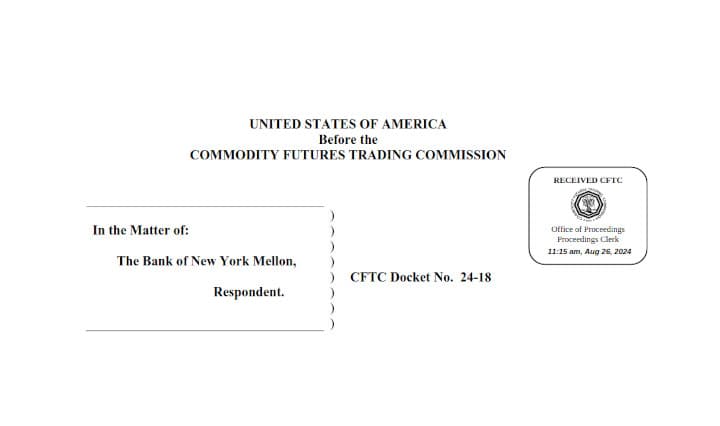

CFTC: From 2018-2023, Bank of New York Mellon repeatedly failed to correctly report at least 5,000,000 swap transactions & failed to properly supervise its swap dealer business with respect to swap data reporting & monitoring.

The Commodity Futures Trading Commission (CFTC) has fined The Bank of New York Mellon (BNYM) $5 million for repeatedly failing to accurately at least five million swap transactions and for inadequate supervision of its swap dealer business. These violations persisted despite a prior CFTC order against BNYM in 2019 for